Digital marketing for advisors that converts more prospects into clients.

Get found online in the #1 find-an-advisor directory visited by 500,000 consumers annually and grow your business with the industry’s first testimonial marketing platform designed for SEC and FINRA compliance.

“Wealthtender is one of the best decisions we have made as a firm. I wish we had done it sooner.”

Gerry Barrasso

President & Founder

United Financial Planning Group

Here’s what you can get done with Wealthtender in your first 30 days.

Get started today.

✔️ Sign up in two minutes

✔️ We create your profile(s)

✔️ Choose your benefits

Stand out online next week.

✔️ Rank higher in search results

✔️ Invite clients to write reviews

✔️ Promote client testimonials

Ask why you didn’t join sooner.

✔️ Budget-friendly plans

✔️ Convert more leads to clients

✔️ Lower client acquisition cost

Join the digital marketing platform rated extraordinary by advisors.

– T3 Advisor Software Survey, 2023 & 2024

How Wealthtender Compares

Wealthtender is the Digital Marketing Leader for Growing Advisors & Wealth Management Firms

| Solution Provider |  |  |  |  |

| Company Website (Link) | Wealthtender | Indyfin by WiserAdvisor | Amplify Reviews | Testimonial IQ |

| T3/Advisor Software Survey User Rating (2024) | 8.03 (Extraordinary) | Not Rated | Not Rated | Not Rated |

| PRICING | ||||

| Lowest Monthly Cost (1 Advisor) | $49/mo. | $99/mo. | $99/mo. | $79/mo. |

| Multi-Advisor Discounts | Yes (5+ Advisors) | Unknown | Yes | Yes |

| INBOUND LEAD GEN BENEFITS | ||||

| Consumer Website | wealthtender.com | indyfin.com | N/A | N/A |

| Monthly Consumer Traffic ** | 50,000 | 4,000 | N/A | N/A |

| Domain Authority (SEO Strength) ** | 40 | 19 | N/A | N/A |

| Advisor Directory Listing with Client Reviews | Yes | Yes | N/A | N/A |

| Advisory Firm Directory Listing with Client Reviews | Yes | Yes | N/A | N/A |

| Gold Stars Appear in Google Search Results | Yes | Yes | N/A | N/A |

| Review Sync™ (Sync Firm Reviews to Advisor Profiles) | Yes | No | N/A | N/A |

| TESTIMONIAL MARKETING TOOLS | ||||

| Embed/Display SEC-Compliant Testimonials on Advisor Website | Yes (↗️ Learn More) | No | Yes | Yes |

| Easily Create Social Media Content from Client Testimonials | Yes (↗️ Learn More) | No | No | Yes |

| ADMINISTRATION FEATURES | ||||

| Dashboard to Manage Reviews | Yes | Yes | Yes | Yes |

| Convert Google Reviews to SEC-Compliant Testimonials | Yes | No | N/A | N/A |

| ADDITIONAL DIGITAL MARKETING BENEFITS | ||||

| Get Quoted in the Media | Yes (↗️ Learn More) | No | No | No |

| Get Featured in Local Guides | Yes (↗️ View Guides) | No | No | No |

| Gain Recognition for Areas of Specialization | Yes (↗️ View Guides) | No | No | No |

| Professional Advisor Community | Yes (↗️ Learn More) | No | No | No |

View Table Disclosures

** Domain Authority as of January 2025 (Source: Moz) & Estimated Monthly Consumer Traffic as of January 2025 (Source: Ahrefs)

*** Tools that enable consumers to submit Google Reviews introduce advisory firms to significant regulatory risk. In FINRA Regulatory Notice 17-18, FINRA offers guidance for Registered Representatives applicable to social networks (e.g., Facebook, LinkedIn, Google Reviews), stating: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Based on this language, FINRA makes it clear that the act of solicitation triggers disclosure requirements not supported by the Google Reviews platform.

Should SEC Registered Investment Advisors not subject to FINRA oversight expect the SEC to take a more lenient stance?

We don’t believe so and don’t think it’s worth the risk. Wealthtender believes it’s highly likely the SEC will take issue in upcoming exams and sweeps with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing Rule.

With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing Rule’s prohibitions and disclosure expectations.

We could update our platform tomorrow to enable consumers to submit their reviews to Google. That’s not the issue. We’re simply not in the business of ‘doing it anyway’ and asking for forgiveness later.

We designed our platform for 100% compliance with the SEC Marketing Rule. We’re not here to get cute or help advisors bend the rules. We’re here to empower advisors to abide by them and succeed with compliant testimonial marketing.

Get in Front of More Prospects

Get Found on Wealthtender

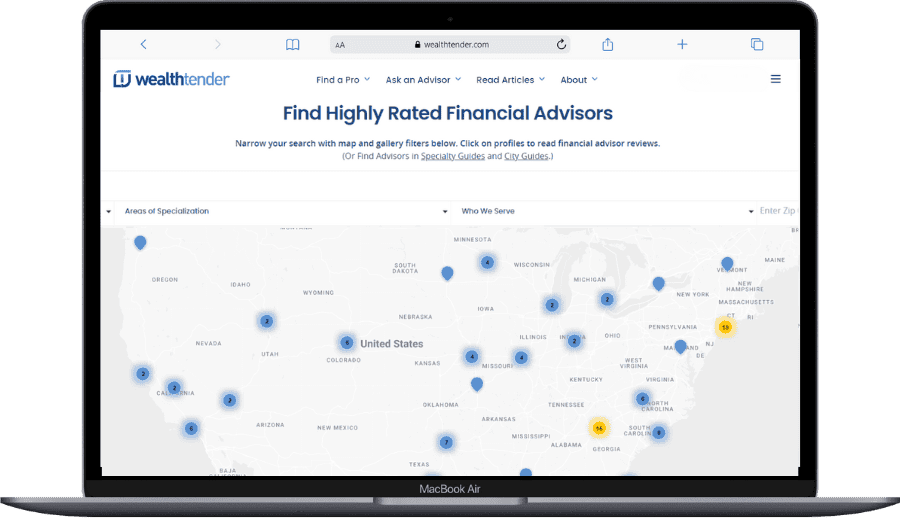

Gain visibility on the first financial advisor online review website and #1 find-an-advisor directory visited by 500,000 consumers annually.

Your Wealthtender profile page benefits from our industry-leading Domain Authority to strengthen your SEO.

Unlike basic find-an-advisor sites that limit your visibility to one directory, you have opportunities featured in local guides and specialist showcases that often rank on the first page of Google for search terms popular among people looking for an advisor.

“Paid web listings” like Wealthtender regularly rank as a Top Marketing Strategy in Kitces Research Surveys on Advisor Marketing.

Wealthtender is designed with compliance at its core. We love making compliance officers smile.

Outsized ROI. Low Monthly Cost.

Digital marketing doesn’t have to be expensive. Wealthtender plans start around $49/month with no long-term commitment. We offer discounted pricing if you prefer annual billing.

Enjoy Done-for-You setup at no additional cost. Your profile will be published within 2 business days.

Grow with Testimonial Marketing

Accelerate the trust-building process with prospects by joining the industry’s first SEC-compliant testimonial marketing platform.

Certified Advisor Reviews™

Certified Advisor Reviews help consumers make smarter hiring decisions when choosing a financial advisor. Advisors can opt in or turn off Certified Advisor Reviews at any time. Learn more.

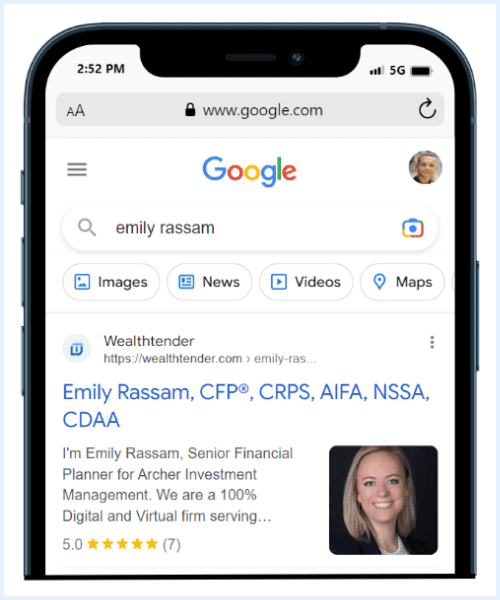

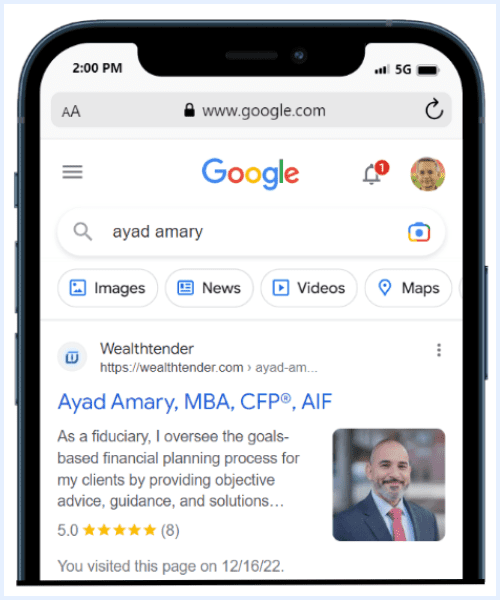

Your Stars Shine on Google

About one week after receiving 5 reviews, advisors can expect to see their gold stars appear in Google search results with their Wealthtender profile page. These positive trust signals are powerful with prospects.

Reviews on Your Website

Wealthtender provides easy-to-use widgets to collect and/or display client reviews on your website, in addition to your Wealthtender profile page. Add a testimonials page to your website with just a few clicks. Learn more.

Compliance Friendly

Before a new review is published, a notification is sent to the financial advisor (or compliance designee) to provide appropriate disclosures. Once added, the review is published. Watch the 7-minute demo video.

Optimize Your Online Reputation

Grow your prospect pipeline with impactful SEO to rank higher on Google while strengthening your online reputation.

Build authority and stand apart from other advisors by getting quoted in the media and on Wealthtender, with weekly opportunities to gain national media recognition in major publications and popular websites.

Gain backlinks to strengthen your online reputation and improve your credibility with search engines.

Get discovered in resources important to your business and popular with prospects, resulting in “multiple shots on goal”.

Take an Interactive Tour of Wealthtender

Get hands-on and discover why hundreds of advisors and wealth management firms

choose Wealthtender as their digital marketing partner.

Your reviews on Wealthtender send positive trust signals to Google.

Collect reviews compliantly on Wealthtender. Rank higher in search engines. Accelerate the trust-building process with prospects.

Join hundreds of financial advisors and wealth management firms that choose Wealthtender as their digital marketing partner.

Promote Your Reviews With Testimonial Marketing Studio™

Harness the full potential of your online reviews to compliantly convert more prospects into clients.

✔️ Access a growing library of professionally designed video and image templates

✔️ Import your online reviews from Wealthtender into Studio projects with just two clicks

✔️ Create scroll-stopping social media content and impactful resources for marketing campaigns in < 2 minutes

✔️ Preview and regenerate projects to optimize their design and ensure disclosures satisfy compliance requirements

↗️ Take a Tour and Learn More About Testimonial Marketing Studio

Get Started Today In Just 2 Minutes.

With free Done-For-You setup service, getting started with Wealthtender is quick and easy.

1. Get Started | ⏱️ ~ 5 minutes

- Sign Up: 2 minutes

- Profile Setup: 0 minutes

- Review / Personalize Profile: 1 to 5 minutes

Within a business day or two, Wealthtender creates your profile and notifies you when your profile is ready for review. You can edit and personalize your profile further with an experience similar to editing their LinkedIn profile.

2. Setup & SEO Activation | ⏱️ ~ 0 minutes

- Profile Indexed in Search Engines: 0 minutes

- Added to Find-an-Advisor Directory: 0 minutes

- Featured in Local Guide: 0 minutes

- Added to Designation Guides: 0 minutes

After your profile is published, Wealthtender submits it for indexing by search engines. This generally results in your profile appearing on the first page of Google search results for relevant keywords within a week.

Your profile is then added to the primary find-an-advisor directory on Wealthtender, in addition to being featured in your local guide, where prospects in your area can find you using tools like interactive maps with filtering options.

If you hold a professional designation(s), you are also added to guides that help consumers find advisors with advanced credentials (e.g., CFP, AIF, etc.)

3. Choose Your Benefits | ⏱️ ~ 5 minutes

- Benefits Selection Form Completion: ~5 minutes

Wealthtender sends you an email with a link to a personalized form that provides an overview of the additional benefits available to you.

In less than 5 minutes, you can confirm additional consumer guides where you would like to be featured (based on your ideal client type or areas of specialization) to increase your visibility with consumers visiting Wealthtender.

You can also opt-in to receive notifications to get quoted in the media, and request information about additional benefits, including how to get started with online reviews.

4. Online Reviews | ⏱️ ~ 15 minutes

- Introduction Video: ~ 7 minutes

- Turning On Reviews Feature: ~1 minute

- Setting Up / Sending Email Template to Request Reviews: ~4 minutes

- Adding Disclosures to Incoming Reviews: ~1 minute (per review)

Wealthtender provides how-to videos, templates, and a quick-start checklist to ensure you get off to a great start asking for reviews from your clients and promoting them compliantly.

“We have seen more immediate impact from Wealthtender than the ‘big’ marketing firm we are spending thousands on.”

SEC Registered Investment Advisor

Headquartered in Austin“Wealthtender is really setting the bar higher. My profile is really kind of beautiful… and I’ve gotten a couple of clients from Wealthtender as well. So overall, a big fan!”

Registered Investment Advisor

Based in Indiana“I reviewed Wealthtender and their client review process, and I am good with it, I actually, really like their process.”

Chief Compliance Officer, Barron’s 2022 Top 100 RIA Firm

Headquartered in VirginiaRead more feedback from financial professionals sharing what they ❤️ about Wealthtender.

Testimonial Marketing

Testimonial MarketingSuccess Story

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Convert more prospects into clients with the industry’s first online reviews platform designed for SEC compliance and #1 find-an-advisor website.

Join hundreds of financial advisors and wealth management firms that choose Wealthtender as their digital marketing partner.

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.

Advisory Firms Convert More Prospects Into Clients With Certified Advisor Reviews™

Wealthtender offers the industry’s first financial advisor review platform designed for SEC Marketing Rule compliance.

Certified Advisor Reviews™ help consumers make smarter hiring decisions when choosing a financial advisor.

Collect and Display Reviews Compliantly

Unlike sites like Google and Yelp, your advisors’ reviews on Wealthtender always include disclosures to satisfy regulatory and firm requirements. You can choose to only display reviews from clients and use admin tools to ensure regulatory compliance and protect the privacy of your firm’s clients. If you have received Google Reviews, Wealthtender’s import tool helps you unlock their potential to strengthen SEO (search engine optimization) and promote them compliantly. You’re always in control of the features accessible by your advisors.

Build Trust with Prospects More Quickly

Online reviews accelerate the trust-building process with prospects. Your advisors already build credibility with their experience and credentials. With online reviews, your advisors also establish an emotional connection with prospects, increasing their likelihood of setting up an introductory call and choosing to hire your advisors over others without reviews online.

Rank Higher in Search Results and Win More Business

Your advisors’ reviews appear on wealthtender.com, visited by 500,000 consumers annually. Your advisors’ reviews also send positive trust signals to Google’s algorithm, and their gold stars will shine bright in search results, helping your advisors stand apart from advisors who lack reviews to win more business. It’s also easy to display reviews on your advisors’ websites and create scroll-stopping social media posts showcasing client testimonials.

Financial advisors and wealth management firms that join Wealthtender are positioned to lead the industry in attracting new clients throughout the historic transfer of trillions of dollars in wealth from Baby Boomers to Millennials over the next decade.

A Message From Our Founder

A Message from Our Founder

Hi there! 👋

Thanks for your interest in joining Wealthtender.

Since launching Wealthtender in 2019, we’ve worked tirelessly to become the #1 find-an-advisor directory1 and online reviews website, helping thousands of Americans each month discover the right financial advisors for their individual needs.

Today, Wealthtender is an essential digital marketing platform helping hundreds of advisors accelerate their growth and convert more prospects into clients.

Our Independence Benefits Consumers and Advisors

Wealthtender is not sponsored by a national wealth management firm, credentialing organization, or industry association. Our independence lets us feature financial advisors with a greater diversity of backgrounds and experience than sites limited to a single firm or professional designation.

Of course, we take great pride in helping consumers learn the potential benefits of hiring advisors who have earned advanced credentials. In fact, we’ve published articles on more than 35 professional designations that describe the credentialing requirements and showcase advisors in our community who hold the designation.

(Before you invest a single dollar in digital marketing, I encourage you to take full advantage of the free benefits available to you through your industry affiliations and credentialing organizations. These directory listings often include a link to your website that can strengthen your SEO.)

Wealthtender Generates Long-Term ROI for Advisors at a Low Monthly Cost

Most directory listings published by industry associations and credentialing organizations are offered to members as a courtesy, providing few details about advisors, and limited value to consumers.

At Wealthtender, on the other hand, our singular focus on becoming the #1 find-an-advisor website explains how we earned our industry-leading Domain Authority1 and successfully launched Certified Advisor Reviews™, the first financial advisor online review platform designed for regulatory compliance.

We also reach consumers each month who read our syndicated content in popular media outlets.

A Top 5 Marketing Strategy

By joining Wealthtender, you benefit from a top 5 marketing strategy2, according to Kitces.com research.

Along with many additional benefits to help you generate the maximum ROI from your digital marketing investment, joining Wealthtender is a smart complement to your marketing activities that work well and a replacement worth considering for those that don’t.

For less than the cost of one tank of gas each month, you’re pumping high-octane marketing fuel into your business to accelerate your growth and get more clients online.

When you join Wealthtender, your digital marketing investment compounds over time, paying dividends when an increasing number of your future clients find you directly online. And when they do, your advisory fee is yours to keep.

Wealthtender is a Top-Rated Solution in Our Category

In 2023 and again in 2024, the annual T3/Inside Information Advisor Software Survey of more than 3,300 advisors was published and previewed on the main stage at the T3 Technology Tools for Today conference.

Wealthtender is prominently recognized in the ‘Mighty Mites’ category that showcases solutions that have achieved ‘an extraordinary average user rating‘.

We’re grateful to our growing community of wealth management firms and advisors for taking the time to participate in the survey and sharing their experience with other advisors interested in finding the best digital marketing tools to grow their business.

Let’s Chat

How can I help you today? Schedule a Zoom meeting or reach out anytime and let’s discuss how Wealthtender can help you get more clients online. Visiting my hometown of Austin? Let me know and I’ll treat us to tacos.

Ready to get started? Choose your plan and join today.

Brian Thorp

Wealthtender Founder & CEO

LinkedIn Profile

Email: brian@wealthtender.com

Phone: (512) 856-5406

Join AGC, The #1 Community for Financial Advisors

Join AGC, The #1 Community for Financial Advisors

The AGC™ is a safe, collaborative community for financial advisors to grow personally and professionally alongside their peers.

Online Community

The AGC™ is a private online network where you can interact, engage, and collaborate with like-minded advisors.

Webinars + Workshops

Focused on personal growth, marketing, content creation, practice management, and more!

Resource Library

A community-built library of resources (templates, deliverables, checklists, etc.) to help advisors grow.

By Advisors, For Advisors

In 2019, Justin Castelli, CFP® & Taylor Schulte, CFP®, set out to create a private community for financial advisors like none other. Learn more.

📰 AGC In the News: AGC, The # 1 Online Community for Financial Advisors, Enters Its Next Stage of Growth by Joining Wealthtender

1 What Makes Wealthtender #1

1 What makes Wealthtender #1?

Wealthtender is the #1 find-an-advisor directory not sponsored by a wealth management firm, credentialing organization, or industry association.

2 Read the Kitces Study

According to a 2020 industry benchmarking study conducted by Michael Kitces at Nerd's Eye View, paid web listing platforms like Wealthtender rank as a category among the Top 5 Most Cost-Effective Marketing Strategies for advisors.

Follow us on Social

Snail Mail

Wealthtender, Inc.

1401 Lavaca St. #893

Austin, TX 78701

yourfriends@wealthtender.com

Phone

Tel: (512) 540-3811

Fax: Just Kidding