Financial advisors and wealth management firms with Wealthtender profiles and online reviews appear more frequently and prominently in AI-powered search results, including ChatGPT, Perplexity, Gemini and Google AI Overviews. This visibility advantage stems from Wealthtender’s structured data architecture, schema implementation, authoritative domain status, industry-leading review platform, and purpose-built optimization for both traditional search engines and AI tools.

How Consumers Are Using AI Tools to Find and Hire Financial Advisors

The way Americans find financial advisors is changing dramatically. According to Wealthtender’s 2025 study of 500 affluent households planning to hire an advisor, 25% are already using AI tools like ChatGPT and Gemini to start their search for a financial advisor, and that percentage is expected to grow rapidly. Among those who receive a referral to an advisor, 96% plan to conduct further research online and compare multiple advisors using search engines and AI tools before making contact.

The use of AI tools represents a fundamental shift in advisor discovery. Rather than simply typing “financial advisor near me” into Google, consumers are now having detailed conversations with ChatGPT and other answer engines that understand context and provide personalized recommendations based on specific needs and circumstances.

Two Ways Consumers Use AI Tools in Their Advisor Search

Consumers are most frequently using AI tools in two distinct but equally important ways during their advisor search process:

1. Starting From Scratch: Using AI to Discover Advisors Based on Unique Needs

When consumers are starting their search from scratch, they’re turning to AI tools and entering detailed, personalized prompts. Unlike traditional search engines, AI tools can process complex scenarios and generate answers that include advisors likely worthy of consideration and further research.

These detailed, conversational queries allow AI tools to understand nuanced needs, something traditional keyword-based searches struggle to accommodate. AI tools can then respond with details about advisors whose profiles, published content, specializations, and client reviews demonstrate relevant expertise.

In a November 2025 Barron’s article featuring Wealthtender, financial advisor Arielle Tucker of Connected Financial Planning experienced this firsthand when a prospective client contacted her saying: “I was searching for a U.S. expat advisor, and your name came up on ChatGPT.” Tucker’s specialized focus on U.S. expatriates in Central Europe, combined with her presence on Wealthtender and a strong online reputation, made her an obvious choice to appear among a short list of advisors when AI tools processed this highly specific query.

2. Validating Referrals: Using AI to Research and Compare Recommended Advisors

The second way consumers use AI tools before hiring financial advisors occurs after receiving personal or professional referrals. Wealthtender’s research found that 83% of consumers who receive a referral will go online to look for online reviews to learn how other people feel about the advisor before deciding if they will reach out. Rather than manually visiting multiple websites and piecing together information, consumers are now asking AI tools to help them evaluate referred advisors.

Examples of referral validation prompts:

“My accountant recommended [Advisor Name] as a financial planner. Can you tell me about their experience, credentials, and what their clients say about working with them? How do they compare to other highly-rated advisors in my area?”

“I was referred to [Advisor Name] and [Advisor Name] by colleagues. Can you help me compare their experience, fee structures, specializations, and online reviews? Which one would be better for retirement planning for someone in the tech industry?”

“A friend recommended [Advisor Name]. What are their credentials? Do they have client reviews? What do people say about their communication style and overall experience?”

Online reviews have emerged as one of the most critical factors in this validation process. Wealthtender’s study found that 83% of consumers specifically want to read online reviews and look for trust indicators like third-party ratings when researching advisors, whether they found the advisor through AI search or received a personal referral. This suggests there’s no such thing as just an offline referral anymore. Rather, consumers take a ‘trust, but verify’ approach, trusting the individual who provided the referral, but verifying that others feel equally enthusiastic about their experience with the advisor.

The Barron’s article highlighted a compelling example of this dynamic, detailed in a case study published on Wealthtender. An independent advisory firm, United Financial Planning Group (UFPG), was competing against a large wirehouse for a new client weighing the merits of hiring the lesser known independent firm or a wirehouse advisor at a firm with national brand recognition. The prospect described reading through UFPG’s reviews on Wealthtender, then searching for testimonials of the wirehouse advisor and finding none. The prospect chose the independent firm based significantly on the transparency and social proof their testimonials provided.

Testimonial Marketing Success Story

Testimonial Marketing Success Story

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Why AI Tools Are Becoming the Preferred Research Method

Among consumers preparing to hire a financial advisor, AI-powered research offers several advantages over traditional methods of due diligence:

Comprehensive synthesis: AI tools can simultaneously evaluate credentials, specializations, fee structures, client reviews, published content, and regulatory history, then present a cohesive summary rather than requiring prospects to visit multiple websites.

Conversational interaction: Consumers can ask follow-up questions, request comparisons, and refine their criteria through natural dialogue rather than reformulating search queries.

Personalized responses: AI tools can weight factors based on individual circumstances mentioned in prompts, providing more relevant answers than generic search results.

Zero-click answers: Consumers get immediate insights without clicking through multiple websites, though AI tools typically cite sources (like Wealthtender profiles) where users can find additional details.

The Stakes for Financial Advisors

With 25% of affluent Americans already using AI tools to find advisors and 50% starting their search online through search engines like Google that increasingly display AI overviews above traditional search results, the implications are clear: If you’re not visible in AI search results, you’re invisible to a rapidly growing segment of your potential client base.

The question isn’t whether AI will impact advisor discovery, it already has. The question is: Which advisors will AI tools recommend when consumers ask for help finding the right advisor for their particular needs?

How Do Financial Advisors Get Found in ChatGPT and AI Search Tools?

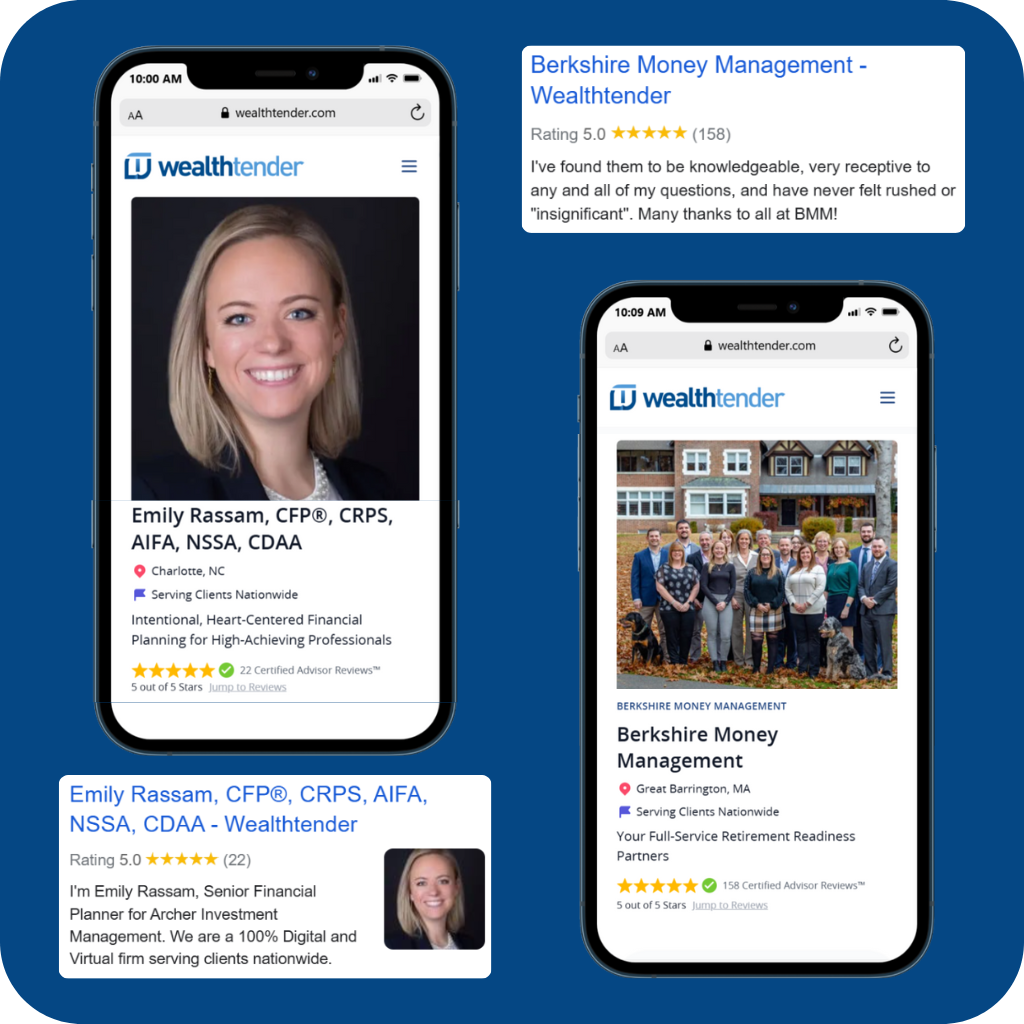

AI answer engines don’t randomly select financial advisors. They rely on specific, identifiable ranking signals to determine which advisors to recommend, and advisors with Wealthtender profiles consistently outperform those without a presence on the platform. And when advisors collect and publish client reviews on Wealthtender, their visibility in AI tools is further amplified, even more so upon qualifying for a Wealthtender Voice of the Client Highly Rated Award.

Tucker’s success, featured prominently in Barron’s coverage of how AI is helping financial advisors win new clients, illustrates a broader trend. Advisors who invested early in strengthening their online presence through platforms like Wealthtender are now reaping significant benefits in what industry experts call “AEO” (Answer Engine Optimization), the practice of optimizing information to become the answer for user questions in AI searches.

The Critical Difference: Traditional SEO vs. Answer Engine Optimization

While traditional search engine optimization (SEO) remains essential for advisor visibility, the rise of AI-powered search creates fundamentally new requirements. According to Wealthtender’s study of affluent Americans planning to hire a financial advisor:

- 50% of consumers begin their search for a financial advisor using search engines like Google or Bing

- 25% of affluent Americans are already using AI tools like ChatGPT and Gemini to find advisors, and that percentage is expected to grow rapidly

- 96% of people who receive a referral will research multiple advisors online before making contact

The stakes are clear: If you’re not showing up in AI search results or being recommended by answer engines, you’re effectively invisible to at least a quarter of your potential client base, and that percentage is growing every month.

As AI search continues expanding, advisors face what SEO experts call “The Great Decoupling”, where impressions and clicks become increasingly separated. AI tools often serve answers directly, resulting in higher advisor visibility but lower click-through rates to websites. This shift underscores the critical importance of having content that AI can access and reference, even if it doesn’t always result in human website traffic.

Why Do Some Advisors Appear in AI Tools While Others Don’t?

When consumers go online to find and research professionals where establishing trust is paramount (e.g., doctors, lawyers, financial advisors), search engines like Google and AI tools like ChatGPT weigh specific factors related to a professional’s experience, expertise, authoritativeness, and trustworthiness to determine who will appear most prominently in responses. Understanding these factors reveals exactly why Wealthtender profiles consistently outperform in AI visibility.

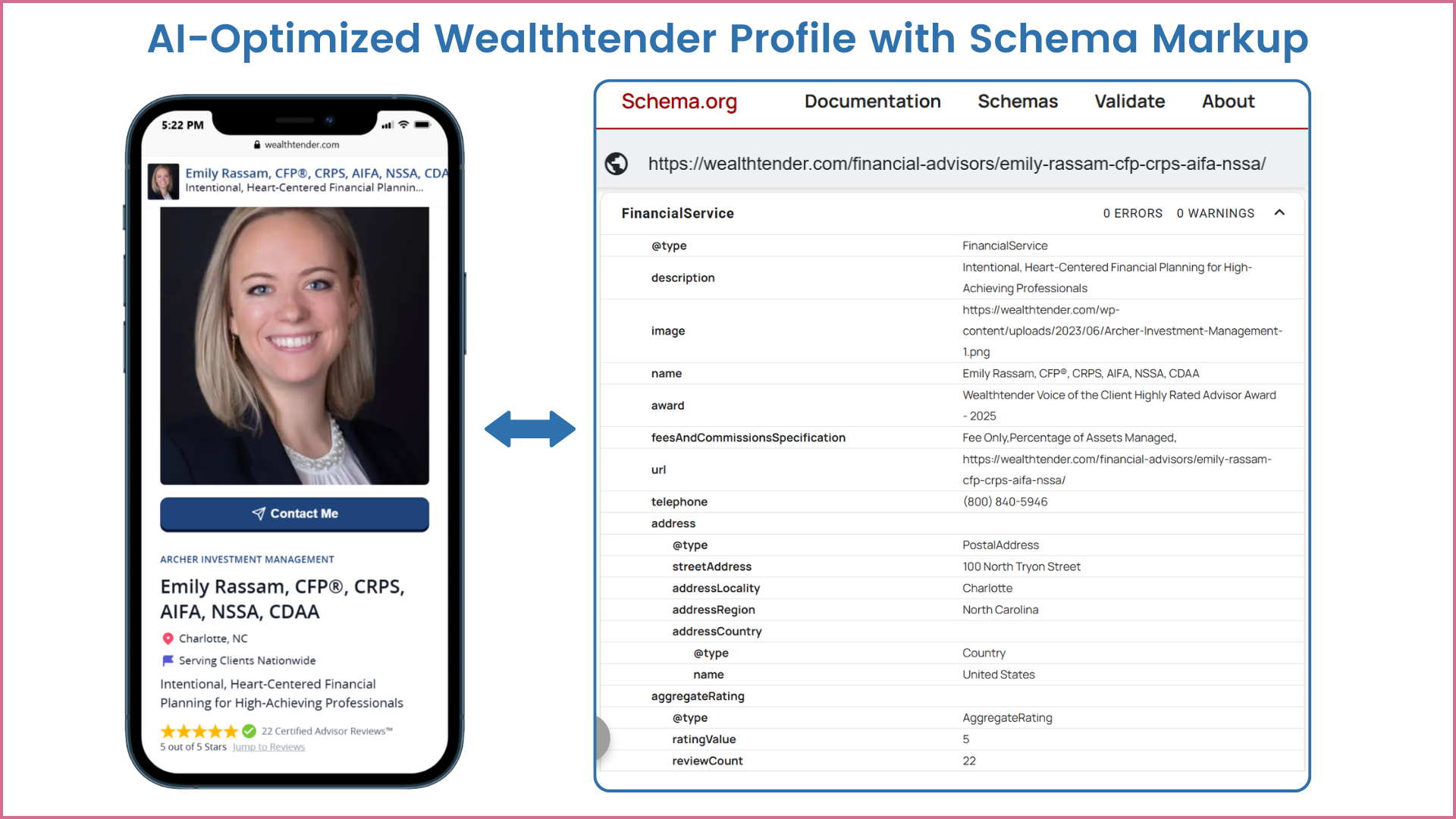

1. Structured Data That AI Tools Can Parse and Understand

Wealthtender profiles are purpose-built with structured data formatting that AI systems can easily interpret and process. Wealthtender provides:

- Verified contact information and service descriptions

- Structured specialization categories (e.g., retirement planning, estate planning, business owners, equity compensation, etc.)

- Geographic data optimized for location-based queries

- Fee structure information

- Star rating (e.g., 22 reviews with an average 5-star rating)

- Multiple schema types (FAQ schema, Review schema, Financial Services schema, Award schema)

(Right) Screenshot of Schema Markup Validator tool verifying schema implementation on Emily Rassam’s profile, used by AI tools.

2. Independent Third-Party Reviews Carry Exceptional Weight with AI Algorithms

AI tools assume that testimonials published on advisor websites represent curated, self-selected feedback with inherent positive bias. Independent review platforms like Wealthtender provide the balanced perspective and third-party validation that AI systems prioritize when assessing client feedback and determining review sentiment.

This principle isn’t unique to financial services, it’s a pattern we see across all trust-based professions where AI tools make recommendations.

In healthcare, for example, independent review platforms like ZocDoc and Healthgrades play a critical role in how AI tools recommend physicians to patients. According to the 2025 Patient Review Survey, 73% of patients rely on online reviews to assess doctors. When consumers ask AI tools like ChatGPT or Perplexity for doctor recommendations, these independent platforms get cited far more frequently than individual physician websites, even when those websites contain testimonials. Why? Because AI algorithms recognize these platforms as authoritative, third-party sources with review verification systems, standardized rating criteria, and comprehensive data structures.

The Same Dynamic Applies to Financial Advisors

Just as ZocDoc and Healthgrades serve as trusted discovery and validation platforms for physicians, Wealthtender functions as the financial services equivalent, providing the structured, independent review infrastructure that AI tools prioritize when recommending financial advisors.

The pattern is consistent across trust-based professions:

Legal Services: Platforms like Avvo and FindLaw provide independent attorney reviews and ratings that AI tools reference more frequently than law firm websites.

Healthcare: Healthgrades, ZocDoc, and Vitals serve as authoritative third-party platforms.

Financial Services: Wealthtender provides independently-hosted advisor reviews with regulatory disclosures and verification, exactly what AI algorithms seek when evaluating trustworthiness.

Why Independent Review Platforms Like Wealthtender Outperform in AI Algorithms

AI answer engines weight independent review platforms more heavily for several technical and practical reasons:

Balanced Representation: Independent platforms display all reviews, positive, negative, and neutral, providing AI tools with a complete sentiment picture rather than cherry-picked testimonials.

Verification Systems: Platforms like Wealthtender display important disclosures (e.g., whether reviewers are clients, whether compensation was provided or any conflicts of interest exist) and require advisor attestations, giving AI tools confidence in review authenticity.

Structured Data: Industry-specific review platforms implement proper schema markup that AI tools can easily parse and understand, unlike unstructured testimonials on individual websites.

Domain Authority: Established platforms have built domain authority over years, signaling to AI algorithms that information from these sources is more reliable than self-published content.

Comparative Context: AI tools can compare multiple professionals on the same platform using standardized criteria, something impossible when evaluating scattered testimonials across individual websites.

The Compounding Advantage of Platform Presence

For financial advisors, the implications are clear: having excellent client relationships and testimonials isn’t enough if those testimonials only exist on your website. To maximize AI visibility, testimonials must be published on independent platforms that AI tools recognize as authoritative sources.

This is why advisors with Wealthtender profiles, especially those with multiple client reviews displaying proper regulatory disclosures, consistently outperform in AI search results. They’re leveraging the same platform dynamics that make physician profiles on Healthgrades discoverable to thousands of patients conducting searches using AI tools everyday.

3. Authoritative Platform Recognition Amplifies Individual Advisor Credibility

AI tools weight information based on source authority. Wealthtender’s established domain authority and reputation specifically within financial services creates a powerful multiplier effect. When an advisor’s information appears on Wealthtender versus solely on their own website, AI systems interpret this as credible third-party validation.

The platform’s recognition as the industry’s first financial advisor review platform designed for regulatory compliance, combined with features like the Wealthtender Voice of the Client Awards, Large Employer Q&As, and extensively structured advisor data, sends powerful trust signals that AI algorithms recognize and reward when determining recommendations.

4. FAQ Schema: The Technical Foundation for AI Citations

One of the most powerful yet underutilized tools for AI optimization is creating ‘Frequently Asked Questions’ resources using FAQ schema markup. Wealthtender profiles incorporate FAQ schema that tells search engines and AI tools that content includes questions with corresponding answers in machine-readable formats.

FAQ schema matters for several important reasons:

SEO Benefits: Google is more likely to display FAQ-rich results in “People Also Ask” boxes and feature answers in AI Overviews on search results pages, driving organic visibility.

Answer Engine Optimization: As AI tools like ChatGPT and Gemini grow in popularity, thoughtful FAQs using schema markup dramatically improve odds of appearing in AI summaries and conversational search results.

Authority Building: Publishing FAQs with schema signals to both search engines and prospective clients that firms prioritize transparency and topical authority. We recommend to advisors that FAQs on Wealthtender profiles are optimized for “find an advisor” searches where consumers may not yet know advisor names. For example: “Does [Advisor Name] offer financial planning services in Austin, Texas to Dell employees requiring help with equity compensation and retirement planning?”

The difference is targeting consumer intent at the discovery phase rather than evaluation phase. Of course, FAQs can include a mix of questions and answers designed to aid consumers in both the discovery and evaluation phase, but especially on a third-party discovery platform like Wealthtender, it’s important that several FAQs reflect the types of questions consumers might ask in AI tools before they have identified any particular advisors.

What Makes Wealthtender Profiles Perform Better Than Advisor Websites Alone?

Financial advisors with their own website AND a Wealthtender profile increase their chances of outperforming advisors who rely solely on their own website. Here’s why:

The Platform Multiplier Effect: Cross-Channel Amplification

A strong Wealthtender presence doesn’t exist in isolation. AI systems increasingly cross-reference information across multiple platforms, and advisors with Wealthtender profiles benefit from:

- Enhanced SEO performance through authoritative backlinks that improve overall search rankings

- Consistent information architecture that AI tools verify across sources for accuracy

- Social proof through independent reviews that appears in multiple search contexts

- Higher domain authority than most traditional advisor websites could ever expect to achieve

Structured for AI-First Discovery with Technical Precision

Unlike traditional websites built primarily for human readers, Wealthtender profiles incorporate multiple technical elements specifically designed for AI parsing and interpretation:

- FAQ schema that appears in featured snippets and AI responses

- Review schema that displays star ratings directly in search results

- Financial services schema that precisely categorizes specializations

- Local business schema enabling accurate geographic targeting

- Award schema highlighting industry recognition and trust signals

The Zero-Click Search Advantage: Getting Cited Without Clicks

AI-powered searches increasingly result in “zero-click” outcomes where consumers receive answers directly without visiting websites. In June 2025, Financial Planning magazine reported that advisors are seeing “zero-click search results, where users get answers directly in the search interface, often without ever visiting a website.”

As Daniel Kopp, founder of Wise Stewardship Financial Planning in Lakewood Ranch, Florida told the author of the article, “Using reviews from sites like Wealthtender that explicitly mention the niche expertise, like ‘my financial advisor helped me understand my military pay and benefits,’ help build the AI authority referral traffic.”

Traditional SEO focused on driving traffic to websites. AI optimization ensures you’re cited in the answer itself even when prospects never click through. Advisors with Wealthtender profiles appear in these zero-click results more often because the platform’s structured data allows AI tools to extract and cite information confidently.

How Do Financial Advisors Rank Higher in ChatGPT, Perplexity, and AI Overviews?

Getting recommended by AI tools requires specific, actionable optimization strategies. Financial advisors succeeding in AI search follow these proven approaches:

Strategy #1: Complete, Comprehensive Wealthtender Profile

AI systems strongly favor complete information over partial profiles. Advisors who thoroughly complete all Wealthtender profile sections, including detailed service descriptions, specializations, credentials, geographic information, fee structures and FAQs, stand to appear much more often in AI results.

Action Step: Review and refresh your Wealthtender profile to ensure every section is fully completed with keyword-rich descriptions of services and expertise.

Strategy #2: Strategic Review Collection for Third-Party Validation

The number and quality of independent reviews directly impact AI recommendations. With only 9.3% of financial advisors using testimonials in their marketing (according to the 2025 Investment Adviser Industry Snapshot), advisors with reviews published on Wealthtender have a massive competitive advantage.

Action Step: Implement a systematic, compliant review collection process using Wealthtender’s platform.

Strategy #3: Specialization Clarity and Niche Targeting for Precise Matching

Advisors who clearly define their specializations perform dramatically better in targeted queries. AI tools prioritize advisors who explicitly identify these specializations in structured formats. Wealthtender’s structured specialization fields, dozens of specialist advisor directories, and Large Employer Q&A features enable this precise matching.

Large Employer Q&A Strategy: Wealthtender’s Large Employer Q&A series helps consumers, search engines, and AI tools discover financial advisors who specialize in serving employees of specific companies. One advisor shared this about her participation in a large employer Q&A published on Wealthtender: “I had a prospect reach out this week from one of the large companies that I did the Q&A on and he mentioned that he found me through a Google search using the keywords of ‘advisor, CFP and [the name of the $50B tech company where he works]’. Wow! These tools at Wealthtender are already working!!”

Action Step: Clearly define 2-3 niche specializations, get featured in relevant specialist advisor directories on Wealthtender, and participate in Large Employer Q&As to demonstrate specialized knowledge that AI tools can reference when making recommendations.

Strategy #4: FAQ Optimization for Direct AI Answers and Featured Snippets

Questions and answers formatted clearly with FAQ schema help AI tools extract information for direct responses and featured snippets.

Consumer-Focused FAQ Examples for Wealthtender Profiles:

❌ Don’t Ask: “What is financial planning?”

✅ Do Ask: “Does [Advisor Name] offer financial planning services in Austin to Amazon employees with RSU compensation?”

❌ Don’t Ask: “How do fees work?”

✅ Do Ask: “What is [Advisor Name]’s fee structure for retirement planning services, and do they act as a fiduciary?”

❌ Don’t Ask: “What services do you provide?”

✅ Do Ask: “Can [Advisor Name] help widows navigate finances after loss of a spouse, including estate settlement and income planning?”

These consumer-centric FAQs dramatically increase likelihood that AI tools surface your profile when prospects search for specialized help.

Action Step: Create 8-10 FAQs on your Wealthtender profile addressing common questions your target clients ask, using natural language that matches how people phrase queries to AI tools. Wealthtender automatically implements FAQ schema markup for these answers.

How Does Wealthtender Compare to Other Advisor Marketing Strategies for AI Visibility?

Financial advisors and wealth management firm leaders considering how to invest marketing dollars should understand how Wealthtender compares to alternatives:

Wealthtender Reviews vs. Google Reviews: Compliance and AI Performance Considerations

While Google Reviews provide local SEO benefits when consumers specifically search within the Google system for a firm by name or proximity, they fall significantly short for AI optimization and regulatory compliance. Just below, you’ll find excerpts from this in-depth article comparing Wealthtender vs. Google Reviews spotlighting a few differences worth considering:

AI Visibility Gap: Google Reviews have limited visibility in AI-powered search environments, including Google’s own Gemini AI platform (as of November 2025). Wealthtender reviews are indexed by search engines that power AI tools, making them far more likely to appear in ChatGPT, Perplexity, Claude, and similar platforms.

Regulatory Compliance Problem: Google Reviews lack the SEC-required disclosures for testimonials, preventing advisors from being able to actively promote them. Referencing Google Reviews triggers “adoption” or “entanglement” issues under the SEC Marketing Rule. (Isaac Mamaysky, Partner of Potomac Law Group, elaborates on why this scenario is problematic in this December 2025 Kitces Guest Post.) Wealthtender’s compliance-first design overcomes this shortcoming and allows for confident promotion across all marketing channels.

Personal Brand Building Limitation: Google Reviews are associated with a single Google Business Profile typically reflecting the firm name, while prospects preparing to hire financial advisors are primarily researching and comparing individual financial advisors. Wealthtender profiles create visibility for both firm and individual advisor names.

Zero-Click Performance: Google Reviews rarely appear in AI-generated answers. Wealthtender reviews, structured with proper schema markup on an authoritative domain, are much more likely to get cited in AI responses.

Wealthtender vs. Traditional Website SEO: Complementary Not Competitive

Your website remains important, but Wealthtender provides complementary benefits your site alone cannot deliver:

Instant Authority Signals: Wealthtender’s established domain authority provides instant credibility that many advisor websites lack and take years with a significant investment to develop independently.

Independent Verification Advantage: Third-party platforms carry substantially more weight with both AI tools and human prospects than self-published content. AI systems recognize and reward independent validation.

Platform-Wide Schema Optimization: While you can add schema markup to your website, Wealthtender’s platform-wide optimization ensures consistent, AI-friendly data architecture without ongoing technical maintenance.

Review Credibility Differential: Independent reviews on Wealthtender carry significantly more weight with AI algorithms than testimonials published on advisor websites. ChatGPT explicitly noted it “downweights” advisor website testimonials as “curated by the advisor.”

What Specific Features Make Wealthtender Profiles Effective for AI Search?

Understanding the technical advantages clarifies exactly why Wealthtender consistently outperforms in AI visibility:

Advanced Multi-Schema Implementation

Wealthtender implements multiple schema types simultaneously that AI tools rely on for accurate interpretation.

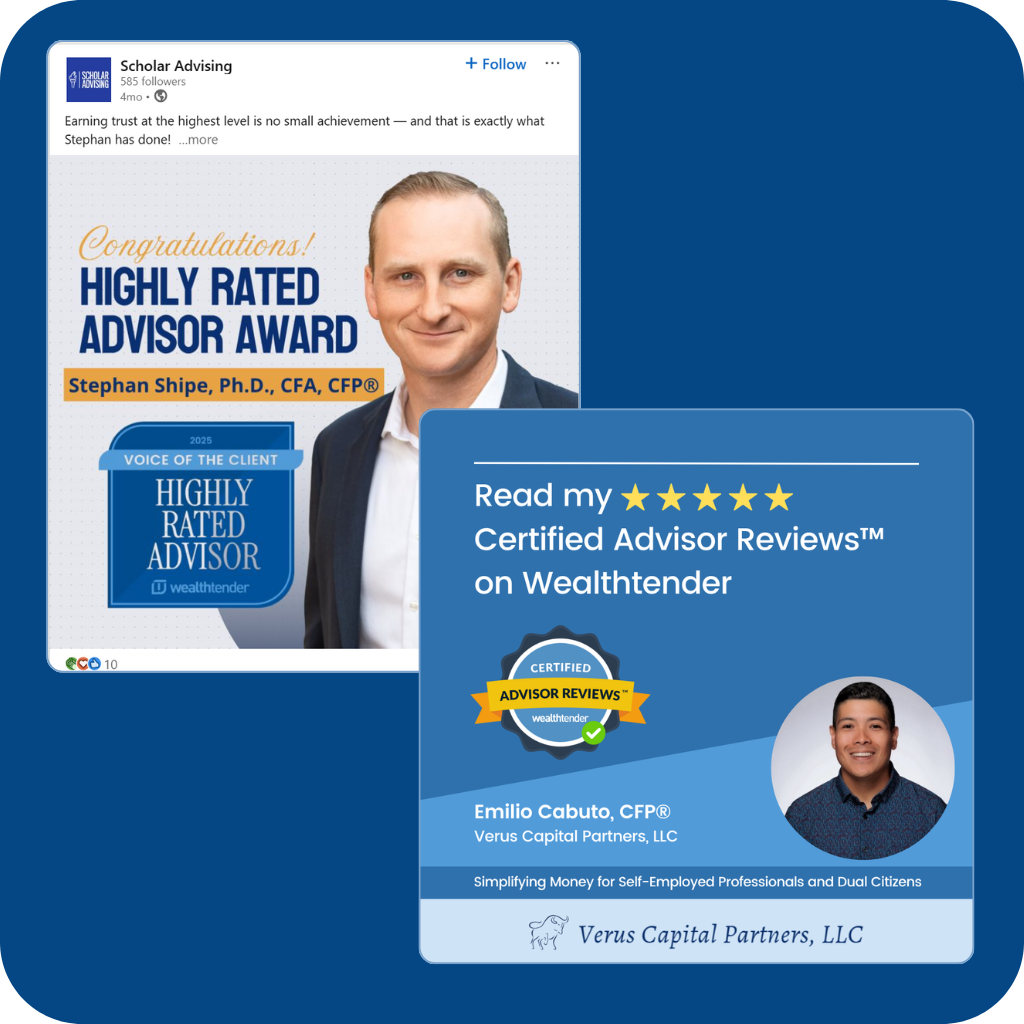

Voice of the Client Awards: AI-Recognized Trust Signals

Advisors and firms meeting award eligibility criteria receive Voice of the Client Awards coded with award schema. These awards serve as powerful trust signals that AI algorithms specifically recognize when determining which advisors to recommend. Awards generate additional SEO/AEO benefits and provide opportunities for compliant promotion, amplifying reputation beyond individual testimonials.

Review Sync Feature: Multiplying Visibility Across Profiles

Advisory firms can amplify reviews across all advisor profiles using Wealthtender’s Review Sync feature. Each client review strengthens visibility for both the firm and individual advisors, creating a powerful multiplier effect for AI discoverability. When prospects search for either the firm name or any individual advisor name, the gold star ratings appear prominently in search results.

Large Employer Q&A Integration: Targeting High-Value Niche Searches

Wealthtender’s Large Employer Q&A features allow advisors to demonstrate specialized knowledge for employees of major corporations. These Q&As target highly specific, intent-driven searches with exceptional prospect quality. As one advisor noted, the benefit operates “like a call option: the cost is small, but the payoff can be substantial.”

How Can Financial Advisors Get Started with AI Search Optimization?

For advisors and wealth management firm leaders ready to improve AI visibility, follow this implementation roadmap utilized by hundreds of advisors and firms that have partnered with Wealthtender for SEO and AI optimization:

Immediate Actions (Week 1)

- Join Wealthtender: It takes just 2 minutes to sign up by visiting this page

- Wealthtender creates your profile(s): Within a day or two, your profile(s) are published on Wealthtender, immediately strengthening SEO and AI visibility

- Specialization deepening: Get featured in Wealthtender resources like specialist directories and local guides

- Review FAQ schema opportunities: Identify 8-10 common questions to answer with FAQ formatting

Short-Term Strategy (Months 1-3)

- Implement systematic review collection: Begin gathering client testimonials using Wealthtender’s compliant platform

- Website integration: Add Wealthtender review widgets to website to maximize testimonial visibility

- Evaluate Large Employer Q&A opportunities: Identify target companies where you have expertise and participation would attract ideal clients

- Get quoted in the media: Respond to writers for opportunities to gain visibility in popular publications; media citations send trust signals to AI tools

- Update profile quarterly: Refresh profile information regularly to signal active engagement to AI algorithms

Long-Term Positioning (Months 3-12)

- Review volume building: Aim for 10+ high-quality reviews within first year

- Award qualification: Meet criteria to earn a Voice of the Client Highly Rated Award

Best Practices for Maximum Impact

Write Conversationally, Not Formally: AI tools prioritize content matching natural language patterns people use in queries. Instead of formal marketing copy, write as if answering a friend’s question directly.

Embrace Specificity Over Generalities: General statements about financial planning don’t differentiate you. Specific insights like “retirement planning strategies for Dell employees navigating equity compensation and 401(k) rollovers” help AI tools match you with relevant queries.

Maintain Cross-Platform Consistency: Ensure Wealthtender information aligns with your website and other online presence. AI systems verify information across sources and favor consistent, trustworthy profiles.

Emphasize Client Outcomes: Reviews and content focusing on specific results and client experiences provide the concrete information AI tools need to make confident recommendations with supporting evidence.

Why Wealthtender Creates Measurable AI Search Advantages for Financial Advisors

Financial advisors and wealth management firms with robust Wealthtender presence are positioned to outperform peers in AI-driven search results.

Key Competitive Advantages Summarized

✅ Structured Data Architecture: Purpose-built for AI interpretation with comprehensive schema markup and standardized information formatting

✅ Independent Review Authority: Third-party testimonials carrying substantially more weight with AI algorithms than self-published content

✅ Established Domain Authority: Years of credibility in financial services providing instant trust signals to AI systems

✅ Specialization Spotlight: Large Employer Q&A features and specialist directories enabling alignment between advisor expertise and client needs

✅ FAQ Schema Implementation: Technical foundation for appearing in featured snippets and AI-generated answers

✅ Content Marketing Infrastructure: Publishing platform demonstrating thought leadership and expertise AI tools recognize

✅ Compliance-First Design: SEC/FINRA compliant approach allowing confident promotion of testimonials across all channels

✅ Cross-Platform Amplification: Enhanced visibility in traditional search engines, AI tools, and across individual and firm profiles simultaneously

✅ Industry Recognition: Voice of the Client Awards providing additional trust signals AI algorithms weight heavily

The Strategic Imperative: Act Now or Fall Behind

With 25% of affluent Americans already using AI tools to find financial advisors and 50% starting their search online, the question isn’t whether to optimize for AI visibility, but how quickly you can implement effective strategies.

Financial advisors who delay risk becoming increasingly invisible to a rapidly growing segment of their target market. Those who act now benefit from:

- Early-mover advantages in a rapidly growing area before other firms catch on

- Compounding benefits as reviews and content accumulate over time

- Higher-quality leads as AI tools better identify the right advisors for consumers based on areas of expertise

- Reduced marketing costs through organic visibility reducing the benefits of paid advertising

- Sustainable competitive differentiation as laggard wealth management firms fail to adapt to the AI opportunity

As the Barron’s article notes, platforms like Wealthtender are “designed to help make advisors discoverable by AI chatbots.” For advisors serious about remaining competitive in an AI-driven marketplace, establishing a robust Wealthtender presence isn’t optional, it’s essential for business growth.

Want to see how individual advisors and leading wealth management firms are successfully using Wealthtender to grow their business? Visit Wealthtender.com/grow or schedule a demo to learn how you can start converting more prospects into clients with compliant testimonial marketing.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.