To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

How to use projected long-term annualized returns and their uncertainties when planning for retirement…

It’s one of my all-time favorite quotes.

Yogi Berra could have said, but it came from Danish physicist and Nobel Prize laureate Nils Bohr.

“It’s hard to make accurate predictions, especially about the future.” — Nils Bohr, physics Nobel Prize laureate

But as hard as it is, sometimes we have no choice.

Sometimes, e.g., when planning for retirement, we need to use our best guesses about the future as the basis for our plans. However, when doing that, we need to come up with ways to mitigate the worst of Murphy’s practical jokes.

Here’s what I’ve been using for a while now, how I estimate the uncertainties in these numbers, and how I use those uncertainties to mitigate against overly optimistic projections.

Retirement Planning Requires Making Long-Term Predictions

If you’re in your 20s or 30s, making a retirement plan requires you to guess how much you’ll need to spend in retirement, which will likely start 35–45 years later and may last over 30 years.

Yes, you’re trying to predict something that will happen between 35 and 65 years from now!

Crazy!

What’s worse, your plan depends on making another projection, estimating market returns across multiple asset classes during that same lengthy period.

Your spending is at least somewhat up to you, but market returns? Not so much.

A Great Resource for Long-Term Projected Investment Returns

One of my favorite resources to help with this is an annual report from Morningstar, “The State of Retirement Income.”

In these, they quote research-based projected annualized 30-year returns by asset class.

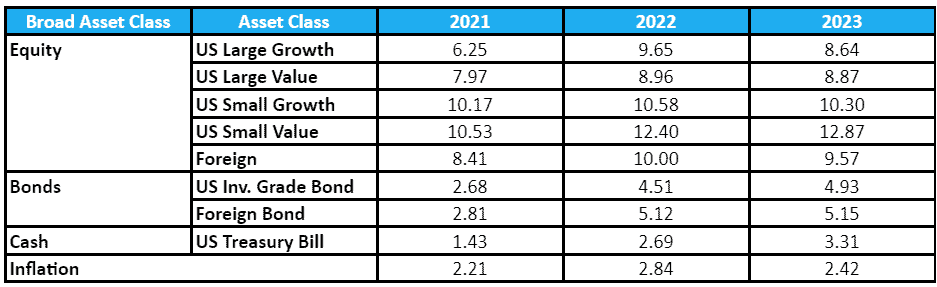

The following table shows the recent evolution of their projected 30-year annualized return percentages by asset class, along with their projected annualized inflation from the 2021, 2022, and 2023 reports.

Several things jump out at us:

- From 2021 to 2022, US Large Growth equities’ projected 30-year annualized returns jumped by over 50 percent, from 6.25 percent to 9.65 percent. In terms of the projected increase in value over 30 years, we see an increase from 6.16× to 15.86×, or nearly 2.6× higher!

- Projected bond returns showed an even larger jump of 68 percent for US bonds and over 82 percent for foreign bonds! In terms of the 30-year projected return, US bonds went from 2.21× to 3.76×, a 70 percent increase), and foreign bonds went from 2.29× to 4.47×, a 95 percent jump.

- Treasury bills showed an 88 percent increase in annualized returns and went from a 1.53× 30-year value increase to one of 2.22×, a 45 percent increase.

- From 2021 to 2022, projected annualized inflation increased nearly 29 percent, from 2.21 percent to 2.84 percent. For 2023, this dropped by 15 percent to 2.42 percent. The 30-year compounded inflation projection increased from 1.93× in 2021 to 2.32× for 2022 and dropped to 2.05× for 2023.

In general, the changes from 2022 to 2023 were far more muted than those from 2021 to 2022, across all asset classes.

Still, how can we understand the massive changes from 2021 to 2022?

What Did These Asset Classes Do in 2022?

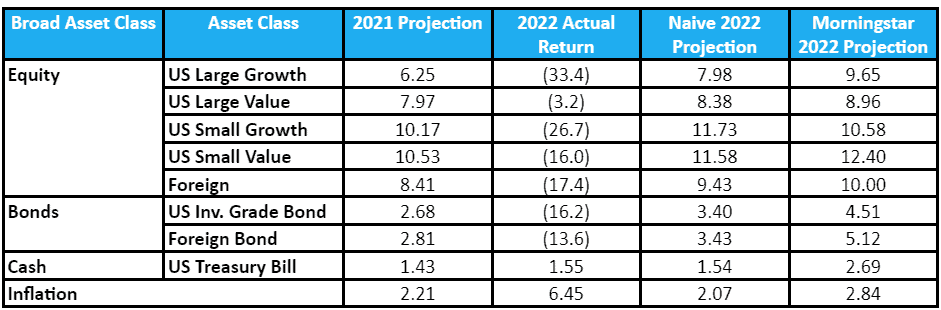

Let’s look at the 2022 returns of some Vanguard funds as proxies for the above asset classes.

- US large growth equities: Vanguard Growth Index Admiral (VIGAX), negative 33.4 percent.

- US large value equities: Vanguard High Dividend Yield Index Adm (VHYAX), negative 3.2 percent.

- US small growth equities: Vanguard Russell 2000 Growth Index I (VRTGX), negative 26.7 percent.

- US small value equities: Vanguard Russell 2000 Value Index I (VRTVX), negative 16.0 percent.

- Foreign equities: Vanguard FTSE All-World ex-US Index Admiral (VFWAX), negative 17.4 percent.

- US Investment grade bonds: Vanguard Intermediate-Term Corp Bond Index Admiral (VICSX), negative 16.2 percent.

- Foreign bond: Vanguard Total International Bond Index Admiral (VTABX), negative 13.6 percent.

- Cash: Vanguard Federal Money Market Investor (VMFXX), positive 1.6 percent.

- Inflation in 2022, according to the Bureau of Labor Statistics calculator, was 6.45 percent.

How Do These Short-Term Returns Impact Long-Term Projections?

If we naively update the 2021 projections to recover from the 2022 losses and project an extra year out, we see the set of annualized projections in the next-to-last column of the following table.

These are quite different from Morningstar’s updated research-based 2022 numbers.

Clearly, Morningstar did far more than simply recalibrate their projections based on the 2022 returns.

We see that (a) long-term projections are, at best, educated guesses that mean little in terms of what the markets will do next year; and (b) large jumps in 30-year projections from one year to the next imply high uncertainties in these annual projection numbers.

Long-term projections mean little in terms of what to expect next year; even over long periods, the uncertainties are significant.

Especially US bonds and cash were impacted by the Fed’s rapid rate increases from March 2022 to July 2023. These significantly increased bond yields, explaining Morningstar’s massive jumps from 2021 to 2022, and smaller increases in 2023.

What Do the Latest Numbers Suggest for Your Retirement Investments?

In their simulations, Morningstar varied stock vs. bond allocations in 10 percent increments, from 0 percent to 100 percent. Within each broad asset class, they assumed a constant sub-allocation to asset classes, as follows.

Equities comprises:

- 30 percent in US large growth stocks.

- 30 percent in US large value stocks.

- 20 percent in foreign stocks.

- 10 percent in US small growth stocks.

- 10 percent in US small value stocks.

The bond/cash side comprises:

- 10 percent in cash (except for the 100-percent stock portfolio).

- 80 percent of the remainder, if any, in US bonds.

- The remaining 20 percent of the remainder, if any, in foreign bonds.

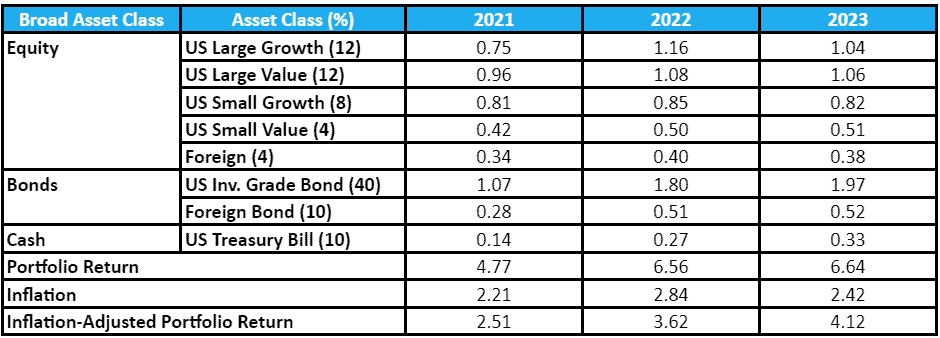

For example, if we pick a 40/60 (stock vs. bonds/cash) allocation in retirement, the least conservative portfolio that still achieves the highest safe initial withdrawal of 4 percent, we’d have:

- 12 percent US large growth (30 percent of 40 percent).

- 12 percent US large value (30 percent of 40 percent).

- 8 percent foreign (20 percent of 40 percent).

- 4 percent US small growth (10 percent of 40 percent).

- 4 percent US small value (10 percent of 40 percent).

- 40 percent US bonds (80 percent of 50 percent, where the 50 percent comes from subtracting 10 percent cash from 60 percent bonds and cash).

- 10 percent foreign bonds (20 percent of 50 percent).

- 10 percent cash (since the bonds/cash is higher than 0 percent).

For this allocation, the long-term projection would have suggested the following overall returns.

Here, we see a much more plausible nominal return of 7.0 percent in 2021, 8.7 percent in 2022, and 8.5 percent in 2023. Adjusted for inflation, these go down to 4.7 percent, 5.7 percent, and 5.9 percent, respectively.

The Bottom Line

The ancient Jewish sage Rabbi Yochanan once said that ever since the destruction of the Temple, prophecy was taken from the prophets and given only to fools and babies.

You and I are certainly no longer babies, and one hopes we’re not fools either.

That, and our distinct shortage of operational crystal balls means we have no way of accurately seeing the future.

We find ourselves limited to educated guesswork, such as the above-described Morningstar research. With this resource, we can guesstimate the long-term average investment returns of different asset classes and those of portfolios with different allocations.

However, we need to remember that the uncertainties in these numbers are far larger than one would prefer.

From the difference between the naive expectation for 2023 (extrapolated from the 2021 projections and the 2022 actual market returns) and the 2023 research-based projections, the uncertainties seem to be ±50 percent or more on any given asset class, ±15 percent for a 40/50/10 portfolio, and ±10 percent for an 80/10/10 portfolio.

This is why I assume in my long-term projections a more modest 7 percent annual return during the accumulation phase rather than the latest Morningstar-based projection of 8.5 percent.

It allows for 20 percent lower-than-projected returns.

I’d much rather be pleasantly surprised by a higher-than-expected long-term return than having to figure out how to cover the shortfall from lower-than-expected returns.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor