May 2025: Wealthtender Voice of the Client Study

Every online review published on Wealthtender tells a short story about the impact financial advisors are making in the lives of their clients. In aggregate, thousands of reviews make one thing crystal clear: When invited to share their thoughts, clients of advisors have something to say… and it’s overwhelmingly positive.

A note from our founder:

On May 4, 2021, the Securities and Exchange Commission (SEC) repealed its 60-year prohibition of client testimonials for financial advisors. That same day, Wealthtender launched the first find-an-advisor directory to feature online reviews with accompanying disclosures to satisfy regulatory requirements. Since then, hundreds of advisors and wealth management firms have invited thousands of clients to submit reviews about their experiences working together.

Our team at Wealthtender enjoys front row seats to a digital parade of client testimonials published every day on the profiles of financial advisors across the US. These reviews bolster the reputation of advisors who have worked hard to earn their accolades, setting themselves apart from the 90% of advisors not yet utilizing testimonials¹. More importantly, online reviews provide consumers who are preparing to hire advisors with the peer validation they’re seeking to feel more confident in deciding which advisors will make their short list.

To commemorate four years since the testimonial “prohibition era” ended², we’re excited to share what we’ve learned in this inaugural Wealthtender Voice of the Client Study.

Reading thousands of client stories published on Wealthtender reinforces our conviction about the value of professional advice and the important role financial advisors play in the lives of their clients. In an age where Artificial Intelligence dominates the headlines, it’s reassuring to see the value Americans continue to place on the human experience.

Brian Thorp

Wealthtender Founder and CEO

LinkedIn | brian@wealthtender.com | Join Wealthtender

Footnotes: ¹ Ficomm 2024 Financial Advisor Growth Marketing Study (PDF) | ² Unlike their federally registered counterparts, state-registered financial advisors who operate reputable small businesses in ~25 states remain prohibited by state regulators from inviting their clients to write online reviews that could help consumers make smarter hiring decisions. As I wrote in this NAPFA article, it’s beyond time for these holdout states to follow in the footsteps of the SEC by repealing their prohibition of advisor testimonials. Update: On July 29, 2025, the North American Securities Administrators Association (NASAA) issued a news release seeking public comment on a model rule that could pressure the remaining holdout states to permit advisor use of testimonials.

About This Wealthtender Study

In April 2025, with the fourth anniversary of the SEC Marketing Rule effective date approaching, the Wealthtender team took a deep dive into our treasure trove of financial advisor reviews to uncover new insights, identify common themes, and better understand what clients appreciate most in their advisor relationships.

This study summarizes findings derived from 2,568 online reviews published on Wealthtender between May 2021 and April 2025 for more than 200 financial advisors and wealth management firms across 35 states and the District of Columbia. In our effort to purely capture ‘the voice of the client’, we only included reviews identified as current or former clients of advisors, and excluded reviews submitted by non-clients (e.g., professional acquaintances, friends, centers of influence, etc.).

Below the Key Findings, the study dives deeper into the data, with commentary and charts that include a mix of objective analysis, noteworthy observations, and the opinions of our team.

We look forward to updating this study in 2026 with year over year comparisons and deeper insights made possible as a growing number of advisory firms and national networks embrace online reviews and implement compliant testimonial marketing programs in partnership with Wealthtender. If you have questions about the 2025 study or interest in learning how financial advisors with online reviews are winning business and converting a higher percentage of prospects into clients, please email yourfriends@wealthtender.com.

Republishing Guidelines: You are welcome to republish or reference any part of this Wealthtender study, including embedded graphics. We kindly ask that you include attribution and a link back to the original research.

Key Findings:

86% of reviews convey strongly positive sentiment, underscoring widespread client trust and satisfaction.

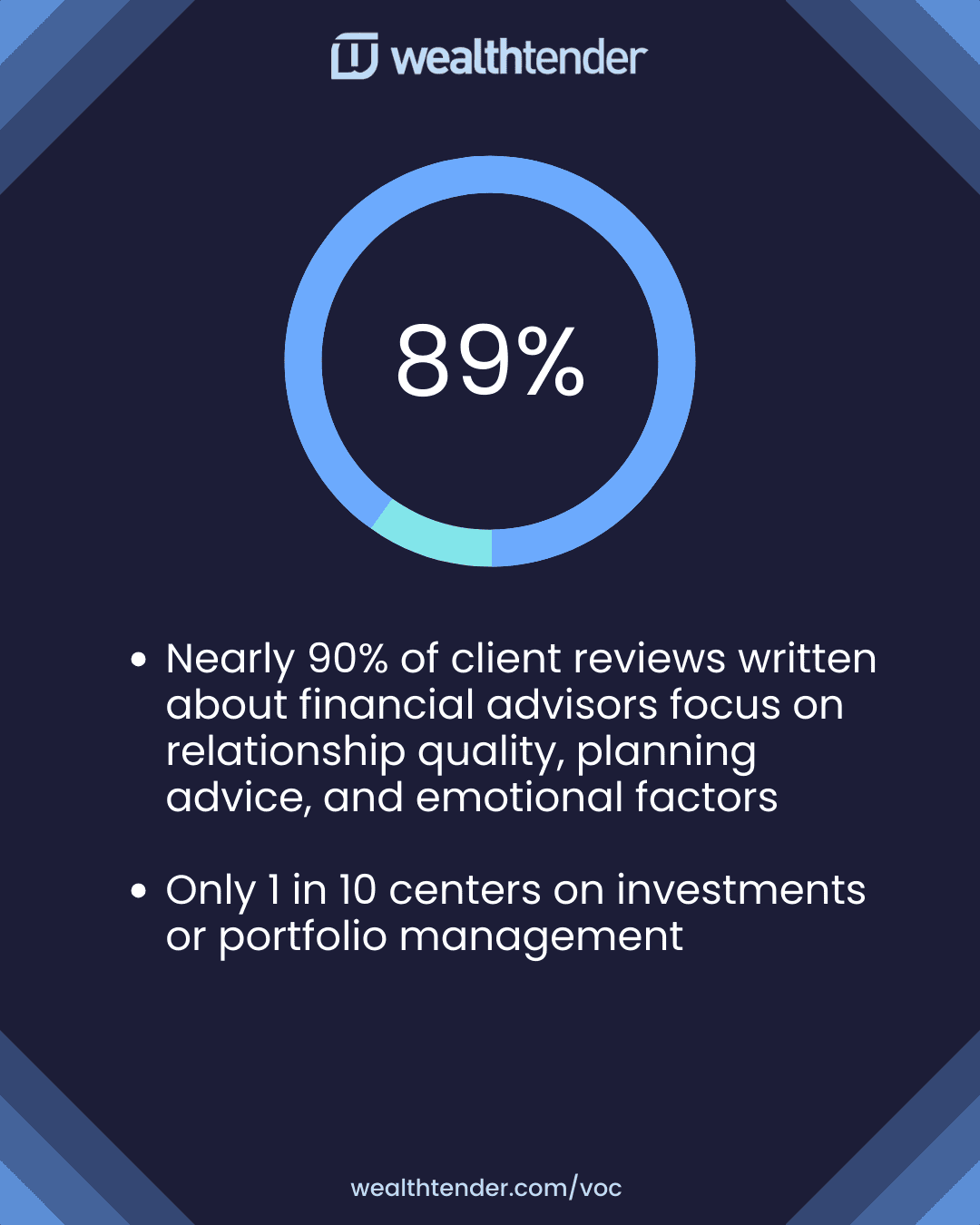

89% of reviews center on relationship quality, planning advice, and emotional factors; just 1 in 10 focus on investments or portfolio management.

Personalized financial planning and long-term relationships rank highest among the services that clients value most from their financial advisors.

Clients use an average of 86 words per review, with many sharing detailed, story-like testimonials, a sign of deep emotional investment.

Trust, communication, and personalization consistently emerge as major drivers of client loyalty and satisfaction.

Client reviews are nearly 25 times more likely to mention an advisor by name than just a firm, reinforcing the personal nature of relationships.

Jump to a Study Section:

- Beyond the Stars: Clients Feel Remarkably Positive About Their Advisors

- More Than Words: Online Reviews Often Tell Short Stories

- It’s About the Plan, Not the Portfolio: Clients Value Activities Linked to Long-Term Goals

- Say My Name: Client Reviews Mention Advisors Much More Often Than Firms

- To Ask or Not To Ask: Why a Proactive Approach to Gathering Online Reviews Matters

- Conclusion: Clients Overwhelmingly Value the Human Side of Financial Planning

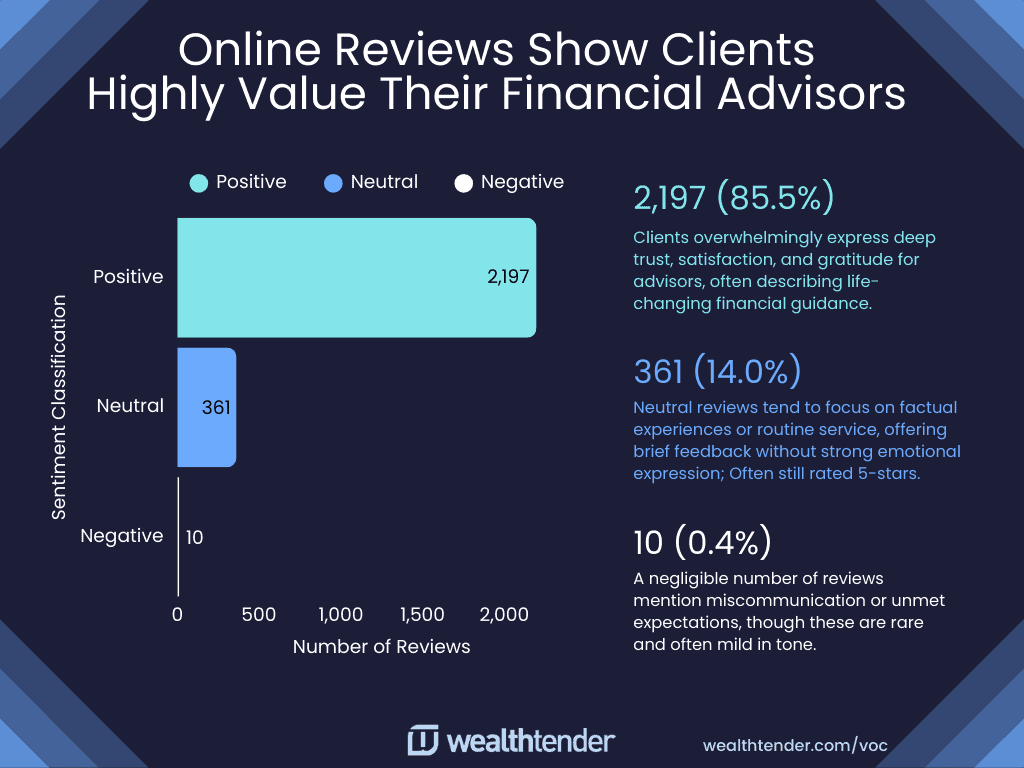

Beyond the Stars: Clients Feel Remarkably Positive About Their Advisors

We’ll be the first to say it – Those gold stars accompanying online reviews play an incredibly important role in strengthening the Search Engine Optimization (SEO) for the advisors and wealth management firms that have earned them; but what matters most to consumers preparing to hire financial advisors is less about the stars and more about the stories.

Online reviews tell stories that help consumers learn firsthand how clients feel about their experiences with financial advisors. For this study, we wanted to look beyond the star ratings to better understand how thousands of clients feel about their financial advisors, utilizing text-based sentiment analysis³ to group each review in one of three classifications: Positive, Neutral, or Negative.

Sentiment Analysis Summary of 2,568 Financial Advisor Reviews:

- Positive Sentiment: 2,197 (85.5%)

- Neutral Sentiment: 361 (14.0%)

- Negative Sentiment: 10 (0.4%)

This sentiment analysis clearly demonstrates that clients feel strongly about the value their financial advisors deliver. Further, it’s interesting to note that most reviews categorized with neutral sentiment received a 5-star rating. While sentiment scoring offers useful insights based on the aggregation of thousands of reviews, we believe it’s important for financial advisors and wealth management firms to evaluate each review on its own merits to truly understand what clients value most. Just below, we’ve included examples of reviews in each sentiment classification.

Positive Sentiment:

The analysis reveals exceptionally positive sentiment, with over 85% of reviews reflecting high levels of satisfaction, trust, and strong emotional connections between clients and their financial advisors. These reviews classified as ‘positive’ often describe advisors as trustworthy partners who bring peace of mind, clarity, and a sense of control over their financial future.

Examples of reviews with positive sentiment:

- “Like many people, my life is complicated. Matt was able to help me with that complicated situation and simplify my financial approach so that it gave me comfort and confidence but did not add to my load. I have been completely satisfied with the service, genuine, caring, and amount of attention Matt has provided. I recommend him with a whole heart. He is worthy of your trust.” (5 Stars)

- “Brett is an experienced advisor that provides me with the tools and guidance so that my retirement goals will be achieved. He provides me with suggestions that will improve the return on my investments as well as advice on moves I should take to avoid probate and make sure my estate plan is complete. Brett is a great resource and is very responsive. I highly recommend Brett!” (5 Stars)

- “Deb pairs her credentials and experience with a genuine interest in our wellbeing. She invested tremendous time listening and learning about our vision for our family’s future. She helped us create a clear plan to achieve our goals and our ongoing collaboration along that path is invaluable.” (5 Stars)

Neutral Sentiment:

Reviews classified as ‘neutral’ (14.0%) tended to be shorter or factual, offering praise without strong emotional language. In some cases, clients mention a shortcoming in their experience that can help financial advisors identify areas for improvement. While the sentiment of these reviews fell short of receiving a ‘positive’ classification, it’s worth noting that a five-star rating accompanies the vast majority of these reviews.

Examples of reviews with neutral sentiment:

- “The onboarding process was organized. Some meetings felt a little rushed, but overall a positive experience.” (5 Stars)

- “My advisor reviewed my 401(k) options and helped me consolidate accounts. Still early in the relationship but a good start.” (5 Stars)

- “The team was very professional and helpful. Planning went smoothly, although some processes were slower than I hoped.” (5 Stars)

Negative Sentiment:

Less than half a percent of reviews were classified as negative, and these were generally mild, focused on communication gaps or service expectations. In fact, we feel this is an area where the sentiment analysis falls short as our manual evaluation of reviews with a negative classification included positive reviews that may have been misclassified based on ‘trigger’ words taken out of context. In rare instances, reviews reflect truly negative sentiment expressing the frustration of former clients.

Example of a review with negative sentiment:

- “While I’d love to give this company 5 stars, they decided to drop me suddenly as a client – arbitrarily and insensitively increasing their minimum portfolio. They also raised their rate / fee for me halfway through our working together. Would not recommend.” (2 Stars)

Sentiment Analysis Key Takeaway:

Clients express considerable satisfaction and feelings of gratitude in their reviews, suggesting that financial advisors should feel proud of their value proposition, the level of trust they have established, and the quality of relationships they have cultivated. Further, these findings reinforce what we fervently believe at Wealthtender – money is an emotional topic, deeply personal, and when trust is established, clients respond with loyalty and advocacy.

³ Sentiment Analysis Methodology

To evaluate how clients feel about their experiences with financial advisors, we applied text-based sentiment analysis to the full body of 2,568 reviews utilizing ChatGPT. Here’s how the analysis was conducted:

Natural Language Processing (NLP) Engine:

We used the TextBlob Python library, a popular NLP tool that evaluates the sentiment of written language by calculating a “polarity score” for each review:

- Polarity Range: -1.0 (most negative) to +1.0 (most positive)

Classification Logic:

Each review was automatically scored and categorized based on its polarity:

- Positive: Polarity > +0.1

- Neutral: Polarity between -0.1 and +0.1

- Negative: Polarity < -0.1

This rule of thumb ensures minor fluctuations in language don’t overrepresent sentiment swings. For instance, a review like “It was okay” would remain neutral, while “I felt confident, supported, and grateful” would clearly register as positive.

Aggregate Insights:

- The majority of reviews (85.5%) scored positive, indicating that most clients feel satisfied or highly appreciative of their advisor relationship.

- Only 0.4% of reviews were classified as negative, reflecting an overall high level of trust and satisfaction among financial advisors across the Wealthtender platform.

- 14.0% of reviews were neutral, typically offering objective or factual commentary without strong emotion.

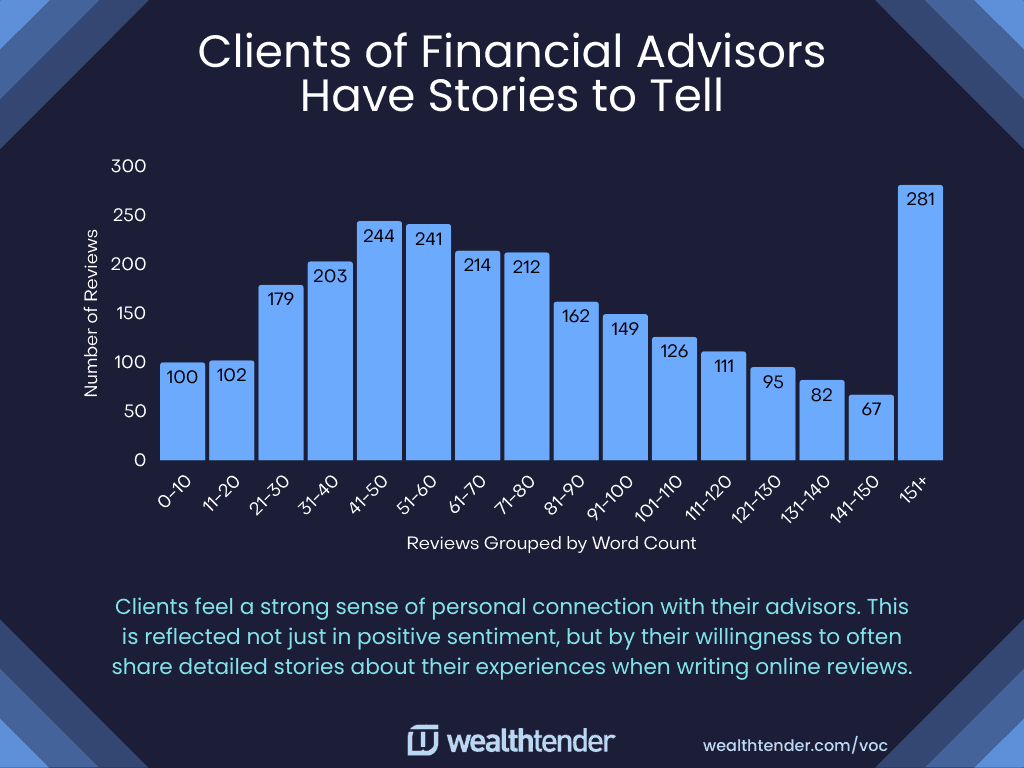

More Than Words: Online Reviews Often Tell Short Stories

Analyzing the word count of financial advisor reviews allows us to understand not just what clients are saying, but how willing they are to share details about their experience.

While reviews under 30 words in length are common and typically express satisfaction succinctly, the majority of reviews fall between 30 and 150 words, suggesting a deeper level of thought and emotional investment. These reviews frequently highlight personalized service, trust, and a partnership focused on long-term outcomes.

Notably, a meaningful number of clients wrote reviews exceeding 150 words, indicating they felt compelled to elaborate on their experiences, often with an emotional tone. This level of engagement reflects more than satisfaction; it reveals that many clients view their advisor relationship as impactful enough to warrant storytelling. The willingness to write thoughtful, in-depth feedback speaks to the strength of advisor-client relationship. The stronger the relationship, the more clients want to share.

Word Count Analysis of 2,568 Financial Advisor Reviews

- Average Word Count: 86 words

- Average Sentence Count: 6 sentences

Here’s what the data reveals:

Depth of Engagement:

- The average review contains 86 words and 6 sentences, indicating that clients are not leaving simple one-line feedback, they’re investing time and effort to reflect on their experiences.

- Reviews with over 150 words make up a meaningful portion of the dataset, showing that many clients feel deeply enough to share detailed, story-like testimonials.

Distribution by Word Count:

- A sizable number of reviews fall in the 21–50 word range, which often includes concise but impactful praise.

- A healthy number land between 51–150 words, offering rich insight into the advisor’s strengths, communication style, and client impact.

- The presence of both very short (under 20 words) and very long (150+ words) reviews shows a spectrum of expression, from brief accolades to emotional stories.

Word Count Key Takeaway:

Many reviews read more like mini case studies or letters of recommendation than simple comments, reflecting the deep trust clients place in their advisors.

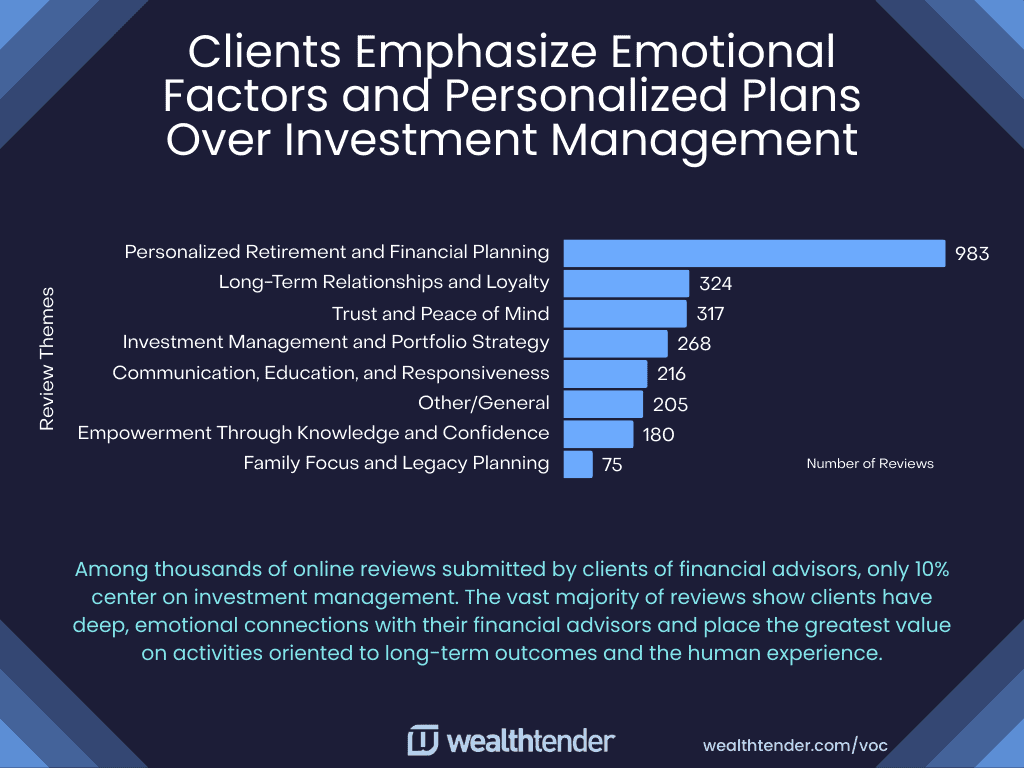

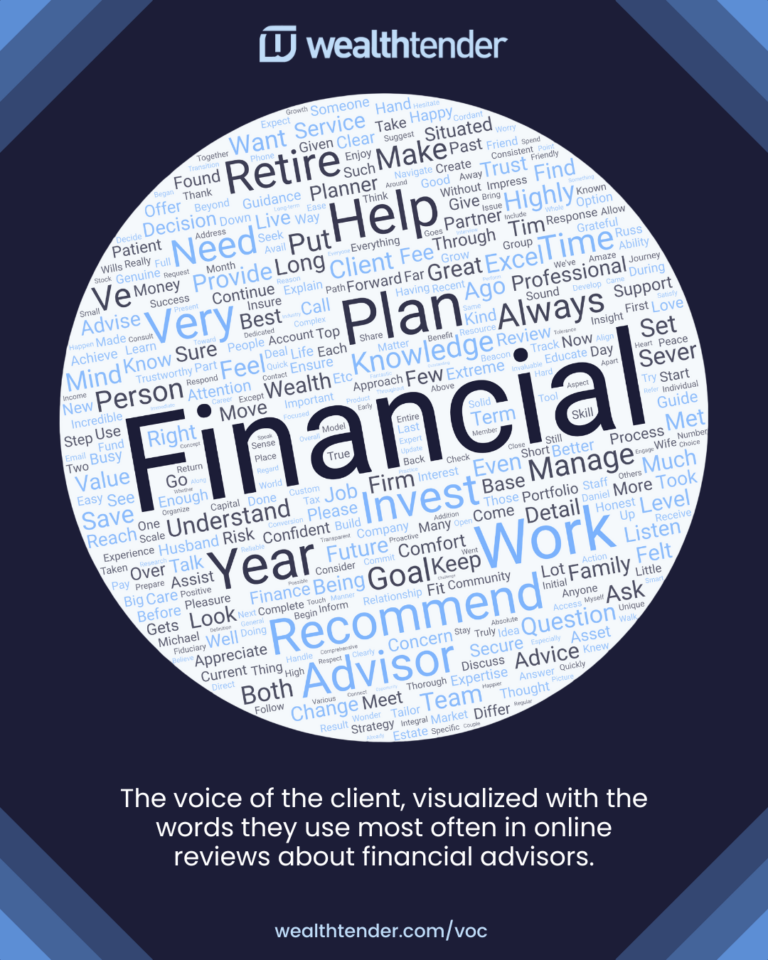

It’s About the Plan, Not the Portfolio: Clients Value Activities Linked to Long-Term Goals

In an effort to understand the topics that clients most frequently discuss when writing reviews about financial advisors, we identified seven distinct themes based on patterns observed in the reviews. While longer reviews may have covered multiple topics, we assigned each review to a single theme based on the dominant emotional and experiential factors expressed by clients.⁴

Online Reviews Organized Into Seven Themes (% of Reviews)

- Personalized Retirement and Financial Planning (38%)

- Long-Term Relationships and Loyalty (13%)

- Trust and Peace of Mind (12%)

- Investment Management and Portfolio Strategy (10%)

- Communication, Education, and Responsiveness (8%)

- Empowerment Through Knowledge and Confidence (7%)

- Family Focus and Legacy Planning (3%)

With just 1 out 10 reviews flagged with investment management or portfolio strategy as a theme, it’s abundantly clear that clients find the greatest value from financial advisors comes from long-term planning services and emotional factors that produce peace of mind.

To provide a deeper understanding of the types of reviews that fit into each of the seven themes, you’ll find excerpts of actual reviews below (with minor edits for brevity and clarity).

Personalized Retirement and Financial Planning (38%)

Clients deeply value advisors who offer personalized, forward-looking financial strategies that align with their unique life goals, preparing them for a confident retirement. The key takeaway is that personalization and proactive planning consistently drive client satisfaction and trust.

- “He has been very helpful in preparing for my retirement and explaining things in a way I can understand.”

- “They have helped me set up a financial plan for retirement that fits my needs and goals.”

- “After working with him, I feel confident in my retirement plan and future financial security.”

- “She explained different retirement options and helped me create a plan to maximize my income.”

- “The guidance we received on 401(k) rollovers and pension planning made our retirement transition stress-free.”

- “They listened carefully to my retirement goals and designed a personalized plan that gives me peace of mind.”

Long-Term Relationships and Loyalty (13%)

Many clients highlight decades-long partnerships with their advisors, emphasizing consistency, loyalty, and trust. The key takeaway is that advisors who stay committed over time earn deeper trust and advocacy from clients.

- “I have been working with my advisor for over 20 years, and I trust him completely.”

- “We’ve been with them for almost 15 years, and their advice has always been solid and dependable.”

- “I have trusted them with my financial planning needs for decades and they have never let me down.”

- “They have been by our side through many market ups and downs for more than 25 years.”

- “Our family has relied on their expertise for two generations, and we couldn’t be happier.”

- “They have helped guide me through life events from buying my first home to planning for retirement.”

Trust and Peace of Mind (12%)

Clients consistently emphasize that trust, and the peace of mind it brings, is a vital factor in maintaining a strong advisor relationship. The key takeaway is that clients seek advisors they can trust with both their money and their future life decisions.

- “I completely trust my advisor to guide me through all stages of my financial life.”

- “He always acts in my best interest and gives me great peace of mind.”

- “They have earned my trust by consistently providing sound advice over the years.”

- “Knowing I have someone who truly cares about my financial well-being helps me sleep at night.”

- “She has my complete trust and has helped me feel secure about my retirement plans.”

- “Their honest and straightforward approach gave me peace of mind during uncertain times.”

Investment Management and Portfolio Strategy (10%)

Clients appreciate advisors who provide thoughtful, strategic investment management, but they value it most when it is tied to their broader life goals rather than just performance metrics. The key takeaway is that clients want investments managed wisely but as part of a bigger, meaningful life plan.

- “They have developed an investment strategy that fits my risk tolerance and retirement timeline perfectly.”

- “My portfolio has been managed with great attention to my personal financial goals.”

- “He always takes the time to explain investment options and why they make sense for me.”

- “They helped me diversify my investments and protect my portfolio during market downturns.”

- “I appreciate that they align my investment plan with both my short-term needs and long-term goals.”

- “Their advice on asset allocation and rebalancing has helped me stay on track even in volatile markets.”

Communication, Education, and Responsiveness (8%)

Clients highly value advisors who are easy to reach, responsive to questions, and proactive in educating them about financial decisions. The key takeaway is that clear communication builds trust and empowers clients to make informed choices.

- “He is always quick to respond to any questions I have, no matter how small.”

- “They take the time to educate me about my financial options in a way that is easy to understand.”

- “I appreciate how clearly they explain complex financial concepts so I can make informed decisions.”

- “Their responsiveness and willingness to answer all of my questions made a huge difference in my experience.”

- “I never feel rushed. They take time to ensure I truly understand every recommendation.”

- “Their consistent communication keeps me informed and reassured, especially during uncertain market conditions.”

Empowerment Through Knowledge and Confidence (7%)

Clients appreciate advisors who help them feel more knowledgeable, in control, and empowered about their financial lives. The key takeaway is that clients don’t just want advice, they want to grow their own confidence and understanding.

- “They have given me the confidence to manage my financial future independently.”

- “Thanks to their guidance, I feel empowered to make smarter financial decisions.”

- “I now have a clear understanding of my investments and feel much more confident discussing my finances.”

- “They encouraged me to learn about my options rather than just telling me what to do.”

- “After working with them, I feel knowledgeable enough to ask better questions and be more involved in my financial planning.”

- “They empowered me by teaching me how my financial plan works instead of keeping me in the dark.”

Family Focus and Legacy Planning (3%)

Clients express immense gratitude toward advisors who help them protect their family’s future and plan meaningful legacies for generations to come. The key takeaway is that clients value advisors who understand that wealth planning is ultimately about family, not just finances.

- “They helped us set up an estate plan to ensure our children will be taken care of.”

- “Our advisor guided us through planning for our family’s future generations with care and understanding.”

- “I feel confident that my family’s financial security is protected thanks to the planning we’ve done together.”

- “They made the complicated process of legacy planning simple and manageable for our family.”

- “We were able to create a trust for our grandchildren with their expert guidance.”

- “Their thoughtful approach made sure that our family values are reflected in our financial plans.”

Review Themes Key Takeaway:

The results of this analysis reinforce that clients value financial advisors who instill confidence in their ability to achieve long-term goals and reflect meaningful relationships built on a foundation of trust. Notably, only 10% of clients emphasized ‘investment management’ in their reviews, implying what clients value most about their financial advisors is a reflection of the human experience and emotional factors, not asset allocation or portfolio strategy perhaps now considered as commoditized and table stakes, especially among mass affluent Americans.

⁴ Review Theme Methodology

The top client themes were identified through a multi-step categorization process designed to extract meaningful insights from the narrative content of client reviews:

1. Initial Text Preparation

- Each client review was cleaned and standardized.

- Basic formatting issues were resolved (punctuation, spacing) without altering client meaning.

2. Keyword and Phrase Exploration

- Common words, phrases, and emotional tones were reviewed.

- Natural Language Processing (NLP) keyword techniques were lightly referenced (like frequency counts), but human reading was primary to capture nuance beyond just word frequency.

3. Theme Development

- Based on patterns observed in the reviews, seven broad themes were defined to capture the human-centered dimensions of client feedback:

- Trust and Peace of Mind

- Personalized Retirement and Financial Planning

- Communication, Education, and Responsiveness

- Investment Management and Portfolio Strategy

- Family Focus and Legacy Planning

- Long-Term Relationships and Loyalty

- Empowerment Through Knowledge and Confidence

These themes were validated to ensure they were:

- Mutually exclusive as much as possible (each review fits best into one dominant theme)

- Collectively exhaustive (together covering all meaningful client experiences)

4. Review Categorization

- Each review was manually evaluated for dominant thematic content.

- Reviews were assigned to the theme that best reflected the primary emotional or practical takeaway from the client’s perspective.

- If a review referenced multiple areas, the most emotionally emphasized theme was prioritized.

5. Data Aggregation and Charting

- The number of reviews assigned to each theme was tallied.

- Results were presented in a simple bar chart showing the relative frequency of each theme across all client reviews.

Introducing Wealthtender Voice of the Client Awards™

Introducing Wealthtender Voice of the Client Awards™

The first award program to celebrate financial advisors and wealth management firms with consistently exceptional client reviews.

Say My Name: Client Reviews Mention Advisors Much More Often Than Firms

When clients mention names in their reviews, they are nearly 25 times more likely to highlight an advisor than just a firm, reinforcing the value clients place on personal relationships.

Of course, financial advisors typically serve as the face of the firms they represent, so positive accolades about an advisor imply a favorable opinion of their firm, too.

Regardless, we feel it’s especially noteworthy for wealth management firm leaders to consider how proactive campaigns to gather client reviews can elevate the online reputation of individual advisors who do often serve as the face of the brand. Just as consumers write reviews much more frequently about the professionals they work with over the firms that employ them (e.g., consumers write reviews about doctors, not hospitals; lawyers, not law firms), it’s not surprising that clients write reviews about the financial advisors they work with, not the advisory firms that employ them.

This observation shouldn’t diminish the importance of wealth management firms to build brand awareness and maintain a pristine reputation in the communities they serve. Rather, this suggests wealth management firms that treat their advisors as brand ambassadors and encourage them to establish a strong online presence that includes a healthy mix of client reviews can position their advisors to win a disproportionate percentage of business over advisors without online reviews and/or who work at firms that only collect ‘firm’ reviews.

While smaller advisory firms with clients who know the entire team can centralize the function of inviting clients to write reviews and still expect deeply personal feedback, larger wealth management firms that want to optimize their testimonial collection strategy should have advisors send review invitations to clients individually. This personal touch will generate a higher response rate and result in clients sharing more emotional stories and detailed experiences. Firms can then aggregate and curate individual advisor reviews to promote at the corporate level to both humanize their brand and reinforce their company culture.

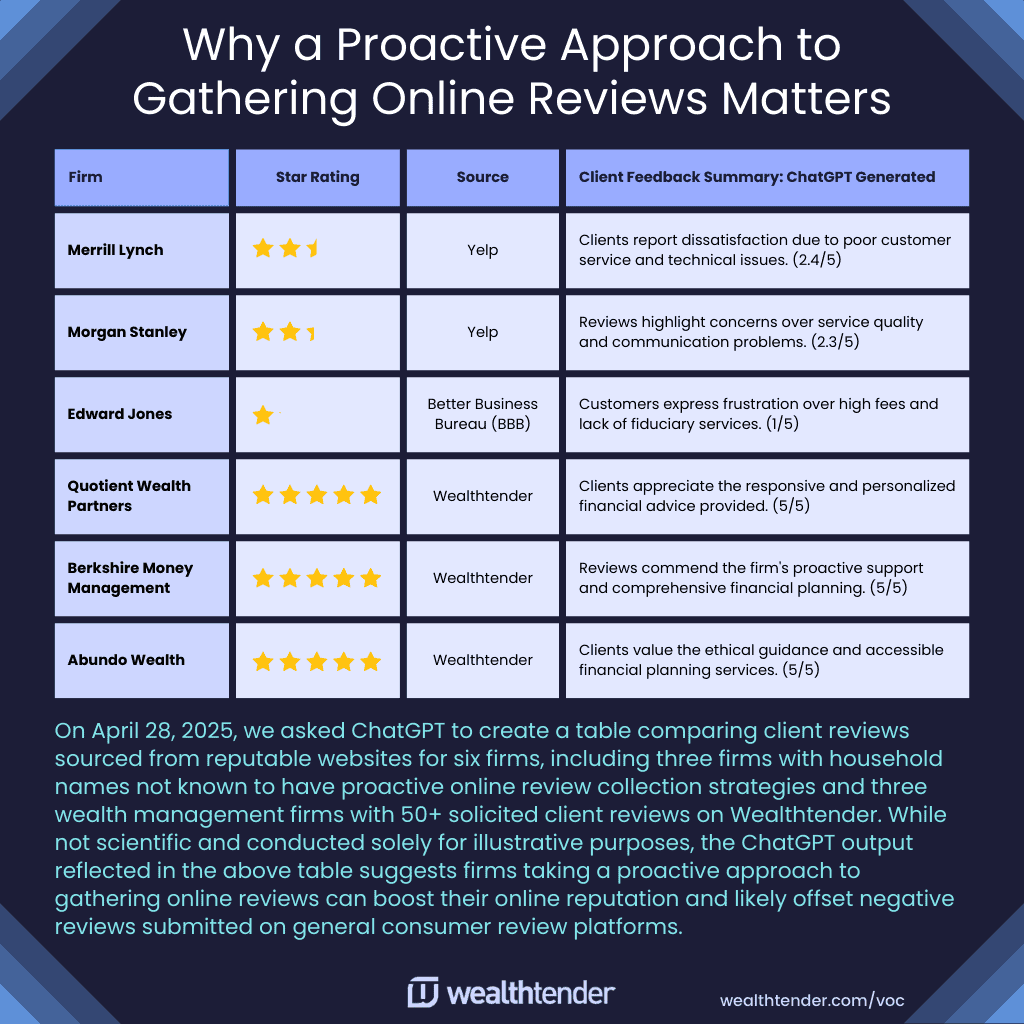

To Ask or Not To Ask: Why a Proactive Approach to Gathering Online Reviews Matters

Since the first online review platforms began to appear in 1999, consumers have turned to the internet to express their opinions about products and services. For many consumers with grievances to share, writing online reviews to vent their frustrations about businesses represents one of the most popular and potentially effective ways for their voices to be heard.

Large financial institutions have experienced this firsthand, with a mix of both legitimate complaints and bogus rants resulting in very low consumer ratings on review platforms that appear prominently in search results. Wealth management firms with household names have experienced this as well, typically with an average rating close to the lowest end of the range.

While the SEC Marketing Rule (in combination with related FINRA guidelines) opened the door for regulated advisory and brokerage firms to offset this negativity by taking a proactive approach to gather online reviews from current clients likely to share positive sentiments, we have yet to see the largest firms embrace the opportunity.

Beyond damaging consumer brand perception and weakening SEO (as illustrated in the graphic below), a lack of positive reviews attributable to the advisors at these firms is now resulting in lost business.

Smaller advisory firms and national RIAs proactively collecting online reviews and implementing testimonial marketing strategies are tilting the playing field in their favor and winning business over advisors whose home offices don’t yet permit them to gather client reviews. Anecdotal feedback we’re hearing from advisory firms like this RIA in New York demonstrates the power of social proof to steer prospects into the arms of advisors with positive client reviews over well-established national firms whose advisors lack client feedback online.

Conclusion: Clients Overwhelmingly Value the Human Side of Financial Planning

Our inaugural Voice of the Client Study paints a bright picture for the future of the financial planning profession and illuminates what really matters most to clients: trusted relationships with financial advisors who provide the guidance needed to achieve long-term goals with emotional support that results in greater peace of mind.

Across 2,568 online reviews, clients overwhelmingly expressed deep appreciation for advisors who prioritize long-term planning, communication, and the human side of wealth management over investment strategy and portfolio management, suggesting the latter represent table stakes perhaps viewed as commoditized among mass affluent Americans.

Client reviews frequently read like short stories, describing highly personal experiences and reflecting strong emotional feelings they hold about their relationships with advisors. Advisors who take the time to understand personal goals, communicate openly, and build lasting trust are not only earning higher client satisfaction but also inspiring loyalty and advocacy.

Moreover, the findings demonstrate that financial advisors themselves, not just the firms they represent, are at the center of client loyalty and praise. Clients mention their advisor by name nearly 25 times more often than the firm, reinforcing the critical role individual relationships play in a client’s perception of value and satisfaction. Leaders of wealth management firms who recognize their advisors as brand ambassadors can increase the quantity and quality of client reviews by implementing an online review collection strategy at the advisor level and enjoy a more impactful testimonial marketing program at the firm level.

With more than 80% of consumers stating that online reviews play an “important” or “very important” role when evaluating financial service providers⁵, wealth management firms that empower their advisors to proactively gather and showcase authentic client feedback are gaining a clear competitive advantage, while larger institutions that delay embracing these strategies risk falling behind. Further, as the next generation of Americans embraces artificial intelligence in their advisor evaluation process, wealth management firms should consider how their online reviews published on reputable third party platforms can improve their rankings and visibility in popular tools like ChatGPT.

Looking ahead, Wealthtender remains committed to partnering with financial advisors and wealth management firms interested in strengthening their digital marketing strategy with a compliant online review collection and testimonial marketing strategy.

We are excited to update this study in 2026 with even deeper insights, as more advisors and firms embrace testimonial marketing and as online reviews become an increasingly integral part of the advisor selection process for millions of American consumers.

We asked ChatGPT to write one hypothetical review that best summarizes the experiences shared across our dataset of 2,568 reviews. Here’s what it suggested:

“Working with my advisor has been one of the best decisions I’ve made for my financial future. They took the time to truly understand my goals and created a personalized plan that gave me clarity and peace of mind. Throughout the ups and downs of life and the markets, they have been a steady and trusted guide. I appreciate their responsiveness whenever I have questions and the way they explain complex topics in simple terms. I feel empowered, confident, and excited about what lies ahead.”

Join the digital marketing platform rated extraordinary by advisors.

– T3 Advisor Software Survey, 2023 & 2024

Convert more prospects into clients with the industry’s first online reviews platform designed for SEC compliance and #1 find-an-advisor website.

Join hundreds of financial advisors and wealth management firms that choose Wealthtender as their digital marketing partner.

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.

“Wealthtender is one of the best decisions we have made as a firm. I wish we had done it sooner.”

Gerry Barrasso

President, United Financial Planning Group