To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

And what the comparison means, beyond our natural vanity

It’s just human.

Unless we’re struggling to survive, we care a lot more about how we’re doing compared to others, especially those we consider our peers than about our objective situation.

Really.

Don’t believe me? OK, let’s do a thought experiment.

Ever hear of Maslow’s hierarchy of needs?

It defines several tiers of what humans need, usually shown in a pyramid. The first two tiers are basic needs: food, water, warmth, rest, physical safety, and security. Beyond that are psychological needs like love, feeling you belong, and a sense of accomplishment. The last tier has to do with self-fulfillment, the sense that you’re achieving your full potential.

Since money has little to do with those psychological and self-fulfillment needs, let’s concentrate here on basic needs, and the likelihood that most people reading this have those covered. That means that regardless of what percentile your income is at, you’re objectively in good shape.

Makes you feel great about your income, right?

“Yeah, not so much if most people make more than me!”

Not convinced yet? OK, let’s do another thought experiment.

You have a car, TVs, laptops, phones (that put more computing power literally in the palm of your hand than Apollo 11’s onboard computers, that helped land the first men on the moon!), running water, indoor plumbing, access to modern medicine, more than enough to eat (for most people reading this), etc.

Your objective living conditions are better than those enjoyed by the kings and queens of ancient kingdoms and empires (setting aside the crown jewels and the ability to order “Off with his head!”).

“So what? They lived in primitive times. I care about people who are around now!”

Not completely convinced yet? OK, let’s do a last thought experiment.

Say your income is exactly the U.S. median of $78,500. Makes you feel kind of… well, average. Right?

What if I told you this income (assuming you and your spouse have two kids in the house), puts you in the top 5% highest-earning families in the world?

“Yeah, that’s nice, but I really care more about where it puts me compared to my neighbors, the Joneses.”

By now, I’m fairly confident you agree that we really care more about where we stand compared to those around us now, than we do about objective conditions and/or comparing us to people who lived a long time ago and/or live in poorer countries.

Where Does Your Household Income Put You?

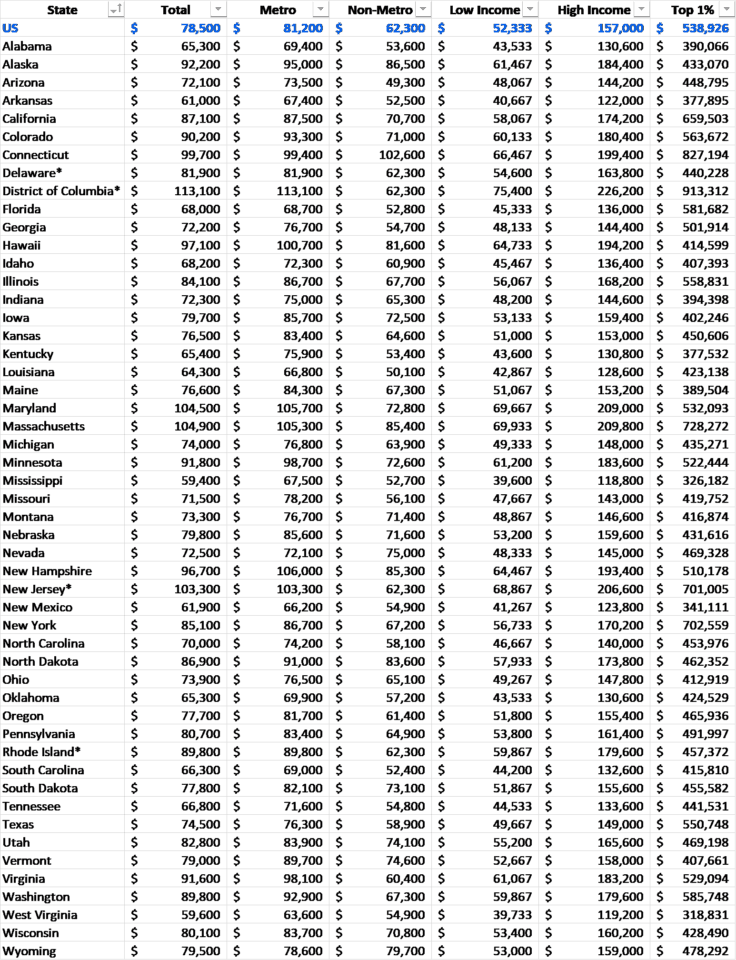

The following table shows median household incomes for the U.S. as a whole and for each state. For each of those, it shows the overall median and the median for people living in metro and non-metro areas. Then, it shows the income level below which you’d be considered low-income (defined by the Pew Research Center as two-thirds of the median income), the income level above which you’d be considered high-income (double the median, according to the Pew Research Center), and the minimum you’d need to make to make it into the top 1%.

The data in the table comes from the following sources:

You can find a far deeper dive into income numbers at the Fool.com.

What Does this Comparison Mean to You Personally?

A 6-Figure Income Isn’t What It Used to Be

One thing that quickly jumps out from the table is that while an income of $100,000, the minimum to count as a “6-figure income,” is higher than the median for all but four states and higher than the national median, it’s not enough to count as “high income” in any state.

This may explain in large part why research from LendingClub’s parent company shows that almost 40% of Americans bringing in a six-figure income continue to live paycheck to paycheck. Looking at all income levels, this research reports that over 54% of consumers are in this precarious situation.

The research also shows that very many Americans are in even worse financial condition, struggling to pay their bills. This is the case for nearly 1 in 8 of those making a six-figure income, nearly 1 in 5 of those making between $50k and $100k, and nearly a third of those making up to $50k.

Thus, if you personally find yourself living paycheck to paycheck, or worse, struggling to pay your bills, know that you’re in good company. Even if your income is over $100k.

You Can See Where Your Income Places You

Find your state in the above table, and you can see if your income places you in the low-income category, the high-income category, between those, or if you’re very privileged, in the top 1%. No matter where your income falls, having more will likely make you more content.

If Your Income Is Plenty Comfortable, Do This

Just because your income is comfortable, or even high, this doesn’t make you wealthy. It just gives you a greater opportunity to build wealth. You’re only wealthy if your net worth is high, and even more specifically if your liquid net worth is high.

Thus, review your spending, and where it isn’t aligned with your values and priorities, consider trimming it and increasing your savings and investing rate.

In addition, consider following some of the other advice below that’s meant for those making less than you do. It may help you reach your financial “enough” point sooner.

If Your Income Is Lower than Comfortable, Do This

At the risk of stating the obvious, the lower your income places you, the more important it is for you to control your spending and increase your earnings.

The first, controlling spending, requires you to track that spending. Then, with brutal honesty, evaluate if it aligns with your values and priorities. Where it doesn’t, cut as deeply as you can. Where it does align, try to find less expensive alternatives and/or hacks (e.g., bringing in a housemate to help reduce your housing costs).

The latter, earning more, can be done by e.g. learning new skills and volunteering to take on more responsibility at work. This will make you more valuable to your employer. You can also try to figure out what worries your boss and find ways to make his or her professional life easier. This will should increase the odds of your getting promoted and/or given a raise. Another path is the well-known one of starting a side hustle, which has the added benefit of diversifying your income sources.

The critical next step is to be very disciplined whenever your income increases, whether temporarily (i.e., you get a bonus) or permanently (i.e., you get a raise). In either case, divert at least half (two-thirds is better) to savings and investment. Spend at least some of the increase on things you value. This is to celebrate your success and make it easier to stay motivated.

Take Advantage of the New Normal

One massive effect of the COVID-19 pandemic was the huge acceleration in the acceptance of remote work. Take advantage of this new normal by offering services you can provide remotely to clients in the highest income states. According to the table, the top 10 are D.C., Massachusetts, Maryland, New Jersey, Connecticut, Hawaii, New Hampshire, Alaska, Minnesota, and Virginia.

Clients in these states are likely used to paying higher wages to their employees, making it easier for them to accept higher contractor rates.

The Bottom Line

Comparing your situation to others around you is a very human thing to do. There’s nothing to be ashamed of in doing it.

However, rather than stopping at that, whether it shows your income is epic or sad, consider following the above guidance to enhance your finances both in the present and the future.

Your future self will thank you profusely.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor