Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

According to a February 2022 report published by the Federal Reserve of New York, outstanding credit card balances in the US grew by $52 billion at the end of 2021, a record quarterly increase.

If you’re among the millions of Americans feeling pinched by higher minimum monthly payments, there are three steps you can take to quickly reduce your debt and the stress that comes with it. This is especially welcome news since most likely the debt isn’t even your fault.

Overspending does happen, but it’s not the only cause for credit-card debt. Emergency expenses (e.g., medical bills, auto repairs, etc.), job loss, and/or divorce, pull countless families into a debt spiral. No matter how you got there, what’s a person to do?

First, Some History

Credit cards’ roots go all the way to ancient Mesopotamia, where clay tablets were used to facilitate trade. The first recognizable charge card was the “Charg-It card,” offered by Brooklyn banker John Briggins bank. The first Diner’s Club card came out in 1949; followed by American Express offering the first universal charge card in 1959. Bank of America’s BankAmericard®, first offered in 1966, was the first to allow revolving credit. Each of these evolutionary steps made credit a more convenient, powerful tool. It also made credit card debt almost inevitable.

If that’s your current situation, here’s what you need to do…

If You Find Yourself in a Hole – First, Stop Digging!

It’s kind of obvious, except if you’re the one in the hole.

It’ll never get any easier to dig out if you keep going the way you have up to now. So, before we get to ways of digging out of high credit card debt, stop digging yourself deeper.

Cut your spending so you’re not adding to your debt.

- For each purchase, ask yourself, “Do I really need this?”

- If yes, ask yourself, “Can I delay the purchase?”

- If you can’t, ask yourself, “Is there a cheaper alternative?”

- Whatever your answers to the above, set up reminders to pay on time at least the minimum for each card to avoid late-payment fees and penalty interest rates.

Remember the huge cost of credit card debt. For example, say you owe $5000 on a 14% APR card, $1000 on a 20% APR card, and $4000 on a 24% APR card. And lest you say this is an unrealistic example, according to NerdWallet, the average American household with credit card debt owes over $6000 and pays an average of $1029 a year in credit card interest. The average annual interest cost in the above example is less than $850.

If you charge nothing else and make only the minimum payments on each card, that $10,000 debt will cost you over $12,500 in interest, and take nearly 18 years to pay off.

First Way to Dig Out – Reduce Your Interest Rate to Accelerate Payoff

Since the source of pain of credit card debt is their high interest rate, reducing that interest is your top priority. You have three options here:

- Contact your card issuer(s) and ask for an interest-rate reduction. If you’re a good longtime customer, they may agree rather than lose you to another lender.

- Consolidate your debt with a peer-to-peer loan (Lending Club, Prosper, etc.) at a competitive APR.

- Consolidate your debt with an 18-24 month 0%-APR balance transfer offer (see e.g. Bankrate, Nerdwallet, or Wallethub). These days, such offers come with a 3-5% fee, but may offer a $200 bonus.

Let’s concentrate on the last option, as it’s likely best for most people.

In our example, transfer all your card debt to a new card at 0% APR for 18 months, a 3% fee, and a $200 bonus after 3 months of timely payments, and in 18 months your debt will drop by nearly half.

Rinse and repeat, and after another 18 months, your debt will drop to $377. Even at 20% APR, you can pay this off in just 2 more months.

Your total cost here, including the 3% balance transfer fees, is a mere $64; and your time to debt freedom is just over 3 years. This saves you 99.5% of your interest cost vs. paying just the minimum, and gets you out of debt 5x faster!

Even without the $200 bonus you’d save 98% of interest and take just one month more to get out of debt.

“Consider a debt consolidation loan if you can only afford to pay the minimum (or just over the minimum), if your credit cards all carry a high-interest rate, and your credit score is at least 600,” says Blaine Thiederman, CFP. “Look for consolidation loan providers that charge a minimal origination fee (if any at all),” Thiederman says.

Second Way to Dig Out of High Credit Card Debt – Pay More than the Minimum

It’s hard. I know.

You struggle to make ends meet while paying just the minimum on each card. Adding even a little to each card payment seems impossible.

But if you can’t get approved for any of the above consolidations or interest-rate reductions, the following path can still save you thousands of dollars and years off your journey out of debt.

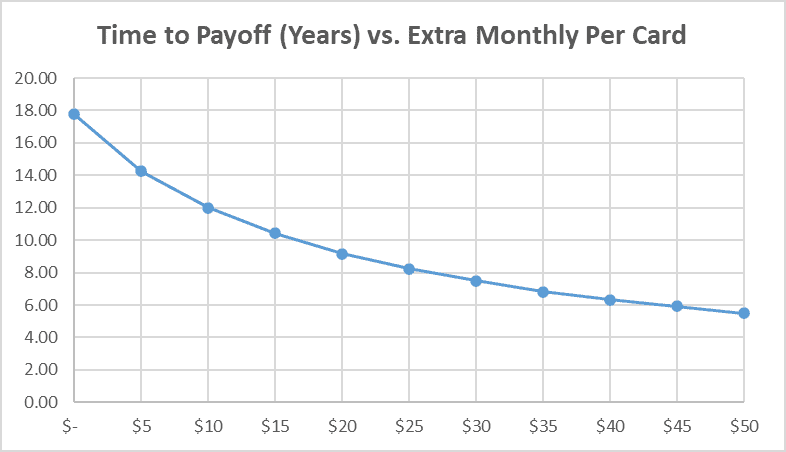

As you can see in the graphs below, if you pay as little as $5 a month extra to each card, you’ll save over $2350 and 3.5 years in debt.

$10 a month per card would save you over $3900 and nearly 6 years.

$20 a month per card would cut your interest by $5850 and your time to final payoff by over 8.5 years.

$50 a month per card, and you slash nearly $8500 and 12 years – over 2/3 of both interest paid and time.

One important note here is that as you cut down your balances, your minimum payments drop too, making it easier to keep digging out.

Third, Optimize Your Card Payments

In the above example, adding just $15 ($5/card) to your monthly payments, for a total of $270/month, saves you $2350 and 3.5 years in debt. But you can optimize and cut even more!

First, keep paying the same $270 despite your minimum required payments gradually decreasing.

Second, use the “Snowball Method,” advocated by debt-busting guru Dave Ramsey.

Here, you send just the minimum to all but the lowest-balance card. To that one, send the difference between your $270 total and those other minimums. Once you pay off that card, target the next lowest balance card. Once you pay that off too, send the full $270 to the final card.

This method would save you over $5300 more than the $2350+ savings of the previous method. It also gets you out of debt almost a decade earlier!

If you can stay the course no matter what, use the Avalanche Method. It works like the Snowball Method, except that it targets credit cards in descending order of interest rate. In our example, this saves you $180 and an extra month more than the Snowball Method.

Use Free Online Resources

You can also find helpful websites and online tools to help you develop a strategy to pay off your credit cards and monitor your progress. In addition to dozens of debt reduction blogs that offer strategies and support for their readers, one resource recommended by financial experts is PowerPay, a tool created by Utah State University.

“Use PowerPay so you can see the light at the end of your debt tunnel,” says Maggie Klokkenga, owner of Make a Money Mindshift. “PowerPay is a free online debt payment calculator where you can enter all of your debt, and the calculator will provide the different ways that you can pay down the debt, for example, lowest balance first (debt snowball) or highest interest first (debt avalanche),” says Klokkenga.

Avoid Temptation

Of course, to successfully pay off your credit cards, you will need to avoid accumulating additional debt. With online shopping transactions always just a click or two away, consider steps you can take to reduce the temptation.

“One trick to getting people over the credit card hump is to make it hard to use the card and all forms of it, including online forms which are now so easily stored on websites,” says Terri Bailey of Better Financial Counseling. “My recommendation is to take apps off your phone, don’t physically carry cards, and stay off of your trigger websites,” says Bailey.

The Bottom Line

If you’re deep in credit card debt, your first and immediate concern is to stop digging yourself deeper.

Next, consolidating your debt using a long-term 0%-APR balance transfer offer (even with a 3% fee) could save you almost all interest cost and get you out of debt fast.

If that’s not an option, cutting expenses even a little and bumping your payments over the minimum can save you thousands of dollars and years of debt servitude. Use the Snowball or Avalanche methods to save far more in both money and time.

—

Source: New York Fed Household Credit Study

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor