To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Unless you’re one of the lucky few, you likely noticed your money doesn’t go anywhere near as far as it used to a few years ago.

According to MoneyWise, 97% of industries saw real income declines over the past five years, with the average salary down by more than 8% (adjusting for inflation).

By contrast, MoneyWise quotes housing prices as having risen by 56% in the same five years, dramatically impacting housing affordability, even before we consider mortgage rates having more than doubled.

They then project similar salary declines and housing cost increases for the coming years, making an already bad situation appear far worse.

Should we all panic?

What Does Earnings Data Show?

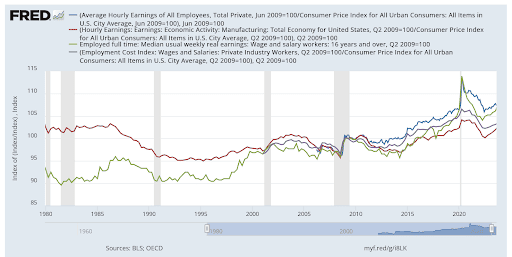

According to data from the St. Louis Fed (see the green line in the graph below), full-time median usual weekly real earnings peaked in the second quarter of 2020, then dropped 8.2% by the second quarter of 2022, before recovering 1.6% by the first quarter of this year. Still, we’re about 7% off the peak.

However (again, adjusting for inflation), we’re 3% higher than five years earlier, in the first quarter of 2019.

Looking at the longer term, from the first quarter of 1980, real earnings suffered several multi-year drops, interspersed with multi-year increases, for a 0.3% average annualized increase (again, adjusting for inflation).

In short, over the long term, median earnings tend to increase slightly faster than prices.

Further, since the most recent year or so has seen real earnings start to recover, and considering the tight labor market, projecting a continued massive drop over the next five years seems unwarranted.

How About Median Family Income?

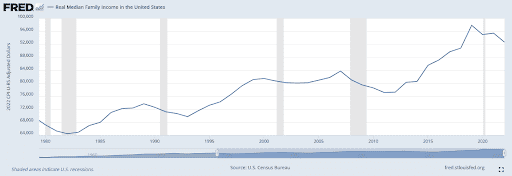

The median weekly earnings may not be the ideal metric to consider.

After all, many of us are married or in another domestic arrangement that pools income from two or more family members, so it may be better to look at real median family income (see next graph).

Here, we see a drop of just 5.3% from the 2019 peak to the 2022 trough (the most recent data available). Still, considering how many of us don’t have enough reserves to cover a $400 emergency without borrowing, making do with 5.3% less inflation-adjusted income requires, at best, some tough choices.

Ronald E. Lang, Principal & Chief Investment Officer, Atlas Wealth Management, wonders, “Why is anyone surprised by this? The example I give clients is the following: if you give 100 people in a community $10,000 each (could be a raise in wage or a government subsidy), then all the business would raise their prices on goods and services. The net result is the extra $10,000 gains you nothing since everything went up in price. Yes, you acquired the goods and services, but at what cost to not being able to afford anything else?”

However, here too, there’s a glimmer of hope.

Over the long term, we see several multi-year income drops interspersed with multi-year increases. However, from 1980 to 2022, the median family income increased at an average annualized rate 0.8% faster than inflation.

This again supports the notion that in five years, we are likelier to see real incomes higher than today rather than seeing them continue to slide another 8% or worse.

How Have Home Prices Changed?

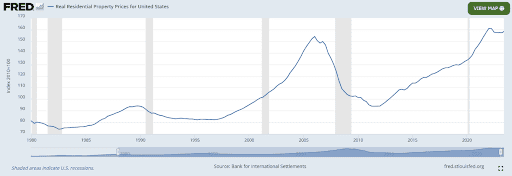

The next graph shows that inflation-adjusted residential prices are near an all-time high.

Comparing the most recent data from the end of 2023 to those of five years earlier, we see inflation-adjusted prices are higher by 24.6%.

That’s an annualized average rate of 4.5% faster than general inflation!

However, if we go back to the five years from the peak of the first quarter of 2006 to the first quarter of 2011, home prices sank by 38% in real terms, for an annualized average rate of negative 9.2%!

Looking over the longer term, from the start of 1980 to the end of 2023, home prices appreciated (in total) nearly twice as fast as inflation, which is an average annualized rate of just 1.6%.

Given how unaffordable housing has become and how mortgage interest rates more than doubled from a low of under 3% to a high of over 8% (and more recent rates around 7%), it’s hard to credit a projection that would see home prices jump another 50%+ in the coming five years.

At worst, I’d expect housing prices to remain more or less flat.

Once mortgage rates start dropping, as expected, once the Fed starts cutting interest rates later this year or early 2025, monthly payments will become more affordable, which could pressure home prices upward.

However, such an interest rate reduction would likely release many homeowners from the “golden handcuffs” of existing far-below-market-interest mortgages that prevent them from selling since any new mortgage would have far higher payments.

This factor would increase supply, likely counterbalancing upward price pressures from lower monthly payments.

The Bottom Line

There’s no denying that the recent spike in inflation and the failure of incomes to keep up have made things dicey for most Americans.

The parallel increase in home prices, along with mortgage interest rates more than doubling, have made a bad situation far worse for anyone wanting to buy a home.

Having said all that, extrapolating these effects and expecting things to continue and worsen at similar rates in the next five years appears to have no basis, in fact.

If anything, incomes will likely catch up with inflation over the coming years, and home prices could drop in some (most?) markets, but should, in any case, not continue to increase at anything like the dramatic rates seen in recent years.

Jorey Bernstein, CEO of Jorey Bernstein Private Wealth Management, mostly agrees, “In recent years, we’ve observed that the real incomes of our clients have generally kept pace with inflation, but the growth rate has been modest. This trend reflects broader economic conditions where wage increases have been somewhat restrained. Looking ahead, we anticipate that real wages will continue to experience gradual growth, influenced by factors such as labor market dynamics and inflationary pressures. As for home prices, we expect them to rise, albeit at a slower pace compared to the past few years, due to potential interest rate adjustments and evolving supply-demand balances in the housing market.”

So, what can you do about all this? Arielle Tucker, CFP & EA, founder of Connected Financial Planning, advises, “In this economic climate, it’s more crucial than ever for individuals to prioritize financial planning. Strategies such as diversifying income sources, investing in inflation-protected assets, and maintaining a disciplined savings approach can help mitigate the impact of declining real wages. It’s also essential for individuals to advocate for their future selves. The days of relying on a single employer for long-term financial stability are over. If your company isn’t growing and not providing regular wage increases, it’s time to explore new opportunities. Additionally, regularly assess your value to the company and take advantage of personal development opportunities to keep your skills up to date.”

Have a Question to Ask a Financial Advisor?

When you’re uncertain about money matters, submit your question to Wealthtender, and it may be answered by a financial advisor in an upcoming article or the Wealthtender Expert Answers Forum.

Need personalized help? Visit wealthtender.com to find the right financial advisor for your unique needs.

This article was originally published on Wealthtender and is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions. Wealthtender earns money from financial professionals, which creates a conflict of interest when these professionals are featured in articles over others. Read the Wealthtender editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor