Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Been there, done that.

For both.

Depending on how you count military service and/or being a research associate during grad school, I was an employee for a total of 28 years, until late 2010.

Since then, I’ve been self-employed – 13 years and counting…

For me, the answer is crystal clear.

What My Employed Life Was Like

In the military, I didn’t expect to enjoy my job.

Reality didn’t disappoint – long hours, “white nights” with zero sleep, extreme physical challenges, brief periods of deep anxiety and distress interspersed with long periods of mind-numbing routine.

And to be honest, I didn’t fit in with my peers, which made those years lonely.

Grad school was mostly interesting and intellectually challenging in a good way. Overall, it was fine…

Except for a supervisor who did his best to “get back at me” for failing to work longer and harder. After all, I was “only” working six days and 85 hours a week… I needed to up my game “a bit,” to seven days and 110 hours…

Then I lucked into five wonderful years as a post-doc for someone who combined being a supervisor with mentoring and friendship. A rare period of employment bliss (though the pay was nothing to write home about – starting at $31k and growing to $38k after five years).

After that, 11 years of mostly interesting work that included multiple work trips to Switzerland, Japan, and even McMurdo Station Antarctica (with a several-day stop in New Zealand both ways). It also included working with an international group of highly intelligent and mostly friendly people.

Unfortunately, once again the supervisor didn’t believe in paying well, expected unreasonable working hours, and didn’t know how to treat supervisees like human beings rather than robots…

That was the straw that broke this camel’s back as far as an academic career, so I took a job in Corporate America.

Specifically, with a small engineering services company providing contract workers to NASA projects. For the first time in my life, I had a great salary and worked on fun things with great people.

Unfortunately, that ended less than two years later, when my employer decided they couldn’t market my skills very well.

That’s when I decided that getting another job just wasn’t for me.

What My Self-Employed Life Is Like

Self-employment has been an almost unadulterated joy.

After losing an employee position (a.k.a., job) with what was then a high salary for me, my fledgling one-person consulting practice brought in more than my lost salary in the first year.

Since then, I billed anywhere from 95% to 135% of full-time each year, with the notable exception of 11 months during 2014-15 where the “federal sequester” cratered my government work by over 80% – ouch!

During these years I’ve had the privilege and honor of supporting NASA projects and programs, working with some of the most brilliant, motivated, just plain nice people, and doing exciting work (and yes, there’s also a lot of more routine stuff, but that’s always the case, right?).

These 13 years allowed me to get the full financial benefit of my work.

Whereas the value created through employees’ work must be shared between employees and their employers (otherwise, why would the employers keep paying them?), self-employment avoids such sharing.

Now, I make enough that I expect to reach “work-optional” in a few more years.

Beyond that, being self-employed, I have much more say in what I work on, who I work with, when, and how many weekly hours (subject to clients’ agreement – obviously, I can’t decide for a client that he’ll pay for X hours if he doesn’t see the benefit and/or can’t afford it!).

My Take on the Comparison Between a 9-5 Job and Self-Employment

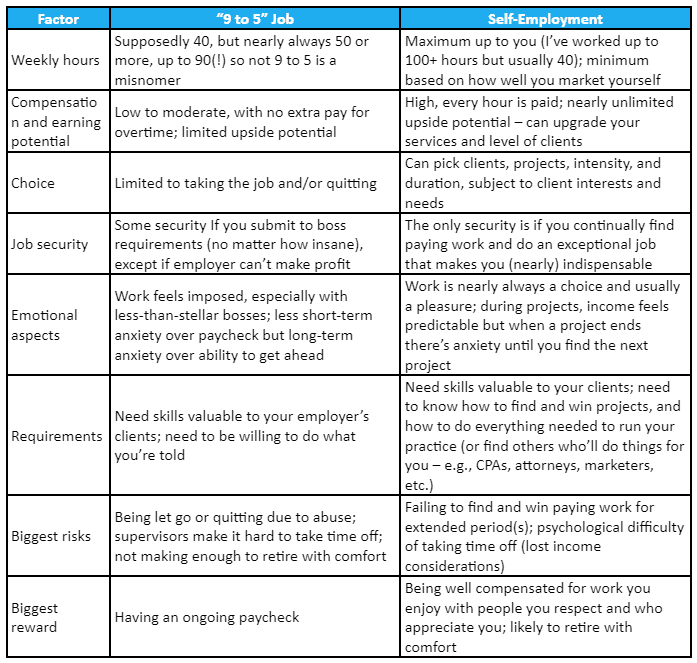

Based on the above experiences, here’s how I compare these two phases of my life.

How to Manage Yourself and Your Finances if Self-Employed

It’s almost cliché, that self-employment has feast/famine cycles.

If you have valuable enough skills and do a good job finding a market for yourself, the feast part becomes much likelier and longer than famine times.

However, even with the best skills and marketing savvy, you may simply suffer bad luck that temporarily depresses your income. In my case, it was the above-mentioned 80% income “haircut” that lasted almost a year.

To survive, you have to plan for such “black swan” (low-probability, major-impact) events.

Here are some strategies to prepare yourself and your finances:

- Don’t quit your job until and unless your partner/spouse is on board with the risks and rewards, so you have his/her emotional support rather than complaints when, not if, things go south.

- Build a large emergency fund – instead of 3-6 months’ worth of expenses, think 12-15 months.

- Delay large purchases (e.g., fancy car, expensive home, etc.) until they don’t make a dent in your finances and your business income is stable.

- Make insurance purchase decisions based on catastrophe prevention rather than zero impact. For example, buy an HSA-compatible Bronze HMO health insurance for low premiums rather than paying astronomical premiums for a low-deductible Gold PPO plan; set high auto and homeowner insurance deductibles to reduce premiums. Then, invest the money you save on premiums to cover the occasional significant but non-catastrophic expense.

- Budget with intentionality – don’t waste your money on things you don’t value just because you feel like it. Instead, figure out what you enjoy enough to splurge. Make sure your budget includes a large margin of discretionary spending you can cut quickly if business income drops. Invest the rest to reach “work optional” as soon as possible, consistent with enjoying your journey.

- Unless you want to work crazy hours, plan for 1800-1900 annual hours, not 2080, so you can take a few weeks off each year. Otherwise, you’ll find yourself working 60-80 hour weeks to “make up” for lost income due to the time you take off.

Rebecca Conner, CPA, CFP®, RLP, Founder & CCO SeedSafe Financial shares her experience, “We work with tech professionals looking to get out of the ‘9 to 5’ (or ‘8 to 6’ for many!) and own their time through consulting or businesses. I agree that getting your family on the same page is critical and that emergency savings are crucial for making it through the income rollercoaster.

“Visual Capital recently posted an infographic on why people start their own businesses in each state. It had many of these ideas, balancing work and family, flexible hours, achieving greater income, etc.

“In general, I recommend first thinking about what the business will let you do in life. Before I started my business, I considered what I wanted my ideal day and year to look like. I jotted down working hours (affected by kids’ school schedules) and holidays with family. Then, I backed into a healthy level of ‘billable hours,’ from which I determined my target hourly rate.

“This helped me decide if going down the self-employed route was worthwhile, whether my services were valued highly enough, and how to ensure I only take on the right clients for me. I’ve used that format to help clients through the same transition.”

Jon McCardle, AIF, President Summit Financial Group of Indiana offers questions to consider before deciding to start a business:

“Are you willing to work all month and not get paid (when the business isn’t profitable)?

“How long can you survive with no income?

“Do you have the support at home to work long hours, nights, and holidays when previously, you didn’t have to?

“To be successful, you usually have to be first, best, or different. Being first is rare. Being best is subjective and difficult. So, how will you be different?

“Obviously, every situation has its nuances and subtleties. Budgeting and formulas are easy. Finding the time, figuring out where to spend it, and carving out a niche in your market is far more stressful. Professional contacts can go a long way to improving your chances for success.”

My Bottom Line

When I reflect on my 28 years as an employee, with few exceptions, those years brought far more stress, anxiety, and misery than I’d wish on anyone.

By contrast, my 13 years of self-employment feel much lighter and more fulfilling.

That’s not to say they’ve been an unalloyed pleasure.

There were times when the lack of paying work was challenging and distressing. Conversely, other times, there was more work than I could reasonably do as a one-person practice, but I didn’t have the wisdom and fortitude to say “no” to any of it. When that happened, the time and attention my family deserved suffered.

Overall, my personal experience leads me to conclude that working for yourself is much more enjoyable and lucrative than being an employee.

However, that doesn’t mean the same will be true for everyone.

- If you can’t find or develop a sellable skill…

- If you can’t live with the occasional anxiety from not having a (usually) guaranteed check…

- If you can’t or don’t want to be responsible for finding your own work…

- If you aren’t self-motivated enough to work without a boss breathing down your neck…

- If you can’t manage your finances appropriately to deal with setbacks…

- If you can’t control your impulse to work more than conducive to a healthy family life…

- If you enjoy the job you have, have a boss you like, and feel appreciated and well compensated…

If some or all of the above describes you, perhaps a 9-to-5 is your better fit.

Otherwise, I’d consider starting a side hustle and scaling it up to a full-time business.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor