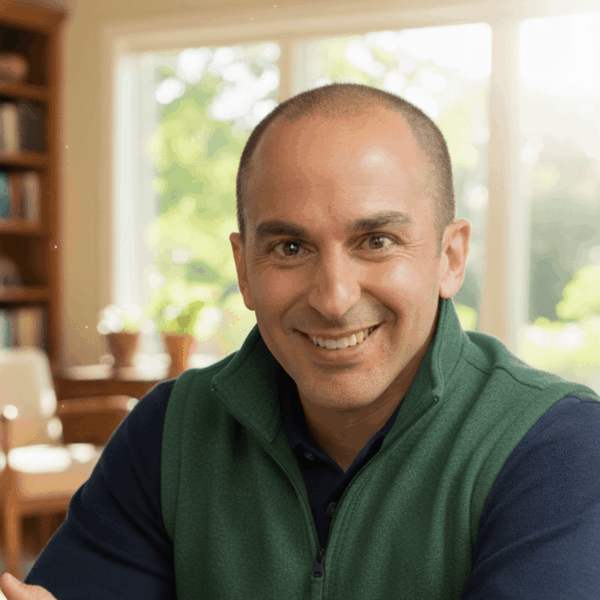

Christopher Lazzaro, ChFC®, RICP®

Advice-Only | Flat-Fee | Fiduciary

Wealthtender Community Connect helps people discover the best financial advisors for their individual needs through their favorite blogs and podcasts.

Click Here to Learn MoreServing Clients Nationwide

Advice-Only | Flat-Fee | Fiduciary

Areas of Focus

- Financial Life Planning

- Retirement Planning

- Retiring Early (F.I.R.E)

- Tax-Smart Accumulation Planning

- Tax-Smart Distribution Planning

About Christopher Lazzaro, ChFC®, RICP®

Hi, I'm Christopher Lazzaro. I founded Plan For It Financial, LLC, to follow my passion for helping others gain a deeper understanding of their personal finances.While most everyone understands the importance of getting their respective financial houses in order, the challenge lies in balancing living for today, while maintaining an eye toward the future. Bridging this gap through realistic goal setting, establishing priorities, and practical, actionable advice without the unnecessary layers of financial jargon and complexity is my firm’s primary value proposition.

I focus principally on mid- to late-career professionals and early-stage retirees. This group is often considered to be nearing or in the retirement "red zone." The retirement “red zone” is characterized as the five years leading up to and following the decision to stop working full time. I have found clients appreciate working with an advisor that can directly relate to this exciting, but also scary, season of life.

My three decades of investment management and insurance experience, includes more than 23 years at one of Boston's preeminent institutional asset managers working with some of the country’s largest public and private pension plans, endowments, and foundations.

I take great pride in and am grateful for the opportunity to offer clients access to personalized, unbiased financial advice to make informed decisions with confidence. If you are ready to take the first step to get your financial house in order, or just in need of a check- up without high pressure sales pitches, let’s connect!

Professional Designations

- Chartered Financial Consultant (ChFC)

- Retirement Income Certified Professional (RICP)

Affiliations

-

Advice Only Network

- Fee Only Network

- Financial Planning Association

- Fee Only Network

Primary Location

17 Paradise Road, Vinnin Square Plaza, Ste 1099 - Salem, MA 01970

Meeting Options

- Video Conference

- In-Person

- Phone

Compensation Methods

- Fee Only

- Flat Fee

- Hourly Rate

- Offers Advice-Only Services

- One-time Financial Plan

What to expect in the first meeting

Click the 'Book Intro Call' button above to schedule a complimentary conversation. We’ll discuss what led you to reach out to a financial planner at this time, set expectations, and clarify whether an advice-only firm like ours aligns with your unique needs and objectives. Thank you and look forward to meeting!About Plan For It Financial, LLC

Plan For It Financial was founded on the belief that a goal without a plan is just a wish. was founded on the belief that a goal without a plan is just a wish. The inspiration? The 1943 classic children’s book The Little Prince. Some 80 years later, we couldn't agree more.With that belief in mind, we are dedicated to guiding individuals and families through the process of defining, creating, and executing financial plans unique to their specific goals and circumstances.

Guiding Principles:

✔️ Plan For It Financial is an advice-only financial planning firm. You can expect comprehensive financial advice and education without the precondition of managing your investments.

✔️ Plan For It Financial is a flat-fee financial planning firm. You will always know what you are paying, upfront, and there are no asset minimum threshold requirements.

✔️ Plan For It Financial acts as a fiduciary to its clients and is legally and ethically required to always act in your best interest.

Who We Serve:

• Mid-Career (Age: 40+)

• Nearing Retirement (Age: 50+)

• Newly Retired

Education

Salem State University, Bachelor of Arts, English

Hobbies and Interests

- Family

- Golf

- Sports

- Tennis

SEC Lookup

View DisclosureWho We Serve

- Baby Boomers

- Corporate Executives

- DIY Investors

- Dual Income Family

- Entrepreneurs

- Families

- Gen X

- Individuals

- Living in Retirement

Wealthtender® is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. Testimonials may not be representative of other clients’ experiences and do not guarantee future performance or success.

Write a Review

By clicking submit, you acknowledge this review is based on your own experience and reflects your genuine opinion. You also agree to our review policy, privacy policy, and terms and conditions, and give this financial advisor permission to publicly display your review on their website.

Highly recommend

Recommending Chris Lazzaro

Just the Advice and Assistance We Needed

Transformational Financial Guidance

Highly Recommend

We Want Your Voice to be Heard

Wealthtender exists to help people discover trusted and authentic financial professionals and educators who may be a good fit based on their unique needs and circumstances.

Your honest reviews help people decide which financial professionals and educators may be best suited to their individual needs.

The majority of people trust reviews as much as personal recommendations, so what you write in your review should reflect your own opinion and experience.

Tips for Writing a Helpful Review

Be descriptive. Instead of just saying what you like or dislike, share why. What have you enjoyed most or least about your experience with the provider? Have they helped you overcome a difficult financial challenge or strengthened your knowledge about particular money matters? The more details, the better!

Be honest. Your rating and review should reflect your actual experience.

Stay relevant. Ensure your review is helpful to others by avoiding off-topic discussions or personal opinions not relevant to your direct experience.

Make your review easy to read. Reviews should be readable to others. Use proper grammar, avoid excessive capitalization or punctuation, and be sure to check your spelling.

Be yourself. Don’t post as, or pretend to be, someone else, and do not say you’re associated with a person or organization with which you are not.

Be nice. Don’t write abusive, hateful, threatening, or harassing content. Avoid personal threats, hate speech, obscenities, or inflammatory language.

Respect the privacy of others. Don’t post information that can be used to identify another individual or compromise their privacy.

Report abuse. Thank you for helping us ensure reviews on Wealthtender are helpful to everyone. If you suspect possible violations of our guidelines or believe a review is inappropriate, please email support@wealthtender.com with a link to the provider’s profile, indicating the review in question and the reason you believe it violates our guidelines.

➡️ Are you reviewing a financial advisor? Learn more about Certified Advisor Reviews.

Disclaimers

Wealthtender reserves the right to remove reviews that violate its guidelines and/or regulations issued by the Federal Trade Commission, Securities and Exchange Commission, FINRA, and other regulatory agencies. Further, financial advisors are subject to individual firm policies and rules prescribed by federal and state regulators that may result in reviews being removed, not published, or potentially modified upon the documented request submitted by an advisor, compliance officer, or other firm professional to maintain compliance with federal and state regulations.

If you submit a review on Wealthtender, the Federal Trade Commission has issued guidance to ensure you always maintain the right and ability to request reviews be removed from any online review website, including Wealthtender. To request the removal of a review you submitted on Wealthtender, please send an email to support@wealthtender.com using the same email address you utilized when submitting the review. Please include in your email a link to the profile on Wealthtender where your review is published.

In addition to your review being published on Wealthtender, you acknowledge your review may also be published by your financial advisor on their website, social media accounts, and/or profile pages on other directory websites.

The reviews posted on Wealthtender are individual and subjective opinions. The opinions expressed in reviews are those of the reviewer and not of Wealthtender, Inc. Wealthtender does not endorse any of the opinions expressed by reviewers.

Please refer to the Wealthtender terms of service and privacy policy for additional information.

If you have questions or if we can assist with anything at all, please contact us by email at support@wealthtender.com or call us at (512) 540 – 3811.

Thank you for visiting Wealthtender and giving us the opportunity to serve you.

© 2024 Wealthtender, Inc.