Most wealth management firms know online reviews accelerate the trust-building process with prospects and significantly improve search engine visibility, but few realize their online reviews can add millions to their business valuation and dramatically reduce marketing costs. Here are seven transformative benefits you probably haven’t considered.

When the SEC Marketing Rule first took effect in November 2021, wealth management firms gained permission to solicit online reviews and publish client testimonials, a practice long established in other industries. While many advisors recognize the power of online reviews to attract new clients, the strategic advantages extend far beyond marketing. The following benefits represent lesser-known but potentially transformative impacts that online reviews can have on your wealth management practice.

1. Enhanced Business Valuation Through Increased Goodwill

The Benefit: Online reviews directly contribute to your firm’s intangible asset value, specifically “goodwill”, which can significantly increase your business valuation in the event of a sale or during succession planning. In today’s M&A market, this impact can mean the difference between a standard multiple and a premium valuation.

Why It Matters for Wealth Management Firms: RIAs can command valuations up to 20X EBITDA, particularly for larger firms backed by private equity, though wealth managers with less than $1 billion in assets typically get eight to 10 times EBITDA, and those with $1 billion to $3 billion will often be able to claim 12 to 14 times (Source: Financial Planning). However, size alone doesn’t determine valuation. Firms, even small ones, that have moved toward becoming “institutionalized” are often able to sell for higher prices, and it’s the difference between operating a thriving business versus running a lifestyle practice.

This is where online reviews become strategically valuable. Goodwill represents the value of a wealth management firm’s brand, reputation, customers, and potential earning capacity beyond its physical assets. For potential buyers, goodwill is one of the main factors that makes one wealth management firm substantially more valuable than another. These factors include a firm’s reputation, a solid customer or client base, brand identity and recognition, operational efficiencies, and a talented team of leaders and employees.

Your portfolio of online reviews serves as documented, third-party validation of your firm’s reputation and client satisfaction, and provide evidence of the intangible goodwill that commands premium valuations. When acquirers evaluate wealth management firms, they’re looking beyond AUM to assess the quality and sustainability of client relationships. A robust collection of positive reviews provides quantifiable validation of:

- Client satisfaction and retention risk: Reviews demonstrate actual client sentiment, not just retention statistics

- Brand strength and market position: Documented reputation that will transfer to the acquirer

- Referral potential: Evidence that clients actively recommend the firm

- Service quality consistency: Evidence that client experience isn’t dependent on a single advisor (reducing “key person” risk)

Acquirers who deemed a particular wealth management firm prospect as an “ideal” fit were willing to increase their offers by 25%. Online reviews help position your firm as an ideal acquisition candidate by demonstrating institutionalized qualities rather than personal practice dynamics.

The Valuation Mathematics: The difference between the acquisition price of the business and the fair market value of the tangible assets included in the sale is the goodwill value. For a wealth management firm generating $2 million in EBITDA:

- At a standard 8x multiple (typical for smaller firms): $16 million valuation

- At a premium 12x multiple (institutionalized firms): $24 million valuation

- Difference: $8 million additional value

That $8 million difference often comes down to demonstrable goodwill, and online reviews provide some of the most credible evidence of reputation, client satisfaction, and transferable value that acquirers seek.

Supporting Evidence from Other Industries: A Berkeley study showed that a restaurant’s Yelp rating going up from 3.5 to 4 stars increases the likelihood of a restaurant being fully booked each evening by about 49%, translating to a 6-9% increase in revenues. While this is from the restaurant industry, the principle applies directly to professional services: documented reputation through reviews creates measurable economic value that drive increased business and higher conversion and retention rates, qualities that generate premium buyout offers from acquirers.

For wealth management firms navigating an increasingly competitive M&A landscape where valuations continue to nudge upwards but buyers have become more selective, a strong online review presence can be the differentiator that moves your firm from the standard valuation range to premium multiples, potentially worth millions in additional enterprise value.

2. Reduced Marketing Costs Through Enhanced Trust Signals

The Benefit: Authentic client reviews serve as powerful, cost-effective marketing assets that build trust more effectively than traditional advertising, reducing your overall customer acquisition costs.

Why It Matters: For wealth management specifically, 83% of Americans said in a 2025 Wealthtender study, after receiving a referral to an advisor, their next step is to research the advisor’s reputation by looking for online reviews and awards, and 96% of people referred to a financial advisor will research them online before making contact. This means even referral-based prospects are evaluating your online review presence before reaching out, making reviews a critical component of client acquisition across all marketing efforts.

Traditional wealth management marketing (e.g., seminars, print advertising, cold calling) requires substantial investment with costs and commitments of time that can escalate quickly. Online reviews, in contrast, work continuously as trust-building assets at virtually no ongoing cost. Every positive review serves as an endorsement that prospects can discover organically.

Supporting Evidence Across Trust-Based Professions: The legal industry has longer experience with online reviews on industry-specific review platforms (e.g., Avvo, FindLaw), providing valuable insights for financial advisors and wealth management firm leaders. Avvo estimates that attorneys can 4.5x the number of leads and clients they’re able to attract by optimizing their profiles with reviews. Additionally, approximately 83% of people check lawyer reviews as their first step to finding an attorney.

The parallels for the wealth management industry is clear: Professionals in trust-based service industries who build strong review presences on industry-specific platforms like Wealthtender (for financial advisors) or Avvo (for attorneys) dramatically outperform competitors without reviews in client acquisition and conversion.

For firms spending thousands of dollars annually on marketing and business development efforts, a strong review presence can reduce client acquisition costs while simultaneously improving conversion rates, a benefit that offers a powerful one-two punch and compounds over time.

3. Competitive Differentiation That Levels the Playing Field

The Benefit: For independent advisors and large wealth management firms alike, online reviews create an opportunity to compete effectively against wirehouse firms whose advisors typically aren’t permitted by their home office to collect or publish client reviews, providing a powerful competitive advantage.

Why It Matters: The wealth management landscape is dominated by large wirehouses and national firms with massive marketing budgets and established brand recognition. For decades, independent advisors and RIAs competed at a significant disadvantage in terms of visibility and perceived credibility. Online reviews fundamentally change this dynamic.

As of 2025, wirehouses still prohibit their advisors from collecting individual reviews, in spite of the regulatory ability to do so. The 2025 Investment Adviser Industry Snapshot shows that just 9.3% of financial advisors use testimonials/reviews in their marketing activities. This means that 90% of your competitors, including virtually all advisors at wirehouse firms like Merrill Lynch, Morgan Stanley, UBS, and beyond, are invisible in the review-driven search and evaluation landscape.

Real-World Evidence: United Financial Planning Group (UFPG), an independent RIA with over $200M in AUM, provides a compelling case study. Mike Barrasso, UFPG’s Director of Business Development, recalls one prospect who was interviewing multiple firms and said, “It is down to you and two other firms. What makes you different?” Along with highlighting they were fee-only with CPAs on staff, Mike asked if either of those firms had as many positive reviews as UFPG. The prospect signed up as a wealth management client the very next day and moved over $1.5 million in assets.

This illustrates how independent advisors with strong review profiles can compete toe-to-toe with, and often win against, larger competitors who can’t yet leverage this powerful trust signal.

Reviews tell stories that traditional marketing copy can’t:

- How you helped a client navigate a complex estate situation

- Your responsiveness during market volatility

- The education and guidance you provided to a first-time investor

- Your approach to intergenerational wealth conversations

- The peace of mind clients experience working with your team

Supporting Evidence: Customers equate volume with reliability. Three perfect reviews? That’s your friends. A dozen or more reviews with honest responses? That’s real. This authenticity creates competitive advantage by building credibility that marketing claims alone cannot achieve. In a marketplace where prospects are evaluating multiple firms, the independent advisor with several authentic reviews detailing specific client experiences will consistently win against wirehouses whose advisors have zero reviews, regardless of the household brand recognition or outsized marketing budget.

For independent advisors and wealth management firms, this represents perhaps the most democratizing shift in wealth management marketing in decades: the ability to demonstrate credibility and build trust at scale, leveling the playing field with much larger competitors.

4. Enhanced Search Visibility Through SEO and AEO (Answer Engine Optimization)

The Benefit: Unlike Google Reviews, online reviews published on Wealthtender dramatically improve your firm’s visibility in both traditional search engines (SEO) and AI-powered answer engines like ChatGPT, Gemini, and Google AI Overviews, making it significantly more likely that prospects will discover you when researching advisors.

Why It Matters for Wealth Management Firms: The way people find financial advisors has fundamentally shifted. In the Wealthtender 2025 Study of Americans with $100K Household Income, 50% of all survey participants plan to use traditional search engines to find potential advisors, while 25% of people already plan to use ChatGPT, Gemini or other AI-powered tools to start their advisor search. This represents a major transformation in advisor discovery, and firms without an optimized online review strategy for their firm and advisors are increasingly invisible to these prospects.

Moreover, 96% of people referred to a financial advisor will research them online before making contact. This means even your referral-based prospects are evaluating your online presence before reaching out, and your review profile plays a central role in that evaluation.

The Search Engine Optimization (SEO) Advantage:

Reviews published on Wealthtender create powerful SEO benefits through several mechanisms:

- Fresh, User-Generated Content: Search engines prioritize websites with regularly updated content. Each new review adds unique, authentic content that signals your firm is actively serving clients.

- Long-Tail Keyword Optimization: Client reviews naturally incorporate the specific language prospects use when searching (e.g., “retirement planning for tech executives,” “financial advisor who explains things clearly,” “help with stock options”). This organic keyword usage improves your discoverability for niche searches.

- Structured Data Markup: Wealthtender implements review schema markup that helps search engines understand and display your ratings directly in search results, increasing click-through rates.

- Domain Authority Transfer: Reviews on high-authority platforms like Wealthtender create backlinks and content associations that boost your own website’s search rankings.

The Answer Engine Optimization (AEO) Revolution:

As AI tools become primary research methods, optimization for “answer engines” (AEO) is becoming as critical as SEO. Unlike a simple search entered into Google (e.g., “financial advisors near me”), consumers using ChatGPT are much more likely to create detailed prompts personalized to their unique needs.

AI tools like ChatGPT, Gemini, and Google AI Overviews evaluate advisors differently than traditional search engines. Wealthtender asked ChatGPT to compare how it evaluates advisor reputation versus how consumers do, and the results reveal critical insights:

| Factor | Consumer Importance | ChatGPT Importance | Key Difference |

|---|---|---|---|

| Positive online reviews (independent sites) | #3 priority (61%) | Moderate-High | AI values independent reviews highly but adjusts for potential bias and sample sizes |

| Client testimonials on advisor site | #6 priority (36%) | Low-Moderate | AI downweights these since they’re curated by the advisor |

The implications are clear: Reviews on independent platforms like Wealthtender carry significantly more weight with AI tools than testimonials on an advisor’s own website. AI tools prioritize:

- Independent verification – Reviews from third-party platforms signal authenticity

- Structured data – Properly formatted review schema helps AI understand and cite your reputation

- Volume and recency – Consistent review flow demonstrates ongoing client satisfaction

- Detailed, specific content – Reviews mentioning specializations, services, and client outcomes help AI match you to relevant queries

Industry Recognition of Wealthtender’s AEO Leadership:

Wealthtender’s pioneering work in AEO for financial advisors has been recognized by industry leaders. Barron’s Advisor highlighted Wealthtender’s role in helping advisors optimize for AI-powered discovery, noting how the platform’s structured data approach positions advisors to be found by prospects using ChatGPT and other AI tools for advisor searches.

The Competitive Reality: The 2025 Investment Adviser Industry Snapshot shows that just 9.3% of financial advisors use testimonials/reviews in their marketing activities. This means 90% of your competitors are essentially invisible in the review-driven search landscape. Firms that build strong review presences on optimized platforms gain disproportionate visibility advantages.

Real-World Impact:

Without optimized reviews on a platform like Wealthtender that implements proper structured data markup, your advisors and firm are less likely to appear in AI-generated answers, even if you’re the perfect fit for that prospect.

The combination of traditional SEO benefits and emerging AEO advantages makes review collection and optimization one of the highest-ROI marketing activities available to wealth management firms. As AI tools increasingly mediate the advisor discovery process, firms with strong review presences on properly optimized platforms will capture disproportionate market share.

5. Superior Talent Acquisition at Lower Cost

The Benefit: A strong online review presence enables your firm to attract top financial advisors and support staff more effectively and at a lower recruitment cost than traditional hiring methods.

Why It Matters: 75 percent of candidates assess an employer’s brand before they even apply, and prospective candidates trust employee reviews 3x more than company statements. More specifically, a Glassdoor study found that 75% of active job seekers are likely to apply to a job if the employer actively manages its employer brand.

For wealth management firms competing to recruit the top financial advisors, planners, and experienced professionals to fill leadership positions, your online review presence serves as a powerful recruiting tool. While client reviews differ from employee reviews, the principle of online reputation management extends across both domains, candidates research both your client-facing reputation and your employer reputation.

Top talent in wealth management will seek out firms with strong reputations, satisfied clients, and compelling growth trajectories. Your online review portfolio signals all three. Advisors considering a move want assurance that they’re joining a firm where they can be proud of the client experience and where prospects will actually want to become clients.

Supporting Evidence: The average cost of hiring a new employee is $4,129 via public channels. Firms with strong online reputations can tap into job boards and referral networks more effectively, significantly reducing these costs while attracting higher-quality talent. When top advisors can see documented proof of client satisfaction, they’re more likely to reach out proactively rather than requiring more expensive recruitment efforts.

6. Actionable Intelligence for Service Enhancement and Product Development

The Benefit: Client reviews provide a continuous stream of unfiltered feedback for wealth management firms that can lead to operational improvements, identify strengths and gaps in your service offerings, and inspire new ways to deliver an exceptional client experience, all without expensive market research.

Why It Matters: Traditional market research for wealth management firms is expensive and time-consuming. Online reviews, however, provide real-time insights into areas of strength and opportunities for improvement.

Reviews often reveal:

- Communication preferences and frequency expectations

- Demand for specific services (tax planning, estate services, sustainable investing)

- Technology and platform usability issues

- Intergenerational wealth transfer needs

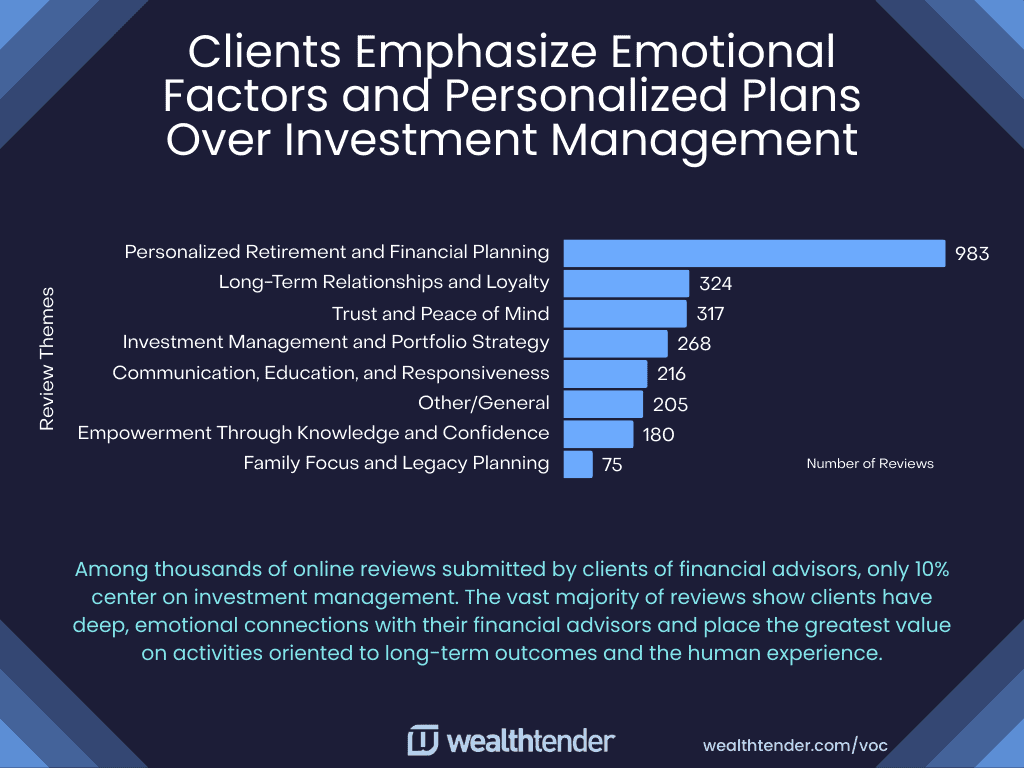

Supporting Evidence from Client Review Analysis: The Wealthtender 2025 Voice of the Client Study analyzed thousands of actual client reviews written about financial advisors to understand what matters most to clients. The findings reveal critical insights for service development: Nearly 90% of client reviews focus on relationship quality, planning advice, and emotional factors, while only 1 in 10 reviews centers on investments or portfolio management. This data contradicts where many firms focus their marketing message.

The study demonstrates that clients value and remember experiences like “feeling heard during difficult decisions,” “receiving clear explanations without jargon,” “getting quick responses during anxious moments,” and “having an advisor who understands our family’s unique situation.” These insights, extracted from authentic client voices rather than hypothetical survey responses, provide a roadmap for service enhancement that resonates with actual client priorities. Firms that analyze their review patterns can identify which aspects of their service delivery create the most meaningful client experiences, then systematically strengthen those elements while addressing any gaps that emerge in the feedback.

7. Increased Resilience During Market Volatility and Challenging Times

The Benefit: A strong foundation of positive reviews provides credibility buffers during market downturns and demonstrates your firm’s long-term value proposition when client anxiety is highest.

Why It Matters: Market volatility inevitably tests client relationships. During periods of significant market stress, whether 2008’s financial crisis, 2020’s pandemic panic, or future downturns, prospective clients become more risk-averse and existing clients more anxious. In these moments, your historical review portfolio becomes a powerful asset.

Especially when markets are turbulent, prospects researching advisors are seeking evidence of steady guidance, clear communication, and emotional support during previous challenging periods. Reviews that mention how you helped clients stay disciplined during past market corrections, provided reassuring perspective during volatility, or communicated proactively during crises become especially valuable.

The Long-Term Credibility Advantage:

A firm with dozens of positive reviews accumulated over several years can weather market challenges better than a firm with minimal or no reviews. The depth and longevity of your review portfolio provides:

- Historical perspective: Reviews from 2-3 years ago demonstrate you’ve guided clients through various market conditions

- Consistency evidence: Steady positive reviews over time show sustained quality, not just a short-term effort

- Crisis management proof: Reviews mentioning challenging periods demonstrate your value during difficult times

- Emotional intelligence validation: Comments about your communication, empathy, and guidance during uncertainty signal your soft skills

When the next market downturn occurs or regulatory changes lead to client anxiety, firms with strong review foundations can point to years of documented client satisfaction as evidence of their long-term value and stability. This historical proof becomes especially persuasive when prospects are evaluating multiple advisors and seeking confidence that their chosen advisor will be a steady hand through inevitable future challenges.

Implementation Considerations for Wealth Management Firms

Wealth management firms ready to get started with online reviews and a compliant testimonial marketing strategy should establish systematic processes for:

- Compliance-first review collection that adheres to SEC Marketing Rule requirements, including proper disclosures and appropriate oversight

- Authentic client engagement requesting reviews at natural touchpoints in the client journey (annual reviews, financial plan completion, goal achievement milestones)

- Strategic promotion of reviews across online and offline marketing activities, starting with your Wealthtender profile(s), and including your website, social media accounts, as well as prospect materials, flyers and other printed materials.

- Ongoing monitoring for reputation management, service improvement insights, and competitive intelligence

- Documentation and recordkeeping to satisfy regulatory requirements for testimonials and endorsements

Setting Your Wealth Management Firm Apart with Online Reviews

The wealth management firms that proactively build their review portfolios now will enjoy compounding advantages in business valuation, client acquisition, competitive positioning, search visibility, talent acquisition, and strategic intelligence for years to come.

While compliance considerations require thoughtful implementation, the strategic benefits, particularly the potential for millions in additional enterprise value through enhanced goodwill, the ability for independent advisors to compete effectively against large national firms, and dramatically improved discoverability in both traditional and AI-powered search, make online reviews one of the most impactful yet underutilized assets available to modern wealth management firms.

In an industry built on trust, there is no more powerful trust signal than the authentic voices of satisfied clients. The question isn’t whether to build a review strategy, it’s how quickly you can begin capturing and leveraging this valuable asset for your firm’s long-term success.

Want to see how individual advisors and leading wealth management firms are successfully using Wealthtender to grow their business? Visit Wealthtender.com/grow or schedule a demo to learn how you can start converting more prospects into clients with compliant testimonial marketing.

Wealthtender offers the industry’s first financial advisor review platform designed for regulatory compliance.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.