To maximize the marketing potential of online reviews and minimize regulatory risk, financial advisors and wealth management firms should carefully compare the features of Wealthtender Reviews vs. Google Reviews when deciding which platform(s) to use. In this guide, you’ll find a side-by-side feature comparison and analysis to help you implement an impactful and compliant testimonial marketing strategy for your firm.

It goes without saying that online reviews and client testimonials are powerful marketing assets. But not all review platforms are created equal, especially when navigating the regulatory requirements that govern advisor marketing. Beyond regulatory matters, the rapid adoption of AI tools like ChatGPT used by consumers to find and research advisors has shifted traffic away from Google Reviews to reputable, independent review platforms like Wealthtender.

Today, the question isn’t whether financial advisors and wealth management firms should gather and publish online reviews; it’s where you should collect them and how you should promote them to maximize impact while staying compliant.

This article compares Wealthtender Reviews (Certified Advisor Reviews™) and Google Reviews head-to-head to help you make an informed decision about which platform deserves your time, energy, and marketing dollars.

A Side-by-Side Comparison of Wealthtender and Google Reviews

| Feature | Wealthtender (Certified Advisor Reviews™) | Google Reviews |

|---|---|---|

| Regulatory Compliance | ✅ Every published review displays the three clear and prominent disclosures required by the SEC Marketing Rule for testimonials and endorsements, with flexibility to include additional FINRA disclosures when/if applicable. | ❌ Reviews automatically published upon submission without disclosures and no ability to prevent prohibited content or misstatements of facts from being published; Limited ability to request removal of problematic reviews. |

| Firm Compliance | ✅ Flexibility to align review collection and publication workflows with firm policies and procedures | ❌ No ability to control who can submit reviews or what gets published |

| Ability to Promote Reviews | ✅ Reviews can be promoted compliantly across advisor websites, social media, and marketing materials with tools provided by Wealthtender | ❌ Cannot tell prospects to “check out our Google Reviews” without triggering adoption/entanglement regulatory risk |

| Personal vs. Firm Visibility | ✅ Amplifies both individual advisor AND firm reputation in search results and AI tools | ❌ Reviews only appear when searching firm name, not individual advisor names; Negligible visibility in AI tools |

| AI-Powered Discovery | ✅ Reviews accessible and frequently cited by ChatGPT, Gemini, Perplexity, Claude, and other AI tools | ❌ Limited visibility in AI-powered search tools; Google’s own AI tool, Gemini, doesn’t fetch Google Reviews (as of November 2025) |

| Industry Recognition | ✅ Eligible for Wealthtender Voice of the Client Awards™ that strengthen SEO and AEO (Answer Engine Optimization (AEO) | ❌ No industry-specific awards or recognition programs |

| Review Import/Export | ✅ Import tool converts Google Reviews into Wealthtender Certified Advisor Reviews that can be compliantly published and promoted | ❌ No integration with third-party platforms, though Wealthtender Reviews often appear in ‘Reviews from the Web’ section of Google Business Profiles |

| Marketing Tools | ✅ Testimonial Marketing Studio and website widgets make it easy to compliantly promote testimonials | ❌ No marketing tools or compliant display options |

| Search Engine Visibility | ✅ Appears in Google, Bing, and all major search engines, sending positive trust signals to help advisors rank higher | ⚠️ Useful for Local SEO; Only appears in Google search results specific to the firm name, not individual advisors |

| Content Control | ✅ Review approval and modification process ensures red flag issues such as promissory language and misstatements are easily addressed and rectified | ❌ No ability to edit or approve reviews before publication; Limited ability to request review removal |

| Client Privacy | ✅ Individuals submitting reviews on Wealthtender choose how they want their name to appear publicly, including the option to be publicly anonymous; Advisors always maintain the ability to easily anonymize or semi-anonymize client names | ⚠️ Google Reviews often display a client’s full name, because most Americans use their full name as the public name used by Google; With your client list publicly visible, risks of scams exploiting this information increase and your clients could be targeted by other businesses |

| Best For | Financial advisors and wealth management firms that want a compliant solution to collect online reviews and promote testimonials with optimal SEO/AEO benefits. | Financial advisors and wealth management firms comfortable with uncertain regulatory risk and confident in their ability to withstand regulatory scrutiny. |

Why Wealthtender Reviews Outperform Google Reviews for Financial Advisors

1. Built-In Regulatory Compliance

A fundamental difference between Wealthtender Reviews and Google Reviews is regulatory compliance. Google Reviews simply weren’t designed with the SEC Marketing Rule or FINRA requirements in mind, which creates a fundamental problem for financial advisors and wealth management leaders. On the other hand, Wealthtender’s online review platform was purpose-built for regulatory compliance to ensure CCOs and compliance professionals can sleep well at night.

The Wealthtender Advantage: Every review published on Wealthtender includes the clear and prominent disclosures required by the SEC Marketing Rule when promoting testimonials, plus the flexibility to display additional disclosures as warranted (e.g., to comply with FINRA and/or to satisfy firm policies and procedures).

The Google Problem: Google Reviews lack regulatory disclosures, which means they fail to meet SEC Marketing Rule requirements for promoted testimonials. Whether you receive unsolicited Google Reviews or you’re inviting clients to submit reviews on your Google Business Profile and comfortable with the potential regulatory risk, you can’t actively promote Google Reviews or direct prospects to view them without risking “adoption” or “entanglement”, regulatory terms that trigger compliance obligations and heightened scrutiny. (Isaac Mamaysky, Partner of Potomac Law Group, elaborates on why this scenario is problematic in this December 2025 Kitces Guest Post.)

In practical terms, this means you can’t say to a prospect: “Go check out our reviews on Google.” But you can confidently say: “Visit my Wealthtender profile to see what my clients are saying about working with me.”

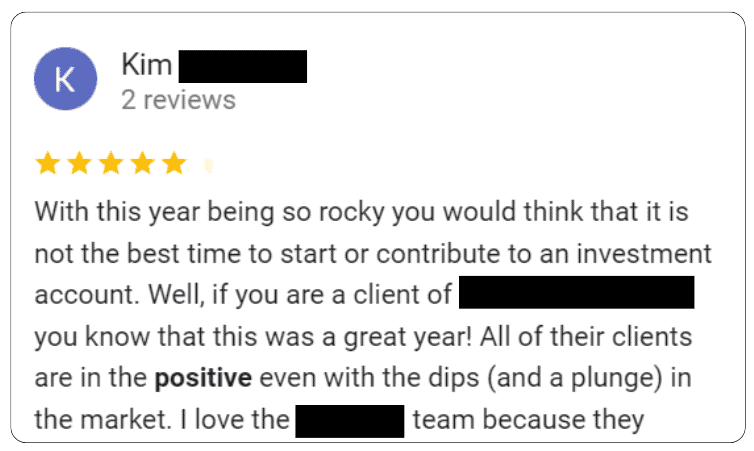

Here’s a real-life example of a Google Review written by a well-meaning client about the wealth management firm she works with in Georgia:

To be clear, the advisory firm that received this review has many positive reviews on its Google Business Profile and appears to be a reputable firm that likely delivers valuable services to its clients. But while the client who wrote the above review had good intentions, her review includes language that appears both promissory and unsubstantiated.

2. Promote Your Reviews with Confidence

What good are glowing client testimonials if you can’t actually use them in your marketing? This is where the Google Reviews platform fundamentally falls short for financial advisors.

The Wealthtender Advantage: Because Wealthtender is designed with a compliance-first approach, you can confidently promote your reviews to prospects using tools offered by Wealthtender that incorporate the features and disclosures required to do so. For example, Wealthtender makes it easy to promote your testimonials on social media, in newsletters, on flyers, in prospect presentations and printed postcards using designs created in Wealthtender Testimonial Marketing Studio with just a few clicks. And with Wealthtender review widgets, it’s simple to display your reviews compliantly on your website homepage, advisor bio pages, and a dedicated testimonials page.

The Google Limitation: Due to the absence of regulatory disclosures, Google Reviews exist in a kind of marketing limbo. They help with local SEO when prospects use Google to lookup your firm name or search Google for a nearby advisor, but you can’t proactively direct attention to them or incorporate them into your marketing strategy. This severely limits their utility as marketing assets. For advisory firms with reviews on Google, Wealthtender’s Google Review import tool offers a streamlined workflow to add disclosures and convert them into compliant testimonials.

For advisors who invest time and effort in collecting client feedback, the ability to actually use testimonials in marketing activities isn’t just a nice-to-have, it’s essential for generating ROI on your testimonial marketing efforts.

3. Amplify Your Personal Brand, Not Just Your Firm

Here’s a reality that Google Reviews fails to address: consumers primarily search for financial advisors by individual name rather than firm name, especially when they’ve received a personal referral or seen an advisor speaking at an event. In fact, 83% of consumers said in an August 2025 survey of 500 Americans the first thing they plan to do after receiving a referral to a financial advisor is to look for online reviews about that individual specifically.

For this reason alone, it’s crucial for financial advisors to recognize that the role they play in the lives of their clients is analogous to other trust-based professions like doctors and lawyers where consumers don’t seek out reviews of hospitals and law firms, they go online to read reviews about the individual professionals with whom they’re looking to decide if they’re a good fit based on personality and emotional factors.

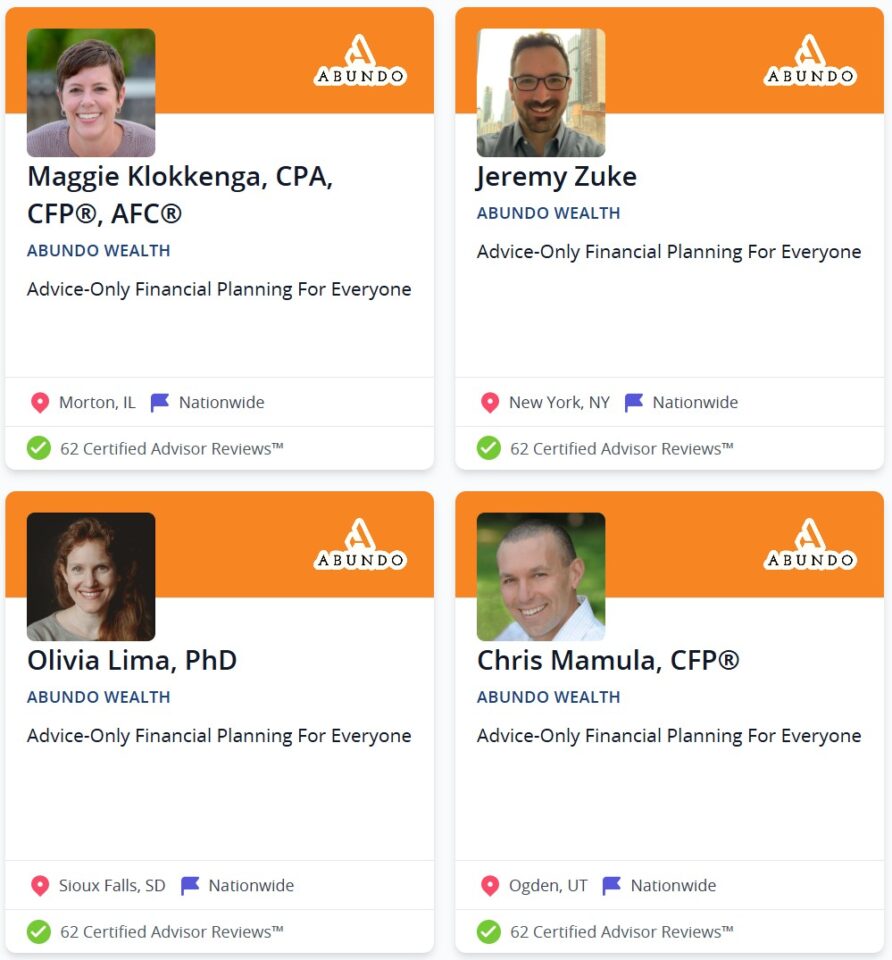

The Wealthtender Advantage: With Wealthtender profiles, your reviews appear in both traditional search engines and AI tools whether someone searches for your name or your firm name. This dual visibility is powerful, and it’s not just limited to searches conducted within the Google ecosystem. A prospect who hears about “Emily Johnson at XYZ Wealth Management” will find Emily’s reviews when searching for “Emily Johnson financial advisor”, not just when searching for “XYZ Wealth Management.”

Additionally, firms that activate Wealthtender’s Review Sync feature can amplify reviews across all advisor profiles, creating a multiplier effect. One review can strengthen visibility for both the firm and every advisor who is part of that firm’s Wealthtender presence.

Learn More About Wealthtender Review Sync™

Advisory firms that join Wealthtender have the option of activating the Wealthtender Review Sync feature to amplify the reach and impact of their firm’s online reviews.

Whether imported from Google Reviews, or collected via their Wealthtender advisory firm profile, activating Review Sync means each incoming review (after the addition of disclosures) is shown on each advisor’s profile on Wealthtender.

The benefits don’t stop there. When prospective clients search Google for your firm name or the name of any advisor at your firm who is featured on Wealthtender, your gold stars appear in search results for your firm and each of your advisors, strengthening SEO and ensuring your firm and advisors stand out from the crowd.

(Prefer to let each advisor collect and display reviews individually on their profiles? That’s fine, too.)

The Google Limitation: Google Reviews are tied exclusively to a Google Business Profile, which should appear when someone searches for your firm’s exact business name, but if a prospect searches for you as an individual advisor, your Google Reviews could be invisible. This is a significant blind spot in personal brand building for advisors.

4. Future-Proof Your Reviews for the AI Era

The way consumers find and research financial advisors is evolving rapidly. While Google remains a popular tool for browsing the web, when it comes to making more informed decisions online, AI-powered tools like ChatGPT, Perplexity, and Gemini are quickly becoming leading platforms where people turn not to browse, but to buy.

The Wealthtender Advantage: Wealthtender reviews are indexed by search engines that power AI tools, making your reviews far more likely to appear when prospects use ChatGPT or similar platforms to find and research financial advisors. And testimonials published on business websites carry less credibility with AI tools that understand the inherent positive bias often prevalent with self-published testimonials. This means your reviews published on Wealthtender, recognized as a reputable third-party review platform, are viewed by AI tools as more credible and balanced, increasing your likelihood of ranking higher and more frequently in answers generated to consumer queries.

Furthermore, financial advisors and wealth management firms that qualify for Wealthtender’s Voice of the Client Awards benefit from additional trust signals used by AI algorithms to identify you as a trusted, highly-rated advisor. As AI continues to reshape how prospects discover advisors, having reviews on a platform that’s optimized for AI discovery isn’t just smart, it’s essential.

The Google Limitation: While Google Reviews may eventually be accessible to AI tools, they currently have limited visibility in AI-powered search environments, including Google’s own Gemini AI platform (as of November 2025).

5. Gain Industry Recognition with Voice of the Client Awards

Beyond individual reviews, Wealthtender offers a unique opportunity for advisors to gain broader industry recognition through its Voice of the Client Awards.

The Wealthtender Advantage: Advisors and firms that meet award eligibility requirements can accept their Voice of the Client Award(s) that are coded with award schema on Wealthtender profiles to boost visibility in AI overviews and traditional search engines. These awards serve as powerful trust signals that differentiate you from competitors and provide third-party validation of the exceptional client experience you deliver.

The awards also generate additional SEO/AEO benefits, media opportunities and ample ways to compliantly promote Voice of the Client Awards, amplifying your reputation beyond individual client testimonials. For advisors looking to stand out in competitive markets, this recognition can be a significant differentiator.

The Google Reality: Google Reviews offer no equivalent industry recognition or awards program. While businesses might accumulate a high rating, there’s no mechanism to translate that into broader industry recognition or visibility in AI-powered search results.

6. A Combination Approach: Import Google Reviews to Wealthtender

For advisors who have received Google Reviews and firms comfortable inviting clients to submit reviews on Google, Wealthtender offers a useful solution to unlock their value: the Google Reviews import tool.

The Wealthtender Advantage: By importing existing Google Reviews to Wealthtender, they’ll first go through a compliance review process where you can add required regulatory disclosures. Once completed, these reviews become fully compliant testimonials you can promote across all your marketing channels. This combination approach offers the local SEO benefits of Google Reviews, plus the ability to actually use those reviews in your marketing with confidence.

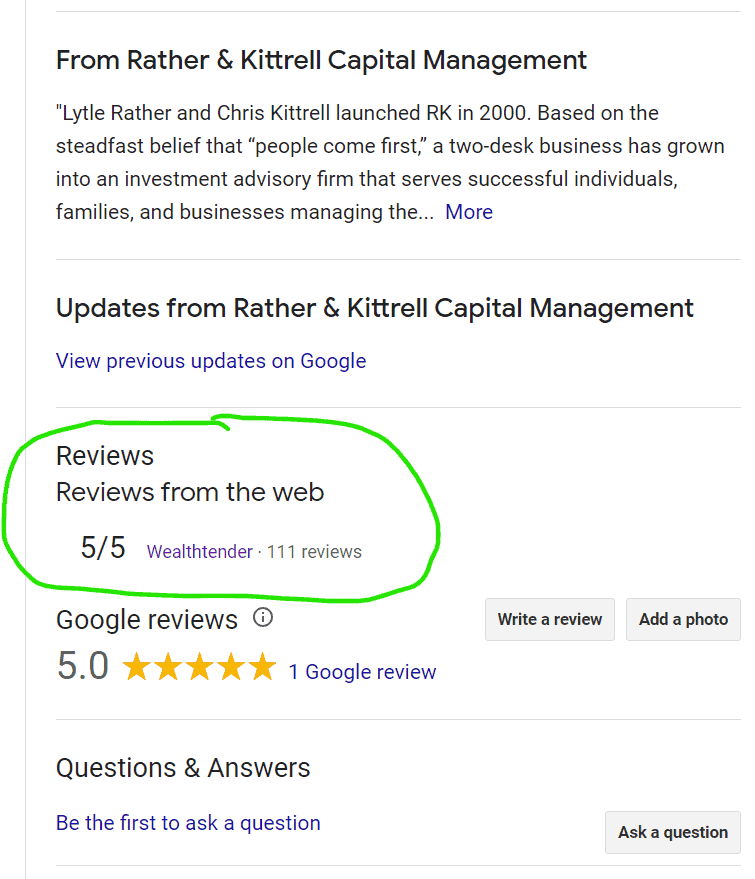

The Google Limitation: On the flipside, Google doesn’t offer reciprocal integration of third-party reviews from platforms like Wealthtender to become “Google Reviews”. However, while Wealthtender Reviews cannot be exported to Google, Google Business Profiles often include a ‘Reviews from the Web’ section to spotlight the reviews a business has earned on reputable, independent platforms, including Wealthtender. For firms and compliance teams that choose not to solicit Google Reviews, this provides an alternative means to gain recognition for reviews on a Google Business Profile without causing regulatory anxiety.

7. Professional Testimonial Marketing and Management Tools Designed for Advisors

Collecting reviews is only the first step. The real value comes from effectively displaying and promoting those reviews to attract new clients.

The Wealthtender Advantage: Wealthtender provides a comprehensive suite of marketing tools specifically designed for financial advisors:

- Website Widgets: Embed compliant review displays directly on your website with customizable elements to match your brand

- Testimonial Marketing Studio: Create professional graphics and videos featuring client testimonials using done-for-you templates

- Review Management Dashboard: Monitor, approve, and manage all reviews from a single interface

These tools transform reviews from static testimonials into dynamic marketing assets that work across every stage of your client acquisition funnel.

The Google Limitation: Google provides no marketing tools beyond the basic display of reviews on your Google Business Profile. There are no widgets, no compliant promotional templates, and no tools to help you leverage reviews in your broader marketing strategy. The reviews exist in isolation on Google’s platform, making them difficult to integrate into a comprehensive marketing approach. While third-party vendors offer widgets for businesses to display Google Reviews on websites, they aren’t designed for the wealth management industry and lack the compliance features necessary for use by financial advisors.

Choose the Right Review Platform(s) To Compliantly Grow Your Business

While Google Reviews may have a place in your digital presence, particularly unsolicited testimonials that don’t open the door to regulatory scrutiny, they simply cannot compete with Wealthtender as a strategic marketing platform for financial advisors.

Wealthtender was built from the ground up specifically for financial advisors, with every feature designed to address the unique challenges you face in marketing your services compliantly and effectively. From built-in regulatory disclosures to AI-optimized visibility and professional marketing tools, Wealthtender transforms client testimonials from passive reviews into active marketing assets that drive business growth.

If you’re serious about leveraging client testimonials to grow your advisory practice while staying on the right side of regulators, Wealthtender is the platform that delivers results.

Want to see how individual advisors and leading wealth management firms are successfully using Wealthtender to grow their business? Visit Wealthtender.com/grow or schedule a demo to learn how you can start converting more prospects into clients with compliant testimonial marketing.

Wealthtender offers the industry’s first financial advisor review platform designed for regulatory compliance.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.