To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Here are my top 7 ways your budgeting fails at getting you to your goals and what you can do differently to win the budgeting game.

We had just moved to the US. Both of us were 30, and we had two toddlers.

We needed to have enough money to buy a used car and some cheap furniture. To raise that money, we sold everything we owned that we couldn’t take with us. Our car, our appliances, our TV and hi-fi, and our furniture. When that didn’t bring in enough, we borrowed a few thousand dollars from my parents.

I knew my salary would be just $31,000. I also knew that my immigration status locked me into that job and that my wife’s status would prevent her from working at all.

Budgeting wasn’t a matter of choice. Keeping a family of 4 afloat on $31,000 wouldn’t be easy.

Almost obsessively, I’d review our budget over and over, trying to figure out what we could remove or at least trim. I’d try to convince myself that we could cut our grocery budget by $100 or even $50. Somehow, by the end of the month, the total spent on groceries was the same as it was before.

I tried thinking of something else we could cut. Nada. Our budget had very little fat.

Lunch was a sandwich from home, or at most, a fast-food “meal.”

Dinner was often a few $0.20 packets of supermarket ramen noodles.

When we discovered that we could get a cooked meal from the local hospital cafeteria for the same $3 as a Big Mac Meal, that was a huge deal.

We weren’t willing to make the sort of changes needed to cut our expenses significantly. Things like moving to a one-bedroom, one-bath apartment in an unsafe neighborhood.

The great “hope” was winning a prize from the Publishers Clearing House sweepstakes. The odds were vanishingly small, but better a next-to-zero-chance hope than no hope at all.

My Conclusions from this Experience:

That time was financially challenging, but it wasn’t all bad.

We had good times with friends, inviting them over to our place or going over to their places. Once a year, we’d take a road trip to visit friends a couple of states over, staying in their house to avoid hotel costs. Occasionally, our parents would visit from overseas and take us on a fun (though still modest) vacation.

These are the 5 lessons I learned from that time:

- If you make barely enough to survive, you can’t budget your way to prosperity; but if you don’t track your spending, you can easily get into financial problems (a.k.a., a debt spiral).

- No matter how little you make, carve out at least a few dollars to set aside for an emergency, at least a few dollars for the future, and at least a few dollars to have fun.

- Family support is crucial to financial survival.

- Even when you can’t afford much, you can still have a great time with friends.

- Always keep hope alive and keep your eyes open for opportunities; one of my favorite quotes says, “Good fortune is what happens when opportunity meets preparedness.”

Here Are the Top 7 Budgeting Mistakes You May Be Making and What to Do Differently

My experience also taught me that budgeting is an art as well as a science and that there are many ways you can fail at it. Here are my top 7.

Budgeting Mistake #1: You don’t budget

As the well-known quote says, “failing to plan is like planning to fail.” A budget is nothing more or less than a financial plan for the coming year(s). If you don’t budget, why would you expect to achieve anything financially?

What to do differently:

- A good budget aligns with your priorities and goals and makes them concrete. Establish your financial priorities and goals. These could include, e.g., retirement (or financial independence, if you don’t want to plan on ever not working), buying a home, buying (or replacing) a car, saving for your kids’ college education, setting up an emergency fund, etc.

- Thinking about each goal, ask yourself where you want to be in a year, 5 years, 10 years, etc.

- Figure out how much money you need to set aside for each goal, given its size and how long until you want to reach it. These amounts are the “pay yourself first” portion of your budget.

- Note how much you’re spending on things you can’t easily change (e.g., mortgage or rent, car loan payments, etc.) and add those to the budget.

- Figure out how much you’re spending on discretionary categories. Then, see how well they align with your goals and priorities.

- Finally, trim or eliminate those discretionary categories that don’t align with your priorities and add to the budget those that do.

Once you decide to budget, Stephan Shipe, Ph.D., CFA, CFP®, Owner & Lead Advisor at Scholar Financial Advising, suggests going beyond the income and expenses you see moving into and out of your accounts every month. He says, “A typical budgeting problem I see is when clients don’t include in their budget items like insurance, retirement savings, or other expenses that are deducted before their income reaches their checking account. We solve this by starting with total gross income and including taxes and other deductions as expense items. This problem is worse if you have “lumpy” income from bonuses or tax refunds, or big irregular expenses. Because these don’t show up monthly, some clients forget to include them in their budget. You need to account for these if you’re planning to retire or want a better understanding of your expenses.”

Budgeting Mistake #2: You don’t track your expenses

If you don’t know where your money goes, you can’t stop it from leaking and getting frittered down to nothing. Tracking lets you compare your actual spending with your budgeted priorities. That, in turn, lets you figure out what you need to change (and it might be recognizing that something you didn’t realize was a priority really is one).

What to do differently:

- Figure out what tracking method is most comfortable and efficient for you. It could be using Quicken and Excel spreadsheets like me, a smartphone app such as Mint, or old-school like putting set amounts of cash in budget-category-specific envelopes.

- Start recording how much you spend in each category.

- Periodically review your actual spending and compare it to your budget. Do this monthly, quarterly, and annually.

- Where you see yourself consistently overspending your budget, consider if this is a hidden priority that you should add to your budget or increase. If it isn’t, ask yourself why you’re wasting money on something that pushes you further away from achieving your goals. You may need to break bad habits or create new and better ones.

Budgeting Mistake #3: You don’t save for emergencies

A major medical problem, a major auto repair, losing your job, etc. Without an emergency fund, it’s not a question of if but when something unexpected like that will happen and knock your finances for a loop. As a result, you may be forced to borrow on your credit cards, with all the impacts and costs of high credit-card debt.

What to do differently:

- Figure out how many months of expenses you should set aside.

- Create an “emergency situation budget” by figuring out what expenses you can’t reduce or avoid altogether.

- Multiply the results of the above two steps – that’s how much you need to set aside for emergencies.

- Prioritize reaching this target relative to other goals and priorities. Once you reach it, you can reallocate those dollars that went into your emergency fund toward the goals you deemphasized until then. Note that once you have enough cash set aside for 2-3 months of expenses in a high-interest checking account, you can consider putting the remainder of your emergency fund into a Roth IRA that’s been open for at least 5 years. You can withdraw your contributions tax- and penalty-free anytime (though you can’t put the money back in, you can just make new contributions per IRS limits). Withdrawing earnings tax- and penalty-free requires that you be over 59.5 years old and that the account was open for 5 tax years (counting from Jan 1 of the year in which you made the first contribution into it).

Budgeting Mistake #4: You don’t invest for the future

Unless you die before it happens, you will reach a point where you’re unable and/or unwilling to keep working for the money you need to survive. To avoid financial ruin when that happens, you must set aside money for that future self. Further, you must invest this money so the returns, compounded over years and decades, greatly reduce how much you need to contribute to your retirement accounts. If you don’t invest a large enough fraction of your income early enough and long enough, you will spend your retirement in poverty.

What to do differently:

- Develop a retirement budget. If you have no idea how much that should be, one way to estimate it is to start with your adjusted gross income (AGI) as reported to the IRS and subtract it from the amounts you set aside for the future.

- Figure out how much you’ll have coming in from Social Security or other sources. Your best bet here is to go to the Social Security Administration (SSA) website and get their estimate. If you’re married, don’t forget to add your spouse’s retirement or spousal benefits, whichever is higher. Then, reduce those benefits by 23% to account for the looming exhaustion of the Social Security Trust.

- Estimate how much you need to amass to cover the difference between your retirement budget and your expected Social Security benefits. A good way to do this is to multiply the annual calculated shortfall by 33.3. The 4% rule would have you multiply by 25, but recent research indicates that a 3% rule is more appropriate given projected stock market returns.

- Figure out how much you need to invest monthly to reach that portfolio.

Budgeting Mistake #5: You’re so frugal that life in the present is unsustainable

If you have zero fun now, it’s almost guaranteed that you’ll grow tired of it and fall off the wagon. This is the same problem as going on a too-extreme diet.

What to do differently:

- Find free or inexpensive things you enjoy doing. This could include:

- Potluck dinners with friends, rotating between homes.

- Reading books, either from the library (free) or Kindle Unlimited, which lets you read as many Kindle books as you want for $9.99/month. Alternatively, if you read 2-3 books or less on average each month, you can simply buy the ebooks typically for somewhere between $0.99 and $4.99. This last lets you keep all those titles in your Kindle library.

- Visiting free museums (e.g., Smithsonian museums in DC are free to the public).

- Hiking or running.

- Drawing, writing, or doing any of a host of low-cost crafts.

- Budget at least some money for things you love doing, saving up for them for a year or more if needed. For example, if you set aside $50/month, in a year, you’d have $600 for, e.g., a long weekend at a bed and breakfast close enough to drive to.

- As you reach financial goals, rather than diverting all the money that went toward that goal to the next goal, consider rewarding your present self by diverting some of that money to do fun stuff.

Budgeting Mistake #6: You spend money you don’t have on things you don’t need

The three-word phrase that will doom your finances – “I deserve it.” If something doesn’t align with your goals and priorities and costs a lot, either as a one-time expense or over time, you have to say “no” to it. This is especially true if you can’t afford to pay cash. Credit card debt has huge costs that you really want to avoid.

What to do differently:

- Understand that your true needs are relatively few, while your wants will inevitably grow to and beyond whatever money you have or can borrow.

- For any large expense or budget category, ask yourself what would happen if you had to cut that category’s budget in half or completely do away with it.

- Ask yourself if, given how spending on something that you did last year made you happy to the extent that you’d want to spend the same or more on it this year. The answer will likely be no, in which case, remove it from your budget altogether or at least reduce it significantly.

- If something isn’t in your budget, only add it if you can reduce spending in other categories. For example, say your friends invite you to join them on a cruise. Figure out the total cost and decide if it’s enough of a priority to reduce spending elsewhere by that much. If it isn’t, politely decline.

Budgeting Mistake #7: You don’t compare prices and features, and/or you buy impulsively

Especially with big-ticket items or recurring purchases that add up, failing to compare features and prices guarantees you’ll overspend. This will bust your budget and delay or even prevent achieving your long-term goals. The same is true if you impulse-shop. That’s why businesses spend so much on figuring out what to display, where, how, and in what packaging. It’s to help them separate you from your hard-earned cash in the quickest, most efficient manner.

What to do differently:

- Don’t go shopping unless there’s something specific you need from the particular store.

- Don’t go into a store without a list of things you decided to buy there. Once you have that list, commit to yourself to only buy things from that list. If you see something else you want, write down what it is and how much it costs, and give yourself at least a week’s cooling-off period before deciding if you still want it enough to go back and buy it.

- Research brands, models, options, features, and prices before deciding what to buy.

- Don’t pay for extended warranties unless independent research shows they’re worth buying on the item you’re thinking of buying. For example, say you’re buying a $500 TV that comes with a 2-year warranty, and you’re offered a 4-year extended warranty for another $125. That $125 only covers years 3-4 (since years 1-2 are already covered). Ask yourself (or better yet research) how likely it is that the TV will break within that 2-year extended period. If you think the likelihood is under 25% (since $125 is 25% of $500), skip the extended warranty.

The Bottom Line

The above lists my top 7 ways your budgeting fails at getting you to your goals. It also shows what you can do differently to win the budgeting game so you reach your financial goals. This works for both short-term goals, like going on a vacation, and long-term ones, like financial independence.

Budgeting Pro Tip:

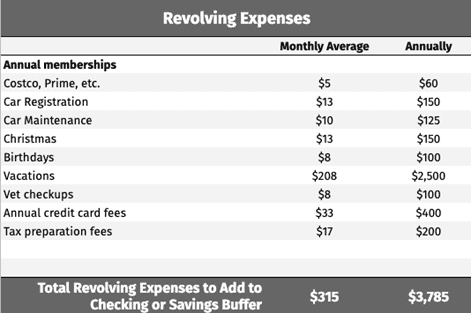

Jen Swindler, CFP®, AFC®, Senior Wealth Manager at Vincere Wealth Management, says, “One of the biggest mistakes I see many clients make is failing to plan for ‘revolving’ expenses – known but irregular expenses such as Christmas gifts, birthdays, vacations, vet checkups, annual fees (such as Amazon Prime, Costco, annual insurance premiums, vehicle registration, credit card annual fees, tax-prep fees, etc.

“When several of these revolving expenses hit in the same month, they can derail your progress, trigger credit card debt, require withdrawals from emergency funds, etc. To address this, I advise clients to add up their annual expenses, take the monthly average, and add that amount to their savings account each month (or keep it as a checking buffer, though that’s usually less successful). The following table gives an example of how you might do this.

“I’ve found this strategy helps clients plan and avoid having high-expense months throw off their progress. It also helps automated savings amounts to stay stable throughout the year, smoothing out these financial bumps.”

Have you noticed other budgeting pitfalls? Have you come up with ways to avoid them?

What to Read Next:

- Find a Sudden Wealth Financial Advisor

- How Much Does a Financial Advisor Cost?

- What is a Certified Financial Planner?

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor who can meet with you online, or you prefer to find a nearby financial planner, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

–

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor