Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.

Stock compensation can be one of the most rewarding benefits your employer can offer you. However, it also carries complexities that require careful planning. Whether you’re dealing with restricted stock units (RSUs), stock options, or performance shares, failing to prepare properly can lead to unnecessary financial stress during tax season and missed opportunities to maximize your benefits.

Now is the time to take control of your stock compensation planning for the year. From reviewing your year-end performance to estimating taxes and creating a spending and saving strategy, I will walk you through actionable steps for your stock compensation.

Did You Meet Your Stock Compensation Goals This Year?

Before you can effectively plan for the next year, it’s essential to reflect on the past 12 months. Review how your stock compensation performed relative to your goals. Use this information to gain insight into what worked and where adjustments might be needed.

Evaluate Your Stock Gains

Did your stock awards or stock option exercises meet your income expectations? If not, where did they fall short? Understanding this will help you create more realistic goals moving forward.

Check Vesting and Exercise Activity

Were there any milestones you missed (i.e. failing to exercise options before expiration)? For RSUs or performance shares, review any unvested equity and upcoming milestones.

Review Financial Alignment

Was your stock compensation aligned with your broader financial goals? For instance, did you allocate enough toward retirement, or were you able to use some of it for a planned purchase?

Taking the time to reflect now can save you headaches later and set the foundation for proactive planning.

Have You Paid Estimated Taxes on Stock Compensation?

In any industry, stock compensation often comes with supplemental income that’s taxed. It’s important to ensure that you’ve paid enough in estimated taxes throughout the year to avoid surprises when tax season rolls around.

Understand Tax Withholding Rules

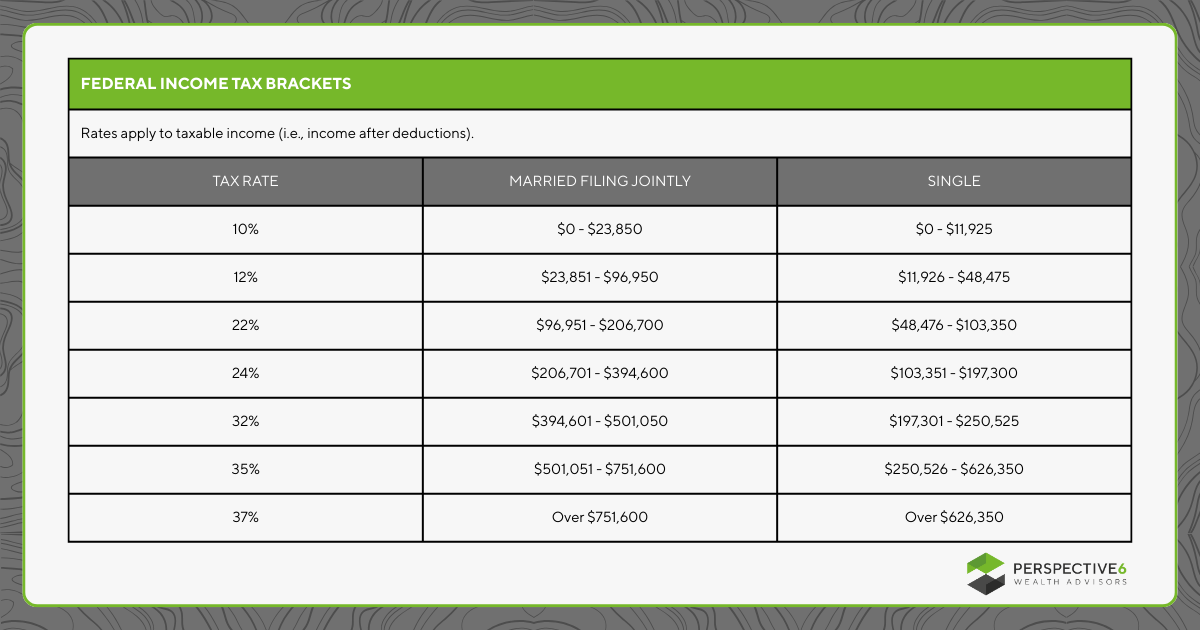

Companies often withhold federal taxes at a flat rate of 22% on supplemental income, including stock compensation. However, for high-income earners like managers, directors, or V.P.s, your actual tax rate might be closer to 35% or higher. This could lead to a gap that needs to be filled with estimated tax payments.

Review Quarterly Estimated Tax Payments

Did you make sufficient quarterly estimated tax payments this year? If not, you risk penalties for underpayment, so be sure to evaluate any shortfalls in your payments and adjust if needed.

Plan for Alternative Minimum Tax Obligations

If you exercised incentive stock options (ISOs), you might owe an alternative minimum tax (AMT). Double-check to see if this applies to you.

Staying on top of your tax obligations ensures a smoother tax season and keeps cash flow manageable.

Estimate Stock Compensation for the Coming Year

To avoid financial uncertainty, it’s crucial to estimate your stock compensation for the year ahead to make a plan. This allows you to map out how much income you can expect and how it will influence your financial planning and goals.

Project Vesting and Exercise Schedules

Review the vesting or exercise schedules for your RSUs, stock options, or performance shares. Create a calendar of important milestones to estimate income from those events.

Assess Company Performance

For performance shares or variable stock awards, consider your company’s growth outlook. For instance, is your team expected to hit performance targets? This can help you project what is to come.

Account for Market Conditions

Stock values can fluctuate based on market conditions. Take a conservative approach when estimating earnings to account for potential volatility.

By projecting your stock income, you can make informed financial decisions throughout the year.

Estimate Your Taxes

Once you have calculated your estimated stock compensation, the next step is to create a plan for managing the tax implications. Here’s how to stay ahead of the curve.

Calculate Your Effective Tax Rate

Understand your overall effective tax rate based on your income bracket and expected stock compensation. Don’t forget to include payroll taxes and state taxes.

Schedule Quarterly Payments

Work with a professional to determine how much to pay in quarterly estimated taxes to avoid underpayment penalties. Divide payments into manageable amounts to stay ahead of tax time.

Set Aside Funds Automatically

Consider allocating a percentage of your stock compensation for estimated tax payments. This will help avoid scrambling to generate cash flow at quarter-end.

A deliberate tax plan provides clarity and helps ensure you retain more of your hard-earned income.

Divide Stock Compensation into Taxes, Spending, and Savings

Stock compensation provides a unique opportunity to grow your wealth when managed strategically. Divide your stock income into three key areas to balance immediate needs, tax obligations, and long-term goals.

1. Allocate for Taxes

Set aside the appropriate portion of your stock compensation for taxes as soon as income is realized. Automating this process can save you significant stress ahead of tax season.

2. Plan for Spending

Use a portion of your stock gains for short-term financial goals or one-time expenses. This might include home renovations, education costs, or leisure activities.

3. Build Long-Term Savings

Stock compensation offers an excellent vehicle for retirement planning. If your company offers an Employee Stock Purchase Plan (ESPP), use it to secure discounted shares. You can also diversify by investing in an IRA or brokerage account.

A disciplined allocation strategy will help you make the most of your stock compensation and set you up for financial freedom.

Take Control of Your Stock Compensation

Whether you’re cashing in RSUs, exercising options, or simply planning ahead, a thoughtful approach to stock compensation ensures you maximize its potential while minimizing risks.

Don’t wait until your next stock grant or tax deadline. Start planning your financial success today.

Resources

How to Optimize Non-Qualified Stock Options

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Matthew Nelson, CFP® AIF® ECA | Perspective 6 Wealth Advisors

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.