To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Face it.

We’re a nation of borrowers.

Most of us couldn’t survive our current lifestyle without borrowing any money.

Be it a mortgage to buy a home, auto loans to be able to drive to and from work, student loans to pay for college, or credit cards to cover expenses that are (hopefully temporarily) higher than income, credit is the lifeblood of most Americans’ day-to-day finances.

From April 2020 to February 2022, the Fed kept interest rates near zero, making the burden of being in debt easier to carry.

Then, when the Fed realized inflation was not “transitory” as they’d insisted to that point, they hiked interest rates. Aggressively.

How aggressively?

From March 2022 to August 2023, rates soared from 0.08% to 5.33%, a 67× increase in just 18 months!

Ouch!

How Much Do We Owe?

According to the New York Fed, household debt increased by $3.4 trillion (over 24%) since the end of 2019 (just before the COVID-19 pandemic started), reaching $17.5 trillion at the end of 2023.

Of this:

- 70% or $12.25 trillion is in mortgages.

- 2% or $360 billion is in Home Equity Lines of Credit (HELOCs).

- 9% or $1.61 trillion is in auto loans.

- Another 9% or 1.6 trillion is in student loans.

- 6.5% or $1.13 trillion is in credit card balances.

- The remaining 3% or $550 billion is in “other balances” (e.g., retail cards).

That’s 75% of the US Gross Domestic Product (GDP), a measure of the size of our total economy!

How Are Payments Affected by Interest Rate?

Mortgages

According to Bankrate, 90% of mortgages have fixed rates (70% are 30-year fixed loans with another 20% having terms between 10 and 20 years), with just 10% having adjustable rates.

This means that most existing mortgage payments aren’t impacted by changes in interest rates, but new loans (purchase or refi) are.

With an average 30-year interest rate of 7.09% per Bankrate and a median home price of $379,100 per the National Association of Realtors (NAR), the monthly principal and interest payment on a new loan with a 20% down payment would be $2036, and the first-year interest charges would be $21.4k.

HELOCs

HELOC interest rates typically adjust each month, so interest rate cuts or hikes will reduce or increase payments. According to the Motley Fool, the average HELOC balance was over $42k in 2023.

With the 10.3% interest rate reported by CBS News, average HELOC payments should be about $360 a month if the borrower pays interest charges alone. If we include principal payoff and assume a 10-year repayment period, that increases to $562 a month, with a first-year interest payment of $4200.

Auto Loans

Most auto loans have a fixed rate, so payments for existing loans aren’t affected by interest rate changes. However, changes in market interest rates do affect new loans.

LendingTree reports that the average new car loan payment as of the end of 2023 stood at $738 with an average term of 68 months. This amounts to about $2.7k interest in the first year of the loan.

Student Loans

Most student loans have fixed rates, but some commercial student loans have adjustable rates. According to CNN, the average borrower owes over $38k. Bankrate reports that 92% of student loans are federal, which currently carry interest rates between 5.5% and 8.05%.

Assuming a 10-year repayment period, the average monthly payment for, e.g., a 6% interest loan would be $422. The first-year interest charges on this loan would be $2.2k.

Credit Cards

Credit card payments include interest rates that adjust monthly, as do retail cards.

According to LendingTree, the average credit card balance for cardholders who don’t pay their balance in full each month stood at $6,864 at the end of 2023. Per Investopedia, the median credit card interest rate is currently 24.37%.

If you want to pay off a $6864 balance at that interest rate over 10 years (which would result in paying nearly 3× the balance over that period), you’d have to pay $153 a month, with a first-year interest amount of $1650.

When Are Interest Rates Expected to Drop and By How Much?

Ah, if only my crystal ball worked… Alas, it doesn’t, so we can only look to various experts to see their guesses.

According to CNBC, Fed watchers expect rates to be cut by 0.75% by the end of 2024, down to 4.50% to 4.75%, then dropping to 3.3% to 3.6% by the end of 2025.

However, this is not the only opinion out there.

Morningstar recently wrote they expect interest rates to start dropping mid-year and continue through 2025, “we expect the first federal-funds rate cut to come in May or June 2024, bringing the rate down [from 5.25% to 5.50%] to 4.00% to 4.25% at the end of 2024. We expect the Fed to continue cutting through the end of 2025, ultimately bringing the federal funds rate down by over 300 basis points [to 2.25% to 2.50%].”

Who’s right?

Who knows.

How Important Are Interest Rate Cuts?

Obviously, the importance of rate cuts hinges on how quickly they come and how significant they’ll be.

For a hypothetical borrower who borrows the above-mentioned average amounts on all debt types, first-year interest payments would total a staggering $32k!

That’s a hard-to-sustain 43% of the $74,580 median household income.

If all rates would drop by 2% (an unlikely prospect for now, but instructive), here’s how average first-year interest payments would shrink:

- New mortgages: From $21.4k to $15.3k

- HELOC: From $4.2k to $3.4k

- New auto loans: From $2.7k to $1.9k

- New student loans: From $2.2k to $1.5k

- Credit cards: From $1.7k to $1.5k

In total, this would drop the first-year interest burden from $32.2k to $23.6k, a 27% reduction!

This means that instead of 43% of the median income, it would be a (still high but) more manageable 32%.

And that ignores the fact that with lower payments, borrowers could pay down debt more quickly, further reducing interest burden in following years.

The Cost of Money (i.e., Interest Rates) Has a Real Impact

Last month, a National Bureau of Economic Research (NBER) working paper titled “The Cost of Money Is Part of the Cost of Living: New Evidence on the Consumer Sentiment Anomaly” offered an intriguing explanation for the wide gap between expected consumer sentiment (given low unemployment and falling CPI inflation) vs. actual sentiment.

The authors propose that “borrowing costs, which have grown at rates they had not reached in decades, do much to explain this gap… While unemployment and inflation have historically been the main drivers of consumer sentiment, there are times when they do not fully explain its variation. In these periods, concerns over borrowing costs must be included as an important driver of consumer sentiment…. We estimate that the consumer sentiment gap using the alternative CPI [that accounts for borrowing costs] would be nearly 75 percent smaller in 2023 than the gap using current CPI inflation.”

In short, the cost of borrowing has a huge impact on consumer sentiment. That’s easy to understand when you look at the above hypothetical interest rate burdens.

How To Position Oneself to Most Benefit from Interest Rate Cuts

Here are a few ways I’ve positioned myself to benefit from anticipated and/or actual interest rate cuts.

- Consider increasing allocation to bonds, as their prices appreciate when interest rates drop. I’ve recently started moving some of my more aggressive growth stock positions to bonds. Note that when interest rates are cut, longer-duration bonds’ appreciation will be greater than shorter-duration ones.

- Consider refinancing high-interest mortgages. When I bought my first house, mortgage interest rates were over 8%. As rates dropped, I significantly reduced my monthly payments through refinancing, even while taking cash out to pay off higher interest balances and/or avoid credit card debt.

- Consider refinancing high-interest auto loans. Here too, make sure any refinancing costs are more than offset by the reduction in payments. Since auto loans are of much shorter duration than mortgages, interest rates need to drop by far more to make this worthwhile. In my case, I was once able to use (sadly no longer available) zero-interest, zero-fee convenience checks to cut my auto loan interest cost to zero by depositing in my checking account a convenience check drawn on my credit card in the amount of the auto loan balance owed. I then paid off the auto loan with this money. The following month, I used another convenience check to deposit an amount lower by $200 into my checking account and used that money plus the $200 I no longer needed to pay for the auto loan to repay the initial check. I continued this process for 10 months until I paid off the last convenience check.

- Consider refinancing student loans when market rates drop enough to make such a move worthwhile. However, you need to carefully consider the differences in terms between existing federal loans and the proposed new private loans. For example, as noted by LendingTree, private loans are rarely subject to loan forgiveness. This is one I’ve never had to do, since I never had to borrow for school, either for myself or for my kids.

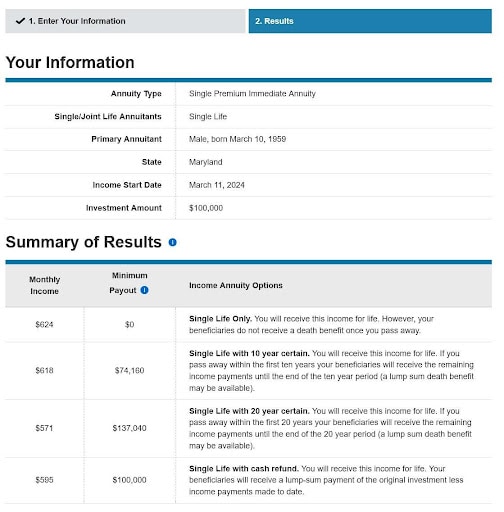

- Finally, with interest rates higher than we expect them to be in the coming years, it could be a good time to consider fixed annuities. For example, according the the Schwab annuity calculator, a 65-year-old man from Maryland who invests in a single-life, immediate, fixed annuity could get $624 a month, or $7488 a year for life. That’s nearly 7.5%!

What Do the Pros Say?

Omar Morillo, Founder of Imperio Wealth Advisors says, “When rates decrease, bonds with longer durations benefit most due to greater price appreciation from the increased present value of future cash flows. Callable bonds may see some benefit, but potential early redemption by issuers limits gains. High-yield bonds offer higher interest to offset credit risk but are less influenced by rate changes. Fixed-rate and zero-coupon bonds are particularly attractive, as their fixed payments or discounted purchase prices become more valuable than new issues at lower rates. However, investors should weigh bonds’ credit quality, duration, and market conditions and diversify to manage risks effectively.”

Raman Singh, Your Personalized CFO at Singh PWM adds, “With anticipated rate cuts looming, investors should align financial decisions with their long-term objectives. For instance, those nearing retirement seeking higher fixed-income allocations might explore investment-grade, US Government or Agency long-term bonds. Prospective homebuyers should recognize that declining interest rates can bolster buying power, potentially driving up real estate prices. Existing homeowners with mortgages at higher rates, say 6% or 7% could refinance, particularly with FHA loans offering a “Streamline Refinance” option to lower interest rates without altering existing terms”

The Bottom Line

The cost of money, a.k.a. interest rates, can make life miserable for consumers who carry significant debt. Following a 67× increase in the Federal funds rate from March 2022 to August 2023, interest costs caused great misery to borrowers, explaining why consumer sentiment is still far worse than expected given the recent dramatic drop in CPI inflation and historically low unemployment.

Now, the market anticipates the Federal funds rate to drop by 0.75% to 1.25% by the end of this year, and another 1.25% to 3.00% in 2025. Such major drops promise things will look far brighter for borrowers (i.e., most Americans) over the coming 22 months.

The above offers some ideas on how one can prepare and position oneself to make the most of such interest rate drops.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor