Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Every year, Morningstar Research reviews medium-term market return projections from several Wall Street firms.

The 2026 Morningstar Research report was just published, and, if you believe the projections, your financial plan may require some significant revisions.

I know I’ll consider how my plan may need to be adjusted.

What the Report Includes and Caveats to Note

The report is information-dense and, used correctly, lets us tailor our financial plans to what’s coming, rather than simply assuming market returns over the coming decade will match long-term historic ones.

However, there are some important caveats.

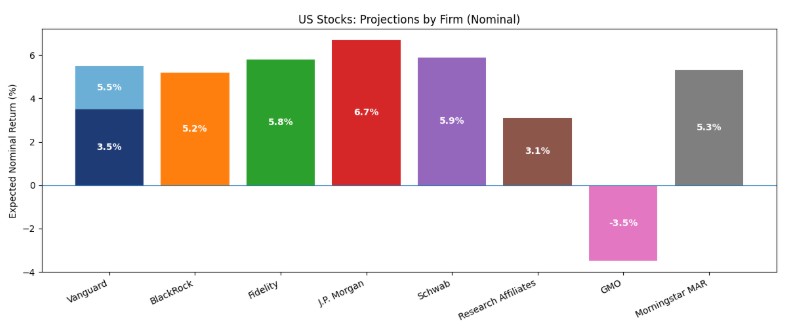

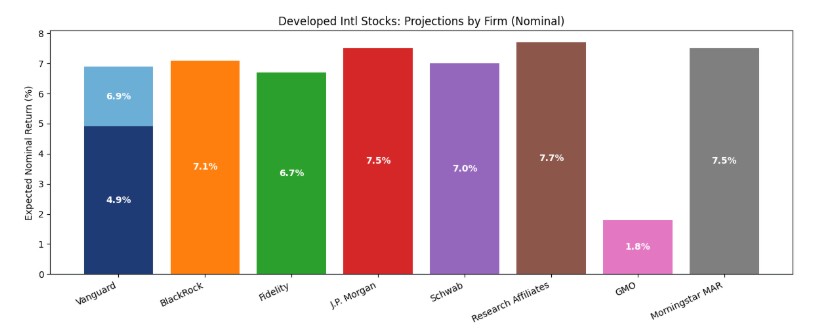

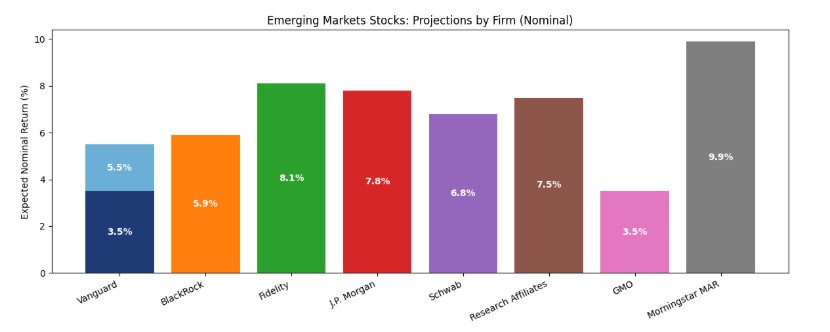

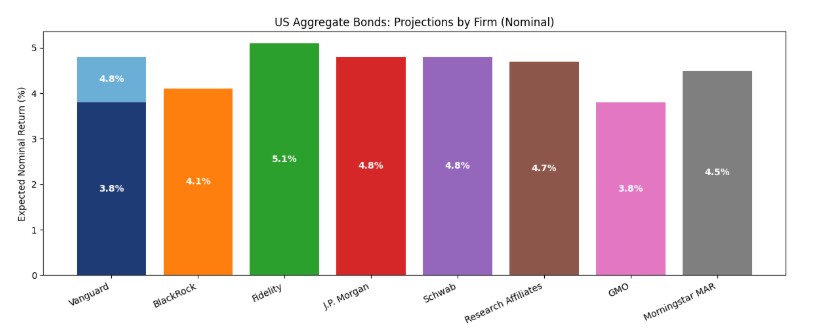

Time Frames Vary Between Projections

For each of four asset classes, the report provides the returns for the next 7-10 years by several Wall Street firms, including Morningstar Multi-Asset Research (Morningstar MAR), though some financial firms provide 10-15-year projections (JP Morgan), 20-year projections (Fidelity), or even 30-year projections (BlackRock and Vanguard, with the latter providing a range of returns for each asset class) instead. As a result, these projections should inform our medium-to-long-term planning, not what to do this year or next, nor what to expect over the long term, unless you concentrate on the three firms offering such projections.

Projections Aren’t Prophecies

The author cautions that these are projections, not guarantees. They’re intended to inform your planning, but you can’t count on them unfolding exactly as projected.

The Numbers Don’t Directly Address What You’ll Experience – They’re Nominal and Pretax

The projected returns are in nominal (except for Grantham Mayo Van Otterloo, or GMO) and pre-tax terms, which means that your plan needs to account for inflation that’s relevant to your personal basket of goods and services, as well as what your personal tax situation will be in retirement.

The Numbers Aren’t Exactly Apples-to-Apples

The different firms don’t necessarily look at the exact same asset classes. For example, JP Morgan, Research Affiliates, and Schwab only include large-cap equities in their US equity projections, BlackRock’s developed-market equities are limited to European companies, etc.

And Now, to the Numbers

Here are the market projections from the eight firms for each of the four asset classes. Note that, just for this section, I converted GMO’s numbers from the real (inflation-adjusted) returns quoted in the report to nominal numbers to better correlate with the other seven firms’ numbers, all of which were nominal.

Now that we’ve seen the numbers, we’ll look at what they mean for you. As we’ll discover below, taken together, these projections throw three major curveballs for investors. Instead of basing your financial plan on long-term historical returns, you should plan on a decade or so of (1) a dramatic collapse in expected US equity returns, (2) international stocks outpacing US stocks, and (3) bonds offering returns so close to equities that stocks’ risk premium becomes minimal.

If you’re still planning based on long-term historical averages, these projections suggest you may be planning for the wrong future. Here’s why these curveballs are heading our way, what they mean, and what you can do to prepare.

How We’ll Interpret the Above Numbers

How much can we trust these projections?

To answer that, here’s a quote I often share: “It’s really hard to make accurate predictions, especially about the future.”

It sounds like something Yogi Berra could have said (and is often misattributed to him), but it was actually a quip by 1922 Nobel prize laureate, Danish physicist Nils Bohr, paraphrasing an old Danish folk saying.

With that in mind, I’ll borrow an analysis tool I used as a grad student doing research at the European high-energy physics lab (CERN) back in the 1980s. Since physicists don’t know how the universe works, the best we can do is make educated predictions and test them against experimental results.

One way to assess our systematic errors is to use multiple methods to make the same prediction and see how widely the results diverge. The more they diverge, the less accurate we believe them to be, and unless we have reason to believe outliers more than other results, we end up with less uncertainty if we discard those outliers.

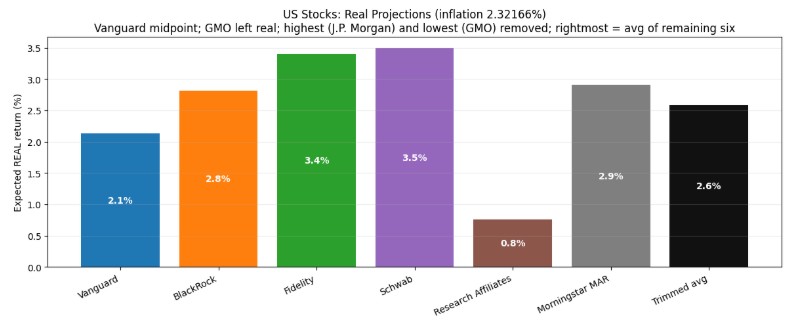

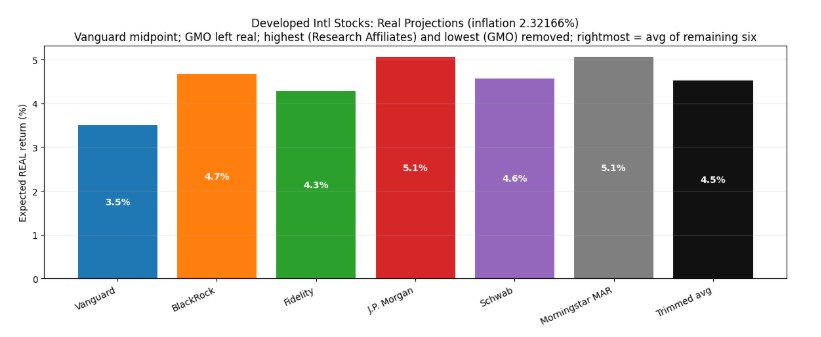

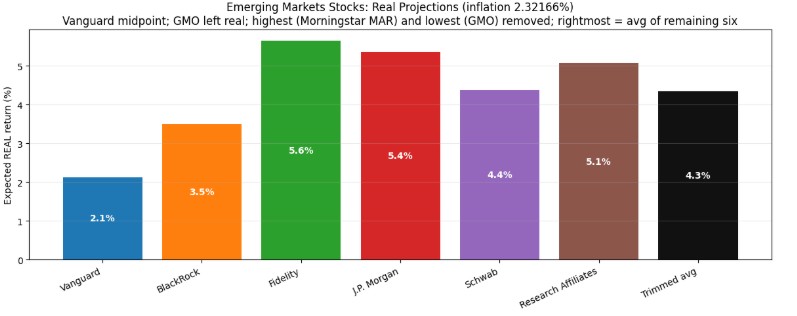

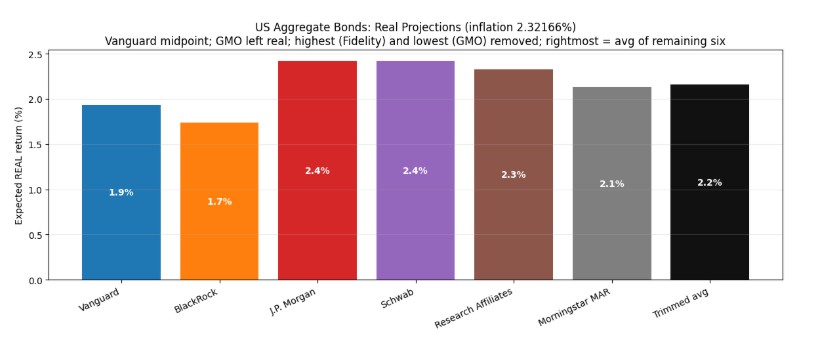

Since the different firms use different methodologies, we can do the same here, discarding the highest and lowest predictions for each asset class, and assessing how much the remaining six projections vary.

Before we decide which number is highest or lowest, we’ll average Vanguard’s conservative and optimistic numbers to arrive at a single point prediction, giving it the same weight as the other firms’ projections.

The following four graphs give us these projected annual returns for the four asset classes, with the “trimmed average” returns in the black bar at the right. However, since what matters most is how your portfolio does in inflation-adjusted, or real, terms, we show real returns, after correcting for the St. Louis Fed’s projected inflation for the next decade, 2.32166%.

Here, for US stocks, even after removing the outliers, we see a spread between 0.8% and more than four-fold higher, 3.5%, projected real returns. This suggests to me that the eventual returns may be more likely to stray further from the 2.6% trimmed average projected real return.

The spread between the second lowest and second highest projected real returns is much smaller for developed market stocks, between 3.5% and 5.1%. The second highest is only 46% greater than the second-lowest projection. This suggests to me that this asset class’s eventual real returns may end up closer to the trimmed average number of 4.5% than will be the case with US stocks.

Emerging market stock real return projections aren’t as widely spread as those of US stocks, but are more spread out than the numbers for developed markets. They vary from 2.1% to 2.7× higher, 5.6%. Thus, I expect the eventual return may stray from the 4.3% trimmed average more than will be the case for developed markets but less than for US stocks.

Here, the projected real returns vary from a second lowest 1.7% to a second highest 2.4%, just 41% higher. This suggests that the eventual bond return may stray from the trimmed average of 2.2% by the smallest amount, compared to the three stock asset classes.

To see how this may affect people’s investment results, let’s consider three hypothetical investors:

- An investor aged 50, with more than a decade to continue accumulating.

- An investor aged 60, who’s looking to retire in the next few years.

- An investor aged 70, who’s already retired.

For each of the three, we’ll assume an appropriate asset allocation, starting with the “equity allocation equals 120 minus age” rule. We’ll then break down the equity allocation further between US stocks, developed-market stocks, and emerging-market stocks in a plausible way, and examine what overall portfolio returns they can expect if the projections are to be believed.

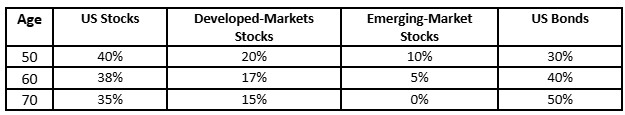

Here are the allocations we’ll use, by age:

Note that these are not “recommended” portfolios, but rather simplified, plausible, realistic example allocations to illustrate how different investors will likely be affected by the quoted medium-to-long-term return projections.

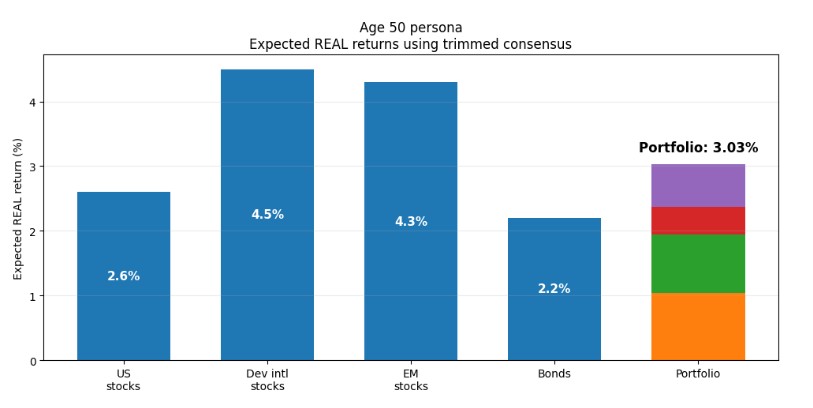

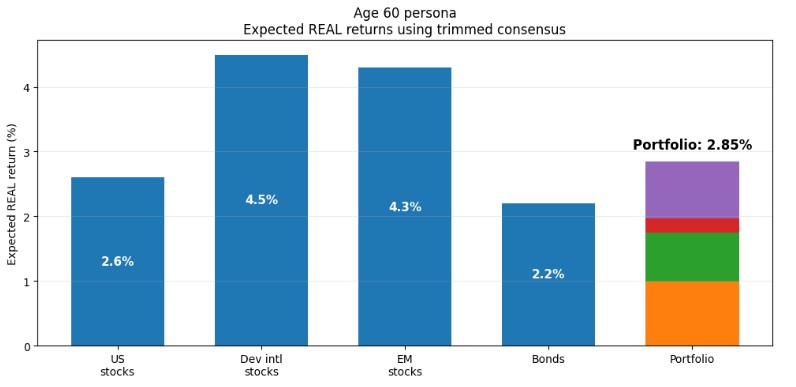

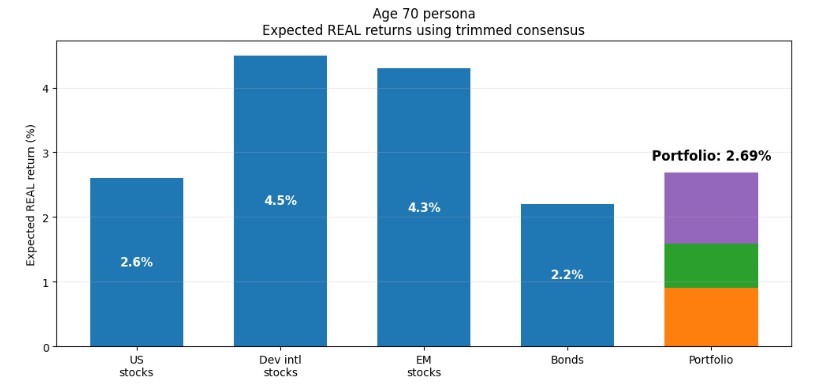

The resulting projected real returns for the three hypothetical investors can be seen in the following three graphs.

The results project a likely annual real return of 3.03% for the 50-year-old’s allocation, 2.85% for the 60-year-old’s allocation, and 2.69% for the 70-year-old’s allocation.

How Does All This Compare to Historic Returns?

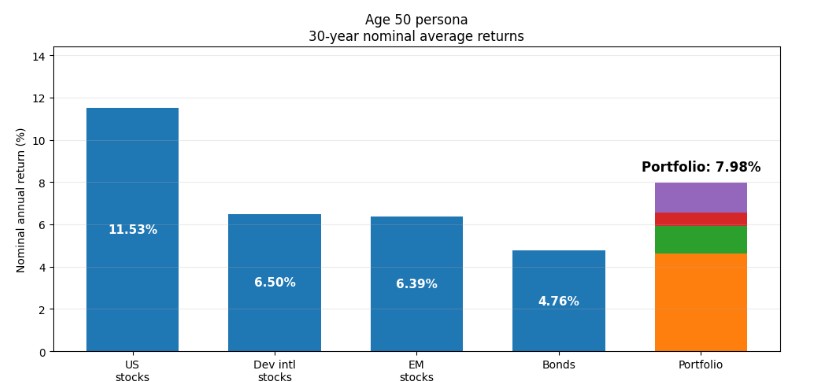

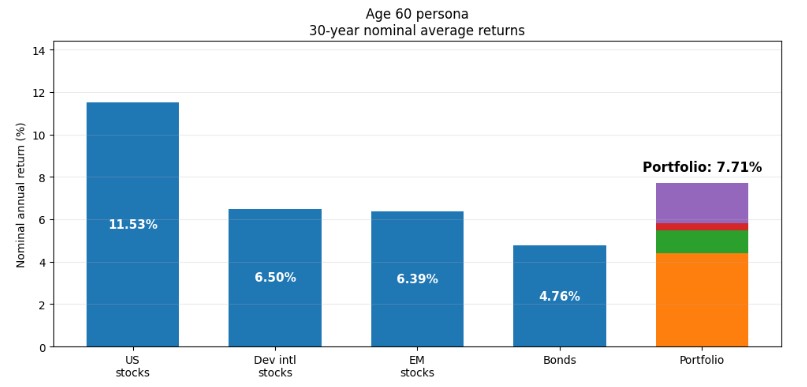

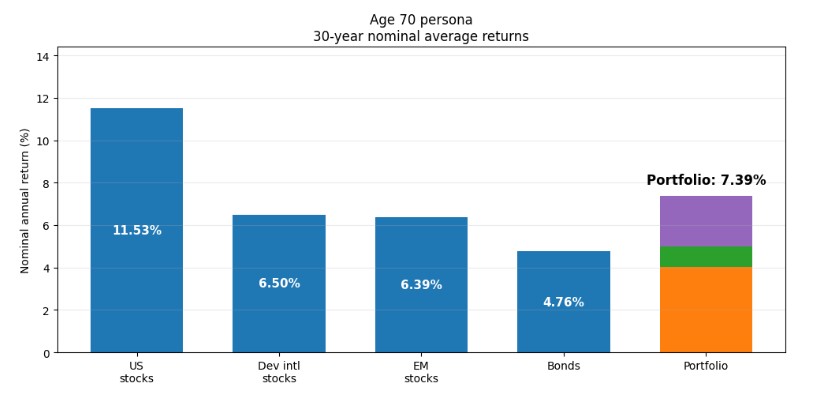

According to NovelInvestor, the four asset classes posted the following average annual nominal returns over the past 30 years:

- US large-cap stocks: 11.53%

- International (developed market) stocks: 6.50%

- Emerging-market stocks: 6.39%

- US bonds: 4.76%

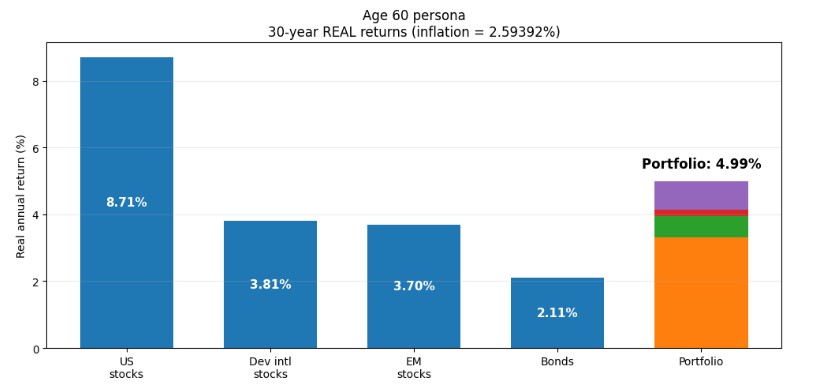

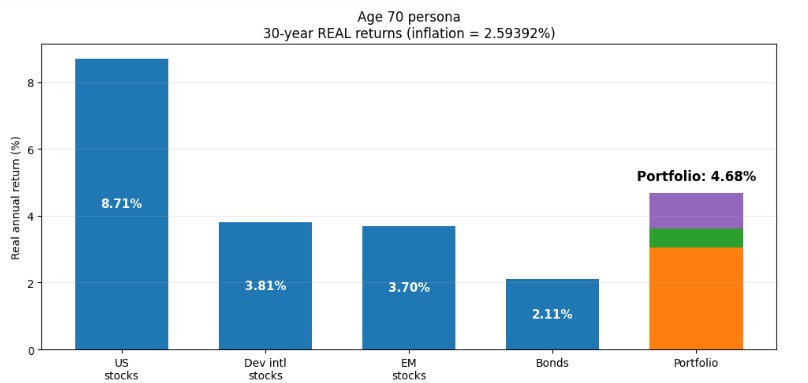

Using these historic returns, we see in the next three graphs how our three investors would have fared.

The 50-year old’s more-aggressive portfolio would have had the highest projected nominal average annual return of 7.98%, the 60-year-old’s more conservative portfolio would have achieved a somewhat lower 7.71% portfolio nominal return, and the 70-year-old’s, the most conservative, would have led to the lowest projected nominal return, at 7.39%.

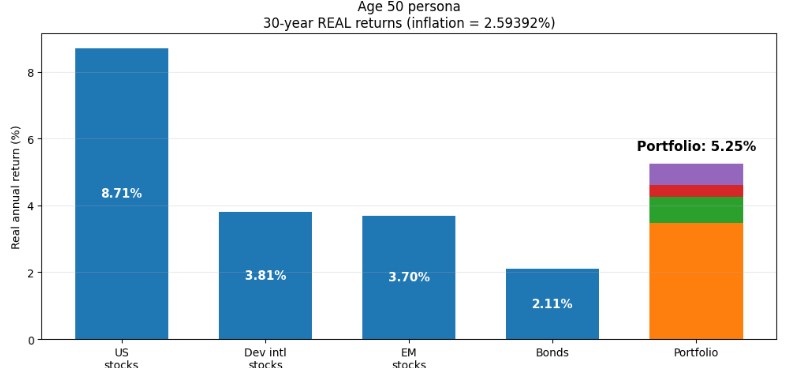

During that time, according to the Bureau of Labor Statistics (BLS), inflation, as measured by the Consumer Price Index for All Urban Consumers (CPI-U), averaged 2.59%. Thus, the real (inflation-adjusted) returns for those four asset classes over the past 30 years were 8.71%, 3.81%, 3.70%, and 2.11%, respectively.

This would have led to real portfolio returns of 5.25%, 4.99%, and 4.68%, respectively, for the three hypothetical investors.

Takeaways from the Above Analysis and the Resulting Curveballs

Over the last three decades, investors saw outsized real returns from US stocks averaging 8.7%, far higher than the more typical ~7% seen over the very long term (say, from 1926 to date). International equities, however, underperformed when considering the last three decades.

However, as alluded to above, blindly expecting the same historical returns to play out into the medium-term future is akin to driving forward with your eyes firmly fixed on the rearview mirror. This is why it’s crucial to consider projections of likely future returns when constructing your financial plan.

The new projections diverge sharply from the results of the past 30 years in three major ways:

- US stock real average annual returns are expected to be 70% lower (!) 2.6% vs. 8.7%.

- International (developed market and emerging market) returns are projected to be higher, at 4.5% and 4.3%, respectively, compared to the last 30 years’ 3.8% and 3.7%.

- US bond returns are expected to be much closer to US stock returns, 2.2% vs. 2.6%, instead of the last 30 years’ 2.11% vs. 8.71%. Thus, instead of gaining a massive risk premium of nearly 6.5%, experts think investors should now expect a risk premium of under 0.4%. This implies that more conservative portfolios may well have better risk-adjusted returns than more aggressive ones, in the medium term.

What to Consider If You Believe the Experts Are Directionally Right

As I stated above, projections are not guaranteed to materialize exactly as we think. Nobody knows how the future will turn out until it’s no longer the future.

However, when we put together our plans, we have to make assumptions as to what we think is likeliest to happen. Then, we need to consider how we will mitigate if things turn out less rosy than our assumptions lead us to believe.

I think we’d do best to use these expert projections as a plausible basis for planning. Doing that, the numbers show that whether you’re a 50-year-old, 60-year-old, or 70-year-old investor, you should expect your real average annual returns over the coming decade to be lower than long-term historical returns by about 2%, a 42% – 43% reduction.

Here are some things to consider doing as a result, depending on your risk-aversion and personal situation.

- If you expect to retire in the next decade, reduce your expectation of safe withdrawal rates to no more than 3%, at least until you’re out of the sequence-of-return danger zone, from a few years before you retire to a few years after. This is when market losses are most likely to derail your retirement plan because, to cover expenses, you’re forced to sell more of your investments at depressed prices.

- To make that work, you’d need to reduce your planned spending, continue working longer to increase the size of your nest egg, bring in a part-time income for at least the first few years of your retirement to cover spending above what the 3% draw would allow, and/or trim your retirement budget to fit that lower draw.

- Increase your financial flexibility by maximizing the discretionary portion of your retirement budget vs. your fixed expenses. Then, game out how you’d reduce your retirement spending, so you’d be able to get by if you had to reduce your annual draw by at least 10%. This would allow you to use the so-called “Guardrails Approach,” which lets you safely draw up to 33% more (say, 4% instead of 3%) initially, if you trim your draw by 10% if the planned draw would exceed your planned rate by over 20% (e.g., 4.8% of your nest egg instead of 4%). On the flip side, if things go especially well and your planned draw ends up being lower than the planned level by 20% (say, 3.2% instead of 4%), you can bump your draw up by 10%.

What the Pros Say

I asked several financial advisors for their opinions as to whether or not expert projections offer value, how to best mitigate the risks of inaccurate projections, and what we should keep in mind when trying to use such projections.

Here’s what they had to say.

Dr. Steven Crane, Founder of Financial Legacy Builders, kicks things off, “Market return projections can be useful, but they should never be treated as a plan. I use them as guardrails, not gospel. Projections help frame expectations, but real financial planning is about building resilience when reality does not cooperate, because it rarely does.

“The best hedge against bad projections is flexibility. I focus on controlling what we can: savings rate, spending behavior, diversification, tax strategy, and income planning. If returns disappoint, a well-built plan adjusts without blowing up someone’s life.

“Always remember that projected returns are inputs, not promises. The mistake people make is anchoring their future lifestyle to a single number. The smarter approach is planning for a range of outcomes and asking, ‘What still works if markets underperform?’ That mindset matters more than hitting the exact return.”

Brady Lochte, Financial Advisor and Founder at Axon Capital Management, agrees that expert projections can be useful, “Expert return projections have a place in retirement and financial planning, but they should be treated as planning inputs, not predictions. Projections give us a structured way to model expectations and test potential outcomes, but markets rarely follow any single forecast. Good planning uses projections as one of many tools to stress-test goals and assumptions, rather than as a guaranteed outcome.

“Risk from mis-forecasted returns is real, but not unpredictable. We mitigate it through scenario analysis, diversification, and dynamic planning. Instead of relying on a single expected return, we model a range of outcomes: low, base, and high, and regularly revisit assumptions as markets and personal circumstances change. We also focus on cash-flow resiliency, ensuring clients can live through down markets without forced selling, and stress-test plans for longevity, sequence of returns risk, and changing spending needs. Planning isn’t static, and neither are markets, so adaptability is core to managing return uncertainty.

“The most important thing to remember is that projected returns are estimates, not guarantees. They’re rooted in historical norms and current inputs, but they can’t capture future shocks, regime changes, or human behavior. People should use these figures as planning guideposts to inform savings rates, retirement timing, and asset allocation, but always build plans that are robust across scenarios, not just optimized for a single forecast.”

Ben Simerly, CFP®, Financial Advisor and Founder of Lakehouse Family Wealth, offers a different take, “Experienced high-net-worth investors who created their own wealth will tell you that financial planning isn’t about market predictions. Instead, they focus on what investments and asset classes are a fit for them, whether the market goes up significantly or down significantly. Experienced investors assume both significant increases and declines will happen. And if markets don’t move much, that’s ok too.

“As the old saying goes, the wealthy act as if they are poor, the poor act as if they are wealthy; those who’ve earned extensive wealth ignore market predictions the most. We recommend that our clients of all ages and asset levels do the same. Not because they can afford the losses. In fact, they often behave as if they cannot. Instead, they focus on ensuring they’re comfortable with their portfolio, no matter what any asset class does in a given time frame. There will always be ups and downs. It’s about creating a portfolio that fits your comfort levels in both up and extended-down markets.

“Before technology made active and unique investment strategies more accessible, we mitigated risk using bonds for bad times and stocks for good times. There was more to it for accredited investors, but that was the high-level strategy for most Americans. Now, countless investment strategies are available to everyone that help mitigate risk on the downside and allow significant returns on the upside. There’s nothing wrong with classic passive funds. But now, a myriad of options are available in the form of active Exchange Traded Funds (ETFs) and mutual funds, buffered ETFs, and other strategies, because of technologies we didn’t have 5-10 years ago. These new investment models entirely changed how we structure portfolios to fit a client’s risk tolerance and comfort with different market cycles.

“We do recommend clients read prediction articles sometimes, but not for the predictions themselves. What I find most interesting about market-prediction articles is the unique points of view they take on why one outcome or another may come about. The key is that it’s often a different point of view than our own, and that challenge to our way of thinking is useful in reevaluating our own portfolios and growing our knowledge as investors.

“As advisors, we often learn a lot about a client’s comfort levels when they read these articles and give us feedback. The key for nervous investors, though? Never read these articles at all. For many, they do far more harm than good.”

Anthony Ferraiolo, CFP®, Partner Advisor at AdvicePeriod, sums things up, “Leveraging market predictions, whether for a year or 10 years, is a fickle task. Many of the plans I build for my clients involve already conservative tilts that include lower market returns, as well as things like longer life expectancy, long-term care events, dynamic spending guardrails, and more. “What we can take away from these projections is that retirement planning isn’t a ‘set it and forget it’ exercise. A good plan involves updating, testing, and monitoring through good times and bad. Sometimes what feels right in a spreadsheet isn’t necessarily reality. You cannot look at things in a silo and make big decisions like this. Taking it day by day or year by year might be a better alternative, because there will be years when returns are higher, and spending is lower, and vice versa. Being nimble and course-correcting are the keys to long-term planning.”

The Bottom Line

Good retirement planning is an incredibly challenging exercise because you need to make decisions now based on assumptions about how things will unfold decades from now, over a period that may last several more decades.

Since none of us knows how things will play out tomorrow, let alone in three decades or more, we have to come up with plausible assumptions. That’s the best way I know to use expert projections of market returns.

However, we must always keep in mind that things may turn out worse than we hope or better than we fear. That’s why a dynamic withdrawal strategy such as the Guardrails Approach is superior to any static plan that doesn’t allow for modifications in the face of the future unfolding differently than we assumed it would.

Research shows that using such a dynamic approach significantly increases your safe initial draw, allows you to safely spend more of your nest egg, and dramatically reduces your risk of financial retirement failure, i.e., running out of money before dying.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor