To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The pandemic affected the wealth of American households… We all (or at least most of us) want to increase our wealth.

For some, it’s a matter of survival.

For others, it’s a quest for long-term security. For some, especially the uber-wealthy, it seems to have become a game of accumulating ever more riches and power, where your net worth is your “scorecard.”

Wherever you stand in that spectrum, you’re probably curious to see how others deploy their wealth…

How Do We Americans Deploy Our Wealth?

A report from the Pew Research Center looked at the types of assets we own. Here are their findings:

- Nearly all of us have bank accounts.

- About 6 in 7 own one or more vehicles.

- About 6 in 10 own a primary residence.

- About 6 in 10 have one or more retirement accounts.

- Just over 3 in 10 invest (outside of a retirement account) in stocks, bonds, and mutual funds.

- Fewer than 1 in 6 have equity in a business.

- About 1 in 10 own one or more rental properties and/or other real estate.

- Finally, 1 in 4 own other assets.

Pew also looked at how much we have in various asset classes.

- Equity in a primary residence (i.e., the difference between the value of your home, assuming you own one, and the mortgage balance owed) is the most valuable asset for most American households, with a typical $174k in 2021, accounting for half or more of Americans’ wealth.

- The typical value of retirement accounts was the next largest part of wealth, at $76k.

- About 8 in 10 households owned either a home or a retirement account, and more than 4 in 10 owned both.

- Next up, stocks, bonds, and mutual funds were typically worth $26.4k.

- For those who owned them, vehicles accounted for a typical $15.2k of wealth in 2021.

- Financial accounts were worth an average of $10k.

- For those who own them, rental properties and other real estate were quite valuable, at $200k and $100k, respectively. However, they contributed nothing to more than 9 in 10 households.

- Other assets round out the list, with a typical value of $20k.

How Did the COVID-19 Pandemic Affect Things?

There’s no argument.

The COVID-19 pandemic was tragic.

According to World Health Organization data reported by the United Nations, the excess mortality (i.e., the full death toll associated directly or indirectly with the pandemic) was nearly 15 million.

And that was just in 2020–2021. Many more died in 2022, 2023, and 2024 to date.

Of these, over a million were Americans.

Here, however, we look just at the impact of the pandemic on Americans’ household wealth.

According to the Pew report, while the median inflation-adjusted household income fell by 2.5 percent during the pandemic, a range of government stimulus plans helped bump up our inflation-adjusted after-tax income by 3.5 percent.

Add to that the reduction in spending because we couldn’t eat out, go to the movies, go on vacations, go in person to the office, etc., leading the Fed to estimate that we socked away an excess $2.3 trillion (yes, trillion with a “t”) into savings from the start of the pandemic until the summer of 2021 alone, and that’s above and beyond what we’d have likely saved had there not been a pandemic.

As a result, says the Pew report, the “typical” American household’s wealth went up by 30 percent, from $128k in 2019 to nearly $167k in 2021.

Why?

A combination of factors “teamed up” to improve our finances.

- According to the St. Louis Fed, home prices shot up from December 2019 to December 2021 by an amazing 31 percent, from just over $212k to well over $278k.

- At the same time, the St. Louis Fed showed a drop in the average 30-year mortgage interest rates from 3.74 percent at the end of 2019 to a low of 2.65 percent in January 2021, before climbing back to 3.11 percent by the end of 2021.

- This meant that someone who bought a median home in December 2021, paying 20 percent down, would have had a monthly principal and interest (P&I) payment of $785. Refinancing this a year later would have dropped their P&I to $672, a 14 percent reduction.

- And if that wasn’t enough, the stock market climbed over 52 percent (!) from the end of 2019 to the end of 2021.

Unsurprisingly, this increase in wealth wasn’t shared evenly. After all, not everyone owns a home and/or invests in the stock market.

- The “wealth” of poorer households, those in the lowest quartile (i.e., up to the 25th percentile) barely budged, from a median of $0 in 2019 to a median of $500 by the end of 2021.

- The wealth increase was just under $20k for households in the second quartile.

- The third quartile saw a median wealth increase of nearly $58k.

- The top quartile saw a median net worth increase of over $172k.

What Happened to Our Wealth Since 2021?

After 2021, the government programs that helped keep us afloat through the pandemic gradually expired, reducing household after-tax income.

According to the US Census Bureau, the median inflation-adjusted US household after-tax income dropped by 8.8 percent in 2022!

However, the release of all the pent-up demand resulted in a spending increase of 9 percent in 2022 vs. 2021, according to the US Bureau of Labor Statistics (BLS), likely funded by people spending down some or all of their excess pandemic savings and wealth increase.

Home prices continued to increase since 2021, though less aggressively (13.6 percent from December 2021 to the most recent Fed data in March 2024, an annualized rate of 5.9 percent).

The stock market dropped into a brief bear market in 2022 before recovering and climbing to about 17 percent higher than at the end of 2021 (a 6.6 percent annualized return).

Meanwhile, mortgage rates nearly tripled from their low point in early 2021 to their October 2023 peak of 7.79 percent before moderating somewhat to their recent level of 6.99 percent.

This made buying a home nearly impossible for most people, and “locked in” people with a mortgage with an interest rate of 3 percent, 4 percent, or even 5 percent.

If these people sell their homes and buy comparable ones, their mortgage payments could easily double!

Are There Other Asset Classes in Which People Invest?

As you begin accumulating more assets, it becomes increasingly important to diversify more broadly.

This doesn’t only mean avoiding having 100 percent of your 401(k) invested in your employer’s stock (you can ask former Enron employees how well that worked), or even investing in multiple stocks or even multiple stock-market sectors.

What it means depends on how much you have and how much you know, as Jorey Bernstein, Executive Director, Wealth Manager, and Founder, Bernstein Investment Consultants says, “As an investor’s net worth grows, it’s important to reevaluate and adjust their asset allocation strategy periodically. Aggressive growth portfolios may be appropriate for younger investors or those with smaller nest eggs. Higher net worth levels call for a more conservative approach, with greater emphasis on capital preservation. This means gradually decreasing exposure to volatile assets such as stocks as net worth climbs and shifting toward stable income producing investments like bonds and real estate. Maintaining the right balance between growth and capital preservation becomes paramount for wealthy investors aiming to fund retirement and transfer wealth across generations.“

Omar Morillo, CFP®, Founder of Imperio Wealth Advisors expands, “As a Wealth Advisor, I recommend diversifying across asset classes – equities, fixed income, real estate, cash, and alternatives – based on a client’s financial goals, risk tolerance, and time horizon. For higher net worth clients, access to sophisticated investments like private equity and hedge funds, tax-efficient strategies, and personalized solutions become more prominent. Moderate net worth clients benefit from broad diversification using mutual funds and ETFs. In contrast, clients with lower net worth should focus on simplified, low-cost growth strategies.”

Rob Duncan, Founder of Global Impact Wealth Management elaborates and adds factors that affect diversification and investment planning, “Deciding on an optimal allocation for a client is not based exclusively on their net worth (though having more investable assets does open the door to more creative options – private equity, venture capital, real assets, etc.) but is determined by their life goals. What allocation is needed to most efficiently and effectively accomplish the things in life they are called to do? Unfortunately, many advisors do not take the time to really help their clients think through and articulate their life goals, and then quantify those goals into monetary terms and run scenarios to determine the feasibility of the client realizing those dreams. The key is that the client’s goals, not the markets, drive the allocation. That being said, we have to consider a client’s behavioral tendencies. If a client’s goals dictate that they need to be very aggressive, can they handle the volatility level such a portfolio may produce? If not, can the goals and expectations be modified? Can we build some hedges into the allocation to provide enough confidence to ride out the volatility? On the other hand, clients who have amassed significant wealth and whose goals are reasonable relative to that net worth may not need to take as much risk in their portfolio to generate higher returns. In this case, a client might choose to invest for impact. We can deploy capital to be a powerful force for good in the world, and those who desire to invest in regions and causes they are passionate about have an opportunity to help alleviate poverty, provide health care, and protect the environment.”

Some typical examples of asset classes you could diversify into (with some overlap with the list in the Pew report) include:

- US equities: You can buy shares in several companies, as long as you have the time and expertise to do your due diligence in picking them, and the time and patience to keep track of how each is doing so you don’t get blindsided by the market. Or you could do what I do and buy shares through mutual funds and/or Exchange-Traded Funds (ETFs) that provide you with instant diversification across dozens if not hundreds of companies.

- Foreign equities: Again, you could buy shares in several companies, or you can invest through mutual funds and/or ETFs to diversify even a small investment across many companies.

- Bonds: These have a lower long-term average return but can be especially helpful when interest rates are high and you anticipate they’ll go down rather than keep going up. Here too, mutual funds and ETFs are your friends as far as identifying the best bonds to invest in, keeping on top of which should be sold or added to, and diversifying across many issuers, durations, etc. to reduce risk.

- Real estate: If you have enough capital, you can invest in rental properties. If you don’t have enough capital, don’t have the expertise and time to pick profitable properties, and/or don’t want to be a landlord, you can buy shares in Real Estate Investment Trusts (REITs). Note that I exclude equity in your home from this asset class (see “Physical assets” below).

- Crypto: This asset class has been growing by leaps and bounds, especially now, after the Securities and Exchange Commission (SEC) approved so-called Bitcoin and Ethereum Spot ETFs. Until recently, I stayed away from this sector since I didn’t understand the value proposition. These days my ignorance is slightly less vast and, more importantly, I see the value of investing a tiny portion of my portfolio that I can afford to lose in its entirety, but that offers a massive upside potential.

- Cash: Due to inflation, this usually isn’t a great long-term asset but it is appropriate for money you expect to spend in the coming months up to several years as you approach retirement, money you want to keep available to invest in sudden opportunities, and money you set aside for emergencies.

- Commodities: This includes, e.g., gold, silver, or other metals; energy resources like oil and natural gas; and agricultural goods like corn, soybeans, etc.. You can invest directly in a commodity or in companies that produce them. since you’re usually betting on the price of a given commodity going up while the seller is betting on its going down, you should have a compelling reason to believe you know better than him or her.

- Hedge funds, private equity deals, and other venture capital opportunities: These are high-risk, high-reward investments, and are appropriate only for investors who can afford to lose a lot.

- Annuities: These aren’t appropriate in all cases, and annuities often charge high fees so use them cautiously if at all.

- Derivatives: This includes options, futures contracts, and swap agreements — complicated and risky — so make sure you know exactly what you’re doing before dipping your toes here.

- Collectibles: This includes art, wines, vintage cars, high-end watches, etc. All require deep relevant knowledge and are usually also high-risk, high-reward investments.

- Physical assets: Things like primary residences, cars, jewelry, etc. that are most often purchased for use rather than as investments. As we saw above, home equity accounts for over half of most American households’ wealth.

What Does Diversification Look Like?

As mentioned above, the answer to this question depends on your personal situation.

In my case, here is how I’ve allocated my investable net worth:

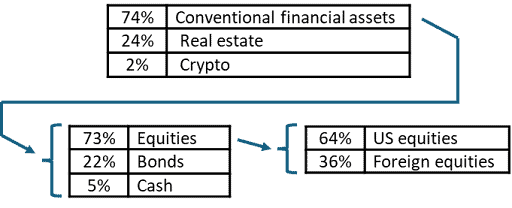

As you can see, my investable net worth breaks down nearly 3/4 in conventional financial assets, almost 1/4 in real estate (excluding equity in our primary residence), and the remaining 2 percent (that I’m willing to lose in its entirety) in crypto.

The 3/4 in conventional financial assets is deployed about 3/4 in equities (through mutual funds and ETFs — I don’t have the expertise or time to dabble in individual stocks), over 1/5 in bonds, and just 5 percent in cash, since I don’t plan to start drawing down investments for almost 10 years.

This is a higher equity position than the “conventional wisdom” suggests — somewhere between 100 and 120 minus my age, which would suggest an equity position between 40 and 60 percent of financial assets. Since I’m a more aggressive than average investor, and have multiple safety nets and backups, I’m comfortable with this position.

Finally, US equities make up about 2/3 of my total equity position, with foreign equities making up the remainder.

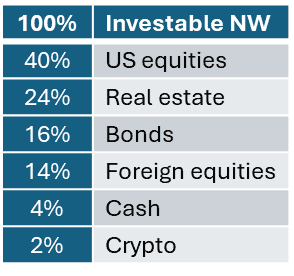

In absolute fractions of investable net worth, my breakdown is shown in the table below.

As things stand, if the US stock market crashes by 60 percent tomorrow, I’d lose 24 percent of my investable net worth (60 percent of 40 percent), plus whatever parallel losses may affect other asset classes.

As I get closer to retirement, I plan to increase my cash position to about 10 percent of my (hopefully large by then) investable net worth (about 3 years’ worth of expenses) and bonds to about 20 percent (about 6–7 years’ worth of expenses).

This would decrease my overall equities allocation from the current 73 percent of non-real-estate non-crypto allocation (including foreign equities) to 70 percent.

The Bottom Line

How American households deploy their wealth varies a great deal between the poorest 25 percent and those at the top of the pile, as does how we’ve fared during the pandemic and since.

The above shows what assets people own, how much they typically hold in each asset type, and my allocation as it stands today.

Note that my allocation (or even that of the average American) isn’t necessarily right for you. What’s more, your ideal allocation, just like mine, will change over time.

Jon McCardle, AIF, President Summit Financial Group of Indiana, speaks to how things can change over time, “As clients’ net worth increases, their sense of security grows, making them more comfortable with calculated risks. We dedicate significant time to helping clients grow their wealth over the decades and tailoring their asset allocation to align with their goals and risk tolerance. Clients typically feel more at ease with risk when they are confident in their careers and perceive the economy as stable. However, during economic downturns or career changes – what we call triggering events – they are prone to making emotional rather than logical financial decisions. When this happens, revisiting their financial plans and running various scenarios helps clients make informed decisions, whether it’s navigating volatile stock markets or purchasing real estate in challenging conditions.”

Despite all this, hopefully, the above can serve as an initial guidepost as you start thinking about how you want to position your allocations.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor