Wealthtender Voice of the Client Awards™

Wealthtender’s Voice of the Client Awards™ recognize financial advisors and wealth management firms that consistently receive superior client reviews.

What are Wealthtender Voice of the Client™ Awards?

Wealthtender’s Voice of the Client Awards recognize financial advisors and wealth management firms that consistently receive superior client reviews.

To qualify for a Highly Rated award, advisors and firms must achieve an average client review rating of 4.75 or higher (on a scale of 1 to 5) based on a minimum number of eligible client reviews published on Wealthtender within a defined timeframe for each particular award. Eligible reviews are limited to clients (as of the review submission date) that advisors/firms must self-attest have no material conflicts of interest and received no compensation in exchange for their reviews.

Although financial advisors and wealth management firms compensate Wealthtender for marketing services (including eligibility to be considered for awards), Wealthtender’s award criteria is objective and not influenced by compensation. Wealthtender Voice of the Client Awards are not a guarantee of future performance or success and client reviews may not be representative of the experience of all past or future clients.

Scroll down to learn more about specific award criteria and eligibility requirements.

What makes Wealthtender Voice of the Client Awards™ unique?

We established the Wealthtender Voice of the Client Awards as the industry’s first awards program to celebrate financial advisors and wealth management firms with consistently exceptional client reviews published online.

Unlike many popular award programs with ranking factors that favor financial institutions with the most assets and the fastest revenue growth, the Wealthtender Voice of the Client Awards provide both local financial advisors who choose to remain small and large wealth management firms with the opportunity to be recognized on a metric that matters more to consumers – actual client feedback reflecting the quality of their experience.

How do Wealthtender Voice of the Client Awards™ benefit consumers?

Wealthtender’s Voice of the Client Awards™ can help consumers make more informed hiring decisions when choosing a financial advisor. Of course, it’s important to understand that all industry awards, including Wealthtender Voice of the Client Awards, should never be relied upon in isolation to make a hiring decision.

We believe it’s always important that individuals and couples preparing to hire financial advisors take the time to read reviews published on Wealthtender to understand what clients say about their individual experiences. Reviews often offer a glimpse into the client experience that consumers can take into consideration in their hiring decision as one factor in their overall evaluation of financial advisors.

Every client’s experience is unique and and there are no guarantees of future success or similar results, so you should speak with multiple financial advisors and consider their education, experience, credentials and any specialized services important to you before deciding who you hire.

Wealthtender Voice of the Client Awards™: Eligibility and Criteria

Eligibility for Wealthtender Voice of the Client Awards is limited to US-licensed financial advisors and wealth management firms that offer financial planning services to individual clients and that compensate Wealthtender for marketing services, including use of the Wealthtender platform to collect and publish online reviews. Wealthtender’s award criteria is objective and not influenced by compensation received for services provided.

To qualify for a Highly Rated award, financial advisors and wealth management firms must achieve an average client rating of 4.75 or higher (on a scale of 1 to 5) based on a minimum number of eligible client reviews published on Wealthtender within a defined timeframe for each particular award. Eligible reviews are limited to clients (as of the review submission date) that advisors/firms must self-attest have no material conflicts of interest and received no compensation in exchange for their reviews. Refer to the table below for the criteria considered to earn a particular award.

| Wealthtender Voice of the Client Award Criteria | 2026 Highly Rated Advisor | 2026 Highly Rated Firm |

|---|---|---|

| Current IAPD Registration | ✔️ (Individual CRD#) * | ✔️ (Firm CRD#) * |

| Active Wealthtender profile | ✔️ * | ✔️ * |

| Review rating on Wealthtender profile | 4.75 or higher * | 4.75 or higher * |

| Client relationship requirements | Award-eligible reviews are limited to reviews that advisors self-attest have been submitted by a) clients (as of their review submission date) b) who received no compensation in exchange for their review, and c) who have no material conflicts of interest. | Award-eligible reviews are limited to reviews that firms self-attest have been submitted by a) clients (as of their review submission date) b) who received no compensation in exchange for their review, and c) who have no material conflicts of interest. |

| Attribution requirements | Award-eligible reviews for the Highly Rated Advisor Award include a) reviews submitted on an advisor’s individual Wealthtender profile, plus b) reviews submitted on a Wealthtender firm profile and displayed on an advisor’s individual Wealthtender profile (e.g., using the Wealthtender Review Sync feature) that firms attest** are attributable to the advisor. | Award-eligible reviews for the Highly Rated Firm Award include a) reviews submitted on a Wealthtender firm profile, plus b) any reviews aggregated from affiliated Wealthtender individual advisor profiles and displayed on a Wealthtender firm profile (e.g., using the Wealthtender Review Roll Up feature). |

| Eligible review timeframe | Advisors who did not earn the 2025 Highly Rated Advisor Award: Award-eligible reviews reflect review submission dates between July 1, 2025 and the award date. Advisors who earned the 2025 Highly Rated Advisor Award: Award-eligible reviews reflect review submission dates after January 1, 2026 and the award date. | Firms that did not earn the 2025 Highly Rated Firm Award: Award-eligible reviews reflect review submission dates between July 1, 2025 and the award date. Firms that earned the 2025 Highly Rated Firm Award: Award-eligible reviews reflect review submission dates after January 1, 2026 and the award date. |

| Minimum average rating | Average rating of 4.75 or higher for award-eligible reviews | Average rating of 4.75 or higher for award-eligible reviews |

| Review count minimum | Advisors who did not earn the 2025 Highly Rated Advisor Award: Financial advisors must have 10 or more award-eligible reviews. Advisors who earned the 2025 Highly Rated Advisor Award: Financial advisors must have 5 or more award-eligible reviews. | Firms that did not earn the 2025 Highly Rated Firm Award: Wealth management firms must surpass a minimum number of award-eligible reviews based on a multiplier that takes into consideration the number of its financial advisors as reflected in its Form ADV Item 5.B.(1) ***. Specifically, the minimum number of award-eligible reviews for firms is 10 times the number of financial advisors times the applicable multiplier as follows: ▪️ .7 [firms with 2 to 10 advisors] ▪️ .6 [11 to 20 advisors] ▪️ .5 [21 to 30 advisors] ▪️ .4 [31+ advisors] For example, the minimum number of award-eligible reviews for a firm with 18 advisors is 108 (10x18x.6). Firms that earned the 2025 Highly Rated Firm Award: The review count minimum is calculated by applying the same formula reflected just above and divided by two. |

| Award qualification dates | Beginning on February 1, 2026 and the first day of each subsequent month through January 1, 2027, Wealthtender evaluates eligible financial advisors based on award criteria to determine award recipients. | Beginning on February 1, 2026 and the first day of each subsequent month through January 1, 2027, Wealthtender evaluates eligible financial advisors based on award criteria to determine award recipients. |

| Award issuance dates | Within the first seven days of each month from February 2026 through January 2027, Wealthtender contacts qualifying financial advisors to confirm acceptance of their award. | Within the first seven days of each month from February 2026 through January 2027, Wealthtender contacts qualifying wealth management firms to confirm acceptance of their award. |

* As of Award Date. | ** For more details, please refer to this FAQ below: Can reviews collected on our firm profile be attributed to an advisor for Highly Rated Advisor award eligibility? | *** Wealth management firms may petition for the number of financial advisors used in the award calculation to be reduced by submitting written attestation that specifies its number of financial advisors with retail client-facing responsibilities. Firms operating under a distinct business name (D/B/A) listed in Form ADV Section 1.B. “Other Business Names” of an SEC-registered investment adviser may petition for the number of financial advisors used in the award calculation to be reduced by submitting written attestation that specifies its D/B/A number of financial advisors with retail client-facing responsibilities. | Wealthtender will not issue awards to financial advisors and wealth management firms that qualify for an award, but choose not to accept an award. In rare circumstances, Wealthtender, in its sole discretion, may choose to not issue awards to financial advisors or wealth management firms based on factors not reflected above. Wealthtender reserves the right not to disclose its rationale when choosing not to issue an award.

Expand to View 2025 Voice of the Client Award Criteria

| Wealthtender Voice of the Client Award Criteria | 2025 Highly Rated Advisor | 2025 Highly Rated Firm |

|---|---|---|

| Current IAPD Registration | ✔️ (Individual CRD#) * | ✔️ (Firm CRD#) * |

| Active Wealthtender profile | ✔️ * | ✔️ * |

| Review rating on Wealthtender profile | 4.75 or higher * | 4.75 or higher * |

| Client relationship requirements | Award-eligible reviews are limited to reviews that advisors self-attest have been submitted by a) clients (as of their review submission date) b) who received no compensation in exchange for their review, and c) who have no material conflicts of interest. | Award-eligible reviews are limited to reviews that firms self-attest have been submitted by a) clients (as of their review submission date) b) who received no compensation in exchange for their review, and c) who have no material conflicts of interest. |

| Attribution requirements | Award-eligible reviews for the Highly Rated Advisor Award include a) reviews submitted on an advisor’s individual Wealthtender profile, plus b) reviews submitted on a Wealthtender firm profile and displayed on an advisor’s individual Wealthtender profile (e.g., using the Wealthtender Review Sync feature) that firms attest** are attributable to the advisor. | Award-eligible reviews for the Highly Rated Firm Award include a) reviews submitted on a Wealthtender firm profile, plus b) any reviews aggregated from affiliated Wealthtender individual advisor profiles and displayed on a Wealthtender firm profile (e.g., using the Wealthtender Review Roll Up feature). |

| Eligible review timeframe | Award-eligible reviews reflect review submission dates between January 1, 2024 and the award date. | Award-eligible reviews reflect review submission dates between January 1, 2024 and the award date. |

| Minimum average rating | Average rating of 4.75 or higher for award-eligible reviews | Average rating of 4.75 or higher for award-eligible reviews |

| Review count minimum | Financial advisors must have 10 or more award-eligible reviews. | Wealth management firms must surpass a minimum number of award-eligible reviews based on a multiplier that takes into consideration the number of its financial advisors as reflected in its Form ADV Item 5.B.(1) ***. Specifically, the minimum number of award-eligible reviews for firms is 10 times the number of financial advisors times the applicable multiplier as follows: ▪️ .7 [firms with 2 to 10 advisors] ▪️ .6 [11 to 20 advisors] ▪️ .5 [21 to 30 advisors] ▪️ .4 [31+ advisors] For example, the minimum number of award-eligible reviews for a firm with 18 advisors is 108 (10x18x.6). |

| Award qualification dates | Beginning on June 1, 2025 and the first day of each subsequent month through January 1, 2026, Wealthtender evaluates eligible financial advisors based on award criteria to determine award recipients. | Beginning on June 1, 2025 and the first day of each subsequent month through January 1, 2026, Wealthtender evaluates eligible financial advisors based on award criteria to determine award recipients. |

| Award issuance dates | Within the first seven days of each month from June 2025 through January 2026, Wealthtender contacts qualifying financial advisors to confirm acceptance of their award. | Within the first seven days of each month from June 2025 through January 2026, Wealthtender contacts qualifying wealth management firms to confirm acceptance of their award. |

| ↗️ View Highly Rated Advisor Award Recipients | ↗️ View Highly Rated Firm Award Recipients |

* As of Award Date. | ** For more details, please refer to this FAQ below: Can reviews collected on our firm profile be attributed to an advisor for Highly Rated Advisor award eligibility? | *** Wealth management firms may petition for the number of financial advisors used in the award calculation to be reduced by submitting written attestation that specifies its number of financial advisors with retail client-facing responsibilities. Firms operating under a distinct business name (D/B/A) listed in Form ADV Section 1.B. “Other Business Names” of an SEC-registered investment adviser may petition for the number of financial advisors used in the award calculation to be reduced by submitting written attestation that specifies its D/B/A number of financial advisors with retail client-facing responsibilities. | Wealthtender will not issue awards to financial advisors and wealth management firms that qualify for an award, but choose not to accept an award. In rare circumstances, Wealthtender, in its sole discretion, may choose to not issue awards to financial advisors or wealth management firms based on factors not reflected above. Wealthtender reserves the right not to disclose its rationale when choosing not to issue an award.

General Award FAQs

How can I verify that an advisor or firm has earned an award from Wealthtender?

To verify that a financial advisor and/or wealth management firm has earned an award from Wealthtender, view their profile(s) on Wealthtender and scroll down to the Awards tab. Within the Awards tab, look for the Wealthtender Awards area where awards issued by Wealthtender will appear.

You can also view the lists of award recipients here:

- Voice of the Client Highly Rated Advisor Award Recipients

- Voice of the Client Highly Rated Firm Award Recipients

In certain circumstances, a financial advisor or wealth management firm may have earned an award from Wealthtender that does not appear in the Awards tab.

If an award you expected to find in the Awards tab for a wealth management firm or financial advisor doesn’t appear on their profile, please contact yourfriends@wealthtender.com and we’ll be happy to assist.

FAQs for Financial Advisors & Wealth Management Firm Leaders

What happens when we qualify for a Wealthtender award?

Within the first seven days of each month, Wealthtender contacts qualifying financial advisors and wealth management firms to provide confirmation of Wealthtender Voice of the Client Highly Rated Award qualification and to confirm their acceptance of the award(s).

Upon acceptance of the award(s) earned and within 2 business days, Wealthtender will update the applicable advisor/firm profile(s) on Wealthtender to display the award logo and accompanying regulatory disclosures within the Awards tab that will appear on the applicable profile(s). Financial advisors and firms may submit their own regulatory and firm disclosures to replace Wealthtender’s default regulatory disclosures.

Please note that financial advisors and wealth management firms interested in displaying a Wealthtender award logo in digital or print format beyond their Wealthtender profile page(s) must first sign a licensing agreement and pay applicable licensing fees (if any). Please refer to the next FAQ for additional details.

Is a licensing agreement/fee required to promote a Wealthtender award?

Whether or not a licensing agreement/fee is required to promote a Wealthtender award depends on the particular award and where/how it is being used. Please refer to the tables below for additional details. Questions? Please email yourfriends@wealthtender.com. We’re always happy to help.

—

| Licensing Agreement / Fee Not Required: | Licensing Agreement Required (Plus Fee, If Applicable): |

|---|---|

| Neither a licensing agreement nor licensing fee is necessary for financial advisors and wealth management firms to display their Wealthtender award logo(s): a) on their Wealthtender profile page(s), and/or b) to promote a Wealthtender award using plain text and/or a link in email signatures, newsletters, social media posts, and website pages. | Financial advisors and wealth management firms interested in displaying a Wealthtender award logo(s) in digital or print format beyond their Wealthtender profile page(s) must first sign a licensing agreement and pay applicable licensing fees (if any) as described in the fees table below. Examples of Wealthtender award logo uses that require a licensing agreement (plus fee, if applicable), include: – Printed communications (e.g., brochures, press releases, post cards, newspapers, signage, etc.) – Internet uses (e.g., Licensee’s website(s), social media profiles/posts, directory listings) – Other uses upon request and subsequent written approval from Wealthtender |

—

| 2025 Highly Rated Advisor Licensing Fees | 2025 Highly Rated Firm Licensing Fees |

|---|---|

| Financial advisors who have qualified for the 2025 Highly Rated Advisor Award can enter into a licensing agreement with Wealthtender that defines and permits approved uses of the award logo in digital and print format. Upon execution of the licensing agreement, there is no cost for financial advisors to use the award logo. | Wealth management firms that have qualified for the 2025 Highly Rated Firm Award can enter into a licensing agreement with Wealthtender that defines and permits approved uses of the award logo in digital and print format. The licensing fee for logo use by wealth management firms is calculated based on (A) the number of its financial advisors used in the Highly Rated Firm Award calculation multiplied by $30, and reduced by credits equal to (B) the number of its individual financial advisors with profiles on Wealthtender as of the award date multiplied by $25. For example a firm with 18 advisors used in the award calculation (A) and 10 individual financial advisors with profiles on Wealthtender (B) would incur a gross licensing fee of $540 (18x$30) reduced by credits of $250 (10x$25), resulting in a net licensing fee and payment due of $290 ($540-$250). |

Can I preview the licensing agreement and terms of use for Wealthtender Voice of the Client Awards?

Yes. Please click the link below to preview the licensing agreement (pages 1-2) and terms of use (pages 3-4):

Preview (PDF) – Wealthtender 2026 Highly Rated Award Licensing Agreement & Terms of Use

Preview (PDF) – Wealthtender 2025 Highly Rated Award Licensing Agreement & Terms of Use

Can client testimonials imported from another platform to Wealthtender qualify as award-eligible?

Yes, client testimonials imported from other platforms to Wealthtender that meet all award criteria can qualify as award-eligible reviews. For example, wealth management firms with Google Reviews can use the Wealthtender Google Review Import Tool to import reviews to Wealthtender. We also have experience assisting financial advisors transitioning their online reviews from industry-specific review collection platforms to Wealthtender.

Can reviews collected on our firm profile be attributed to an advisor for Highly Rated Advisor award eligibility?

Many firms choose to invite clients to write reviews on their Wealthtender firm profile and use the Wealthtender Review Sync feature to display reviews across one or more individual advisor profiles. In these instances, firms may submit a Wealthtender Award Eligibility Attestation Form to attribute one or more reviews to a particular advisor(s) to satisfy the attribution requirements for the Highly Rated Advisor award.

Upon submission of the attestation form, Wealthtender staff will evaluate each advisor for Highly Rated Award qualification based on the eligibility criteria requirements and will notify firms within 2 business days with the evaluation results.

If I believe we qualify for an award based on the eligibility criteria above, but I haven’t been notified by Wealthtender, what should I do?

Please send an email to yourfriends@wealthtender.com with a few details about the award you believe you have qualified for and we’ll be happy to evaluate your circumstances.

What is relationship alpha and how does the qualification methodology for the Wealthtender Voice of the Client Awards compare to other industry awards?

Wealthtender’s Voice of the Client Awards shift the focus away from qualification criteria based on firm size, assets under management, and revenue growth prioritized in the methodology of many existing industry award programs, to instead celebrate financial advisors and wealth management firms generating positive relationship alpha* (a measure of relationship strength) as evidenced in client feedback published online.

With a methodology that recognizes financial advisors and wealth management firms that consistently receive superior client reviews, local financial advisors who choose to remain small and large wealth management firms alike can earn a Highly Rated Voice of the Client Award from Wealthtender that reflects the strength of their client relationships.

Wealthtender didn’t coin the term relationship alpha*, but we believe it succinctly conveys a metric now playing an increasingly prominent role among consumers preparing to hire financial advisors and the next generation of AI tools determining which financial advisors will appear in search results.

While a complete definition of relationship alpha* represents a multi-faceted measurement of practices implemented by firms to earn client trust and loyalty, we believe the methodology employed to determine Wealthtender Voice of the Client award winners based on consistently superior client reviews results in recognition for financial advisors and wealth management firms generating positive relationship alpha.

In fact, our inaugural Wealthtender Voice of the Client Study published in May 2025 that analyzed more than 2,500 client reviews of financial advisors, found that 89% of reviews center on relationship quality, planning advice, and emotional factors, reflecting the importance that clients place on relationship alpha metrics.

Learn more about Wealthtender’s partnership with the University of Texas to dive deeper into the concept of relationship alpha to develop the wealth management industry’s first platform to assess the quality of adviser-client relationships and the value advisers deliver beyond portfolio management.

What is Relationship Alpha?

* The term relationship alpha was coined by Charlotte Beyer to serve as a measurement of the strength of a relationship between financial advisors and their clients.

Following the publication of her 2017 book Wealth Management Unwrapped, Revised and Expanded: Unwrap What You Need to Know and Enjoy the Present written for a consumer audience, Beyer authored a 2019 CFA Institute Research Foundation Brief “Relationship Alpha” that introduced the term relationship alpha, suggesting that relationship alpha represents “the emerging competitive

advantage in wealth management“.

Please refer to the CFA Brief and the CFA Institute podcast interview with Charlotte Beyer for an in-depth discussion of relationship alpha.

Beyer, Charlotte B., Relationship Alpha (April 4, 2019). CFA Institute Research Foundation Briefs, April 2019, ISBN 978-1-944960-67-4, Available at SSRN: https://ssrn.com/abstract=3485766.

How can we promote our Wealthtender Voice of the Client Award?

To learn more than a dozen impactful ways to promote your Wealthtender Voice of the Client Award, please read this article.

Where can we learn more about joining Wealthtender?

Thank you for your interest in learning more about Wealthtender. Please visit this page to learn how Wealthtender can support your digital marketing strategy.

Regulatory FAQs

Please note: Although Wealthtender does not provide legal advice to financial advisors or wealth management firms, we are firmly committed to abiding by all regulatory requirements and offering resources and education that demonstrate how third-party ratings can be utilized by advisors and firms to strengthen their reputation and grow their business in a manner that satisfies regulatory requirements. Financial advisors should not utilize third-party ratings issued by Wealthtender or any other organization without first speaking with their compliance team for guidance and to understand firm-specific policies and procedures that require adherence in addition to regulatory requirements. Questions? Please contact yourfriends@wealthtender.com. We’re always happy to help.

What do the SEC and FINRA say about third-party ratings?

Both the Securities and Exchange Commission (SEC) and FINRA have provided guidance to help financial advisors and registered representatives understand how they can utilize third-party ratings, subject to certain conditions. The summary below highlights a few important areas of guidance found in the SEC Marketing Rule and FINRA Rule 2210 that must be followed by financial advisors when utilizing third-party ratings.

For a more complete discussion regarding the regulatory requirements and tips for compliantly promoting third-party ratings, please read this article.

SEC Marketing Rule

The SEC recognizes that marketing activities conducted by financial advisors are “an essential part of retaining and attracting clients and may be conducted easily through the internet and social media.” ¹ In fact, the SEC estimated in the Marketing Rule Adopting Release that approximately 50 percent of financial advisors will use third-party ratings in advertisements, reflecting their understanding about the important role that third-party ratings play among consumers making hiring decisions.

To provide financial advisors with a blueprint for compliantly promoting third-party ratings, the SEC Marketing Rule permits financial advisors to use third-party ratings in marketing and advertising activities when certain conditions are met, including:

- Clear and prominent disclosure indicating:

- The date on which the rating was given

- The period of time upon which the rating was based

- The identity of the third-party that created and tabulated the rating

- (If applicable) That compensation has been provided directly or indirectly by the financial advisor in connection with obtaining or using the third-party rating

- Financial advisors must have a reasonable basis for believing the questionnaire or survey used to prepare the rating meets certain criteria, including making it “equally easy for a participant to provide favorable and unfavorable responses”

- The firm publishing the rating can not be affiliated with the financial advisor and must be in the business of preparing ratings in their ordinary course of business

For an expanded discussion of SEC conditions and disclosure requirements related to the use of third-party ratings, please read this article.

FINRA Rule 2210

Financial advisors who are registered representatives of broker-dealers must abide by FINRA Rule 2210 that governs communications with the public, including the use of third-party ratings and awards.

Financial advisors who are dually SEC and FINRA registered must abide by all SEC Marketing Rule Requirements, in addition to the regulations prescribed by FINRA Rule 2210.

Many of FINRA’s requirements are similar to those found in the SEC Marketing Rule, therefore best practices for advisors subject to FINRA oversight include establishing a compliance program for third-party ratings and awards designed to satisfy the requirements of both the SEC Marketing Rule and FINRA Rule 2210.

For an expanded discussion of FINRA conditions and disclosure requirements related to the use of third-party ratings, please read this article.

¹ Notice by the Securities and Exchange Commission on 07/01/2024

How can financial advisors satisfy the SEC due diligence requirement for Wealthtender awards?

The SEC Marketing Rule states that financial advisors must perform due diligence to establish “a reasonable basis to believe that any questionnaire or survey used in the preparation of the third-party rating is structured to make it equally easy for a participant to provide favorable and unfavorable responses, and is not designed or prepared to produce any predetermined result.”

In its adopting release, the SEC states: “an adviser could satisfy the [due diligence] requirement by accessing the questionnaire or survey that was used in the preparation of the rating.”

Wealthtender published this informational page (including this response and related FAQs) to assist financial advisors and compliance professionals with satisfaction of the due diligence requirement for Wealthtender awards. Additionally, Wealthtender prepared this Regulatory Due Diligence Guide in PDF format we think you will find useful.

—

Effectively, the two due diligence questions and responses to satisfy this requirement can be summarized as follows:

SEC Question 1: Does the Wealthtender questionnaire or survey used in the preparation of its ratings/awards make it equally easy for a participant to provide favorable and unfavorable responses?

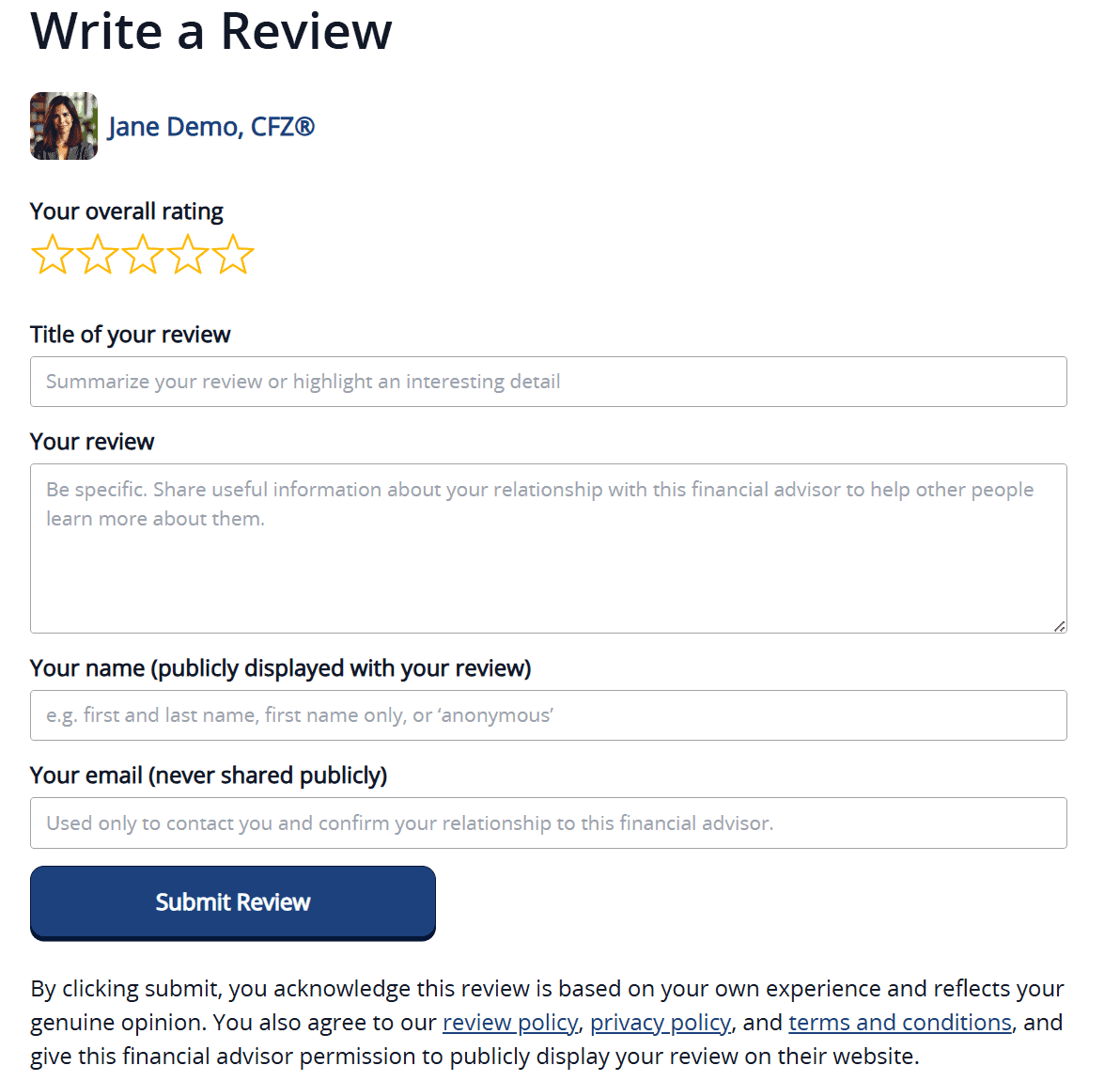

Wealthtender Response: Yes. The Wealthtender Voice of the Client Awards recognize financial advisors and wealth management firms that consistently receive superior client reviews. The Wealthtender review submission form (see screenshot below) is designed to satisfy this regulatory requirement by making it equally easy for clients of financial advisors to provide favorable or unfavorable responses. Using the industry standard “five-star” rating system for client reviews, it is equally easy for a client to rate an advisor “1-star” or “5-stars”. In addition, the labels and “helper text” displayed in the review form encourage “useful” and “genuine” responses to avoid the appearance of encouraging only “positive” responses.

SEC Question 2: Is the Wealthtender questionnaire or survey designed not to produce any predetermined result?

Wealthtender Response: Yes. The Wealthtender review submission form (see screenshot below) is designed not to produce any predetermined result. Further, an individual client review itself cannot result in an advisor qualifying for a Wealthtender award. Only upon satisfying the criteria for the applicable Wealthtender award and receiving at least the minimum number of award-eligible reviews can an advisor qualify for a Wealthtender award.

Screenshot of the Wealthtender Review Submission Form:

When promoting a Wealthtender award, what disclosures must accompany the award to ensure regulatory compliance?

Both the SEC and FINRA provide important guidance that financial advisors must follow when publishing and promoting third-party ratings and awards.

The summary below highlights a few important areas of guidance related to disclosure requirements found in the SEC Marketing Rule and FINRA Rule 2210 that must be followed by financial advisors when promoting third-party ratings/awards.

For a more complete discussion regarding the regulatory disclosures required when promoting third-party ratings, please read this article.

—

SEC: DISCLOSURES REQUIRED WHEN PROMOTING THIRD-PARTY RATINGS

The SEC Marketing Rule requires that a) financial advisors “clearly and prominently disclose”, or b) financial advisors “reasonably believe that the third-party rating issuer clearly and prominently discloses”:

- The date on which the rating was given and the period of time upon which the rating was based

- The identity of the third-party that created and tabulated the rating

- (If applicable) That compensation (cash or non-cash) has been provided directly or indirectly by the financial advisor in connection with obtaining or using the third-party rating

To satisfy the requirement to “clearly and prominently” display disclosures, it’s important to note these disclosures must be displayed alongside or in very close proximity to the published rating/award. Financial advisors cannot link to disclosures on another page to satisfy this requirement.

FINRA: DISCLOSURES REQUIRED WHEN PROMOTING THIRD-PARTY RATINGS

FINRA requires that advertisements and communications to a retail audience promoting third-party ratings prominently disclose the name of the advisor and/or their firm, the name of the organization that issued the rating/award, and the nature of the relationship between the advisor and the third-party rating firm.

Additionally, because third-party ratings/awards could be construed as a form of ‘testimonial’, financial advisors should incorporate the disclosure requirements for testimonials outlined in FINRA Rule 2210 as a matter of good practice, including:

- The fact that the rating/award, often assessed with a historical lens, may not be representative of the experience of all past or future customers,

- The fact that the rating/award should not be construed as a guarantee of future performance or success, and

- If more than $100 in value is paid to be considered for the award or to promote the award, the fact that payment was made for the rating/award

Further, financial advisors must ensure that any promotion of ratings/awards are approved by an appropriately qualified Registered Principal before use or filing with FINRA’s Advertising Regulation Department.

What disclosures accompany Wealthtender awards displayed on a Wealthtender profile?

Wealthtender only displays Wealthtender awards on the Wealthtender profiles of qualifying advisors and wealth management firms after the qualifying advisor/firm:

a) accepts their award, and

b) either acknowledges the default disclosures that Wealthtender publishes to satisfy SEC and FINRA disclosure requirements (see table below) or provides alternative disclosures to satisfy disclosure requirements.

| Highly Rated Advisor Default Disclosure | Highly Rated Firm Default Disclosure |

|---|---|

| Wealthtender awarded [Advisor Name] with its [Award Name] on [Date]. Rating criteria based on eligible client reviews published on Wealthtender between [Date] and [Date]. Although [Firm Name] compensates Wealthtender for marketing services (including eligibility to be considered for this award), Wealthtender’s award criteria is objective and not influenced by compensation. This award is not a guarantee of future performance or success and client reviews may not be representative of the experience of all past or future clients. ↗️ View additional award details and FAQs | Wealthtender awarded [Firm Name] with its [Award Name] on [Date]. Rating criteria based on eligible client reviews published on Wealthtender between [Date] and [Date]. Although [Firm Name] compensates Wealthtender for marketing services (including eligibility to be considered for this award, plus a fee if it chooses to license the award logo for promotional use), Wealthtender’s award criteria is objective and not influenced by compensation. This award is not a guarantee of future performance or success and client reviews may not be representative of the experience of all past or future clients. ↗️ View additional award details and FAQs |

For additional resources to support your compliance responsibilities, Wealthtender prepared this Regulatory Due Diligence Guide in PDF format we think you will find useful.

The #1 Find-An-Advisor Directory To Discover Trusted Financial Advisors

The #1 Find-An-Advisor Directory To Discover Trusted Financial Advisors

Certified Advisor Reviews™ help you make smarter hiring decisions when choosing a financial advisor.