To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Where you choose to collect, display and promote testimonials and endorsements matters. This is especially true for financial advisors and wealth management firms subject to SEC oversight.

In this article, we compare features and policies of general online review platforms (specifically Google and Yelp) to a dedicated industry online review platform (Wealthtender), and your own website to understand the pros and cons of each. We also share insights worth considering for compliance with the SEC Marketing rule [Rule 206(4)-1].

The table below highlights relevant features and policies you’ll want to consider when choosing the platforms you’ll use to collect, display and promote your online reviews. Once you decide on the platform(s) you’ll use, you should add a brief discussion explaining your choice(s) in your policies and procedures for testimonials and endorsements.

| Features and Policies of Online Review Platforms | Yelp | Wealthtender | Your Website | |

| Platform is compatible with SEC rule advertising requirements | 🔴 | 🔴 | 🟢 | 🟡 |

| SEC required disclosures can be added clearly and prominently | 🔴 | 🔴 | 🟢 | 🟡 |

| Search engine optimization (SEO) benefits | 🟢 | 🟢 | 🟢 | 🟢 |

| Profile pages are exclusive to each advisor (no competitors shown) | 🔴 | 🔴 | 🟢 | 🟢 |

| Asking for reviews is permitted | 🟢 | 🔴 | 🟢 | 🟢 |

| Offering compensation for reviews is allowed | 🔴 | 🔴 | 🟢 | 🟢 |

| Reviews can be displayed anonymously | 🔴 | 🟡 | 🟢 | 🟢 |

| Reviews collected on other platforms can be imported and promoted | 🔴 | 🔴 | 🟢 | 🟢 |

| Easy ability to remove bad actor reviews or add required disclosures | 🔴 | 🔴 | 🟢 | 🟢 |

| Ability to cancel account and concurrently remove all reviews | 🔴 | 🔴 | 🟢 | N/A |

| Turn reviews feature off and still enjoy other platform benefits | 🔴 | 🔴 | 🟢 | N/A |

| Platform has been reviewed by an experienced securities attorney | 🔴 | 🔴 | 🟢 | 🟡 |

As the table suggests, general online review platforms can be problematic for financial advisors interested in complying with the Marketing rule. On the other hand, Wealthtender is designed for SEC compliance. Your website developer can work with your compliance team and refer to our Guide to Growing Your Advisory Business with Online Reviews Playbook to add online review functionality to your website in an SEC compliant manner.

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Why We Include Comparisons to Google and Yelp

If Google and Yelp are not compatible with the SEC Marketing rule, you may rightly be wondering why we’re discussing these platforms at all.

Here’s What We Know with Certainty:

Google and Yelp are well-known review platforms popular with consumers. And financial advisors may already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific, as advisors are gaining SEO benefits and visibility among consumers visiting these sites.

But because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g., testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement and, therefore, subject to the prohibitions and disclosure requirements discussed throughout the SEC Marketing rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing rule’s prohibitions and disclosure expectations.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18 which addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants), and we monitor the SEC’s Marketing rule FAQ page daily. We’ll update our Guide to Growing Your Advisory Business Playbook as additional SEC guidance becomes known.

✅ The Reviews Are In.

Financial advisors have a powerful new tool to grow their business thanks to the SEC Marketing Rule and Certified Advisor Reviews™ from Wealthtender.

View LIVE Certified Advisor Reviews

What About Other Online Review Platforms for Testimonials and Endorsements?

Beyond Google, Yelp, Wealthtender, and your own website, you may be wondering about popular social media platforms like Facebook and LinkedIn. There are also reputable websites like the Better Business Bureau, among others popular with consumers, where reviews can be written.

The same challenges largely exist for each of these platforms, just like Google and Yelp, as they’re not compatible with the SEC Marketing rule. In each instance, unsolicited reviews should not pose any issues as long as you don’t direct prospects to visit these websites and read your reviews.

Fortunately, no matter the future guidance provided by the SEC and as discussed in our policies and procedures article, you can use review aggregation to import reviews from any online review platform to Wealthtender or your own website, where appropriate disclosures can be added so you can compliantly promote your reviews to grow your business.

For social media platforms like Facebook, Instagram, and LinkedIn, we believe these platforms offer valuable opportunities to promote your reviews gathered on compliant platforms in posts on these sites with proper disclosures added. (We discuss this in our Guide to Growing Your Advisory Business Playbook.)

Questions to Ask When Choosing an Online Review Platform for Testimonials and Endorsements

In your evaluation of online review platforms, we encourage you to ask questions that will help you decide if a platform is a good fit for your business. Here are a few questions to get you started:

- What experience do you have in the financial services industry?

- How well do you understand the SEC Investment Adviser Marketing rule?

- Is your platform designed for compliance with the Marketing rule?

- How will you work with my compliance team to build trust and rapport?

- What other features and benefits does your platform offer to help grow my business?

- Why should I choose your platform over others?

Getting Started with Testimonials and Endorsements

We hope you found this article helpful, and we encourage you to read each of the articles in our SEC Marketing Rule Education Series for more ideas to compliantly attract new clients and grow your business with testimonials and endorsements.

Financial advisors embracing online reviews will lead the industry in attracting new clients throughout the historic transfer of wealth from Baby Boomers to Millennials over the next decade.

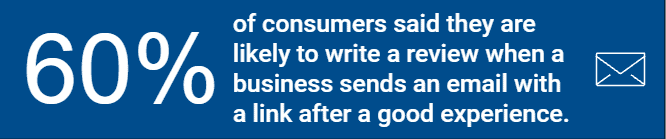

Online reviews establish a human connection with prospects, demonstrating your trustworthiness and increasing their confidence in contacting and hiring you. But online reviews are just one important part of an effective marketing plan to strengthen your online reputation and attract new clients in today’s world.

At Wealthtender, we’re dedicated to helping you grow your business with our Modern Advisor Marketing™ platform that provides the knowledge and reassurance your future clients are looking for online to hire you with confidence and conviction.

Beyond our industry-first Certified Advisor Reviews™ designed for compliance with the SEC Marketing rule, financial advisors and wealth management firms that join Wealthtender gain recognition for their areas of specialization and SEO benefits to rank higher in Google search results.

Whether you choose to join our growing community of financial advisors and advisory firms on Wealthtender or prefer to grow on your own, we hope these articles help you achieve exceptional results with your online reviews for years to come.

If you have questions, feedback, or would like to discuss the SEC Marketing rule with us, please email yourfriends@wealthtender.com or call Wealthtender Founder and CEO Brian Thorp directly at (512) 856-5406.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Request Your Free Personalized Digital Marketing Report from Wealthtender

For personalized insights with tips to help you get more clients online, request your free digital marketing report from Wealthtender. Simply fill out this brief form, and we’ll email your personalized report to you within one business day.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor