Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

It’s an interesting question. Where do all the millions of dollars go when millionaires pass away?

Depending on the source, it seems that 72-88% of the wealthy are self-made millionaires.*

This begs the question: If Millionaires Are Mostly Self-Made, What Happens to All Their Millions When They Die?

What a fascinating question!

Here are thoughts on what could be happening that could help solve the puzzle.

- The wealthy may spend enough of their fortune in retirement to leave under $1 million to heirs.

- They may have multiple heirs, and once you split the bequest, each heir may get less than $1 million.

- Heirs may blow through enough money to drop under $1 million in investable net worth – easy come, easy go, as they say.

- The heirs may already have been millionaires, so their inheritance didn’t change their status.

- Too many millionaires may still be alive – wait long enough, and lots more millionaires will be created from bequests.

Let’s look at these in a bit more detail…

Potential Explanation 1: Spending Down Before Dying

According to DQYDJ.com, 21% of Americans in the 70-74 age bracket have over $1 million (excluding equity in their primary residence). In the 75-79 age bracket, that drops to 17%.

The 79th percentile line drops to $737k, implying these retirees spent about $263k of their net worth in five years.

The 12% who had $1 million when they hit the 75-79 age bracket appear to have had over $1.9 million while in the 70-74 age bracket. This implies they spent over $900k in five years. These numbers imply that about 43% of millionaires aged 70-74 drop under the $1 million mark in five years.

The caveat is that we’re looking at different cohorts and assuming the current 70-74 year-olds will be similar in five years to those currently 80-84 years old.

Potential Explanation 2: Multiple Heirs Splitting the Fortune

Using the same DQYDJ calculator and assuming the average number of heirs of millionaires is two, 17% of those in the 75-79 age bracket have at least $1 million, while just 11% have over $2 million.

These numbers imply that 35% of millionaires can’t leave $1 million to each of two heirs.

Potential Explanation 3: Heirs May Blow Through Inheritance

Many cite a study that claims 70% of second-generation wealth will dissipate their inheritance. However, according to at least one researcher, that oft-cited study may not be as well designed as many think.

Whether it’s 70%, 50%, or even 30%, clearly, many who inherit a good deal of wealth proceed to squander it.

As Angela Dorsey, Principal, Dorsey Wealth Management, says, “Many people do not know how to properly manage newfound wealth. Many are quick to overspend or give money away, which prevents them from achieving long-term financial success. Some may have good intentions to invest and build wealth, but they get caught up in get-rich schemes and quickly lose their money.”

Potential Explanation 4: Those Inheriting a Great Deal of Money May Already Have Been Millionaires

The cited Bank of America study found that 46% of the affluent had a head start from inheritance rather than having achieved wealth solely from a bequest.

For these people, either the inheritance was far short of $1 million, or they could have already had over $1 million, and the bequest just boosted their net worth further.

Ross Dugas, Ph.D., Founder and Financial Advisor at Scientific Financial speaks to this, “Most millionaires are just normal folks who made simple financial decisions like saving 10% of their salary in their 401(k). These millionaires didn’t necessarily make great financial decisions or inherit the money. They just avoided the common pitfalls like investing in the latest hot stock or trying to time the market. Good investing is simple and boring. A $10k/year investment can surpass $1M in 25 years with average historical stock returns. Becoming a millionaire isn’t nearly as difficult as it might seem.”

Potential Explanation 5: Many (Most?) Millionaires May Be Too New to Have Died and Left Bequests

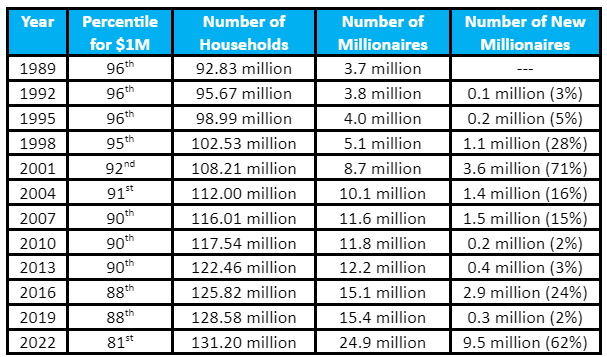

Let’s use another DQYDJ calculator, net worth by year, to find the percentile of having $1 million investable net worth from 1989 to 2022. Then, we can use a Statista graph to see how many American households existed for each relevant year.

From the table, we can see clearly that over half of all American millionaires as of 2022 reached that status after 2013, i.e., in under a decade. Nearly 4 of every 5 millionaires as of 2022 reached that status in less than a generation, i.e., since 1998.

It’s not a stretch to believe that most, if not all, of those millionaires are still around, so their heirs have to wait to receive those riches.

Will You Become an Inheritance Millionaire?

As Dugas says, becoming a millionaire on your own doesn’t take great genius or incredible stock-picking acumen. Live below your means and consistently invest in assets that appreciate over the long term.

As for inheriting millions, we find many possible explanations as to why we don’t see so many more “inheritance millionaires.”

Most likely, it’s a combination of multiple factors.

Still, inheriting a million bucks (or more) would be sweet…

—

* Source example articles referencing the percentage of wealthy who are “self-made” millionaires.

- Business News Daily: “Further, a second study by Fidelity Investments found that 88 percent of all millionaires are self-made, meaning they did not inherit their wealth.”

- The Millionaire Next Door: “In my thirty-plus years of surveying and studying millionaires, I have consistently found that 80 to 86% are self-made.”

- Bank of America Study of Wealthy Americans: “Legacy wealth: Those with an affluent upbringing and an inheritance… 28%.” If 28% are legacy wealthy, then 72% are at least partially self-made.

—

Have a Question to Ask a Financial Advisor?

When you’re uncertain about money matters, submit your question to Wealthtender, and it may be answered by a financial advisor in an upcoming article or in the Wealthtender Expert Answers Forum.

Need personalized help? Visit wealthtender.com to find the right financial advisor for your unique needs.

This article was originally published on Wealthtender and is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions. Wealthtender earns money from financial professionals, which creates a conflict of interest when these professionals are featured in articles over others. Read the Wealthtender editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor