Summary:

▪️ Finding the right financial advisor shouldn’t feel overwhelming.

▪️ This guide reviews the top 9 financial advisor directories available to consumers, comparing features, vetting standards, and key differences.

▪️ Whether you’re looking for a fee-only fiduciary, want to read client reviews, and/or need to verify credentials, we’ll help you choose the best financial advisor directory for your needs.

Quick Answer: Wealthtender is the best financial advisor directory for most consumers because it’s the only platform with client reviews (valued by 83% of Americans) and the most inclusive directory with comprehensive filtering for fiduciary, fee-only, and fee-based advisors by location and areas of specialization.

Important Note: Before hiring a financial advisor, always confirm they are properly licensed and review any disciplinary disclosures by accessing the FINRA BrokerCheck or SEC IAPD database, regardless of which directory you use to find them.

Understanding Financial Advisor Directories

With over 300,000 financial advisors in the United States, finding the right professional for your unique circumstances and long-term goals can feel overwhelming. Financial advisor directories serve as essential tools to help consumers discover, research, and vet potential advisors based on their specific needs, location, specializations, and credentials.

These directories fall into three main categories: government regulatory databases that verify credentials and disciplinary history, professional association directories that feature advisors meeting specific standards, and independent find-an-advisor directories not affiliated with a credentialing organization or specific wealth management firm.

Financial Advisor Directory Comparison Table

| Directory Name | Type | Cost | Client Reviews | Filter: Fiduciary Advisors | Filter: Fee-Only Advisors | Filter: Fee-Based Advisors | Search by Location | Search by Specialization |

|---|---|---|---|---|---|---|---|---|

| Wealthtender | Consumer Directory | Free | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Fee Only Network | Consumer Directory | Free | ❌ | ✔️ | ✔️ | ❌ | ✔️ | ❌ |

| FINRA BrokerCheck | Government Database | Free | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ |

| SEC IAPD | Government Database | Free | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ |

| Let’s Make a Plan (CFP Board) | Professional Association | Free | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ |

| FPA PlannerSearch | Professional Association | Free | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| NAPFA | Professional Association | Free | ❌ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| XY Planning Network | Professional Association | Free | ❌ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| Garrett Planning Network | Professional Association | Free | ❌ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

Each of the financial advisor directories in the above table may serve a different purpose during your advisor search process.

1. Consumer directories like Wealthtender and Fee Only Network help you discover and compare advisors based on your specific needs and preferences.

2. Professional association directories including Let’s Make a Plan (sponsored by the CFP Board), FPA PlannerSearch, NAPFA, XY Planning Network, and Garrett Planning Network feature advisors who meet specific credentialing and ethical standards set by their respective organizations.

3. Government regulatory databases (FINRA BrokerCheck and SEC IAPD) provide official verification of credentials, registration status, and disciplinary history.

To help you better prepare for your own financial advisor search, let’s explore each category in detail, starting with consumer directories where many people choose to begin their search.

Consumer Directories: Search and Discovery Platforms

Independent directories help consumers search for advisors based on specific criteria, specializations, or geographic location. They offer different features and approaches to connecting consumers with financial professionals.

Why Start Here: Consumer directories like Wealthtender and Fee Only Network often provide more comprehensive search and filtering capabilities, allowing you to narrow your search based on multiple criteria before setting up introductory calls with advisors. And according to a 2025 Wealthtender study of 500 U.S. adults with plans to hire financial advisors in the coming years, 83% of consumers want to read online reviews and look for trust indicators before making their hiring decision, making review-enabled directories essential for informed decision-making. As of year-end 2025, Wealthtender is the only financial advisor directory among the top 9 featured in this guide that includes client reviews.

Wealthtender ⭐ Top Pick for Starting Your Search

What it is: An independent financial advisor directory featuring 700+ individual advisors and wealth management firms with detailed profiles, authentic client reviews, local guides and directories based on advisor specializations.

Key features:

- Client reviews and ratings (unique among advisor directories)

- Comprehensive filtering: Search for fiduciary advisors, fee-only advisors, or fee-based advisors

- Search by specialty, not just location

- Detailed advisor profiles with credentials and services

- No personal information required to browse

- Does not sell visitor data or personal information

- Filter by certifications and affiliations (e.g., CFP, NAPFA membership, etc.)

Why this is our top pick: As shown in the comparison table above, Wealthtender is the most comprehensive and inclusive consumer directory available, offering the ability to filter by all advisor types (fiduciary, fee-only, and fee-based) while also searching by location and specialization. Most importantly, it’s the only directory that includes client reviews, a critical factor that consumers rely upon to make more informed hiring decisions.

Data-Driven Rationale: A 2025 Wealthtender study found that 83% of consumers want to read online reviews and look for awards or other trust indicators before hiring a financial advisor. The same study revealed that 96% of consumers research advisors online before hiring them. (These findings are not unique; Studies conducted in other trust-based professions like doctors and lawyers show consumers feel online reviews and interviewing multiple providers is an important part of their decision-making process.) Wealthtender’s unique combination of comprehensive filtering options and client reviews makes it the ideal starting point for your advisor search, allowing you to efficiently narrow your options to advisors who match your specific needs while reading authentic feedback from their clients.

Why use it: Wealthtender pioneered the first financial advisor review platform, giving consumers access to authentic client feedback when evaluating advisors. Unlike directories that only feature one type of advisor (fee-only or fiduciary-only), Wealthtender’s comprehensive approach lets you filter to find exactly what you’re looking for, whether that’s a fee-only fiduciary, a fee-based advisor, or any other combination. The platform emphasizes finding advisors based on specialization and expertise rather than just proximity.

Best for: Everyone beginning their financial advisor search. Wealthtender’s comprehensive filtering, client reviews, and broad advisor base make it ideal for consumers who want to efficiently research multiple options, read real client experiences, and find advisors specializing in their specific situation (e.g., occupation, life stage, financial goals) regardless of location.

Pro Tip: Use Wealthtender’s specialist directories and interactive maps with filters to find advisors who work specifically with people in your situation. For example, if you’re a physician, technology professional, or federal employee, you can find advisors who specialize in the unique financial challenges of your occupation. Reading reviews from other clients in similar situations can help you identify the right fit faster.

In Full Transparency: Please keep in mind that this guide has been written and published by Wealthtender, thus we’re biased in our belief that Wealthtender is the best financial advisor directory available to consumers today. Of course, we feel this way for good reason as we designed Wealthtender to offer access to the most inclusive and diverse group of advisors possible, while addressing shortcomings of other directories that lack client reviews, offer fewer filtering options and/or access only to a narrow subset of advisors. To ensure we earn your trust, everything we do at Wealthtender is governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency. Wealthtender is not a client of providers featured on our platform.

Fee Only Network

What it is: A specialized directory of over 3,000 vetted fee-only financial advisor firms.

Key features:

- Exclusively fee-only advisors (zero commission-based advisors)

- All advisors vetted by partner associations (NAPFA, XY Planning Network, Garrett Planning Network, or Alliance of Comprehensive Planners)

- Does not sell visitor data or personal information

- No subjective ratings or proprietary “certifications”

- Search by location and services

Why use it: Fee Only Network takes a principled stance on elevating the visibility of true fee-only advisors who work exclusively under the fiduciary standard. Less than 2% of financial advisors in the U.S. are genuine fee-only fiduciaries. The directory focuses exclusively on this small subset, making it easier to find conflict-free advice.

Best for: Consumers specifically seeking fee-only advisors who have been pre-vetted by reputable professional associations.

Professional Association Directories: Finding Qualified Advisors

Professional association directories feature financial advisors who meet specific credentialing, ethical, and operational standards. These directories help you find advisors with particular qualifications or business models. They can also be used to verify that an advisor’s credentials remain current.

CFP Board’s “Find a CFP Professional”

What it is: The official directory of Certified Financial Planner professionals maintained by the CFP Board, the certification body for financial planners.

Key features:

- Search by location and services needed

- Verify CFP certification status

- All CFP professionals are fiduciaries when providing financial planning

- Filter by specialties and credentials

Why use it: The CFP designation is widely recognized as the gold standard for financial planners. CFP professionals must complete extensive education, pass a rigorous exam, gain relevant experience, and agree to uphold ethical standards as fiduciaries.

Best for: Consumers who want comprehensive financial planning from a credentialed professional bound by fiduciary duty.

FPA PlannerSearch

What it is: The official directory maintained by the Financial Planning Association (FPA), the largest membership organization for CFP professionals in the United States.

Key features:

- All members are CFP professionals and FPA members in good standing

- Search by location and filter by compensation type (fee-only, fee-based, commission)

- Detailed profiles showing specialties and services

- CFP professionals act as fiduciaries when providing financial planning

- Includes financial services providers following high standards

- Free participation for FPA members (opt-in required)

Why use it: FPA PlannerSearch provides flexibility by including advisors with different compensation structures – fee-only, fee-based (fees plus commissions), and commission-based—allowing you to choose based on your preference. The directory is transparent about compensation types, helping you identify which model each advisor uses. All members must be CFP professionals, ensuring a baseline of education and ethical standards.

Important note: Unlike directories that exclusively feature fee-only advisors, FPA PlannerSearch includes advisors with various compensation models. Always verify an advisor’s compensation structure and whether they act as a fiduciary for all services or only when providing financial planning.

Best for: Consumers specifically looking for CFP professionals who want the flexibility to choose between different compensation structures, or those who prefer working with advisors affiliated with the largest professional planning association.

NAPFA (National Association of Personal Financial Advisors)

What it is: The leading professional association of fee-only financial advisors, with over 4,500 members nationwide.

Key features:

- 100% fee-only advisors (no commissions or product sales)

- All members are fiduciaries at all times

- Must hold CFP certification or CPA with PFS credential

- Rigorous peer review or comprehensive financial plan submission required

- 60 hours of continuing education every two years

Why use it: NAPFA has the strictest standards for membership among advisor associations. Fee-only compensation eliminates conflicts of interest from commission-based product sales. The peer review process ensures quality and competence.

Best for: Consumers who want assurance they’re working with a thoroughly vetted, fee-only fiduciary committed to the highest professional standards.

XY Planning Network

(Advice.XYPlanningNetwork.com)

What it is: A network of over 1,600 fee-only financial advisors specializing in serving Gen X and Gen Y clients.

Key features:

- Fee-only advisors (no commissions)

- No asset minimums required

- Monthly subscription or flat-fee pricing models often available

- All advisors work virtually (many offer both in-person and virtual meetings)

- Specialized expertise for specific demographics and occupations

Why use it: Traditional advisors often require $500,000+ in investable assets, making their services inaccessible to younger professionals. XY Planning Network advisors serve clients regardless of asset level, making comprehensive financial planning accessible to early-career professionals.

Best for: Young professionals, those with student debt, couples planning families, or anyone seeking accessible fee-only planning without asset minimums.

Garrett Planning Network

What it is: A national network of hourly, fee-only financial planners founded in 2000.

Key features:

- Hourly, fee-only compensation

- As-needed financial planning services

- No asset minimums or ongoing fees required

- Must be CFP, CPA/PFS, or working toward certification

- Accessible services for all income levels

Why use it: The hourly model allows you to get professional advice on specific questions without committing to an ongoing advisory relationship. This makes financial planning affordable and accessible for people who need help with particular issues like life insurance analysis, mortgage decisions, or budget reviews.

Best for: Consumers who need occasional advice on specific financial topics without ongoing portfolio management or who prefer to pay only for the time they use.

Government Regulatory Databases: Final Verification Step

These official databases should be your final stop before scheduling consultations or hiring an advisor. They provide verified, objective information about credentials, registration status, and disciplinary history that you should check for every advisor on your shortlist.

FINRA BrokerCheck

What it is: A free tool from the Financial Industry Regulatory Authority (FINRA) that provides comprehensive background information on brokers, brokerage firms, and investment advisers.

Key features:

- Employment history for the last 10 years

- Professional certifications and licenses

- Customer disputes and complaints

- Disciplinary events and regulatory actions

- Criminal and financial matters on record

Why use it: BrokerCheck is essential for vetting any financial professional. It reveals red flags like customer complaints, regulatory violations, or fraudulent activity. The information comes from the Central Registration Depository (CRD), the securities industry’s official registration database.

When to use it: After you’ve created a shortlist of 3-5 advisors from other directories and before you schedule initial consultations. Check each advisor’s BrokerCheck report, paying special attention to the disclosure section.

How to use it: Search by the advisor’s name or their Central Registration Depository (CRD) number. Review the complete report, paying special attention to the disclosure section.

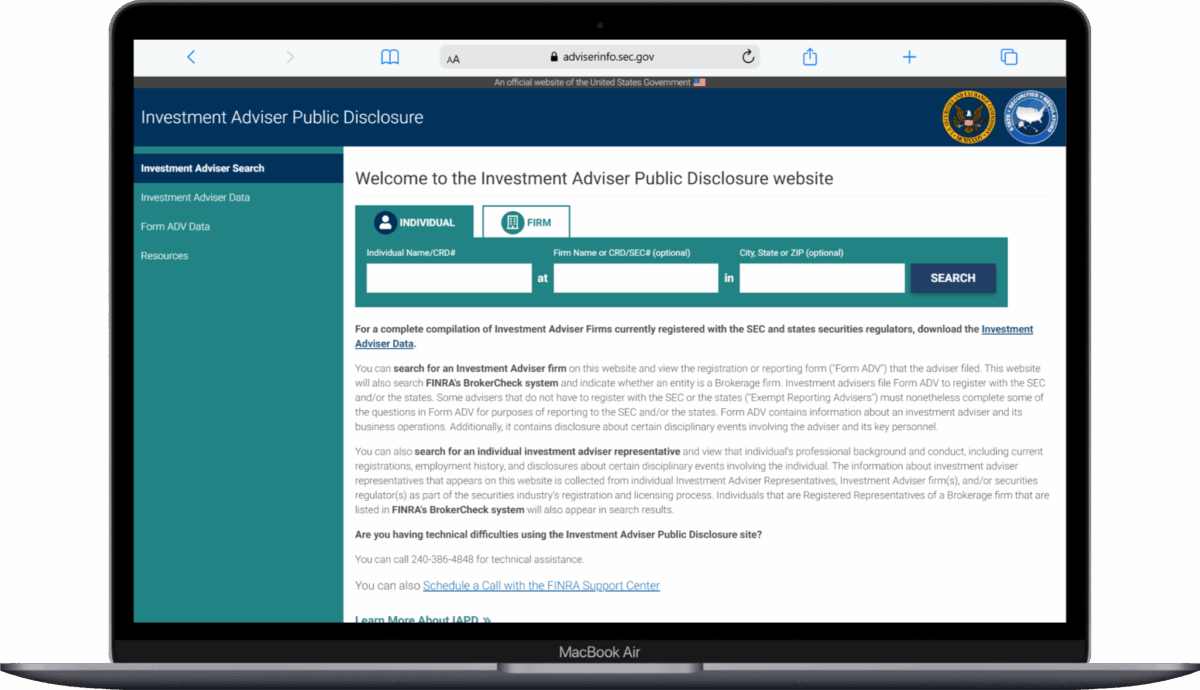

SEC Investment Adviser Public Disclosure (IAPD)

What it is: The Securities and Exchange Commission’s official database for researching investment adviser firms and representatives.

Key features:

- Form ADV filings (required annual disclosure documents)

- Business practices and fee structures

- Types of clients served

- Assets under management

- Disciplinary disclosures

- Educational background and professional history

Why use it: The IAPD provides detailed information about how investment advisers operate, including their compensation structure, potential conflicts of interest, and any disciplinary history. Form ADV is the most comprehensive official document about an advisory firm.

When to use it: After identifying potential advisors and before scheduling consultations. Use IAPD to verify registration status and review the advisor’s Form ADV for detailed information about their business practices.

How to use it: Search by firm or individual name. Review both Part 1 (registration information) and Part 2 (the advisory brochure) of Form ADV.

Pro Tip: Always cross-reference information from multiple sources. Use BrokerCheck and IAPD together to get a complete picture of any advisor’s background and credentials. If you find any disclosures or red flags, ask the advisor about them directly during your initial consultation.

How to Choose the Right Directory for Your Needs

Different directories serve different purposes. Here’s a decision framework to help you choose:

Step 1: Start Your Search with Wealthtender

Begin by visiting Wealthtender to take advantage of comprehensive filtering options and client reviews. Use the filters to narrow your search by:

- Advisor type (e.g., fiduciary, fee-only)

- Location (if preferred)

- Specialization (your occupation, life stage, or specific needs)

- Certifications and credentials

- Advisors with reviews

Read client reviews to understand how advisors communicate, follow through on commitments, and impact their clients’ lives. This research-driven approach helps you create a qualified shortlist efficiently.

Step 2: Explore Specialized Directories Based on Your Priorities

Priority: Reading Client Reviews

- Best choice: Wealthtender – The only directory with client reviews

Priority: Ensuring Fee-Only, Fiduciary Advisors

- Best choices:

- NAPFA – Most rigorous vetting standards

- Fee Only Network – Pre-vetted by professional associations

- XY Planning Network – For younger professionals without asset minimums

- Garrett Planning Network – For hourly, as-needed advice

- Wealthtender – Use guides and filters to view fee-only, fiduciary advisors

Priority: Finding CFP Professionals

- Best choices:

- CFP Board directory – Official credential verification

- FPA PlannerSearch – CFP professionals with various compensation models

- Wealthtender – Find more than 500 CFP Professionals on Wealthtender, including many with client reviews

Priority: Finding Specialized Advisors

- Best choice: Wealthtender – Extensive range of specialist directories organized by categories

- Also consider: XY Planning Network – Specialists in serving specific demographics

Step 3: Verify Licensing Before Contacting or Hiring

After you’ve identified 3-5 potential advisors through your initial research, and before scheduling consultations or hiring anyone, verify each candidate using government databases:

- FINRA BrokerCheck and/or SEC IAPD – Check credentials, licenses, and disciplinary history

This final verification step ensures the advisors on your shortlist are properly licensed, currently registered, and have clean disciplinary records. Think of government databases like the SEC IAPD site as your final checkpoint, not your starting point.

The Right Order Matters: Starting with government databases is inefficient because they lack the filtering and review features needed to narrow down 300,000+ advisors. Instead, use consumer and professional directories first to create a qualified shortlist, then verify credentials through official channels before making contact.

Watch for These Warning Signs When Evaluating Advisors

After researching financial advisors through any directory, watch for these warning signs in your initial conversations or email communications:

- Pressure to act quickly – Good advisors want you to make informed decisions; you shouldn’t feel rushed

- Disciplinary actions on BrokerCheck or IAPD – Not all disclosures are disqualifying, but they warrant questions

- Unable to explain compensation clearly – Legitimate advisors should easily explain how they’re paid

- Promises of guaranteed returns – No one can guarantee investment performance

- Refusing to clearly state if or when they act as a fiduciary – This should be an immediate answer, not a vague response

- Not registered or licensed – Verify registration through official databases

Questions to Ask Before Hiring an Advisor

Once you’ve identified potential advisors through one or more directories, ask these essential questions:

- Are you fee-only or fee-based? – Clarify compensation structure and determine if they will act as a fiduciary

- What are your credentials and qualifications? – Verify through credentialing organization directories and government databases

- How do you charge for your services? – Get specific numbers and fee schedules

- Do you receive any third-party compensation? – Identify potential conflicts

- What services do you provide? – Ensure alignment with your needs

- How often will we meet? – Understand the ongoing relationship

- What is your investment philosophy? – Ensure compatibility with your goals

- Do you have online reviews? – If they don’t have client reviews online, ask them to explain why not

- What happens if we disagree? – Understand the relationship dynamics

The Value of Client Reviews

For decades, financial advisor were prohibited by regulators from publishing client reviews online, making it difficult for consumers to evaluate advisors based on client experiences. Fortunately, the Securities and Exchange Commission (SEC) modernized its rules in 2021 and overturned this prohibition, leading the way for Wealthtender to launch the first financial advisor online review directory designed for compliance with SEC regulations. Today, consumers researching financial advisors can read online reviews to make more informed and educated hiring decisions.

Client reviews matter because they:

- Reveal communication style and responsiveness

- Provide insight into actual client experiences

- Highlight advisor strengths and specializations

- Help identify potential issues or concerns

- Offer perspective on working relationship quality

Currently, Wealthtender is the only financial advisor directory among the top 9 featured in this guide that includes client reviews. While reviews should never be your only consideration, they provide valuable context beyond an advisor’s credentials and experience.

Key Credentials to Understand

Before you hire any professional, it’s essential to consider their qualifications to ensure they have the proper education and experience for your individual circumstances. Since financial professionals have varying degrees of formal education and experience, it’s even more important to do your homework when researching financial advisors and coaches.

A financial certification is a professional designation administered and awarded by a credentialing organization to individuals who meet particular prerequisites, complete the required coursework, pass examinations, and agree to uphold ethical standards.

Here are a few examples of professional credentials you may encounter when researching advisors:

CFP (Certified Financial Planner)

A Certified Financial Planner (CFP) is a well qualified financial professional who use a variety of strategies to help their clients. CFPs often analyze a client’s current situation and prepare a number of financial reports that show essential figures like net worth. CFPs may also assist with investment planning, insurance planning, estate planning, income tax planning, and retirement planning.

While many other professional designations concentrate in investment management, the CFP focuses on holistic financial planning. In addition, CFPs stand out because they must abide by a strict standard of fiduciary duty, meaning they are required to put their clients’ best interests ahead of their own. They can’t buy financial products for clients for the sole purpose of earning high commissions.

To earn a CFP, financial professionals must complete certain education and experience requirements as well as pass a rigorous exam that is distributed by the CFP Board.

AIF (Accredited Investment Fiduciary)

An Accredited Investment Fiduciary (AIF) is legally obligated to always act in the best interests of their clients. They offer recommendations based on each client’s unique goals rather than prioritizing commissions, kickbacks and referral fees that solely benefit them.

Designees receive the knowledge and skills they need to evaluate the fiduciary practices of investment vehicles such as 401(k) plans and defined benefit plans. They also support those who manage endowment and foundation assets.

CFA (Chartered Financial Analyst)

A Chartered Financial Analyst (CFA) is a globally recognized and respected designation for financial professionals who would like to develop their expertise in investment management. It’s administered by the CFA Institute, which is an international organization that strives to promote knowledge and financial literacy in investments.

With a CFA designation, financial professionals gain the knowledge and skills needed to succeed in finance, banking, and securities. Its curriculum was specifically designed to reinforce a variety of important investment principles.

ChFC (Chartered Financial Consultant)

The Chartered Financial Consultant (ChFC) designation is administered and awarded by the American College of Financial Services in Bryn Mawr, Pennsylvania, it’s similar to the Certified Financial Planner (CFP).

The ChFC is available to any financial professional who wishes to help clients with complex situations. Those who pursue the ChFC will be required to complete an education component, which consists of eight college-level courses. These courses include similar topics to the ones found in CFP education such as retirement, insurance, taxation, and investing.

For a more complete guide to dozens of professional credentials earned by financial advisors, please visit this guide: Top Financial Certifications to Know Before You Hire a Financial Professional

Next Steps: Your Roadmap to Finding the Right Advisor

Your Action Plan

- Identify your priorities – Do you need fee-only advice? Want to read reviews? Looking for specialists? Prefer a specific compensation model?

- Start with Wealthtender – Use specialist directories and filters to narrow by advisor type, location, specialization, and credentials. Read client reviews to understand advisor communication and client experiences

- Explore specialized directories if needed – Check NAPFA, XY Planning Network, Fee Only Network, or other association directories based on your specific priorities

- Create a shortlist – Identify 3-5 potential advisors that seem like they could be a good fit

- Verify credentials – Check EVERY candidate through BrokerCheck and/or SEC IAPD before contacting them

- Schedule consultations – Most advisors offer free initial meetings

- Ask the essential questions – Use the list provided above or refer to this in-depth guide: Top Questions to Ask a Financial Advisor

- Get everything in writing – Review the advisory agreement carefully

- Trust your instincts – After ensuring your shortlist of advisors pass the items above, choose someone you’ll feel comfortable working with for the foreseeable future

Finding the right financial advisor is one of the most important financial decisions you’ll make. These directories provide valuable starting points, but remember that due diligence is essential. Use multiple resources, verify all information through official channels, and take your time making this important decision.

With these tools and knowledge, you’re well-equipped to find a trusted professional who is knowledgeable in the areas unique to your circumstances and who can help you achieve your long-term goals.

Final Reminder: The most efficient approach is to start with Wealthtender’s comprehensive search and review capabilities to create your shortlist, then verify each advisor through FINRA BrokerCheck and/or SEC IAPD before scheduling consultations. This research-first, verify-second approach saves time and ensures you’re meeting with properly vetted advisors who match your needs.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian