To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

As a Christian business owner, it’s important to choose financial advisors who understand the unique challenges and opportunities that come with integrating faith into business decisions.

The intersection of faith and finance is not always easy to navigate as a Christian business owner. Consider hiring financial advisors who have the expertise and knowledge to guide you through the process. They recognize the importance of Biblical principles such as stewardship, generosity, and ethical decision-making when it comes to managing a business.

You’ll likely find dozens of nearby financial advisors well-suited to help you reach your money goals with a personalized plan. But it may be more difficult to find a financial advisor who specializes in working with Christian business owners.

Fortunately, many financial advisors offer virtual services so you can meet online no matter where you (or they) live. This means you can choose to hire a specialist financial advisor who lives hundreds of miles away if you decide their knowledge and experience working with Christian entrepreneurs is a better fit to help with your unique financial planning needs.

Financial Planning for Christian Business Owners

💡 In the Q&A below, you’ll gain insights from financial advisors who work with Christian business owners to help them make smart decisions aligned with Biblical values.

🙋♀️ Do you have questions not answered below? Use the form on this page to submit your questions, and we’ll update this article with answers from the financial professionals and educators in the Wealthtender community. You can also contact the financial advisors featured in this article directly to set up an introductory call or ask your questions by email.

💸 Smart Money Insights for Christian Business Owners

This page is organized into sections to help you quickly find the information you need and get answers to your questions:

- Q&A with Financial Advisors Specializing in Serving Christian Business Owners

- Get Answers to Your Questions

- Browse Related Articles

Q&A: Financial Advisors Specializing in Christian Business Owners

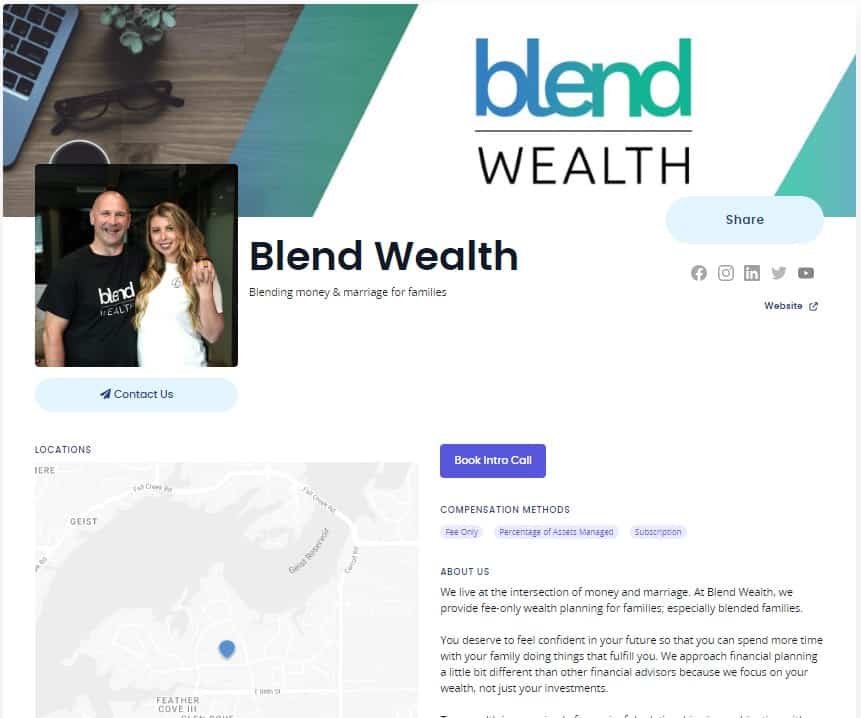

We asked Blend Wealth financial advisors and co-founders, Tim and Alexis Woodward, to answer a few questions to help us learn more about their background, useful tips for Christian business owners, and how they help clients navigate the challenges of running a business consistent with Christian values.

Q: How do the services you offer Christian Business Owners distinguish your firm from other advisory firms?

As Christian financial advisors, we offer advice with a Biblical worldview. Our primary goal is to blend faith, family, and finances together for Kingdom impact. When you have a Kingdom vision for your finances, you make different decisions.

We approach financial planning topics such as debt, giving, retirement, estate planning and wealth transfer differently than many other advisors because of our Biblical perspective.

Q: What is a financial planning challenge unique to Christian Business Owners that you encounter when working with your clients? How do you work with them to overcome this challenge?

“Which retirement plan is best for myself and my employees?” is one of the most common questions we get asked by Christian business owners. Many Christian business owners are not solely interested in maximizing the dollars in their pockets. They also want to make sure their employees are taken care of because they view their employees as extended family and want to make sure they are set up for success.

We help business owners care for their employees by sponsoring a retirement plan for their benefit. Many business owners don’t offer retirement plans to their employees for three primary reasons:

- They believe their business is too small to qualify for one. We help business owners with any company size set up a retirement plan. Even solopreneurs have retirement plan options.

- They believe they are too expensive to set up and manage. With improvements in technology and automation, many 401k platforms are very affordable. And for companies just starting a 401k plan or adding auto-enrollment, there are tax credits available.

- They don’t believe they can afford to pay a match to their employees. We educate business owners on all options, including non-elective contributions, various matching options, and even no match at all unless there is sufficient profitability. There is always a win-win option for owners and employees.

Q: For Christian Business Owners who are unsure whether they should hire a financial advisor at the current point in their lives, what guidance can you provide to help them make a more informed and educated decision?

People spend thousands of dollars on starting and building a business, but they don’t always take the time or have the time to learn about how to manage and steward their income and assets. We recommend hiring a financial advisor if you:

1) Are unsure of what to do with your finances

2) Don’t have time to manage your finances

3) Want a second opinion when it comes to financial decisions or

4) Desire accountability from a Biblical perspective

If any of these apply, you should speak with a Christian financial advisor.

Q: For Christians thinking about leaving their current employer to start their own business, what actions do you recommend they take before resigning and shortly thereafter?

We work with a lot of business owners, and many of them make similar mistakes when they launch their business. To avoid some of the most common mistakes new business owners make, here are 10 steps you should take when starting your business:

1. Have a business plan

Your business plan will certainly change over time, but you should have an initial plan to get started. Proverbs 29:18 says, “Where there is no vision, the people perish.” Don’t let the details get you caught up in this step. Your business plan should be simple and fit on one page.

2. Build an emergency fund with at least 12-18 months of expenses

You want to avoid the stress of having cash flow issues when you start a business. In the first few years, revenue may be small and irregular, so having this emergency fund is crucial.

3. Start tracking your cash flow

You need to know your income and expenses for your business to run efficiently. Try to keep your business expenses low when you first launch. Using budgeting software and keeping your books organized will help your business be set up for success.

4. Set up business bank accounts

Many business owners make the mistake of comingling their personal assets with their business assets. Doing this will only make your finances more confusing. Be sure to set up separate business bank accounts from the beginning.

5. Determine your business structure

Spend some time researching which business structure is the best way to set up your business for tax purposes. Don’t be afraid to pull in a professional if you needed. Structures to consider include:

- Sole Proprietor

- LLC

- S Corp

- Partnership

- Corporation

6. Get insurance in place

Unless your spouse works somewhere that allows you to be on their insurance, you will need to address health, life, disability, dental, vision, etc. insurance policies. You may also need to look into getting key-man or buy/sell insurance. Self-insuring may also need to be an option.

7. Research retirement accounts

Don’t neglect having a plan for your retirement. You will want to look into which type of retirement account will be best for your business. Options include:

- Solo/Individual 401k (if it’s just you or you and your spouse)

- Group 401k

- SIMPLE IRA

- SEP IRA

8. Save for taxes

If you don’t save for taxes throughout the year, you could end up owing a lot of money to the IRS. We recommend working with a CPA to determine how much you need to save and pay in quarterly estimated taxes.

9. Develop a network of professionals

Having a team of professionals to ask for help, guidance and mentorship is never a bad idea. Ask them for feedback on your business plan and ideas. Consider finding the following professionals to have in your corner as you launch a business:

- Tax professional (CPA)

- CERTIFIED FINANCIAL PLANNER™ (Financial Advisor)

- Legal professional (Attorney)

- Experts in your industry (Mentors)

10. Develop a marketing strategy

The best idea or product will still fail without sales revenue. Developing a marketing strategy that you can stick with will be a key factor in your growth. What problem do you solve? How will you message your business? Will you have a niche? How will you tell people in your network about your business? How will you reach people outside of your personal network? How will you build a personal brand? Develop a marketing strategy and be consistent with it.

Q: What questions do you recommend Christian Business Owners ask financial advisors they’re considering hiring to help them decide if they’re a good fit?

Here are the best questions to ask financial advisors when hiring one:

- Are you a Certified Kingdom Advisor®?

- Are you a CERTIFIED FINANCIAL PLANNER™?

- Are you a fiduciary?

- What services do you provide? A comprehensive financial advisor will help you design and implement these 5 areas of financial planning – Taxes, Investments, Insurance, Retirement Income & Estate Planning

- What do you charge, and how do you get paid?

- Are you a fee-only (i.e. commission-free) advisor?

- How do you communicate with clients?

- How often do we meet?

- What’s your investment philosophy (i.e. passive or active)?

- Who do you do your best work with (i.e. are you their ideal client)?

- Are you able to advise me on both my personal finances and my business?

- Who is your qualified custodian (i.e. where is my money held)?

Q: For Christian Business Owners, are there fellowship groups or online networking resources you recommend they consider?

Check to see if your local church offers any small groups for business owners because many of them do. Truth at Work and Faith Driven Entrepreneur are great organizations that host mastermind groups for Christian Business Owners.

Q: What Christian business books can you suggest aspiring entrepreneurs and business owners read next?

Our favorite Christian books for business owners include:

Get to Know Blend Wealth:

Are you a financial advisor who specializes in serving Christian business owners?

✅ Join Wealthtender and get featured as a specialist financial advisor based on your knowledge and experience. (Subject to availability and terms.)

✅ Sign up today and join financial advisors attracting their ideal clients on Wealthtender

✅ Or request more information by email:

Resources to Help You Choose a Financial Advisor

✅ Top Questions to Ask a Financial Advisor

✅ How Much Does a Financial Advisor Cost?

🙋♀️ Have Questions About Financial Planning for Christian Business Owners?

📰 Browse Related Articles

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

Brian Thorp

Founder and CEO, Wealthtender

Brian and his wife live in Texas, enjoying the diversity of Houston and the vibrancy of Austin.

With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor