Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Ask an Advisor: Should You Invest Differently in Retirement Than While Saving?

Here’s Why the Math Changes: Investing Before vs. In Retirement

There’s a significant difference between the math of a retirement portfolio and that of a saver’s portfolio.

The main cause of this difference?

Portfolio withdrawals.

A saver’s portfolio benefits from regular contributions and the power of compounding over time, whereas routine and sometimes unexpected withdrawals gradually diminish a retirement portfolio.

Most retirement research focuses on managing this risk with ‘safe withdrawal’ strategies, the most famous being the 4% rule. However, there are many approaches to suit different needs and spending plans.

While everyone needs a withdrawal strategy tailored to their spending needs, many overlook the importance of investing their retirement portfolio differently than their saver’s portfolio.

The first thing to note is that there is no perfect investment strategy. The best investment strategy is one that you can stick to for the long run.

How do you choose the best investment strategy for yourself?

By reviewing market history.

Fortunately, this doesn’t require a fancy credential like a CFA, nor does it require extensive backtesting. Numerous studies and tools are available to help you gain a big-picture understanding of how your investment strategy handles certain market environments.

To be clear, the point isn’t to use history to predict the future, but to use it as a guide. Understanding past market environments helps you appreciate the value of risk management, so you’re better prepared when history repeats or rhymes.

Q: Can you explain what you mean by the “math of a retirement portfolio differs from a saver’s portfolio?”

Nate: The best way to explain this is by taking a recent real-world, worst-case scenario using your current investment strategy. However, let’s keep it easy and focus on it through the lens of basic math.

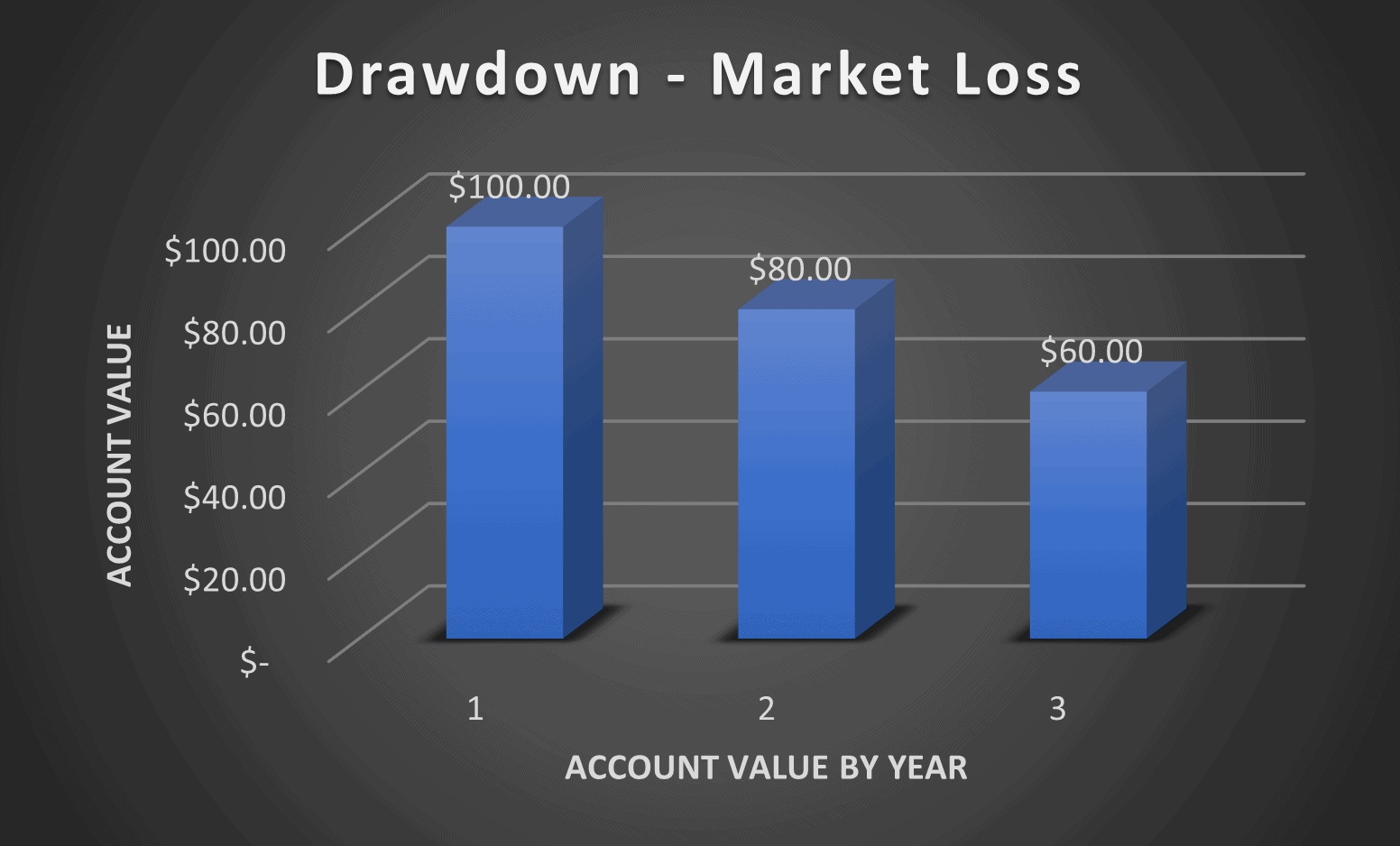

First, you must understand that a market drop has a linear impact on your portfolio balance in the absence of moving funds into or out of your portfolio:

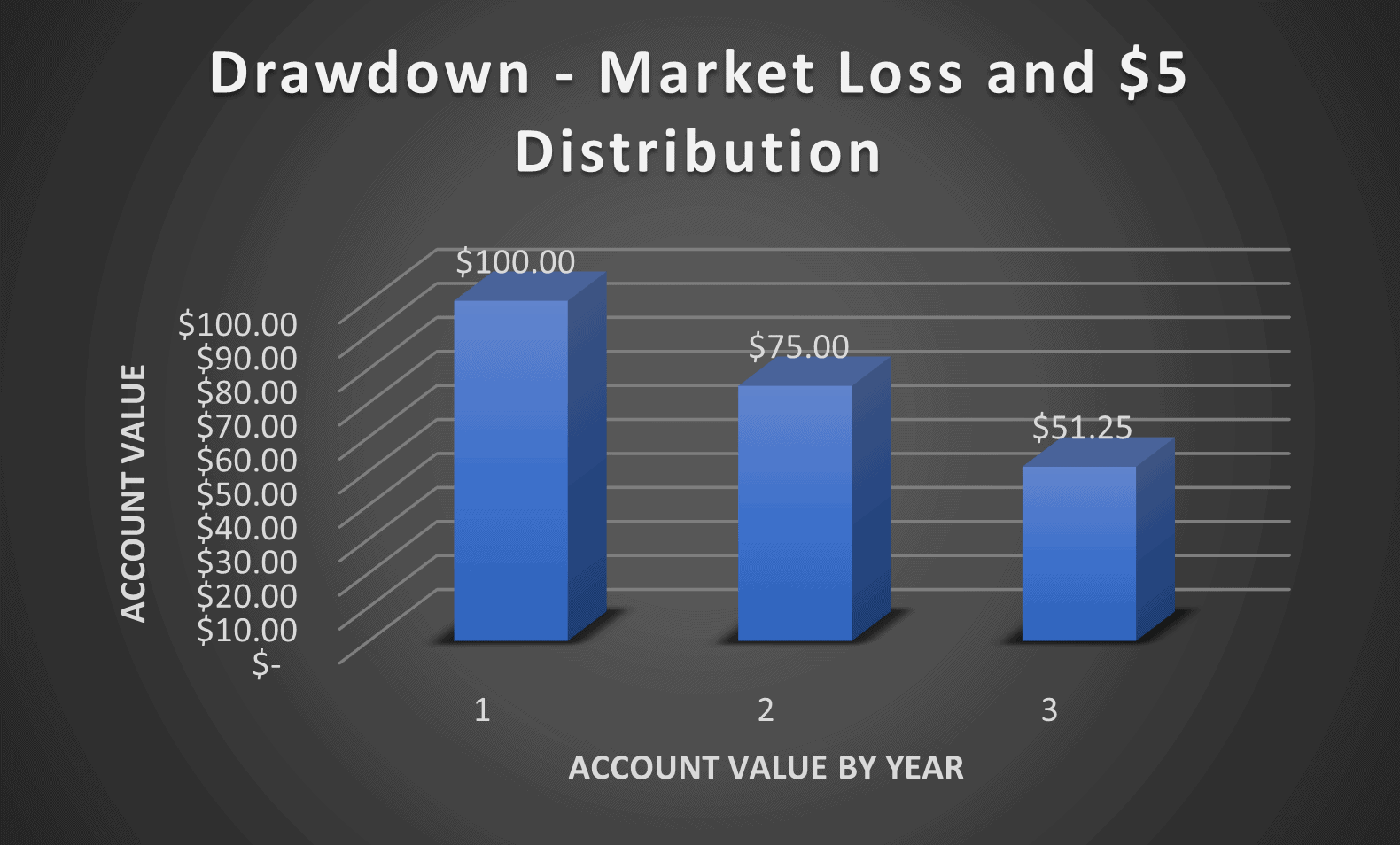

Next, when you introduce portfolio withdrawals, the losses are magnified:

- Year 1 = 20% investment loss.

- Year 2 = 25% investment loss.

A key clarification on the two images above. Both images show a 20% and 25% investment loss, but image #2 introduces portfolio withdrawals which turns that 20% loss into a 25% drawdown and 31.67% drawdown. A portfolio drawdown is the decline in value of an investment from it’s peak, which ultimately is the number that matters because it considers both portfolio losses and distributions.

Awareness of drawdowns is important because it brings us to the most important factor of all.

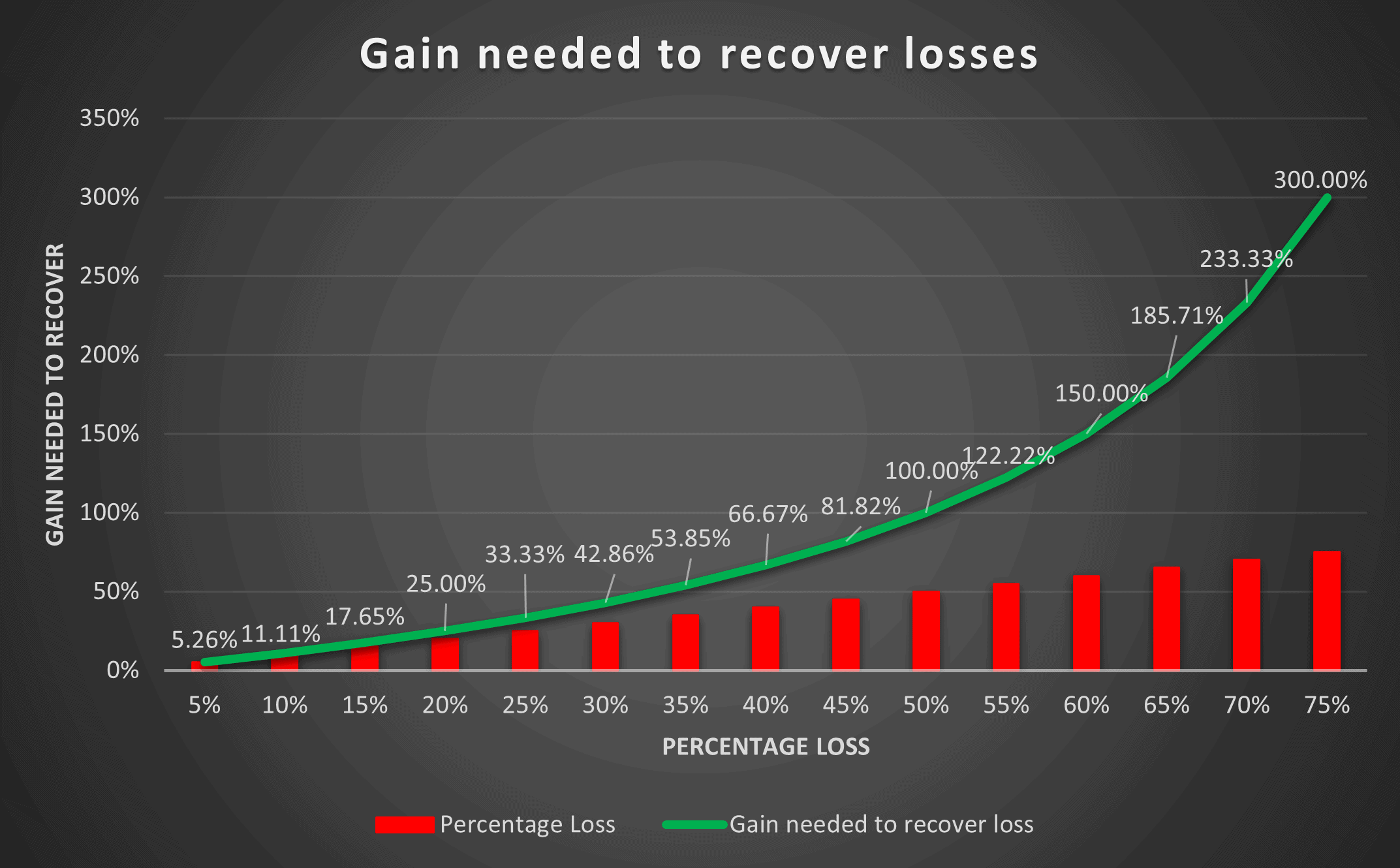

The math of gains and losses.

Why does the math of gains and losses matter? It’s because the math of gains and losses is “nonlinear.” This means that as the loss gets bigger, the gain needed to recover the loss increases at an exponential rate:

Market losses are an inevitable part of investing. Portfolio withdrawals are an inevitable part of a happy retirement.

Therefore, you need to understand that withdrawals magnify losses, and the larger the loss, the longer it takes to recover.

With this in mind, you can see how the math of a retirement portfolio differs from the math of a saver’s portfolio.

Q: When meeting with new clients, how do you describe how they should invest their retirement portfolio differently from their saver’s portfolio?

Nate: The first thing I do is try to understand their beliefs and experience surrounding investing. Understanding their beliefs and experiences is critical to helping them choose the right investment process.

This leads to a discussion that involves examining market history. I highlight the best and worst periods for each asset class (e.g., stocks, bonds, and real assets), as well as average times, to give a balanced perspective.

Completing this exercise creates many ah-ha moments.

Before understanding this concept, most retirees base their investment decisions on what’s worked well recently. This recency bias has blinded them to the fact that different economic environments can exist. It proves that no asset class is always superior, so a prudent approach to diversification provides the risk management they need in retirement.

The final step in the process is to expand their awareness around alternative risk management options such as trend following, or what I like to call “tactical asset allocation.” Tactical Asset Allocation (TAA) is a flexible approach that adjusts your investment mix based on changing market conditions, aiming to manage risk and seize opportunities as they arise.

Tactical Asset Allocation (TAA) will lean into or sit out of certain asset classes when its risk/reward ratio is favorable or unfavorable. This helps remove our natural recency bias as investors, where we tend to own what’s worked for the past few years. It ultimately gives us a solid process for owning asset classes that were previously out of favor or with which we are unfamiliar.

Q: How did you first learn why you must treat a retirement portfolio different from a saver’s portfolio, and what led you to specialize in helping your clients choose the right investment process for their retirement?

Nate: The biggest influence on my awareness around this issue goes to Todd Tressider of FinancialMentor.com who created the Expectancy Wealth Planning course. The next influential resources are from Meb Faber’s Global Asset Allocation and Quantitative Approach to Tactical Asset Allocation. Finally, the cherry on top is from work by James Sandidge’s work on retirement income risks. You can find a complete list of my favorite resources by clicking here and scrolling to the bottom of the page.

After learning from some of the brightest minds in retirement, I felt like it was my duty to spread the word and help more people avoid the negative effects of mistreating their portfolio in retirement. You only have one shot at a financially successful retirement, so taking a careful approach to designing a retirement portfolio is a critical step in the right direction.

Q: Are there particular market environments where you feel it’s more important prudently manage a retirement portfolio?

Nate: While every retiree must take a prudent approach to managing their retirement portfolio, there are certain market environments where you need to be more aggressive with your portfolio risk management.

A retirement portfolio is at its greatest risk during periods of:

- High market valuations

- Low interest rates

- High or volatile inflation.

These environments can amplify risks for retirees, making prudent risk management and diversification even more critical.

Since most investors base their investment decisions based on what’s worked well most recently, they typically find themselves invested in asset classes with high market valuations. While some asset classes warrant a higher valuation, the higher the valuation of that asset class, the lower probability of it continuing to grow the way it did in the past.

That said, valuation should never be used as a timing tool. It’s best used as an expectations tool.

If interest rates are low, then asset classes that are interest rate sensitive will pay a lower yield and face headwinds as interest rates rise. Possibly worst of all is high or volatile inflation periods that often present complex periods for traditional stock and bond portfolios to navigate.

Since we’re always dealing with an unknowable future, it’s my preference to include properly designed tactical asset allocation within a retirement portfolio. It will never provide the “perfect” allocation for the time period, but it can provide a much more consistent return stream through all economic regimes, which is an important feature of a retirement portfolio.

You only get one shot at a financially secure retirement. By understanding the unique challenges of retirement investing and adopting a flexible, risk-aware approach, you can better protect your nest egg and enjoy the retirement you’ve worked so hard to achieve.

Have a Question to Ask a Financial Advisor?

When you’re uncertain about money matters, submit your question to Wealthtender, and it may be answered by a financial advisor in an upcoming article or in the Wealthtender Expert Answers Forum.

Need personalized help? Visit wealthtender.com to find the right financial advisor for your unique needs.

This article was originally published on Wealthtender and is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions. Wealthtender earns money from financial professionals, which creates a conflict of interest when these professionals are featured in articles over others. Read the Wealthtender editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

About the Author

Nate Byers, CPA/PFS | Calculated Wealth

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor