To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Occasionally, I get a reader request to cover a specific topic.

As a writer, it’s one of the best compliments you can give me.

And though I really appreciate any of you spending some of your busy days reading what I write, clapping for my article, and/or leaving praise in a comment, asking me to cover a topic for you truly makes my day.

What I read in such a request is more than mere appreciation of my writing (as gratifying as that is). It’s you saying you trust me to cover a topic that’s important for you, and that you’re confident I’d do so better than what you can already find on the Web.

Pretty heady stuff, and a responsibility I don’t take likely.

If I’m not familiar with the topic, I research it online and/or with contacts who know more about it than I do. If possible, I run the result by such contacts to filter out possible egregious mistakes.

A Reader Request for More Information About Annuities

Here’s a (lightly edited) recent reader request:

“A good friend just met with a potential financial advisor, whom she trusts and who used to manage her firm’s health insurance. During their meeting, he talked up annuities. When I hear the “A word,” it raises red flags for me. I’ve heard stories of bad experiences, people losing retirement savings, and suing the financial pro involved. These may be just a few outliers, but a quick google search added to my concern. In my friend’s case, she was thinking it would be an insurance policy of sorts if she ever goes into nursing home care. Can you cover annuities in an article?”

So, are annuities a valid recommendation, a shrewd move to secure guaranteed income for life?

Or are they an unethical advisor’s way of fleecing unsuspecting clients by convincing them to move assets from their portfolio into a complicated insurance product plagued by excessive fees?

First, What Is an Annuity?

In the simplest terms, an annuity is an insurance product (that only licensed agents may sell) that guarantees you monthly payments. The payments may start right away (immediate annuity), or in the future (deferred annuity).

There’s a broad range of annuities and possible riders, each with its own specific characteristics, including but not limited to:

- Do payments start immediately, and if not, when?

- Are payments fixed or variable, and if variable, how is the amount determined?

- Are payments adjusted for inflation (usually this will be a set percent increase per year rather than indexing to the consumer price index, CPI)?

- Do payments last for your lifetime, or will your spouse continue to receive them if s/he outlives you?

- Is there a set maximum number of payments? Some annuities payout for say 10 or 20 years, and then stop even if you’re still alive.

- What if you and your spouse both die before the annuity pays out what you paid in? Some annuities’ payments stop immediately, others continue until 10 or 20 years pass from the first payment, and yet others guaranty to pay your heirs a lump sum equal to the original premium(s) less whatever money you already received (potentially zero).

- Is the agent compensated by commission or straight fee? Commissions tend to be higher for more complicated annuities, and can range from a very reasonable one percent to a sickening 10 percent!

- How high are the fees that come out of the annuity, reducing your payments? These also vary greatly and can range from less than two percent to over six percent.

- How high is the surrender fee, and how long does it apply? This usually applies to variable annuities.

The more riders you tack on, and the less risk you’re willing to take, the lower the payments you should expect to receive for a given premium.

After all, the insurer isn’t doing this to take a loss (though, a bit like a casino, they’re willing to lose on some clients, as long as they more than make up for it in higher profits on others).

The point of the above is that with such a broad range of options, there’s no simple answer to the question, “Are annuities financially good or bad?” that would apply to everyone.

When May an Annuity Be a Good Choice for You?

Annuities picked correctly are the right choice for some people in some circumstances.

The only way to know for sure if that includes you is to first have a comprehensive financial plan, and then figure out if any annuity option offers enough benefits to justify the costs.

These costs include the dollars you pay in premiums of course, but also the opportunity cost of not investing those funds differently and, for many of us, the impact on your eventual estate.

One attractive feature is that the amount invested in an annuity may provide a much higher guaranteed payment than the 4 percent (give or take) you could typically withdraw each year from an at-risk portfolio.

Example 1: Single-Premium Immediate Annuity

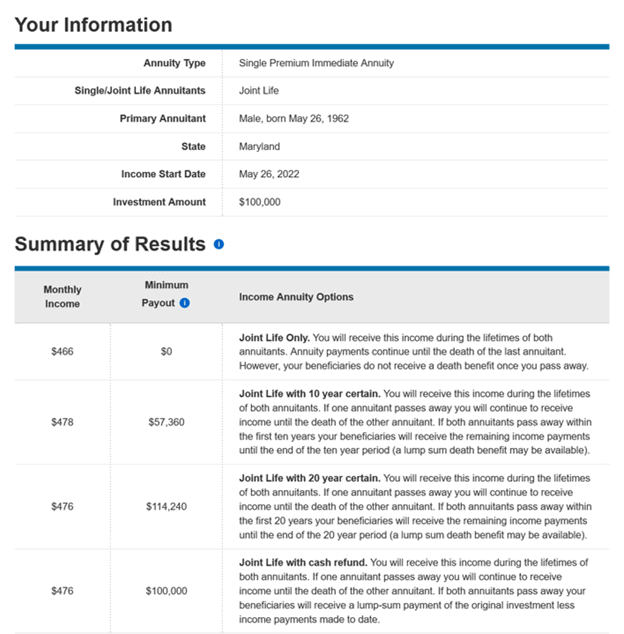

Charles Schwab has a nifty annuity calculator that shows you approximately what payments you can expect from fixed annuities.

I used the calculator on 5/26/2022 to see what an immediate annuity might payout for a single premium of $100,000 when the insured and spouse are both 60 and live in Maryland.

The “joint-life-with-10-year-certain” option pays the most, but only $2/month over the “joint-life-with-20-year-certain” or “joint-life-with-cash-refund” options. Comparing minimum payouts, the best may be the “joint-life-with-20-year-certain” option, at $114,240. There, the annual payout would be $5712, or 5.7 percent of the premium invested in the annuity.

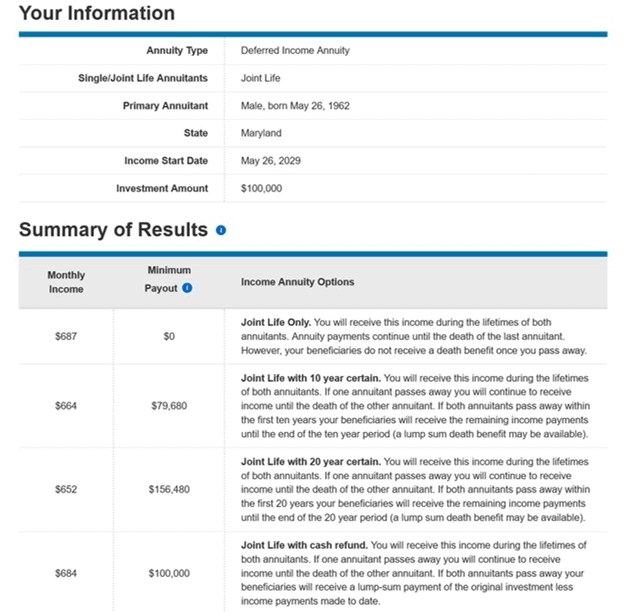

Example 2: Single-Premium (seven-year) Deferred Annuity

Another option is investing now, but delaying payouts until retirement, say at age 67. In this case, monthly payments are nearly 40 percent higher because the company gets to invest your money and let it grow for seven years.

Here, “joint life only” pays $687 a month, $3/month over “joint life with cash refund” that guarantees to pay out at least your initial $100,000. If you’d rather not lose too much from your payments to guarantee the highest minimum payout, you can pick the latter, even over the “joint-life-with-20-year-certain” option that guarantees at least $156,480 will be paid out no matter what but pays $32/month less.

With the “joint-life-with-cash-refund” option, you’d get $684 a month, which is $8208 a year or 8.2 percent of your initial premium. Note, however, that this doesn’t say anything about adjusting for inflation. On the plus side, even if you assume your alternative would be to invest in the stock market for those seven years, and that you’d get a 10 percent annual return (which is far from certain, especially in the coming decade), this $8208 a year would be more than 4 percent of the resulting nominal stock value.

However, once payments cease, your heirs receive the difference between the original premium and the total of all the payments you received, possibly zero. This is compared to the stock investment alternative, where drawing 4 percent annually could leave almost $200,000 for your heirs (assuming the above-mentioned far-from-certain 10 percent annual return).

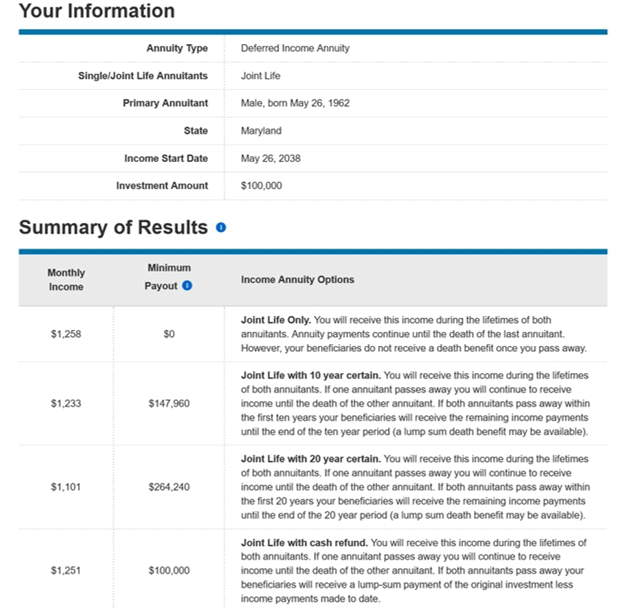

Example 3: Single-Premium (25-Year) Deferred Annuity

Another way to use a deferred annuity is to delay payments for a much longer time, say until you turn 85.

Retire at age 67, and this allows you to draw more from your portfolio than the ~4 percent “safe draw,” since the portfolio only needs to enable the high draw for 18 years, rather than say 30. Once the annuity kicks in, you can reduce your draw by the payment amounts, helping your portfolio last longer.

The monthly payout here is highest for the “joint-life-only” option, at $1258 (164 percent higher than with the immediate annuity). However, the “joint-life-with-cash-refund” option pays out only $7/month less, and guarantees at least $100,000 will be paid out. Give up another $18/month, and the “joint-life-with-10-year-certain” option guarantees a minimum payout of $147,960.

If you choose this last, your payments would be $15,096 a year, or 15.1 percent of your initial premium. This is almost four-fold higher than a 4 percent draw, which is nice. However, if you assume the alternative is to invest the money say at a 10 percent annual return (far from guaranteed) rather than stuff it under a mattress, 4 percent of the resulting investment would be $22,240, nearly half again as much as the deferred annuity payments.

The question here would be if you prefer the safety of guaranteed payments or want to take the risk of investing in an uncertain stock market in the hope of coming out further ahead.

Are Annuities Taxable?

The way you buy the annuity will determine the answer to that question.

If you buy an annuity with pre-tax dollars, your premium reduces your taxable income for that year. However, eventual payments (monthly and/or lump sum) are taxed as regular income in the year they’re paid.

The benefit here is that the annuity may let you defer taxes beyond the IRS contribution limits on IRAs and 401(k) plans.

An annuity may let you defer taxes beyond the IRS contribution limits on IRAs and 401(k) plans.

According to Annuity.org, buying an annuity inside a Roth plan results in tax-free payments. Buying an annuity with after-tax dollars outside of a Roth results in paying no tax on the portion of each payment attributed to the original premium(s), but the remaining portion is taxable.

If you’re setting up an annuity that starts paying before you’re 59½ years old, you may have to pay 10 percent early withdrawal penalties to the IRS.

Signs an Annuity May Be the Right Choice for Your Situation

If all the following are true, your advisor’s advice to purchase an annuity may be legit.

- The advisor’s first step was to develop a comprehensive financial plan for you, and then explain convincingly (a) how the proposed annuity fits into your overall plan, (b) what alternatives s/he considered, and (c) how such alternatives would or would not have resulted in lower or higher compensation for the advisor, and (d) why the annuity is the superior choice for you.

- The advisor explains clearly when the payments start and how they’re determined.

- The advisor explains if and how the payments vary for different scenarios of stock returns, bond returns, and levels of inflation, and shows how the portion of your financial goals for which s/he’s recommending the annuity will materialize under a plausible worst-case scenario.

- The advisor explains clearly the tax implications of each way of buying the annuity and explains why s/he’s recommending buying the annuity with pre-tax dollars, or inside a Roth plan or taxable account.

- The advisor discloses all fees and how s/he gets compensated, and the amounts don’t seem outlandish. One relatively new development is that insurers that issue annuities are finally starting to make those available to fee-only advisors in a way that compensates them similar to other investment options.

- The advisor chooses a highly rated insurer since you’re buying a guaranteed long-term payment stream, so you don’t want to risk the issuing company going under.

- The advisor suggests buying the annuity when you’re older (or at least deferring the payments until you’re older and no longer working).

- Your family history and current health suggest you likely have a higher-than-average life expectancy for your age.

- Current interest rates, and thus the projected annuity payments, are historically high.

Possible Red Flags an Annuity May Not Be a Good Fit for Your Situation, Despite the Advisor Pushing It

Of course, an advisor may try pushing annuities even if they’re not the best fit for your situation and goals.

The reason could be as benign as it is the only product they sell, so they fall prey to the proverbial, “If all you have in your toolbox is a hammer, pretty soon everything starts looking like a nail.”

While the advisor in this scenario may not be unethical, it increases the risk that an annuity is a poor choice for you.

A less benign possibility is that the advisor may be unethical, placing their financial interest ahead of yours.

Since annuities often pay the agent selling them much higher commissions than what s/he would receive for investing your money in mutual funds, let alone the zero commissions s/he’d receive if you invest in no-load mutual funds, there is a big incentive for agents to push annuities, and the more complicated the better (for the advisor).

For example, say you have $500,000 already invested in mutual funds.

An unscrupulous advisor suggests rolling that amount into new “better” funds that just happen to carry a 4 percent sales load. Agree to this, and the advisor pockets $20,000 of your $500,000, and the funds aren’t likely to perform better (unless you chose even more poorly to begin with).

In the same example, the advisor could steer you to buy a complicated annuity with that $500,000, one that pays him or her an 8 percent commission. Agree to this, and the advisor pockets $40,000 of your money!

Such a massive payday can be a big incentive for advisors with questionable ethics.

To protect yourself, look for any negative reviews and/or disciplinary measures the advisor may have been subjected to.

Even if you find nothing concerning, here are some potential red flags that even if the advisor isn’t unethical, pushing you into an annuity may not be in your best financial interest.

- The advisor pushes you to buy an annuity without first understanding your financial situation, goals, risk tolerance, etc., and developing a comprehensive financial plan that works better with the annuity.

- The advisor tries to hurry your decision, claiming the offer will soon disappear. It may indeed, but there will likely be comparable offers later.

- The advisor hasn’t figured out how annuity payments will be taxed.

- The advisor hasn’t disclosed his/her compensation and/or the fees you’ll be charged and/or hasn’t shown you the impact of those on your eventual payments, and/or the compensation and/or fees are unacceptably high.

- The advisor hasn’t shown you similar products from other issuers with better credit ratings (but that may pay him or her a lower commission).

- The advisor suggests an immediate annuity while you’re relatively young and still working.

- Your family history and current health point to a lower-than-average life expectancy.

- Current interest rates, and thus projected payments, are historically low.

Other Considerations

Even if an annuity is right for you, do your due diligence in comparing annuities sold by brokers vs. no-load ones sold by the issuing company.

The latter may require you to do more of your own research, or use a fee-based financial advisor who may receive compensation for sending you to the annuity issuer, but may not be paid a higher commission than for other investment options.

How Do Annuities Compare to Social Security Retirement Benefits?

If you’re American, it’s almost guaranteed that you’re already covered by an annuity-like program — Social Security. The stream of monthly payments from Social Security is similar to those of a deferred annuity.

In fact, a 2017 comparative analysis made an in-depth comparison. The following are a few of the most salient points.

- Since annuities are voluntary, the people buying them usually self-select as having a longer-than-average life expectancy. This increases the likelihood of longer payouts, driving payments lower than those of (the mandatory) Social Security programs.

- Social Security benefits are fully indexed to the CPI, while annuities either have no inflation protection or at most offer a set percentage annual increase that may or may not compensate for inflation in full. This sort of rider, as with anything else that increases the insurer’s risk, requires you to pay more for the annuity, or accept lower payments.

- The paper estimated the premium needed to replicate the average Social Security benefit. With a 3 percent annual increase to (partially) compensate for inflation and 100 percent continued payments to the surviving spouse, it was (at the time of the analysis) over $367,000.

- Social Security payments don’t depend on market interest rates, whereas annuities’ payments fluctuate if interest rates are relatively high or low when you invest.

The Bottom Line

Annuities come in such a wide array of options and choices, that determining which if any is a good fit for you is no mean feat.

Given that an annuity may or may not be good for a specific individual in a specific situation, it’s impossible to make a general statement that annuities are a shrewd financial choice or a terrible financial mistake for everyone.

Since a clear-cut general answer is impossible, the above lays out what factors affect whether or not it’s a good choice for your specific situation, which questions you should ask, what factors may make annuities likelier to be a good fit for you, and what red flags you should watch out for.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor