When clients write reviews about financial advisors, they mention individual advisors by name 25 times more often than they mention firms. Wealth management firms only collecting firm reviews are missing out on the strategy that healthcare and legal professionals have used for years to maximize lead conversions while building trusted brands at both the individual professional and firm levels. Your advisors are already your most valuable brand ambassadors – and the smartest wealth management firms are turning this reality into their biggest competitive advantage.

When was the last time you chose a doctor based solely on the hospital’s reputation?

The answer is likely “never”, because in trust-based professions, consumers don’t just hire firms. They hire individuals.

For decades, healthcare and legal professionals have understood a fundamental truth that many wealth management firms are only beginning to grasp: nearly 75% of patients turn to online reviews as the first step when searching for a new physician, and they’re not looking at hospital-level ratings. They’re researching individual doctors by name. The same pattern holds true for attorneys, where platforms like Avvo create profiles for 97% of attorneys in the United States, with each lawyer evaluated and reviewed individually.

In the wealth management industry, where online reviews have only recently become available, advisory firm leaders can jump ahead of competitors by applying the lessons learned in the legal and healthcare professions over decades, or risk operating on flawed assumptions, losing prospects to peers and having to play catch-up a year or two down the road.

The data proves collecting reviews only at a firm level simply misses the mark. Wealthtender’s 2025 Voice of the Client Study analyzed over 2,500 client reviews of financial advisors and discovered a revealing truth: clients mention individual advisors by name nearly 25 times more often than they mention their firms. When clients write reviews, they’re thinking about their advisor, the person who guided them through major life transitions, celebrated their successes, and provided reassurance during uncertain times. Importantly, this shouldn’t be viewed as detracting from the value proposition of the firm – just the opposite. A five-star review about an individual advisor is a testament to the caliber of the wealth management firm, it’s culture, and the advisors themselves who serve as brand ambassadors for the firm.

To further test the hypothesis that the healthcare and legal playbook applies to financial advisors, Wealthtender commissioned its inaugural Study of $100K+ Households Seeking Financial Advice, published in August 2025. The survey of 500 Americans planning to hire a financial advisor shows that 96% of people who receive a referral to a financial advisor will research that advisor (and at least one more) online before making contact, with 83% specifically looking for online reviews. And when they search, much more often than not, they’re looking for reviews about the individual advisor, not just your firm.

Table of contents

- What Healthcare and Legal Professionals Know That Wealth Managers Don’t

- The Psychology of Individual vs. Institutional Trust

- The Case for Individual Advisor Reviews in Wealth Management

- Four Compelling Reasons to Collect Reviews at the Individual Advisor Level

- Why Wealthtender is the Optimal Online Review Platform for Wealth Management Firms

- Implementing an Individual Advisor & Firm Review Collection Strategy

- The Competitive Advantage of Early Adoption

- How Wealth Management Firms with Advisor Reviews Can Outperform Peers

- Ready to Implement Your Advisor + Firm Testimonial Marketing Strategy?

What Healthcare and Legal Professionals Know That Wealth Managers Don’t

The Doctor’s Prescription for a Healthy Online Reputation

In healthcare, the transition to individual professional reviews wasn’t optional, it was driven by consumer demand. A 2025 Tebra Research Report reveals a critical insight: the reviews that patients write and that consumers read before choosing a provider aren’t reviews of hospitals or medical centers. They’re reviews of Dr. Sarah Chen, Dr. Michael Rodriguez, Dr. Jennifer Thompson, individual practitioners who have built their reputations one patient interaction at a time.

The reasons are both practical and profound:

Personal Connection Drives Engagement. When Dr. Chen’s patient receives a request to review their experience, they’re reflecting on a specific relationship, e.g., how Dr. Chen listened to their concerns, explained treatment options, and made them feel cared for during a vulnerable time. When patients feel like their individual experience is valued, they’re more motivated to share their positive impressions. This personalized approach generates reviews that are more detailed, more emotional, and ultimately more persuasive to prospective patients.

Search Behavior Reflects Individual Focus. A 2025 RepuGen report indicates that when consumers are evaluating healthcare providers, they’re not searching for “best hospital in Boston”, they’re searching for “Dr. Sarah Chen cardiologist reviews” after receiving her name from a friend or their primary care physician.

Quality Insights Enable Performance Management. Healthcare practices that treat reviews as continuous feedback loops (e.g., monitoring sentiment and making improvements based on feedback) outperform on loyalty and retention. When reviews are collected at the individual physician level, practice administrators can identify which doctors excel at patient communication, who might need additional training in bedside manner, and where systems issues (like wait times) consistently impact specific providers’ patient experiences.

How Individual Attorney Reviews Raise the Bar

The legal profession’s approach to individual professional reviews provides another compelling case study. Platforms like Avvo have revolutionized how consumers find and evaluate attorneys, creating a system where each lawyer is individually rated and reviewed. These consumers aren’t browsing law firm websites, they’re comparing individual attorneys based on credentials and client reviews. The platform’s success demonstrates several critical principles:

Individual Differentiation Creates Competitive Advantage. Within a single law firm, different attorneys inevitably have different specialties, communication styles, and track records. A lawyer whose Avvo profile is fully filled out, including awards, speaking engagements, and recommendations from other attorneys, will have a high Avvo rating. This individual differentiation helps potential clients find the right attorney for their specific needs, rather than making a generic choice based on firm marketing alone.

Personal Reputation Drives Hiring Decisions. As long as star ratings are the best they can be across all platforms, attorneys are in a good position to get found by highly interested potential customers at the bottom of the marketing funnel. These are people who have already decided they need legal help and are actively comparing their options. Individual reviews provide the social proof necessary to convert that interest into a retained client.

Aggregation Still Delivers Firm-Level Benefits. Here’s the key insight many wealth management firms miss: collecting reviews at the individual attorney level doesn’t preclude firm-level benefits. Law firms routinely showcase their top-rated attorneys on their websites, and those individual ratings contribute to the firm’s overall reputation and brand equity. You get the best of both worlds.

The Psychology of Individual vs. Institutional Trust

Why does this individual focus matter so much in trust-based professions? The answer lies in fundamental human psychology and the nature of professional relationships.

Both personal branding and reputation strategies aim to increase authority in your area of expertise. Personal branding achieves this by making you more recognizable as a trusted resource. When consumers face important decisions about their health, legal matters, or financial future, they instinctively seek connection with another human being, not with an institution.

The vast majority of millennials (84%) don’t trust ads and businesses, but they do trust the individuals behind those brands when the individual has two things: a good reputation and a well-developed brand. This generational shift has profound implications for wealth management firms. The next generation of investors grew up reading individual reviews for everything from restaurants to college professors and babysitters. They expect the same transparency and individual accountability when choosing a financial advisor.

The Case for Individual Advisor Reviews in Wealth Management

Now let’s apply these insights specifically to your wealth management firm. The parallels are striking, and the opportunities are enormous.

The Reality of How Consumers Find Financial Advisors

To briefly recap key findings from our Wealthtender 2025 Study of $100K+ Households Seeking Financial Advice: 96% of people referred to a financial advisor will still research them online before making contact. This is the same behavior we see in healthcare and legal services: referrals create interest, but online research drives hiring decisions.

But here’s what makes this research particularly relevant: when people search, they’re most likely to have been referred to the individual advisor by name, and that’s who they will be searching for. Not your firm. Not your brand. The specific advisor who was recommended to them.

And the data confirms this individual focus: The Wealthtender 2025 Voice of the Client Study found that clients mention individual advisors by name nearly 25 times more often than they mention their firms. This isn’t a small preference, it’s an overwhelming pattern that reveals the true nature of financial advisory relationships. First and foremost, clients form bonds with individual professionals, not institutions.

The study found that 83% of respondents plan to research an advisor’s reputation by looking for online reviews and awards as their primary next step after receiving a referral. If those reviews don’t exist, or if they only exist at the firm level rather than the individual advisor level, you’re missing the critical moment when a warm referral converts into a scheduled consultation.

The Voice of the Client Reveals the Truth

Let’s dive deeper into the Voice of the Client Study that analyzed over 2,500 client reviews from more than 200 advisors across 35 states. The study reveals exactly what clients value when writing about their financial advisors:

89% of reviews center on relationship quality, planning advice, and emotional factors, the human elements of the advisor-client relationship. Only 10% focus on investments or portfolio management.

This finding is instructive for how we think about modern marketing tactics for wealth management firms. Clients aren’t writing elaborate reviews about your firm’s investment philosophy or your Chief Investment Officer’s market outlook. They’re writing about how their individual advisor made them feel across major life milestones, the clarity their advisor brought when difficult decisions needed to be made, and the trust built through years of personalized guidance.

The study found that 86% of reviews convey strongly positive sentiment, with clients using an average of 86 words per review, many sharing detailed, story-like testimonials that reflect deep emotional investment in the relationship. These aren’t curt “5 stars, great service” reviews. They’re narratives about how Stefanie helped a widow navigate her finances after losing her husband, or how Michael guided a couple through retirement with confidence, or how Emily became not just an advisor but a trusted partner through life’s biggest transitions.

This emotional, relationship-focused content is marketing gold, but it only exists when you collect reviews at the individual advisor level.

Four Compelling Reasons to Collect Reviews at the Individual Advisor Level

1. Higher Response Rates Through Personal Connection

When your client receives a review request from “ABC Wealth Management,” it’s a transactional ask from an institution. When they receive that same request from “Sarah Martinez, CFP,” it’s a personal ask from a trusted professional.

The difference in response rates is dramatic. Healthcare providers find that it takes only between one and six reviews for potential patients to form an opinion about a practice, which means every review matters. The personal connection between client and advisor dramatically increases the likelihood that busy clients will take time to share their experience.

Think about your own firm’s top advisors, the ones with multi-year client relationships, who attend their clients’ children’s weddings and have become trusted confidants, alongside their role as a financial advisor. These relationships have depth and emotional resonance. Reviews should capture that reality.

2. Richer, More Persuasive Review Content

Compare these two hypothetical reviews:

Firm-Level Review: “ABC Wealth Management has provided solid investment advice for our portfolio. We’ve been clients for 10 years and are satisfied with their services.”

Advisor-Level Review: “Working with Sarah Martinez has been life-changing. When my husband passed away unexpectedly, Sarah didn’t just help me navigate the financial complexity, she listened, provided emotional support, and created a plan that gave me confidence I could maintain our lifestyle and put our kids through college. Her quarterly check-ins feel like conversations with a trusted friend who happens to be brilliant with money. I can’t imagine going through this without her guidance.”

As a consumer preparing to hire a financial advisor, which review would compel you to schedule a meeting?

Advisor-level reviews naturally elicit more specific, emotional, and relatable content because clients are reflecting on a personal relationship rather than evaluating a corporate service. They’ll mention the advisor’s communication style, specific ways the advisor helped them through challenges, personality traits that made them comfortable, and tangible outcomes that mattered to their family.

This emotional specificity is marketing gold. Our research shows that 83% of people want to read online reviews about financial advisors before hiring one, and they’re looking for reviews that help them understand what it will actually be like to work with that individual professional. Generic firm-level reviews simply cannot deliver this level of insight and connection, while advisor-level reviews can provide insights into both.

3. Performance Management and Training Insights

Here’s a benefit many wealth management firm leaders likely haven’t yet considered: individual advisor reviews provide invaluable business intelligence for managing and developing your team. For example, imagine how individual-advisor reviews could enhance your annual performance assessment process. Insights gathered from advisor reviews could help identify which advisors excel in soft-skills like communications and empathy, and others receiving praise for the outcomes they’ve generated through years of financial planning.

Beyond opportunities to recognize and reward exceptional client service, reviews may also illuminate areas where advisors could benefit from additional coaching or training. (This is exactly what we’re fleshing out through our Wealthtender partnership with the University of Texas.)

Healthcare practices that treat reviews as continuous feedback loops improve on both patient loyalty and employee retention. The same opportunity exists in wealth management. Client reviews, collected consistently at the individual advisor level, become a powerful tool for identifying strengths to celebrate, gaps to address, and best practices to share across your advisory team.

This is impossible to achieve with firm-level reviews alone. When clients write about “the firm,” they rarely provide the specific, actionable insights that individual advisor reviews naturally generate.

4. The Best of Both Worlds

The good news about collecting reviews at the individual advisor level is that doing so doesn’t prevent you from also promoting them at the firm level, essentially providing the best of both worlds for wealth management firms that execute a holistic testimonial marketing strategy.

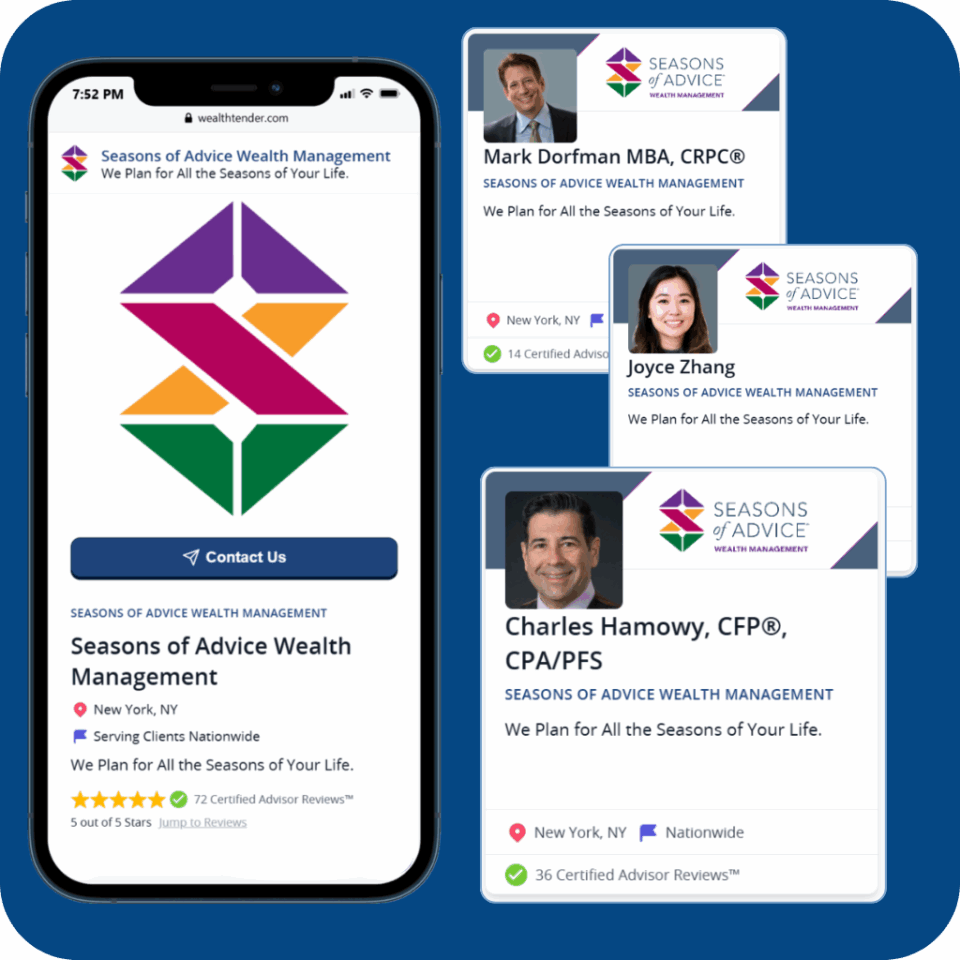

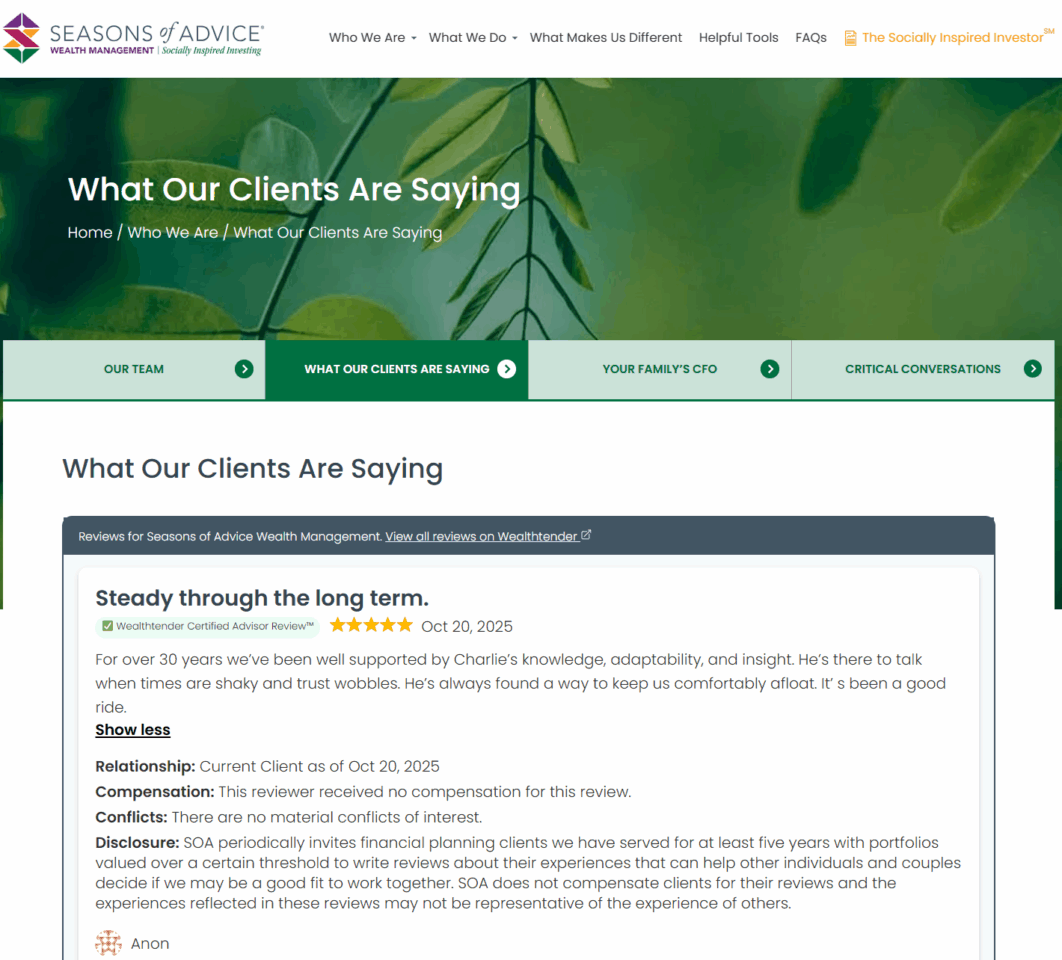

Consider Seasons of Advice Wealth Management, a $1B+ AUM advisory firm in New York City that partners with Wealthtender to collect and publish compliant reviews.

Visit their firm profile on Wealthtender and you’ll see an aggregation of all of their individual advisor reviews, plus links to the profiles of each individual advisor, strengthening SEO and AI-optimization for the firm and advisors alike. The reviews you’ll find aren’t generic firm testimonials; they’re specific, heartfelt accounts of individual client-advisor relationships.

Looking at Charles Hamowy’s reviews, you’ll see clients describing him as “the architect of my well lived life” and “the reason I have a healthy retirement portfolio.” For Chris Conigliaro, clients write about “20+ years” of trust and how “he is someone I trust.” These deeply personal testimonials reflect the reality uncovered in the Voice of the Client Study: 89% of reviews focus on relationship quality and emotional trust, not just financial outcomes.

Here’s where Seasons of Advice gets even more value from their client testimonials. Beyond their publication on Wealthtender, they also display reviews on individual advisor bio pages on their website using embeddable widgets from Wealthtender, allowing prospective clients searching for a specific advisor to see relevant social proof immediately. And they roll up these same reviews on their firm-level reviews page, creating a comprehensive showcase of client satisfaction that elevates the online reputation of both advisors and the firm.

This is the “best of both worlds” approach that forward-thinking firms are adopting: collect at the individual level, publish at both the individual and firm level, and promote wherever it makes strategic sense. You can’t do this in reverse. Firm-level reviews are more difficult to attribute to individual advisors, and to the extent they are, they’re much less likely to include the emotion captured in reviews submitted at the advisor level.

Moreover, this approach aligns perfectly with how consumers want to research advisors. They want to read about the specific advisor they might hire, but they also want to see evidence that the firm as a whole maintains high standards. Individual advisor reviews aggregated at the firm level provide both.

The Potential Exception: Small Ensemble Advisory Firms

For small wealth management firms, typically those with just two to three advisors that provide financial planning services to clients through an ensemble approach, collecting reviews at the firm level could still result in testimonials that describe how individual team members made a difference in their lives. Unfortunately, this approach doesn’t offer the SEO and AI-optimization benefits at the individual advisor level, but as we discuss in the next section, Wealthtender introduced its Review Sync feature to solve for this shortcoming.

Why Wealthtender is the Optimal Online Review Platform for Wealth Management Firms

We founded Wealthtender in 2019 in anticipation of the SEC’s repeal of its longstanding prohibition of advisor using testimonials in their marketing activities. When the SEC Marketing Rule became effective on May 4, 2021, we publicly launched Wealthtender as the industry’s first online review platform designed for regulatory compliance.

While the regulatory elements we incorporated throughout Wealthtender are naturally based on SEC and FINRA requirements, our design of Wealthtender to incorporate both individual and firm-level reviews was inspired by the data-driven insights available in the healthcare and legal professions.

Individual Advisor Profiles with Firm-Level Aggregation

Wealthtender’s design incorporates best practices implemented by similar healthcare and legal platforms after many years of real-world consumer use. By creating detailed individual profiles with reviews for each advisor, then rolling up those reviews to the firm level, wealth management firms benefit from lessons learned by doctors and lawyers for more than a decade before online reviews became available to financial advisors.

With Wealthtender, each advisor gets their own profile page optimized for visibility in traditional search engines and AI tools like ChatGPT and Gemini, online reviews that further elevate their stature as a brand ambassador for the firm, while the firm itself maintains a profile that highlights the entire team’s collective excellence.

Alignment with Modern Consumer Search Behavior

By collecting reviews on Wealthtender, firms ensure their advisors are discoverable both through traditional search engines like Google and emerging AI-powered search tools like ChatGPT, Gemini, Perplexity and Claude. Wealthtender’s structured data and third-party validation provide AI tools confidence in the authenticity and relevance of the reviews, increasing the likelihood that your advisors appear in AI-generated recommendations.

In addition to meeting the expectations of consumers during their advisor evaluation process, wealth management firms that partner with Wealthtender to collect and publish individual advisor reviews enjoy SEO and AI-optimization benefits that bolster their brand at both the advisor and firm level.

Learn how Wealthtender helps advisors and wealth management firms optimize for the AI era:

Wealthtender Featured in Barron’s | How Advisors Get Found in ChatGPT & AI Tools | On-Demand Webinar with Samantha Russell

Review Sync for Small Ensemble Advisory Firms

Small wealth management firms operating with an ensemble approach that join Wealthtender can activate the Review Sync feature to collect reviews on their advisory firm profile, and then, once disclosures are added, incoming reviews are displayed on each advisor’s Wealthtender profile, in addition to their firm profile.

This approach strengthens SEO and provides AI-optimization benefits for the firm and each advisor. When prospects preparing to hire financial advisors conduct research online, whether they search the name of the firm or any of the individual advisors in Google, ChatGPT, Gemini or any other search engine or AI tool, the reviews reflected on each Wealthtender profile results in maximum visibility.

Implementing an Individual Advisor & Firm Review Collection Strategy

Step 1: Shift Your Mindset

The first and most important step is recognizing advisors for the client-facing role that they play, each with their own unique strengths, styles, and client relationships. Each advisor is a brand ambassador for your firm, and their individual reputations contribute to (rather than compete with) your firm’s overall brand equity.

Step 2: Create Individual Profiles on Wealthtender

Work with Wealthtender to establish detailed profiles for each advisor on your team. Profiles should include professional credentials and experience, areas of specialization, and personal background that helps clients feel an emotional connection. Embedding a ‘get to know you’ video is also recommended to help prospects get a sense of an advisor’s personality.

The completeness of profiles matters. In the legal profession, attorneys whose profiles are fully filled out, including reviews, awards and detailed bios, receive more prospect inquiries. The same principle applies to financial advisors.

Step 3: Systematize Review Collection

The most successful firms make review collection a standard part of their client service process, not an afterthought. Consider:

- Personal Touch: Have the review request come directly from the advisor, not from a generic firm email address

- Make it Easy: Provide direct links to submit reviews on the advisor’s Wealthtender profile

- Timing: Invite clients to write reviews a week after annual client meetings or to coincide with the firm’s anniversary

Step 4: Celebrate and Share Reviews

When advisors receive glowing reviews, celebrate them. Share highlights in team meetings, feature exceptional reviews in internal newsletters, and include review metrics in advisor performance evaluations. This creates a culture where client feedback is valued and where advisors feel recognized for the relationships they’ve cultivated.

On the external side, leverage these reviews in multiple ways:

- Display reviews on individual advisor bio pages on your website

- Showcase testimonials on your firm’s main reviews page

- Reference specific feedback in advisor bios and marketing materials

- Share (with client permission) success stories in thought leadership content

- Promote reviews compliantly with Testimonial Marketing Studio

Promote testimonials in social media posts, prospect nurturing campaigns and other marketing initiatives with compliant templates created in Testimonial Marketing Studio™. Learn More & View Examples

Step 5: Monitor, Analyze, and Improve

Establish a process to review your advisor’s reviews to identify patterns:

- Which advisors are most effective at generating thoughtful reviews from their clients?

- What common themes appear in the most compelling reviews?

- Are there hints of service gaps discernable in reviews?

- Which advisors might benefit from additional training or support?

Wealth management firms that treat reviews as continuous feedback loops, monitoring sentiment and using the insights to make improvements stand to outperform on loyalty and retention. Make this ongoing analysis part of quarterly or annual business reviews.

The Competitive Advantage of Early Adoption

Most wealth management firms haven’t yet begun collecting online reviews, which means early adopters have an enormous opportunity to differentiate themselves. In fact, fewer than 10% of advisors are actively collecting and publishing reviews according to Form ADV data.

This contrasts significantly with our consumer research that shows that 83% of people want to read online reviews about financial advisors before hiring one.

Think about that disparity: more than 8 in 10 prospective clients are looking for reviews, but 9 in 10 advisors don’t have them. If you’re among the first in your market to build a robust collection of individual advisor reviews, you’re not just slightly ahead, you’re setting your advisors and firm apart from 90% of competitors. And you’re not just winning on marketing; you’re providing the transparency and social proof that consumers today expect to find before making a hiring decision.

How Wealth Management Firms with Advisor Reviews Can Outperform Peers

The wealth management industry will continue to adapt and evolve as consumers increasingly look for online reviews to decide which advisors they can trust, and as AI search tools like ChatGPT use online reviews as a primary trust signal to determine which advisors will appear more frequently and prominently in responses to consumer queries.

This isn’t just about reviews, it’s about strategically thinking about how your firm approaches talent development, client relationships, and brand building.

Many of the most successful firms in the coming years will include those that:

Embrace advisors as brand ambassadors. Recognize that strong individual advisor brands strengthen your firm’s overall brand. Every glowing review of an individual advisor enhances the perception of your firm’s hiring standards, training programs, and client service culture.

Celebrate advisor excellence publicly. Make your advisors visible. Showcase their expertise. Let their personalities and values shine through. Prospective clients don’t want to work with a faceless firm, they want to work with Sarah, with Michael, with Jennifer.

Build systems that scale reputation. Don’t leave review collection to chance. Build it into your client service model. Make it easy. Make it consistent. Make it a point of pride for advisors to share their client feedback.

Use reviews as a strategic tool. Go beyond marketing to use client feedback for training, quality assurance, advisor development, and continuous improvement. The firms that extract the most value from reviews will be those that view them as business intelligence, not just social proof.

Act with urgency. Every month that passes without collecting reviews is a month of lost opportunity, both to capture client feedback while experiences are fresh and to build your competitive moat before the rest of the industry catches up.

Ready to Implement Your Advisor + Firm Testimonial Marketing Strategy?

The parallels between wealth management and other trust-based professions are undeniable. Doctors and lawyers have proven the model works. Consumer research confirms that this is exactly what prospective clients are seeking. Platforms like Wealthtender have solved the compliance challenges. And forward-thinking wealth management firms partnering with Wealthtender have demonstrated how it’s done.

With 96% of Americans researching advisors online after receiving referrals, and 83% specifically looking for reviews about individual advisors, the consumer has spoken. Individual advisor reviews aren’t a nice-to-have feature, they’re table stakes for wealth management firms that want to optimize their marketing activities for maximum conversion potential.

Start by scheduling a demo call or signing up for Wealthtender – it takes just 2 minutes. We’ll create your firm and advisor profiles on Wealthtender and provide the step-by-step guidance that hundreds of advisors and firms have used to collect thousands of glowing reviews. We provide compliant tools to amplify the impact of your client testimonials on your website, in social media posts, and beyond. Implement systems to make review collection a routine part of your service model. Celebrate the results and use the insights to continuously improve.

Your advisors have spent years building deep, trusting relationships with their clients. It’s time to let the world see the exceptional work they do, one authentic review at a time.

Want to see how individual advisors and leading wealth management firms are successfully using Wealthtender to grow their business? Visit Wealthtender.com/grow or schedule a demo to learn how you can start converting more prospects into clients with compliant testimonial marketing.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.