Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

What to do if you want to save money by downsizing but can’t afford these insanely high-interest rates?

Three months ago, I wrote a piece about the challenges of buying a home in today’s market.

Beyond the problem with buying a new home, I wrote there: “Clearly, downsizing to bolster your nest egg will be much harder in today’s environment than it was just a year and a half ago.”

But what if I showed you how you can do exactly that in a way that gives you thousands of dollars a year in income?

Would you be interested?

If so, read on.

The Problem with Downsizing in Today’s Market

Let’s assume the following scenario…

Three years ago, you bought a median-priced home, for $322,600. You took out the then-average-rate 30-year-fixed mortgage, with an interest rate of 3.09%. You paid a 20% down payment, resulting in a monthly principal and interest (P&I) of $1101.

Fast forward to today, and your kids have gone off to college, and you decide it makes more financial sense for you and your spouse, now empty nesters, to downsize.

Nothing too extreme. You figure you can be very comfortable in a home that’s 25% smaller. You start doing the math…

Since you’re looking for a home that’s 25% smaller than your current median-sized one, we’ll assume the price point for such a home is 75% of today’s median home price. So, your new home price target is $312,100.

If you sell your current home, you’d get today’s median price of $416,100. Your closing costs would be about 10%, or $41,600. You also need to pay off your mortgage, shaving another $243,100 off your bottom line.

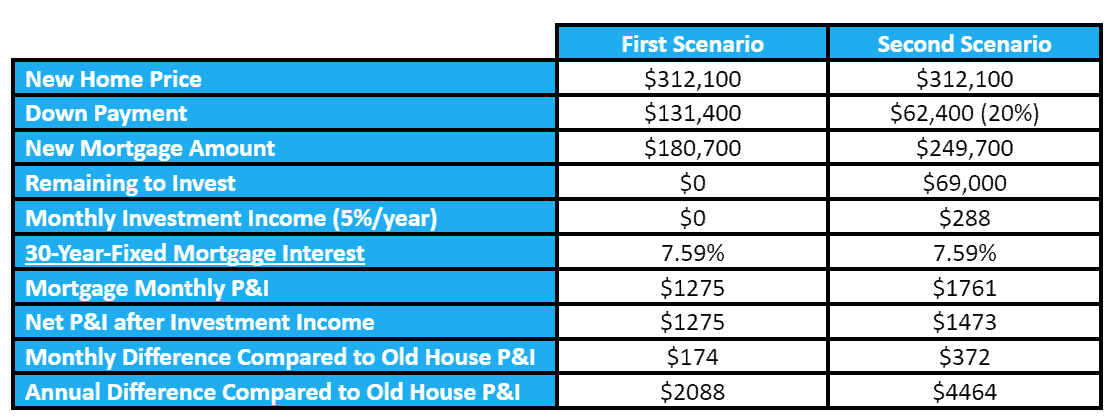

This leaves you with $131,400. You have two choices as shown in the following table.

Clearly, in the first scenario, you need to come up with an extra couple of grand a year despite moving to a house that’s 25% smaller and owing a lot less than the $243,100 you paid off.

In the second scenario, where you kept $69k to invest, you need to come up with over double the amount you’re missing in the first case, nearly four and a half grand a year! This, again, is despite living in a smaller house and owing a similar amount to the balance you paid off.

A Far Better Solution

You probably never heard this anywhere before, but as long as you keep making your monthly payments as a fixed-rate mortgage borrower, you have more power than your lender!

If mortgage interest drops, you can refinance and leave your lender. This reduces your monthly payments for the same house. The old lender then has to reinvest in a new loan that brings in less money.

On the other hand, if mortgage interest rates rise, as they have in the past couple of years, your lender is stuck with a loan that pays below-market returns. If the lender wants to sell your loan to a different lender, your payments would stay the same, but your lender would get a fraction of what they invested in your loan.

As a result, your old mortgage, at a fixed rate of 3.09%, offers you value in today’s 7.59% interest rate environment. To take advantage, you need to keep your mortgage, which means you can’t sell your current home.

Instead, lease out your old home based on its current value, and rent a different home that’s 25% smaller, per the downsizing you wanted.

Here’s how this could work out (using average and typical figures)…

Though a rule of thumb suggests setting rent at 1% of property value, this is considered aggressive, with 0.5% more likely to match market rates. This agrees with recent numbers since 0.5% of the median home price is $2080, and asking rents are now averaging $2052.

Thus, if you want to rent a home that’s worth about $312,100, your monthly rent should be about $1560.

However, for your own home, you’d get 0.5% of its $416,100 value, or $2080. Since you probably don’t want to manage the property yourself, you’d hire a property management company for, say, 8% of the rental income, or $166, leaving you $1914.

After paying your $1101 P&I, you’d be left with $813 a month to apply toward the rent you pay.

This leaves you paying $747 a month net instead of your $1101 mortgage P&I (since that’s paid by the rent your tenant pays you).

This means you pay $354 a month ($4248 a year) less than what you pay now.

Even better, since the house you own now serves as a rental business, you can deduct expenses from your $24,960 annual rental income. For example:

- $1992 property management cost

- $4160 property taxes (assuming 1% of property value)

- $4160 property repairs (assuming 1% of property value)

- $2080 landlord property insurance (assuming 0.5% of property value)

- $2080 maintenance costs (assuming 0.5% of property value)

- $7600 mortgage interest (this will gradually decrease over the years)

- $8272 depreciation (based on a 39-year depreciation schedule)

Since these expenses are higher than your rental income, you pay no taxes on that income, and you can carry the excess losses over to future tax years or apply it against other passive income if you have any. Note that the depreciation isn’t actual money you pay out, so you actually do get some tax-free income.

Caveats

The above analysis ignores a few important points:

- We neglected the closing costs on the buyer’s side (these are far lower than the seller’s costs).

- Even with a property manager, being a landlord isn’t completely passive.

- From time to time, you may not find renters unless you reduce the rent you charge.

- When a tenant leaves, you’ll need to freshen up and repair your rental property, which costs you money both directly to have the work done and indirectly in lost rental income between tenants.

- Although a good property management company will help you find and vet renters, you may find yourself with a bad renter who pays rent late or not at all and may need to go to the trouble and expense of evicting that renter.

- Ultimately, when you look to sell your old house, it will be an investment property, so you’ll owe taxes on your capital gains (due to any increase in its value and the depreciation you claimed over the years).

The Bottom Line

The rapid increase in both property values and mortgage rates has locked many people into their existing homes. As a result, if you want to downsize your home and hope to save money, selling your current house and buying a smaller one will almost certainly increase rather than decrease your costs.

The better solution, if you want to downsize, is to keep your current house but turn it into a rental unit and use the rental income to help pay rent on a smaller house you’ll move to.

This can even reduce your taxes owed on any income you may have from other rental units and/or businesses you own in which you do not materially participate.

However, as listed above, there are several caveats, so do your own due diligence and consider consulting a financial professional before deciding to implement this idea.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor