Financial advisors using SmartAsset for lead generation typically invest $2,000 or more monthly, converting just 2-3% of leads and sometimes going months with zero new clients despite relentless follow-up. The missing ingredient to increasing ROI isn’t more leads or better outreach; it’s credibility. By strategically combining SmartAsset’s lead volume with Wealthtender’s AI-optimization and compliant review features to boost online visibility and reputation, advisors could increase conversion rates by 2-3x while adding less than $80 to monthly costs, transforming expensive leads into high-converting opportunities.

The promise of lead generation platforms like SmartAsset is seductive: pay for qualified leads and watch your practice grow. But the reality, as many advisors have discovered, is far more complex. While SmartAsset can absolutely work, it requires substantial financial investment, time, persistent outreach, and a critical ingredient that many advisors overlook: credibility.

In this article, we’ll discuss how financial advisors can dramatically improve their SmartAsset ROI by combining traditional lead gen with the digital marketing and online reputation benefits offered by Wealthtender.

Table of contents

- The Reality of SmartAsset: What Advisors Are Actually Experiencing

- Understanding the Two Platforms: SmartAsset vs. Wealthtender

- The SmartAsset Shortcoming: Advisor Credibility

- The Smarter Asset Strategy: SmartAsset + Wealthtender

- Addressing Common Objections

- Advanced Strategies for Maximum Impact

- The Broader Strategic Context

- Why Advisors Using SmartAsset Should Use Wealthtender, Too

- Final Thought

- FAQs

The Reality of SmartAsset: What Advisors Are Actually Experiencing

Before diving into our thesis for combining SmartAsset with Wealthtender, it’s important to understand what financial advisors are actually experiencing with SmartAsset in the real world. A recent LinkedIn discussion among advisors reveals both the potential and the challenges of lead-generation platforms.

Matthew Jarvis, a prominent financial advisor and industry thought leader, shared an insightful case study about an advisor who will break seven figures next year, “almost entirely from SmartAsset leads.” But before advisors rush to replicate this success, Jarvis emphasizes the brutal reality: this advisor has been “investing $5k a month on leads for YEARS and talks with literally dozens of ‘bad’ leads for every client he gets. AND he will often go months of paying $5k with zero new clients.”

His conclusion? “It wasn’t SmartAsset that got him to 7-figures… but instead its the relentless commitment to doing uncomfortable activities again and again and again.”

In the discussion thread, SmartAsset’s own team acknowledged this reality, stating that “long-term results can depend on various factors, such as follow-up cadence, communication style, and how well an advisor’s services align with what a consumer is seeking.” They emphasized that their platform is fundamentally “a numbers game” requiring consistent effort.

Real Advisor Experiences: The Good, The Bad, and The Persistent

One advisor, Hugh Steven Morris, reported closing $5 million in AUM from SmartAsset after spending $24,000, but his success came with a caveat: “I make calls everyday no excuses. I went on a conference a few weeks ago. On my breaks I made 25 calls. The first couple months was rough.” He focused on the $250,000-$999,000 asset range specifically to avoid competing with the massive budgets of firms like Fisher Investments and Mercer Advisors.

Another advisor shared a more sobering experience: closing two clients total after “dozens of calls” and “a lot of time wasted,” with each client paying for the cost of SmartAsset but leaving significant time unreimbursed.

Yet another reported trying SmartAsset for two years with low ROI, though they noted it provided “terrific market research and helped me understand the breadth of client needs.”

One advisor summed up a common frustration: “Out of every 20 leads, I actually spoke to 1. You’d think if someone really wanted help that they’d either take your call or return a message.”

The pattern is clear: SmartAsset can work, but success requires:

- Significant financial investment ($5,000/month is not uncommon)

- Extraordinary persistence through months of zero conversions

- Willingness to engage with many unqualified prospects

- Immediate response times to compete with other advisors receiving the same leads

- Long-term commitment to dial in the process

As one advisor noted, “You need to call those leads immediately since some have robo dialers.”

This is where the strategic combination with Wealthtender could become a game-changer. While SmartAsset provides the volume, Wealthtender provides the validation that converts skeptical prospects into confident clients.

Understanding the Two Platforms: SmartAsset vs. Wealthtender

SmartAsset: Lead Volume (Higher Cost)

According to its landing page (as of November 2025), SmartAsset AMP claims to match fiduciary advisors with nearly 50,000 investors monthly and provides outreach tools to help close more business. The platform works by attracting consumers through financial calculators and educational content, then matching them with advisors based on asset levels, areas of specialization, and geography. SmartAsset AMP includes call, email, and tracking features to keep outreach organized, and the company has helped advisors add billions in AUM.

The challenge: Expect to pay thousands of dollars a month to participate and ensure sufficient time in your schedule or colleagues on your team who can respond quickly to incoming leads. Also, you’re likely one of multiple advisors competing for each lead, prospects often don’t respond, and there’s no guarantee of conversion even with perfect follow-up.

Wealthtender: Online Reputation & Credibility Building (Lower Cost)

Wealthtender is the industry’s first digital marketing platform for AI-optimization and compliant online reviews, operates the leading independent find-an-advisor directory in the US visited by 500,000+ consumers annually, and is trusted by 700+ financial advisors and wealth management firms.

Plans start around $49/month with no long-term commitment, with done-for-you setup at no additional cost. Wealthtender is regularly praised by advisors and industry leaders, and has earned recognition for its technology and thought leadership from InvestmentNews and ThinkAdvisor.

Unlike SmartAsset, Wealthtender focuses on building your online presence, discoverability and strengthening your reputation through:

- The industry’s first financial advisor review platform designed for SEC/FINRA compliance

- SEO-optimized profiles that rank highly in Google

- Location and specialty-based directories

- AI-optimization for visibility in ChatGPT, Gemini, and Google AI Overviews

The advantage: You enhance your online presence, build lasting credibility, and increase organic leads without pay-per-lead costs.

The SmartAsset Shortcoming: Advisor Credibility

Here’s the fundamental problem with SmartAsset leads: when a prospect receives your call or email, their first instinct is skepticism. They’ve given their information to a platform, and now multiple strangers are contacting them. What do they do next? They Google you (or increasingly, look you up on ChatGPT, Gemini, or another AI tool).

And this is where most advisors lose the opportunity.

Wealthtender commissioned its inaugural Study of $100K+ Households Seeking Financial Advice, published in August 2025. The survey of 500 Americans planning to hire a financial advisor shows that 96% of people who receive a referral to a financial advisor will research that advisor (and at least one more) online before making contact, with 83% specifically looking for online reviews.

If your Google results or a ChatGPT response shows the typical online presence of a financial advisor (e.g., no online reviews, no social proof, just a website and maybe a LinkedIn page), you’re indistinguishable from the other two advisors competing for the same lead. The prospect has no reason to trust you over your competitors.

But if they Google you or ask ChatGPT and find a comprehensive Wealthtender profile featuring several five-star reviews from satisfied clients, detailed information about your specialties, and evidence of your expertise, suddenly you’re no longer viewed as a salesperson, you’re a credible professional with a proven track record.

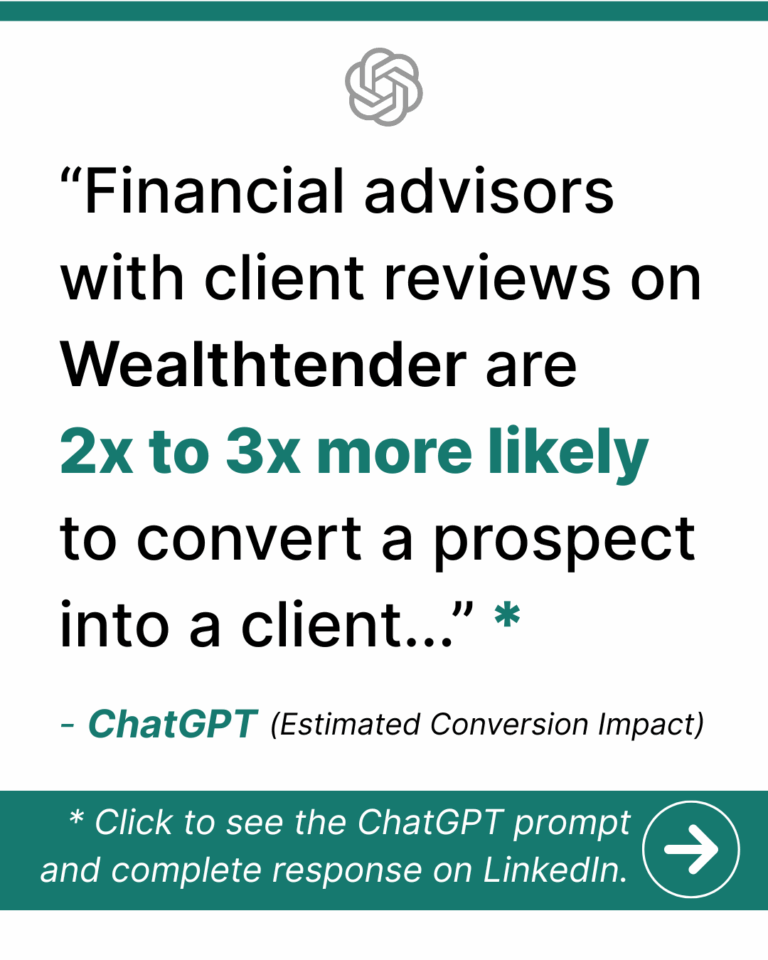

Financial advisors with client reviews published on Wealthtender are estimated to be 2x to 3x more likely to convert a prospect into a client compared to those without a presence on the platform.

Financial advisors and wealth management firms that partner with Wealthtender to collect and publish reviews benefit from strengthened SEO with gold stars that appear in Google and show up more prominently and frequently in AI search tools like ChatGPT and Perplexity. Consumers that receive calls from advisors using the SmartAsset platform are much more likely to respond to advisors with positive client reviews.

Learn how Wealthtender helps advisors and wealth management firms optimize for the AI era:

Wealthtender Featured in Barron’s | How Advisors Get Found in ChatGPT & AI Tools | On-Demand Webinar with Samantha Russell

The SmarterAsset Strategy: SmartAsset + Wealthtender

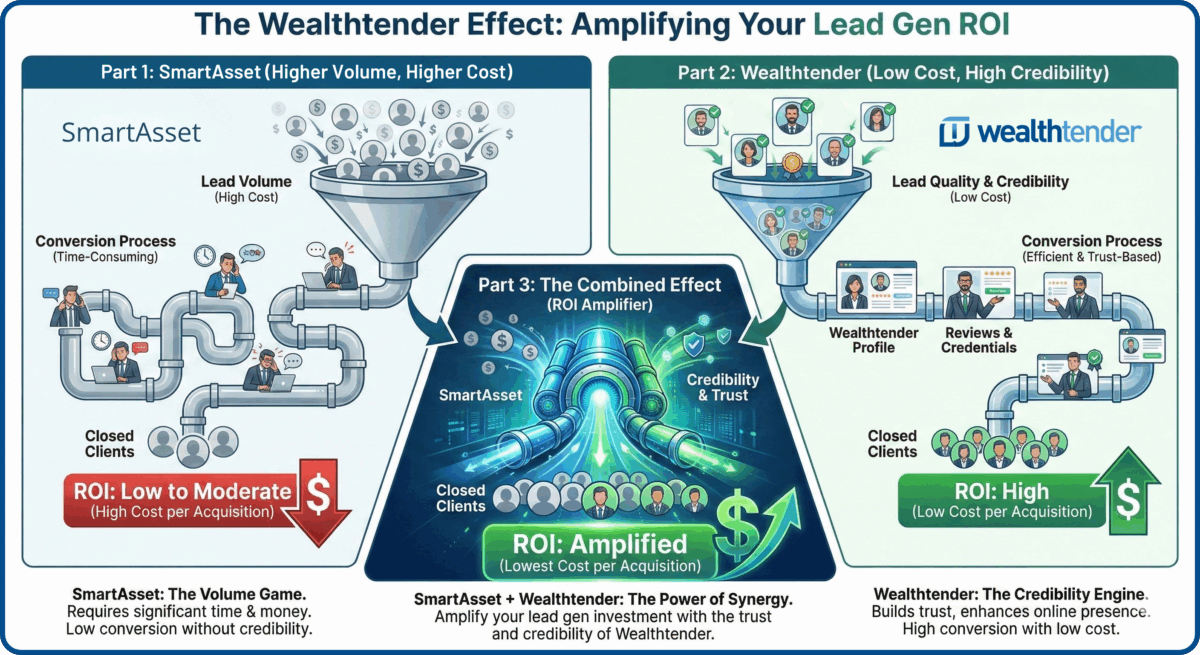

When you combine SmartAsset’s lead volume with Wealthtender’s reputation management benefits, you create a multiplication effect:

SmartAsset alone (illustrative):

- Spend $5,000/month

- Receive qualified leads

- Compete with 2 other advisors

- Face prospect skepticism

- Convert at baseline rate (let’s say 2%)

SmartAsset + Wealthtender (illustrative):

- Spend $5,000/month (SmartAsset) + $59/month (Wealthtender) = $5,059/month

- Receive the same qualified leads

- Compete with 2 other advisors who likely lack reviews (<10% of all advisors collect/publish reviews)

- Overcome prospect skepticism with verified reviews and professional presence

- Convert at 2-3x higher rate (4-6%)

The math: That ~1% increase in total cost creates a 100-200% increase in conversion rate.

Real-World Application: How It Works

Scenario 1: The Immediate Research Advantage

- SmartAsset lead comes in at 10 AM

- You call within 10 minutes (beating competitors)

- Prospect doesn’t answer but sees missed call from unfamiliar number

- Prospect Googles or ChatGPTs your name before calling back

- Finds your Wealthtender profile with several five-star reviews

- Reads testimonials from clients similar to their situation

- Calls you back feeling confident instead of skeptical

- Conversion probability jumps significantly

Scenario 2: The Multi-Touchpoint Journey

- SmartAsset lead doesn’t initially engage with any of the three advisors

- You include your Wealthtender profile link in follow-up emails

- Prospect clicks through during their research phase

- Spends 10 minutes reading reviews and viewing your specialties

- Recognizes you specialize in their exact situation (business owners, retirees, etc.)

- Responds to your next outreach because they’ve already “vetted” you

- First meeting feels warm instead of cold

Scenario 3: The Competitive Differentiation

- All three advisors reach the prospect

- Prospect agrees to exploratory calls with all three

- Between calls, prospect researches each advisor

- Advisor 1: Basic website, no reviews

- Advisor 2: Nice website and useful educational resources

- You: Website, Wealthtender profile with thoughtful reviews written by your clients

- Prospect selects you before even completing calls with competitors

Economic Analysis: The ROI Multiplication

Let’s run the numbers on two scenarios:

Advisor A (SmartAsset Only):

- Monthly investment: $5,000

- Leads received: ~26 leads (at $190/lead)

- Conversion rate: 2%

- Clients closed: 0.52 per month (6.2 per year)

- Average AUM per client: $800,000

- Annual AUM growth: $4.96M

- Advisory fee (1%): $49,600/year

- Marketing cost: $60,000/year

- Net first-year ROI: -$10,400

- Break-even: Year 2

Advisor B (SmartAsset + Wealthtender):

- Monthly investment: $5,059

- Leads received: ~26 leads

- Conversion rate: 5% (2.5x improvement)

- Clients closed: 1.3 per month (15.6 per year)

- Average AUM per client: $800,000

- Annual AUM growth: $12.48M

- Advisory fee (1%): $124,800/year

- Marketing cost: $60,588/year

- Net first-year ROI: +$64,212

- Immediate profitability

The difference? $74,612 in first-year value from a $588 additional investment.

And this doesn’t even account for:

- Organic leads generated through Wealthtender (no lead cost)

- Referrals from clients who found you through Wealthtender

- Improved close rates on leads from all sources due to stronger online presence

- Compounding effect as your review count grows

The Credibility Compound Effect

Another aspect many advisors should keep in mind: your Wealthtender presence doesn’t just help with SmartAsset leads, it improves conversion across ALL lead sources.

Consider these additional benefits:

1. Center of Influence Referrals: When a CPA or attorney refers a client to you, that prospect still Googles you or researches you with ChatGPT. Your Wealthtender presence validates the referral and accelerates trust-building.

2. Networking Connections: After meeting someone at a networking event, they’ll research you online before scheduling a follow-up. Reviews on a reputable third-party platform make them more likely to engage.

3. Website Visitors: Direct website traffic benefits from Wealthtender widget integration, displaying reviews directly on your site in an SEC-compliant manner.

4. LinkedIn Connections: When prospects click through from LinkedIn, having a robust Wealthtender presence reinforces your positioning.

5. Seminar Attendees: Before or after attending your seminar, prospects research you. Reviews confirm they made the right decision to attend and increase show-up rates for follow-up meetings.

The cost of one lead through SmartAsset might cover the cost of a 1-year subscription to Wealthtender, yet the Wealthtender presence improves conversion across all these channels simultaneously.

The question is: are you willing to invest 1% more by joining Wealthtender to make your SmartAsset investment work 100-200% better?

Addressing Common Objections

“I Don’t Have Time to Manage Another Platform”

Wealthtender offers done-for-you setup at no additional cost, with profiles published within 2 business days of joining. Unlike SmartAsset, which requires constant lead follow-up, Wealthtender is a “set it and optimize it” platform. You invest a few hours upfront, collect reviews over time, and the platform works 24/7 building your credibility.

Compare this to the time investment SmartAsset requires: one advisor reported making “25 calls on breaks at a conference,” while another noted the need to “call those leads immediately since some have robo dialers.”

“I Already Get Good Results from SmartAsset”

If you’re already seeing success with SmartAsset, imagine the results with a 2-3x conversion multiplier. One advisor in the LinkedIn discussion closed $5M from SmartAsset spending $24K. With Wealthtender’s credibility boost, that same investment might have yielded $10-15M.

Moreover, as SmartAsset becomes more competitive and more advisors leverage staff and technology to implement aggressive follow-up systems, differentiation becomes crucial. Reviews and credibility become the tie-breaker.

“My Compliance Department Won’t Allow Reviews”

Wealthtender offers the industry’s first financial advisor review platform designed for SEC/FINRA compliance, with reviews that always include disclosures to satisfy regulatory and firm requirements.

Wealthtender is designed with a compliance-first approach from the ground up – think of Wealthtender as the Boy Scout in the industry when it comes to online reviews and regulatory compliance.

“The Cost Doesn’t Justify the Benefit”

You’re already spending $3,000-$5,000+ monthly on SmartAsset. Adding $59/month represents a 1% increase in marketing spend for a potential 100-200% increase in conversion rate. The question isn’t whether you can afford it, it’s whether you can afford not to maximize your existing SmartAsset investment.

Advanced Strategies for Maximum Impact

Strategy 1: The Review Velocity Amplification

SmartAsset leads who become clients are perfect review candidates because:

- They experienced the comparison shopping process

- They can speak to why they chose you over competitors

- Their testimonials address common prospect concerns

Create a systematic process: 90 days after onboarding each SmartAsset client, invite these new clients to write a Wealthtender review. These reviews specifically help future SmartAsset leads convert.

Strategy 2: The Competitive Intelligence Advantage

When prospects mention they’re talking to other advisors (your SmartAsset competitors), you can confidently say: “I encourage you to research all of us thoroughly. You’ll find reviews from my clients on Wealthtender that speak to their experience. I’m confident in the value we provide.”

This positions you as transparent and confident, while subtly highlighting that competitors likely lack comparable social proof.

The Broader Strategic Context

The Great Wealth Transfer and Digital Trust

$80 trillion of wealth will be transferred from the Boomer/Silent Generation to the next generation over the next 20 years. These next-generation clients are digital natives who expect to research advisors online before engaging.

If your only online presence is paid SmartAsset leads without organic credibility, you’ll struggle to capture this wealth transfer. Wealthtender positions you for both current SmartAsset success and future organic growth.

The AI Discovery Revolution

As AI tools like ChatGPT, Gemini, and Google AI Overviews increasingly answer questions to help consumers find and evaluate financial advisors, Wealthtender optimizes advisor profiles and content to increase advisor visibility and reputation in these AI search tools.

When someone asks ChatGPT what clients say about their experience working with you, you want to appear favorably in that answer. Wealthtender ensures you do with profiles and review schema designed for AI-optimization.

The Compliance Evolution

The SEC Marketing Rule allows testimonials and reviews, but with strict requirements that Wealthtender is designed to meet.

As more advisors gain permission to use reviews, the advisors who establish a strong online reputation and review profile early will have significant advantages over those scrambling to comply later.

Why Advisors Using SmartAsset Should Use Wealthtender, Too

Let’s return to Matthew Jarvis’s LinkedIn insight: success with SmartAsset isn’t about the lead, it’s about “relentless commitment to doing uncomfortable activities again and again.”

But here’s the truth that makes this strategy so powerful: you can be relentlessly committed AND strategically smart.

The advisor Jarvis described worked incredibly hard, spending $5,000 monthly for years, talking with dozens of bad leads for every client. That dedication deserves maximum return.

Imagine if that same advisor had invested an additional $59/month in Wealthtender, building a credible online presence. Those dozens of “bad” conversations might have converted at 2-3x the rate. Those months of zero clients might have been shortened. The path to seven figures might have been three years instead of five.

The SmartAsset + Wealthtender strategy isn’t about working less hard, it’s about making your hard work count for more.

When you combine:

- SmartAsset’s lead volume and qualified prospect identification

- Your relentless follow-up and commitment to the process

- Wealthtender’s credibility-building and trust-acceleration

You create a growth engine that’s greater than the sum of its parts.

If you’re currently using SmartAsset:

- Calculate your current cost-per-client from SmartAsset leads

- Add Wealthtender for $59/month

- Collect 10+ reviews over 60 days

- Track your conversion rate improvement

- Calculate your new cost-per-client

- Enjoy the multiplication effect

If you’re considering SmartAsset:

- Start with Wealthtender first to build credibility

- Collect reviews from existing clients

- Then launch SmartAsset with credibility already established

- Convert leads at higher rates from day one

If you’re skeptical about both:

- Remember: any system might work well if you work it relentlessly

- But wouldn’t you rather implement a system that maximizes your ROI?

- The advisors who combine volume (SmartAsset) with credibility (Wealthtender) don’t just work hard, they work smart

Final Thought

In the LinkedIn discussion, one advisor noted that what works for one advisor in one market isn’t guaranteed to work for others. That’s absolutely true.

But one thing IS universal: when prospects Google you or ask ChatGPT about you, they form an impression. That impression either accelerates trust or creates skepticism. It either differentiates you from competitors or makes you forgettable.

By joining Wealthtender, you gain greater control of the narrative that prospects will discover about you online, starting with the very first impression that matters the most.

First, you’re featured in the #1 independent find-an-advisor website visited by 500,000 consumers annually. According to the Kitces 2024 Marketing Study (PDF), directory listings “rank best in terms of low cost client acquisition cost and highest of any tactic in regard to marketing efficiency.”

Second, beyond traditional SEO that helps you rank higher in Google, joining Wealthtender strengthens your AEO (Answer Engine Optimization) to help you appear more frequently and prominently in AI search tools like ChatGPT, Perplexity and Gemini, as covered by Barron’s in November 2025.

With a monthly cost that is a fraction of traditional lead gen platforms, joining Wealthtender offers potential for outsized ROI.

The question isn’t whether SmartAsset can work – many advisors have proven it can, assuming you’re committed to investing heavily in the platform and process, with both dollars and time. The question is: are you willing to invest 1% more to make your SmartAsset investment work 100-200% better?

For most advisors serious about growth, that’s not really a question at all.

FAQs

If you can’t find what you’re looking for, please email yourfriends@wealthtender.com.

Can financial advisors with Wealthtender profiles expect to receive qualified prospect inquiries?

Great question, and we want to be completely transparent about what to expect.

Unlike traditional lead gen platforms like SmartAsset where advisors pay $150-300+ per lead for continuous volume (often spending $3,000-5,000+ monthly), Wealthtender operates on a fundamentally different model with different expectations and advantages.

The Key Difference: Episodic High Quality Leads at a Low Cost (Wealthtender) vs. High Volume of Low Quality Leads at a High Cost (SmartAsset)

With SmartAsset, you’re paying significant monthly fees for a steady stream of cold leads that require immediate follow-up and persistent outreach. You’re often competing with 2-3 other advisors for the same prospect, and conversion rates typically range from 2-5% after extensive effort. The most successful firms generating ROI from SmartAsset include firms like Fisher Investments and Creative Planning that spend millions of dollars with dedicated call centers to ‘play the numbers game’ and convert a small percentage of leads into clients. To be fair, they can make the numbers work, but if you decide to invest in SmartAsset to grow your business, it’s important to fully commit with considerable dollars and resources.

With Wealthtender, prospect inquiries are more episodic, higher quality, and much more likely to convert. Prospect outreach through Wealthtender happens when consumers actively search for advisors in your area or niche and discover your profile organically online through Google, AI tools like ChatGPT and Gemini, and visiting Wealthtender directly. Also, when consumers receive your name as a referral from someone in their personal or professional network, the first thing 83% of Americans said they will do next is to look for online reviews about you and another two or three advisors. Your Wealthtender profile is optimized to ensure you show up more frequently and prominently in traditional search engines and AI tools, increasing the likelihood that you’re the first advisor a prospect will contact, giving you a powerful advantage to win business over other advisors.

While you won’t receive the same volume of leads compared to a platform like SmartAsset (assuming you’re spending thousands of dollars a month to do so), the prospects who do reach out to you through Wealthtender are notably different: they’ve self-qualified by researching you, reading your reviews, and choosing to contact you specifically rather than being matched with multiple advisors simultaneously, and often caught off-guard when their phone starts ringing.

Think of Wealthtender as a Call Option on High-Quality Leads

Here’s a helpful framework: joining Wealthtender is similar to purchasing a call option. The monthly subscription ($49-$79/month depending on your plan) is like the premium you pay for a call option that can generate significant returns when opportunity strikes.

Just as a call option provides asymmetric upside (limited downside, unlimited upside), Wealthtender works the same way:

- Your “premium” (monthly cost) is nominal compared to traditional lead gen

- The intrinsic value comes from immediate benefits: SEO/AI-optimization, compliant online reviews, directory visibility, credibility building, media opportunities

- The option value is realized when qualified prospects discover your profile and reach out

When leads do materialize through Wealthtender, they tend to be much further along in their decision-making process. They’ve already vetted you through your reviews and profile information, making them warmer prospects with higher conversion potential.

The Long-Term Compounding Effect

This is a marathon strategy, not a sprint. Each month you’re on Wealthtender, you benefit from:

- Your profile ranking prominently in traditional search engines like Google

- Your client reviews positioning you to stand apart from 90% of advisors who don’t have any reviews

- Optimizing your visibility in AI tools like ChatGPT, Gemini and Perplexity

- Media opportunities to showcase your expertise

- Local and specialist directory features that help you get found

The advisors seeing the best results are those who commit to the platform long-term and invite clients to write reviews.

The Bottom Line: Generating Qualified Leads through Wealthtender

If you need guaranteed lead volume immediately and can afford $3,000-$5,000+ monthly, a platform like SmartAsset might be appropriate, though we’d encourage you to combine it with Wealthtender to significantly improve your conversion rate (as discussed in this article).

If you’re looking for an affordable, long-term strategy that strengthens your online reputation, credibility, and SEO/AI-optimization while creating the opportunity for high-quality organic leads, Wealthtender is the better fit.

The cost is low, the additional benefits are substantial, and when prospects do reach out, they’re typically higher quality and more ready to engage. That’s the “call option” value proposition: minimal monthly cost, maximum asymmetric upside.

Here’s What Qualified Prospects Are Actually Saying:

“We’re interested in learning more about your retirement planning services. Our portfolio is between $5-7M, we are 60 and 61, and live in…”

“My wife and I are looking for an advisor to help with equity and options. We are corporate professionals with options/RSUs in …”

“We are in Austin and retiring in a few weeks… selling our business. I would like to schedule a meeting with you and very likely proceed to …”

“I am currently with Edward Jones and wanted to look into a fiduciary or advisory financial planner…”

“I am an engineer at Google. I would appreciate the opportunity to schedule a brief introductory call …”

“I am looking for a fee based financial planner that specializes in real estate.”

“I am a physician with investments in my hospital practice, retirement accounts, real estate, and…”

“We live in CA and have a net worth around $5.5M. Please contact me if you are interested in working with us…”

“I am looking for a flat fee financial advisor. I found your contact information on Wealthtender.”

“I came across your profile and would like to explore working with you for divorce-related financial planning…”

These are real messages from qualified prospects who are contacting financial advisors through their Wealthtender profiles.

Can financial advisors with reviews published on Wealthtender expect to convert more prospects into clients?

Yes. Firms like United Financial Planning Group (showcased in this case study) and advisor testimonials about Wealthtender demonstrate how financial advisors and wealth management firms are converting more prospects into clients with Wealthtender as their digital marketing partner.

We also encourage you to ask the AI tool of your choice how collecting verified client reviews on Wealthtender can improve your conversion rate of prospects into clients. For example, ChatGPT estimates the conversion impact of joining Wealthtender to result in a 2x to 3x lift in the number of your prospects becoming clients.

Here’s the response from a ChatGPT query explaining how collecting client reviews on Wealthtender can significantly improve your prospect conversion ratio.

Prompt: If you had to estimate how much more likely it is for a financial advisor with client reviews published on Wealthtender to convert a prospect into a client over an advisor without a presence on Wealthtender, what would you say?

ChatGPT Response (Summary): While precise data would require access to controlled studies or internal analytics from Wealthtender, we can make an informed estimate based on known marketing and behavioral principles. Estimated Conversion Impact: Financial advisors with client reviews published on Wealthtender are 2x to 3x more likely to convert a prospect into a client compared to those without a presence on the platform. ↗️ View the full response on ChatGPT

How does Wealthtender help advisors and wealth management firms optimize for visibility in search engines (SEO) and AI tools (AEO)?

While SEO (Search Engine Optimization) is a well-established term and a vital component of digital marketing strategies that many financial advisors have implemented over the last decade, optimizing for AI remains an emerging topic that will continue to evolve. While the industry hasn’t yet fully settled on which three letter/word acronym will become the “SEO” of AI-optimization, the term “AEO” (Answer Engine Optimization) is growing in popularity, so that’s how we often refer to optimization in the age of AI. Wealthtender is leading the way for advisors and wealth management firms to optimize their visibility in search engines and AI tools.

Recommended Reading:

- How to Get Found by ChatGPT and AI Search Tools (Wealthtender)

- Answer Engine Optimization (AEO) for Financial Advisors (Wealthtender)

- 3 Ways AI Is Helping Financial Advisors Find and Win Over New Clients (Barron’s)

How Financial Advisors Improve SEO and AEO by Joining Wealthtender

While we have our own opinions on the many ways financial advisors can improve their AEO by joining Wealthtender, we decided to “turn to the source” and ask an AI-tool itself how it believes financial advisors can strengthen their AEO by choosing Wealthtender as their digital marketing partner.

The 8 areas below reflect the response provided by ChatGPT to answer this question, lightly edited for accuracy as we would give ChatGPT a B+ for its original response that required a little touchup in areas it didn’t quite get right.

—

Financial advisors can improve their Answer Engine Optimization (AEO) by joining Wealthtender, a platform designed to enhance their online visibility and credibility. Here’s how joining Wealthtender can help:

1. Build a Strong Wealthtender Profile

- Wealthtender provides SEO-optimized advisor profiles that rank well in search engines.

- Advisors can highlight their specialties, credentials, services, and client focus areas.

- A well-crafted profile increases the likelihood of appearing in Google’s featured snippets and answer engine results.

2. Get Featured in Niche Financial Directories

- Wealthtender categorizes advisors based on their expertise (e.g., tax planning, retirement, small business owners, etc.).

- Being listed in these directories improves search relevance for potential clients searching for financial guidance on specific topics.

3. Answer Frequently Asked Questions (FAQs)

- Wealthtender allows advisors to contribute answers to common financial planning questions.

- These FAQs can appear in Google’s “People Also Ask” section and other search results.

- Well-written answers with keywords and structured responses enhance visibility.

4. Publish Articles and Blog Posts

- Advisors can contribute articles and blog posts to Wealthtender, improving their authority and credibility.

- Search engines prioritize informative, high-quality content, increasing the chances of ranking for financial-related queries.

- Sharing insights on trending topics boosts organic search traffic.

5. Earn Backlinks for SEO Benefits

- Wealthtender provides authoritative backlinks to an advisor’s website, which helps improve its domain authority.

- Search engines rank websites higher when they have quality inbound links from reputable third-party platforms.

6. Encourage Client Reviews and Testimonials

- Positive client reviews on Wealthtender can appear in search results.

- Reviews enhance trust signals for both search engines and potential clients, boosting credibility.

7. Utilize Structured Data for Better SERP Visibility

- Wealthtender uses structured data (schema markup) to improve how profiles and reviews appear in search results.

- This increases the chances of appearing in rich snippets, knowledge panels, and answer engines.

8. Participate in Wealthtender’s Media and PR Opportunities

- Advisors can be quoted in articles and featured in media pieces that Wealthtender distributes.

- Media mentions improve brand recognition and search rankings.

By leveraging Wealthtender’s features, financial advisors can increase their visibility in search engines and answer engines, ultimately attracting more qualified leads and converting more prospects into clients.

What do financial advisors and wealth management firm leaders say about Wealthtender?

I met with a prospect recently who I thought would become a client, but they told me they decided to hire a financial advisor they found on Wealthtender instead. Why would they do this?

It’s frustrating when a promising prospect goes with someone else, especially when you felt the meeting went well. If they chose an advisor from Wealthtender and you haven’t yet partnered with Wealthtender to strengthen your digital marketing strategy, we asked ChatGPT to share a few likely reasons that can help explain why and give you insight into how to better position yourself in the future. Here’s the ChatGPT response:

1. Social Proof & Online Credibility

Wealthtender is a platform designed to give advisors visibility and trust through:

- Verified profiles

- Client reviews/testimonials

- SEO optimization

If the advisor they chose had a strong presence (many positive reviews, media features, or niche specialization), that could have built trust before or after your meeting—even if your pitch was stronger in person.

2. Niche Alignment

Many Wealthtender advisors specialize in niches—like tech employees, physicians, or LGBTQ+ individuals. If the other advisor had clear expertise aligned with their background, that could have tipped the scale.

People are increasingly drawn to “someone who works with people like me.” If your website and messaging are more generalist, they may have felt someone else understood them better.

3. Post-Meeting Comparison Shopping

Even if your meeting went well, they might have gone home, Googled “best financial advisor for [their situation],” and Wealthtender came up. That means you lost the follow-up battle—not just the initial meeting.

4. Transparent Pricing or Service Model

Wealthtender encourages transparency in fees and service models. If the other advisor was more clear (or more affordable) about their fees upfront, the prospect may have felt more confident making a decision.

What You Can Do Now

- Google yourself. What shows up? How do you compare to the top Wealthtender profiles?

- Claim or build your own Wealthtender profile. It’s inexpensive and can help you compete in that same digital space.

- Clarify your niche and value proposition on your website, email signature, and follow-up materials.

- Ask the prospect (graciously) what factored into their decision. You might learn something actionable.

Want to see how individual advisors and leading wealth management firms are successfully using Wealthtender to grow their business? Visit Wealthtender.com/grow or schedule a demo to learn how you can start converting more prospects into clients with the industry’s first digital marketing platform for AI-optimization and compliant online reviews.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.