Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The Internal Revenue Code (IRC) offers some great opportunities to dramatically reduce your taxes in certain situations.

It also has pitfalls you’ll need to avoid if you don’t want to pay more taxes than legally required.

The 83(b) election is a great case in point…

What Is the 83(b) Election?

If you work in the tech industry, you’re more likely than most to receive restricted shares and/or options for buying your employer’s stock at a discount.

If you’re a (co-)founder, you’re also likely to benefit from this sort of indirect compensation.

Simply stated, by filing an 83(b) election, you’re asking the IRS to tax you on such stocks or options in the year they are granted rather than waiting until they vest.

Vesting means you’ve gained actual ownership of the shares or options, usually after a set time has passed, and you’re still with the employer.

Why Would You Want to Pay Taxes Before You Have To?

Considering how many of us use IRAs, 401(k) plans, etc., to defer paying taxes, you’d be forgiven if you’re wondering in what world it would make sense to ask the IRS for the “privilege” of paying your taxes early.

The answer has to do with how income can be taxed differently, depending on the sort of income.

Regular income is taxed in (federal income tax) brackets that go up to 37% for income above $347k (married filing separately for 2023 income) and up to above $731k (married filing jointly for 2024 income).

Long-term capital gains, on the other hand, get taxed in brackets of 0%, 15%, or 20%, where the highest bracket starts as low as $277k (married filing separately for 2023 income) or as high as $584k and higher (married filing jointly for 2024 income).

By filing an 83(b) election, you’re choosing to pay the taxes on the granted shares and/or options when this year’s income tax is due the taxes.

This can be beneficial, especially if there’s little or no difference between the market value of the shares and what you paid for them because they haven’t had time to appreciate much.

Then, when you sell the shares after they vest (assuming it’s at least 12 months later), the taxable income is considered long-term capital gains, so you may get up to a 57% discount (!) on the tax you owe (e.g., 15% vs. 35% if your taxable income is $244k up to $519k for a single taxpayer).

In addition, your 83(b) election starts the clock on the 12-month holding period required to turn short-term capital gains, taxed like regular income, into long-term capital gains, which are taxed at the lower brackets.

Who Is Most Likely to Benefit from an 83(b) Election?

Two groups are most likely to benefit from an 83(b) election:

- You received stock options from your employer and can exercise them early, i.e., before they vest.

- You’re a (co-)founder or a key employee of your company and your compensation includes a significant component in restricted shares – ones that require you to remain with the company to avoid forfeiting them.

When Would You Most Benefit from an 83(b) Election?

An 83(b) election is most favorable when:

- You plan to stay with your employer long enough for the shares/options to vest and at least 12 months past when they were granted, and the risk of the company letting you go and/or going bankrupt is small.

- The difference between the current market value and what you paid for the shares/options is small.

- The likelihood of your employer’s stock price increasing significantly is high.

- You have enough liquid assets to pay the higher current taxes without having to borrow at a high interest rate.

- Your current tax bracket and tax rates are likely to be lower than when the shares/options vest.

When Should You Be Cautious About Filing an 83(b) Election?

On the flip side, you should be far more cautious and potentially decline to file an 83(b) election if:

- The likelihood of your leaving your employer (quitting your job, being laid off, and/or the company going out of business) is high. In this scenario, you might end up having paid taxes on shares you never receive, and that tax payment is nonrefundable.

- The difference between the current market value and what you paid for the shares/options is substantial.

- The likelihood of your employer’s stock price increasing significantly is low and/or the risk of the stock price dropping is significant.

- You don’t have enough liquid assets to pay the higher current taxes without borrowing at a high interest rate.

How and When Do You Need to File the 83(b) Election?

The filing schedule is critical – the IRS requires you to file no more than 30 days after you’re granted the shares and/or exercise the options. The clock starts ticking the day after and keeps ticking through all calendar days, including weekends and holidays.

If you miss that deadline, you’ve lost the opportunity to potentially get a huge discount on your taxes.

The filing process is straightforward.

- Complete and sign an 83(b) election form (the form needs to include your name, address, and Social Security number; the company, type, and number of shares/options; the granting date, fair market value as of that date, and restrictions to which they are subject; how much you paid for the shares/options; and the resulting gross income you will report to the IRS).

- Mail the signed and dated form to the IRS center where you normally file your income tax return (best practice is to mail it certified with a return receipt requested to prove the date you filed).

- Provide a copy to your employer.

- Retain in your records a copy of the form and the return receipt once you get it.

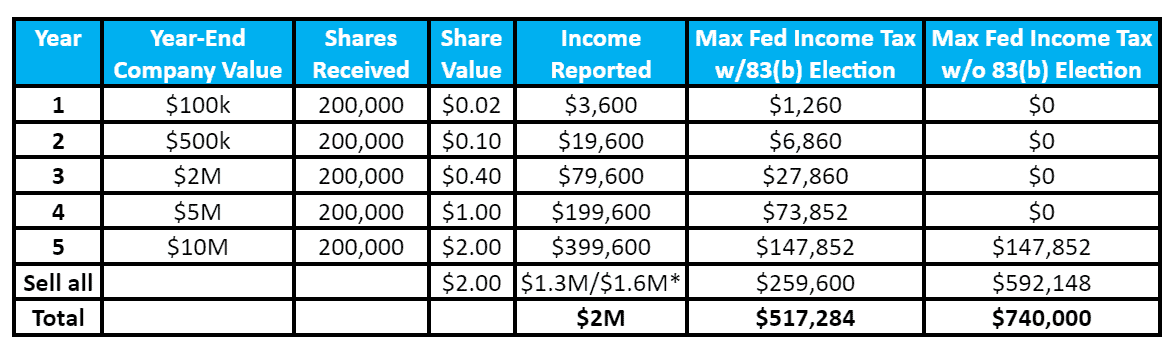

An Example of How an 83(b) Election Could Save You Money

For this example, we’ll make some simplifying assumptions:

- You’re a single taxpayer and remain such throughout the period in question.

- We ignore inflation’s effects on tax brackets, income, and share values.

- You’re a cofounder and receive 1 million shares, for a 20% ownership stake, spread evenly over five years, with each share initially valued at $0.001 (initial company valuation of $10k).

- In Years 1-3, you’re in the 35% regular income bracket and 15% long-term capital gains bracket.

- In Years 4-5, you’re pushed into the 37% and 20% tax brackets.

- At the end of Year 5 you cash out of all your stock.

What Do the Pros Say?

Alicia Vande Ven, a financial advisor with Walkner Condon Financial Advisors, shares, “The reason I’m knowledgeable about this obscure bit of tax law is because my husband works at a company that offers restricted stock, and we had to evaluate if we wanted to make an 83(b) election ourselves. The first time it was offered we didn’t have the cash or liquidity for the taxes and didn’t want to risk it, but we did make the election for later grants saving tens of thousands of dollars and counting. The more the stock price goes up, the more money the 83(b) election can save you.”

—

Anthony Ferraiolo, Partner Advisor of AdvicePeriod, expands, “An 83(b) election is not a one-size-fits-all process, even with the significant long-term tax benefits. A good candidate for this may have strong cash flow, higher income, a low spread between the strike price and 409A value, an early employee, or a sizable portfolio outside their company stock since we never want to encourage a client to put all their eggs in one basket, especially since their income is associated with the company. Those with higher income or larger portfolios can afford this added risk, and their higher income may reduce the associated alternative minimum tax (AMT) on the early exercise decision.

“Inversely, we’ve suggested clients not do an 83(b) election when the spread between their exercise price and 409A value was so wide that it would have resulted in a large AMT cash outflow in addition to the cost to exercise. There have been other scenarios where a client had high credit card debt or wasn’t maxing out other diversified tax-efficient vehicles, so we opted for a more strategic formulaic approach over time to reduce the cash outflow.

“It may be even more urgent to evaluate the 83(b) election if the company is under $50M in net assets (typically smaller companies with a valuation below $1BN) and a C Corp because this might allow an employee or founder to elect Section 1202 qualified small business tax treatment (QSBS) which may eliminate capital gains taxes altogether if additional holding and timing criteria are met.

“There have been cases where we’ve worked with clients to conduct an 83b election on qualified small business stock (QSBS) to help save on taxes and in cases where the total benefit exceeds $10M, we’ve encouraged clients to work with an attorney to explore QSBS stacking, which may further extend the tax benefits of these elections.

“The 83(b) election gets a lot of attention because of the allure of lower taxes, but this could come with the caveat that you may pay some taxes now and have to wait a long time before seeing the benefit of your election. The pitfalls could be challenging too, where the 409A price reduces, there’s no timeline for a liquidity event (IPO or Tender Offer), or an investor’s goals are concentrated on a home purchase rather than maximizing their illiquid portfolio.”

—

Rebecca J Conner, Founder and Lead Planner at SeedSafe Financial, agrees, “We advise clients to move forward with an 83(b) election when they’re on the founding team of a new startup or when the bargain element (difference between the fair market value and strike price) is low with a higher expected long-term return. One client was able to qualify for a QSBS exclusion and distributed millions of dollars tax-free.

“However, startups are some of the most risky endeavors to put your money into. So, clients who cannot take the risk with their money or don’t believe in the company long term may want to avoid an 83(b) election or exercise it partially (in the case of non-qualified stock options).”

The Bottom Line

Filing an 83(b) election under the right circumstances could potentially save you tens, if not hundreds of thousands of dollars in reduced taxes.

On the other hand, prepaying taxes following this election reduces your liquid assets, and you run the risk that the taxes you pay may end up being unnecessary if you forfeit the shares/options and/or they become worthless (e.g., the company goes out of business before you can exercise and sell them).

Given the risks involved, you should consult a tax professional well-versed in this area of the IRC before deciding on an 83(b) election.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor