Key Takeaways:

- Online reviews written by your clients tell stories about the positive impact you’re making in their lives as their financial advisor.

- Prospective clients are eager to hear these stories to increase their confidence in hiring you as their advisor.

- The SEC Marketing Rule provides the framework for advisors to compliantly promote client testimonials.

- Wealthtender helps financial advisors and wealth management firms succeed with compliant testimonial marketing to convert more prospects into clients.

For financial advisors and wealth management firms collecting reviews on Wealthtender, the reviews displayed on your profiles are automatically shared with search engines like Google and Bing, sending positive trust signals to their algorithms and helping you rank higher in search results. And for the next generation of prospects turning to AI tools like ChatGPT, your reviews go to work for you there, too. All without you having to lift a finger.

In this article, we’ll show you additional ways to promote your client testimonials online (and offline) to convert more prospects into clients, all while maintaining compliance with the SEC Marketing Rule.

Why It’s Important to Promote Your Online Reviews and Client Testimonials to Grow Your Business

Consumers looking to hire professionals in trust-based professions (e.g., doctors, lawyers, financial advisors) want to know they’re making the right decision. Your online reviews provide consumers with the social proof they need to choose you over another financial advisor. In fact, a popular online review platform for lawyers found that lawyers with at least five reviews achieved four times the engagement compared to lawyers with just one review.

If you decide not to make online reviews part of your firm’s marketing strategy, another financial advisor nearby or in your niche with several positive reviews is more likely to get the call. But not to worry! With the tips in this article combined with the Wealthtender Online Reviews Playbook, you’re well ahead of the curve and ready to amplify the reach of your online reviews and their powerful ability to convert more prospects into clients.

And remember, even a single online review can turn a prospect into a client.

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Promoting Your Online Reviews and Testimonials Compliantly

When you encourage prospects to read your reviews online, you trigger the SEC Marketing Rule prohibitions and disclosure requirements. Specifically, the rule states that once you have ‘explicitly or implicitly endorsed or approved the information [e.g., an online review] after its publication’, you have adopted the review, thus making it an advertisement subject to the rule’s conditions.

Keep these requirements and tips in mind to compliantly promote your online reviews and testimonials:

- Only provide prospects with links to your online reviews where accompanying SEC-required disclosures are present (e.g., your profile page on Wealthtender or on your website using an embed widget from Wealthtender, or with disclosures manually added to your site)

- Be sure each review includes all necessary clear and prominent and additional disclosures (these are the disclosures that always appear with every review on Wealthtender)

Unlocking Online Reviews Trapped on Google

Google Reviews are popular and well-known among consumers. Financial advisors may already have unsolicited reviews written about them and displayed on their Google Business Profiles. Assuming these are favorable reviews and unsolicited, that’s terrific, as advisors are gaining SEO (search engine optimization) benefits and visibility among consumers.

However, because reviews on Google lack the required SEC disclosures to be considered advertisements (e.g., testimonials that advisors can promote to grow their business), advisors can’t tell prospects to “check out our reviews on Google”. Doing so opens the door to “entanglement” and/or “adoption”, terms defined by the Securities and Exchange Commission (SEC) that trigger additional compliance oversight and disclosure requirements.

To assist firms that have received Google Reviews, Wealthtender offers a tool to import Google Reviews that is popular with advisors in our community to import reviews from Google to Wealthtender. When reviews are imported to Wealthtender from Google, they go through the same compliance process as all other reviews, so disclosures can be added to satisfy requirements prescribed in the SEC Marketing Rule. By ensuring the required disclosures are prominently displayed with each review, advisors can compliantly promote reviews on their Wealthtender profile page.

↗️ Related Article: Get tips about Google Business Profiles & Google Reviews for financial advisors

Learn Our Concerns with Review Platforms like Google and Yelp

Why We Include Comparisons to Google and Yelp

If Google and Yelp are not compatible with the SEC Marketing Rule, you may be wondering why we’re discussing these platforms at all.

Here’s What We Know with Certainty:

Google and Yelp are well-known review platforms that are popular with consumers. And financial advisors may already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific, as advisors are gaining SEO benefits and visibility among consumers visiting these sites.

However, because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g., testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms (doing so would trigger ‘adoption‘ and or ‘entanglement‘ of these reviews, requiring additional oversight and disclosure language these platforms aren’t designed to accommodate).

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement and, therefore, subject to the prohibitions and disclosure requirements discussed throughout the SEC Marketing Rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing Rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing Rule’s prohibitions and disclosure expectations.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18 which addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants), and we monitor the SEC’s Marketing Rule FAQ page. We’ll update our Guide to Growing Your Advisory Business Playbook as additional SEC guidance becomes known.

Ideas to Promote Your Online Reviews and Testimonials Selectively (and Compliantly)

While the SEC permits you to create advertisements featuring only a subset of your reviews, they also say advisors must not cause ‘any misleading implication or inference’. Fortunately, the SEC suggests this concern can be addressed by including a disclaimer that the excerpted review(s) are ‘not representative’ and including a link to ‘all or a representative sample’ of your testimonials.

This means you’ll have opportunities to promote your reviews in various ways, both online and offline. Below are a few ideas to get your creative juices flowing. As always, be sure to discuss your specific circumstances with your compliance team first.

Promoting Your Client Testimonials on Social Media

You’ll have opportunities to promote your reviews on popular social media sites like Facebook, Instagram, LinkedIn, and X (Twitter), but doing so compliantly within the character count limitations and other constraints means it’s important to proceed with caution. Fortunately, each of these platforms permit creating posts with image and video files which can be designed to incorporate the required disclosures.

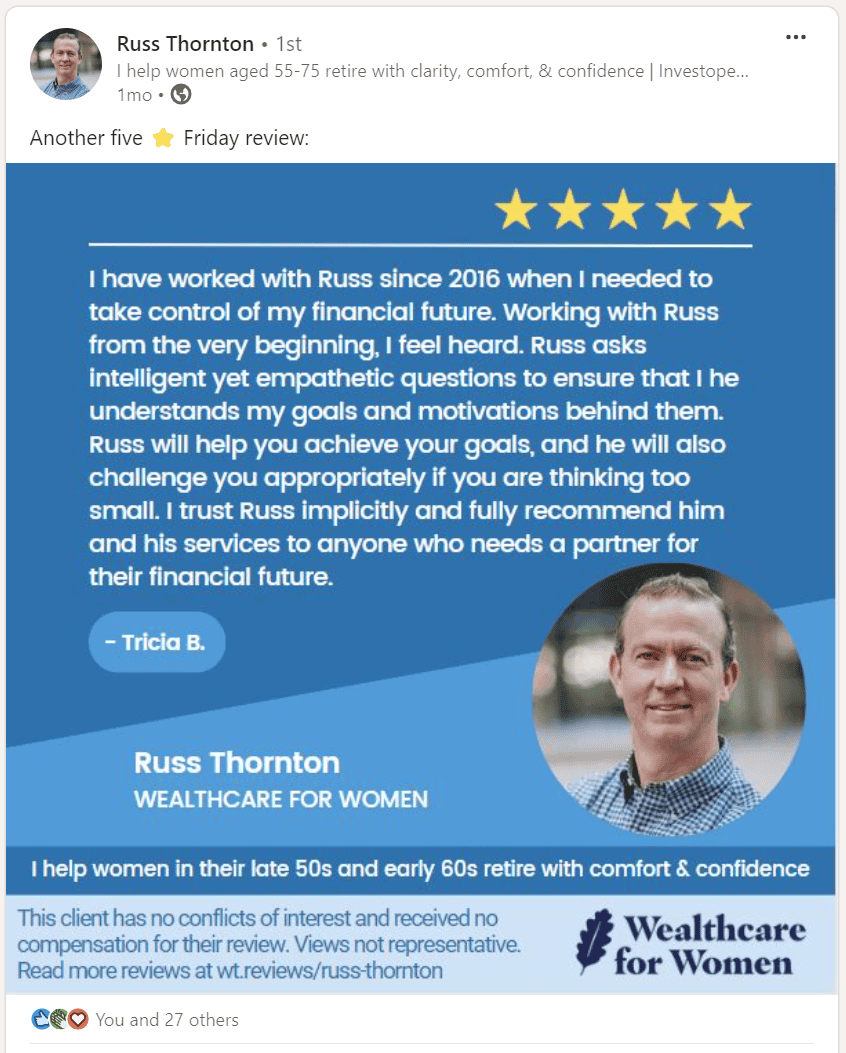

To compliantly promote a client testimonial on social media, you’ll need to ensure you incorporate the required clear and prominent disclosures alongside the review, along with a link to a representative sample of your testimonials (e.g., all of your reviews on your own website or Wealthtender profile page).

For financial advisors in the Wealthtender community, we created Testimonial Marketing Studio to help advisors promote their online reviews compliantly in social media posts and beyond.

With Testimonial Marketing Studio, you can:

✔️ Access a growing library of professionally designed video and image templates

✔️ Import your online reviews from Wealthtender into Studio projects with just two clicks

✔️ Create scroll-stopping social media content and impactful resources for marketing campaigns in < 2 minutes

✔️ Preview and regenerate projects to optimize their design and ensure disclosures satisfy compliance requirements

Illustration showing an example of a LinkedIn post created in Wealthtender Testimonial Marketing Studio with required regulatory disclosures, including a link to a representative sample of reviews. Click here to view additional examples, including images and animated designs.

Promoting Your Online Reviews Offline

Just because your reviews are written online doesn’t mean they have to stay there.

Consider creating a printed flyer or brochure with a curated selection of client testimonials with appropriate disclosures; Include a QR code with a link to your profile page with all of your reviews, or type out the link to all reviews on your website. Insert this resource into your prospect kit to accelerate the trust-building process so your future clients can read firsthand the impact you’ve made in the lives of your clients.

The above approach also works for full-page magazine ads, mailed postcards, and, if you want to go big, perhaps even a billboard? Of course, it’s best to walk before we run, but you get the idea.

While a business card may lack sufficient space to achieve compliance with the above approach, consider adding a QR code prospects can scan with their mobile phone to quickly pull up your Wealthtender profile or testimonials page on your website and read all your reviews online. This can turbocharge your business card’s effectiveness.

Repurposing Your Testimonials and Endorsements to be Both Seen and Heard

Your written reviews aren’t limited to just being read. The SEC permits oral testimonials and endorsements as long as you verbally include the required disclosures concurrently (including mention of the website address people can visit to read a representative sample of your reviews and their accompanying disclosures). This means if you host your own podcast, for example, you can include verbal testimonials at the start, middle, or end of your show.

Another idea is to create a YouTube ‘video’ where the audio version of the review can be listened to while the video concurrently displays the required clear and prominent and additional disclosures. You can then post this ‘video’ on your social media accounts.

It’s important to note the SEC expects you to maintain records of any audio recordings used in social media posts to demonstrate your compliance with the Marketing Rule upon request. While it may be easy to pull up an older podcast episode featuring audio reviews and disclosures, social media posts may prove more difficult. Either way, the SEC suggests maintaining a script of the recording, and disclosures can demonstrate your compliance.

Seminar Marketing: Use Your Testimonials to Increase Conversions of Prospects into Clients

If you conduct educational seminars online or in your community to attract new clients, your reviews can significantly increase your conversion rate of cold prospects who become warm leads and your future clients.

Many people who attend online or in-person seminars have little or no relationship with you prior to the event. Your online reviews overcome this headwind by creating an emotional connection that builds trust and offers the social proof consumers need to hire you with confidence. Consider implementing these ideas before, during, and/or after your seminar:

Turning Your Biggest Fans into Powerful Lead Magnets

As the number of online reviews you collect grows, you’ll discover who among your clients are most enthusiastic about telling the world the value you deliver and the impact you’ve made in their lives. This is the pond you’ll want to fish in to identify clients and non-clients who may be happy to play an even larger role in helping you grow your practice.

For example, if you host a podcast, consider inviting a passionate client onto the show as a guest to elaborate on their experience working with you. Or ask if they would be willing to record a video discussing their experience in a Q&A format you can use on your website and social media.

Or consider asking clients who wrote a glowing review about you if they would be open to recording a video testimonial. You can record this video on your own or consider if it makes sense to engage a professional video testimonial service.

Of course, you’ll need to pay extra attention to compliance requirements given the likelihood that an extended discussion may cover a lot of ground, but with thoughtful planning ahead of time, you can steer clear of topics like investment performance that could lead to a heightened risk of prohibited content and increased regulatory scrutiny.

Convert More Prospects into Clients with Online Reviews and Testimonial Marketing

We hope you found this article helpful, and we encourage you to read each of the articles in our SEC Marketing Rule Education Series for more ideas to compliantly attract new clients and grow your business with online reviews and testimonials.

Financial advisors who embrace online reviews in their marketing efforts will lead the industry in attracting new clients during the historic transfer of wealth from Baby Boomers to Millennials over the next decade.

Online reviews establish a human connection with prospects, demonstrating your trustworthiness and increasing their confidence in contacting and hiring you. But online reviews are just one important part of an effective marketing plan to strengthen your online reputation and attract new clients in today’s world.

At Wealthtender, we’re dedicated to helping you grow your business compliantly with Certified Advisor Reviews™ and our Modern Advisor Marketing platform, providing you with the tools to ensure prospects can find you online and feel confident about their hiring decision.

If you have questions, feedback, or would like to discuss the SEC Marketing Rule with us, please email yourfriends@wealthtender.com or call Wealthtender Founder and CEO Brian Thorp directly at (512) 856-5406.

↗️ Take an Interactive Tour of Wealthtender

↗️ Learn More About Testimonial Marketing Studio

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian