To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Count on the government to name laws in misleading ways.

For example, the so-called Affordable Care Act (ACA, also known as Obamacare).

Before the ACA was enacted, our family had good coverage at a reasonable cost.

Then came ACA, and President Obama pledged to the public, “If you like your health care plan, you’ll be able to keep your health care plan.”

Yeah, right. Nope!

In the years that followed, our non-ACA-compliant plan went the way of the dodo, and we saw our premiums increase dramatically almost every year, sometimes doubling in a single year.

Affordable? To whom?

Luckily our income increased enough to offset the unwelcome extra cost.

However, whether you love the ACA or hate it, we must admit that its subsidies allow low-income Americans to afford insurance even if their employers don’t offer it.

The Impact of ACA Subsidies

As the KFF reports (formerly the Kaiser Family Foundation), your ACA subsidy depends on how many people are in your household and how your income compares to the Federal Poverty Level (FPL). For example, the 2023 FPL is $18,310 for a couple with no dependents.

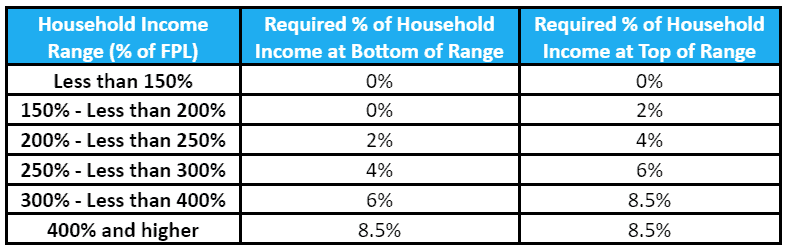

Your tax credit is equal to the difference between the “benchmark” Silver ACA plan cost and your “required contribution level.”

For example, if your income is $50,350 and there are just two of you, you’re at 275% of the FPL, so your required contribution would be about 5% of your income, or $2500 a year.

This means that if the “benchmark” plan annual premium is $6000, your ACA subsidy tax credit would be $3500, the difference between your $2500 contribution and the $6000 cost.

Buy a $7000 plan, and your tax credit won’t change. You’d be responsible for the extra $1000 in annual premium.

Buy a $5000 plan, and your tax credit still wouldn’t change, so your part of the premium would end up being just $1500 (the expected $2500 less the $1000 reduction in premiums).

If you manage to find an ACA-compliant plan that costs $2500, after the subsidy, your cost would be $0. Find an even lower-cost plan, and your post-subsidy cost stays $0. You can’t receive a larger subsidy than your actual premium.

Note that the subsidy cannot apply to certain portions of your health insurance premium. For example, any portion of your premium that provides adult dental care, certain abortion benefits, and/or surcharges due to being a smoker would be yours to bear.

KFF provides a useful calculator if you want to enter your own numbers to figure out how big your subsidy would be.

Can You Keep Your ACA Plan After Age 65?

It seems such a simple question, but the answer isn’t so simple.

If you’re like most Americans, Medicare Part A is free to you, and you must enroll in it when you turn 65 (but see below for the exceptions).

Your enrollment period starts 3 months before the start of the month you turn 65 and ends 7 months later, 3 months after the end of the month you turn 65.

If you or your spouse work for an employer who has at least 20 employees and who provides you with health insurance, you can delay signing up for Medicare Part B without paying a late enrollment penalty. This can save you the Part B premium as long as you or your spouse are active employees there and covered by this employer’s health plan.

Also, according to Mel Schlesinger, an agent with 40 years in the health insurance and Medicare business, “If you work for an employer with 20+ employees who provides qualified health insurance you can opt out of Part A. This is especially important if you are participating in an HSA (Health Savings Account). You cannot have Part A in that case.“

If you do this and you or your spouse suddenly lose the job in question, you’ll have 8 months to sign up for Part B without a late enrollment penalty. If you miss that window, you’d also have to wait for the next open enrollment period (January through March for coverage starting the following July).

Either way, if you lose your employment-based coverage and don’t sign up for Part B immediately, you’d need to buy some other insurance to cover you until you do get Part B. This could be using COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage, but that can be very expensive (e.g., when I had to buy COBRA coverage in 2011, our COBRA premiums were $18k a year, and I’m sure it hasn’t become cheaper in the past 12 years!).

Note that neither retiree health insurance nor post-employment coverage under COBRA affords you the same privilege of delaying Part B enrollment without late enrollment penalties.

If the employer has fewer than 20 employees, you’d need to sign up for Part B to avoid the late enrollment penalty and potentially expensive gaps in your health insurance coverage.

For prescription coverage, provided by Part D, you can avoid late enrollment penalties if you have a prescription plan that’s at least as good as Part D.

Despite all the above, you can keep your ACA plan after age 65 in addition to Medicare, but if you qualify for free Part A, you no longer qualify for the ACA subsidy (if you got it, you’d need to pay it back when you next file your tax return). Also, while you can keep your marketplace coverage, you can’t buy a new marketplace plan.

If you didn’t work and pay into Medicare for at least 30 quarters, your Part A premiums could be higher than what you can buy in the marketplace. If so, you can keep your ACA plan and retain your subsidies rather than sign up for Medicare.

However, if you ever decide to enroll in Medicare (e.g., if your ACA plan becomes too expensive), you’d have to wait for open enrollment and face late enrollment penalties for Part A and B.

Are There Other Ways to Avoid Late Enrollment Penalties for Part B?

Yes.

Since the penalty is a 10% surcharge for every full 12 months, you should have been covered but were not, if you delay Part B by less than a full year, there’s no penalty (but if you have no other coverage, you’d have a potentially expensive coverage gap).

If you live outside the US, you can’t enroll in Part A or Part B until you move back to the US, at which time you’ll have 2 months to enroll without penalty.

In certain circumstances, if you had disability-based Medicare before age 65 and now turned 65, are enrolled in Medicaid, qualify for Medicare Savings Programs (MSPs), etc., late enrollment penalties may be waived.

Other Useful Info

You do have options to get extra coverage beyond that offered by Parts A, B, and D.

After signing up for Medicare, you can replace that coverage with a so-called Medicare Advantage plan, or you can buy Medigap coverage.

In most cases, your spouse’s age isn’t exactly the same as yours, so each of you needs to sign up for Medicare on your own based on when you turn 65. There is no spousal Medicare coverage.

This means that when the older of you enrolls in Medicare and leaves your ACA (or employer) plan, you’ll need to make sure any younger family members continue to be covered by a non-Medicare plan.

Advice from the Pros

I asked financial advisors for the advice they think people most need to hear and are least aware of. Here’s what they said.

- David Berns, Financial Planner, Truadvice Wealth Management, says “Enrolling in Medicare at age 65 is one of the biggest decisions facing retirees. There’s a lot of information out there, and it seems every other ad is selling supplemental Medicare plans. One of the most important tips we share with clients and prospects is that if you claim social security at age 65, you’re automatically enrolled in Medicare. Conversely, if you DO NOT claim Social Security that early, you’re responsible for enrolling in Medicare on your own. We recommend speaking with a professional who’s well-versed in Medicare for your specific situation. One of the biggest mistakes we see is people taking advice from friends or neighbors who aren’t experts and don’t fully know their situation.”

- Jacob Yocco, CFP®, Director of Financial Planning, Cardinal Retirement Planning, says, “Many clients are unaware of the role their income plays in Medicare premiums. Part B premiums can be higher for high-income beneficiaries and are calculated with a 2-year lag (i.e., 2023 premiums are based on 2021 income). Income-Related Monthly Adjustment Amounts (IRMAA) can sneak up on you if you receive large pensions and/or retirement account distributions, and before you know it, you may have to pay 2-3 times the standard premium amount.”

The Bottom Line

While there are certain limited circumstances where people who qualify for Medicare don’t have to enroll, in almost all cases you should enroll in Part A as soon as you can, and Part B as soon as you’re required to, or you face potentially very expensive costs due to late enrollment penalties and/or coverage gaps. If you do enroll in Medicare at age 65, while you could keep your existing marketplace plan, in most cases, you’d no longer qualify for the ACA subsidy.

—

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. An MSc in theoretical physics, a PhD in experimental high-energy physics, a postdoc in particle detector R&D, a research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started several other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. I draw on these diverse experiences to write about personal and small-business finance to help people achieve their personal and business finance goals.

Follow me on Medium (opher-ganel.medium.com).

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

What to Read Next:

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor