Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.

Note that we’re not looking for which structure is the “best” in general here, just which one best suits your needs.

Since there are about 1.5 million active C-corps and 4.9 million active S-corps in the US (according to the IRS, based on 2019 tax year returns), clearly, there can’t be a clear-cut answer that says one is always better than the other.

To see which one may best suit your needs, let’s start by comparing the two structures.

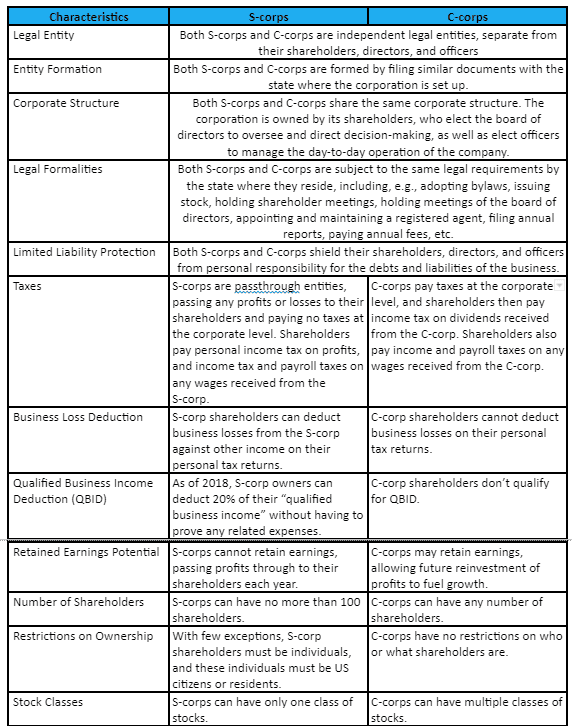

The Similarities and Differences Between an S-Corp and C-Corp

The following table shows the most significant similarities and differences.

The Resulting Pros and Cons of the S-Corp vs. C-Corp Structure

Stated most simply, S-corps are simpler, easier, and less expensive to establish and manage, and avoid double taxation, while providing the same legal protections to shareholders, directors, and officers.

C-corps, on the other hand, have no restrictions on how many shareholders they have or who or what those shareholders are. This makes it far easier to raise equity financing (i.e., selling a portion of the company to raise money) through venture capital and/or initial public offerings (IPOs) on stock exchanges. The drawback is the greater level of scrutiny C-corps are usually subjected to, including required SEC filings.

C-corps can also have multiple stock classes with different rights and privileges (e.g., preferred stocks may have higher dividends and earlier/higher payout during liquidation, while common stocks may offer greater appreciation in the value of shares; alternatively, founders and key executives may be issues shares with outsized voting rights to retain majority control even after selling off the majority of the company’s equity; another possibility is offering restricted stocks that vest over time as part of employee compensation to help retain staff).

One drawback of having many more shareholders is that it tends to complicate decision-making, especially if enough shareholders disagree with and try to oust the company’s management.

Jon McCardle, AIF, President Summit Financial Group of Indiana, explains how he decides what to advise his clients, “Whenever we counsel start-ups or relatively new business owners about the legal and tax structures to establish, we ask: How many employees does your business employ or will soon employ? How much revenue did your business bring in last year, this year, or is projected for next year? What’s your total annual income (including your spouse)?

“Most of the time, in the early phase of a business, the S-Corp provides a legitimate entity that offers legal protections while keeping costs low through the expansion phase. C-Corps, in our opinion, offer retained earnings for tax purposes and some other properties that could be beneficial from a tax perspective. However, they can cost more to operate. This might be best if the owner already has other business interests that need to be kept separate or may need to be folded into the new business. Obviously, we advise them to check with their CPA before moving forward.”

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

Which Is More Popular – the S-Corp or the C-Corp?

Before the establishment of S-corps in 1958, small-business owners had just three entity options – sole proprietorships, partnerships, or C-corps (or plain corporations). The first two kept owners (or at least one partner) on the hook for business liabilities, while the third was subject to double taxation.

The S-corp provided a compelling answer to that problem – shareholders, directors, and officers receive the same protection from business liabilities as from C-corps; and because all S-corp profits and losses are passed through to the shareholders, no taxes are ever due at the corporate level.

Over time, S-corps have increased in popularity:

- The SecStates Blog relates that when S-corps started in 1958, they allowed up to 10 shareholders. That limit was raised to 35 in 1996, possibly explaining in part why S-corps became the most common corporation form in 1997, according to the IRS.

- In that same report, the IRS says, “For Tax Year 2003, about 61.9 percent of all corporations filed a Form 1120S.”

- The limit on the number of S-corp shareholders increased to its current 100 in 2017, possibly explaining their continued growth in popularity, becoming more than three times more prevalent than C-corps by the 2019 tax year (per the IRS, S-corps filed over 76% of all 2019 corporate tax returns).

This seems to imply that S-corps best suit the needs of far more business owners than C-corps, with the limit on the number of shareholders playing a significant role in deciding on the best fit.

Is the S-Corp or C-Corp Status Best Suited for You?

The greater and ever-increasing popularity of S-corps implies the answer to this question tends to be the S-corp in most situations.

However, here are some scenarios where the S-corp would be a poor fit and you’d likely need to go with C-corp status.

- You need or want to be able to sell equity to more than 100 people (e.g., multiple rounds of raising funds, IPO, etc.).

- You need or want to sell shares to people who are not US citizens or residents.

- You need or want to sell shares to other business entities.

- You need or want to issue multiple stock classes (e.g., to retain employees, raise equity funding without losing control, etc.).

- You need or want to have shares in the company be transferable without limitations.

- You don’t plan to make distributions to shareholders (so double taxation isn’t an issue).

- Despite taxation at both the corporate and personal level, taxes would be lower with a C-corp.

The Bottom Line

Unless there is an obvious reason why you must use the C-corp status (e.g., see the above list), the S-corp will likely be a better fit. However, corporate laws and corporate taxation are complicated, so you should consult with knowledgeable tax and legal professionals to make the best decision for your specific situation.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. An MSc in theoretical physics, a PhD in experimental high-energy physics, a postdoc in particle detector R&D, a research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started several other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. I draw on these diverse experiences to write about personal and small-business finance to help people achieve their personal and business finance goals.

Follow me on Medium (opher-ganel.medium.com).

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

What to Read Next:

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.