To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

As an SEC registered investment adviser, the policies and procedures you develop for your firm’s testimonials and endorsements to comply with the SEC Marketing rule [Rule 206(4)-1] will need to be incorporated into your existing written policies and procedures established to prevent violation of the Advisers Act.

Fortunately, the SEC Marketing rule offers a principles-based approach with fairly clear and straightforward guidance so you can successfully grow your business with testimonials in a compliant manner.

In this article, we’ll guide you through important topics discussed by the SEC in the Marketing rule, including opportunities and potential risks you’ll want to consider to help you prepare your policies and procedures for supervision of your firm’s activities associated with testimonials and endorsements.

And since it’s expected the most popular way to collect, display and promote testimonials and endorsements will be on the internet, this article includes practical tips and guidance to help you determine which financial advisor online review platforms may be most appropriate for your firm, including your own firm website.

⭐ At the end of this article, you’ll find a template you can download to help you prepare policies and procedures for your firm.

Asking for Testimonials and Endorsements

At the very heart of the SEC Marketing rule is permission to ask for reviews from current clients (testimonials) and non-clients (endorsements), subject to conditions. But how and where you ask matters. We cover this topic in-depth in this article, so we’ll just touch on three quick points here:

1. The SEC wants to ensure you’re not cherry-picking reviews from your favorite clients, so it’s important to ask all of your current clients for a review when first getting started.

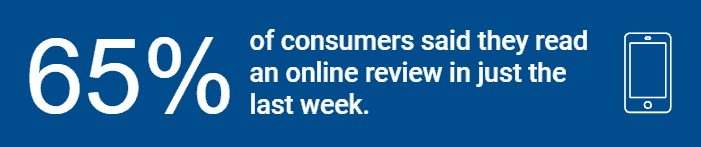

2. Asking for reviews may feel uncomfortable at first, but over 60% of consumers said they are likely to write a review when a business sends an email with a link after a good experience.

3. Think twice before asking for reviews on platforms like Google and Yelp. Since reviews on these platforms are not designed to include required SEC disclosures, promoting your Google or Yelp reviews is off-limits, and there’s not yet clear guidance from the SEC advising if simply asking for reviews on these platforms violates the Marketing rule. Yelp’s policy also prohibits businesses from asking for reviews, and Google’s policy prohibits compensating for reviews.

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Learn Our Concerns with Review Platforms like Google and Yelp

Why We Include Comparisons to Google and Yelp

If Google and Yelp are not compatible with the SEC Marketing rule, you may rightly be wondering why we’re discussing these platforms at all.

Here’s What We Know with Certainty:

Google and Yelp are well-known review platforms popular with consumers. And financial advisors may already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific as advisors are gaining SEO benefits and visibility among consumers visiting these sites.

But because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g., testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement and, therefore, subject to the prohibitions and disclosure requirements discussed throughout the SEC Marketing rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing rule’s prohibitions and disclosure expectations.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18 which addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants), and we monitor the SEC’s Marketing rule FAQ page daily. We’ll update our Guide to Growing Your Advisory Business with Online Reviews Playbook as additional SEC guidance becomes known.

Compensating For Testimonials and Endorsements (Cash & Non-Cash)

While the SEC allows you to offer compensation for testimonials and endorsements, any published review written by a reviewer who receives compensation must clearly disclose the compensation arrangement, even if it’s non-cash (e.g., gift cards, advisory fee reduction, etc.). And if you choose to pay a reviewer more than $1,000 in value within a 12-month period, you’ll need a written agreement in place between you and the reviewer. You should also consider the policies of online review platforms.

If you plan to offer compensation in any form, consider this guidance to comply with the Marketing rule and policies of online review platforms:

Reviewers Compensated with Cash

- Disclose the amount paid, including any reimbursed expenses

- Establish a written agreement if > $1,000 within a 12-month period

Reviewers Compensated with Non-Cash

- If non-cash compensation is in the form of an advisory fee reduction, disclose the time period and discount percentage of the total advisory fee

- If the value of non-cash compensation is quantifiable in dollar terms, the dollar value of the compensation provided should be disclosed

- Establish a written agreement if > $1,000 in value is given within a 12-month period

Compensation Policies of Online Review Platforms

| 🔴 | No, compensation not allowed; No ability to add disclosures | |

| Yelp | 🔴 | No, compensation not allowed; No ability to add disclosures |

| Wealthtender | 🟢 | Yes, compensation permitted; Yes, disclosures can be added |

| Your Website | 🟢 | Yes, compensation permitted; Yes, disclosures can be added |

🚦 You should be aware the SEC will consider the timing of compensation received by an individual relative to publication of their online review to judge in their eyes whether or not an individual has been compensated for their review. In other words, an incidental dinner, gift, or other consideration within an undefined window of time before or after the review, could be considered by the SEC to be compensation for the review.

Accordingly, even if your policy is to not compensate anyone for a review, the SEC might conclude otherwise if you offer cash or non-cash compensation to an individual around the time they write a review.

To comply with the SEC rule beyond the avoidance of doubt, consider erring on the side of caution and drafting your policy to disclose any cash or non-cash compensation received by a reviewer if the timing is relatively near the time of writing or publication of their review.

✅ The Reviews Are In.

Financial advisors have a powerful new tool to grow their business thanks to the SEC Marketing Rule and Certified Advisor Reviews™ from Wealthtender.

View LIVE Certified Advisor Reviews

Anonymous Testimonials and Endorsements

Certain clients (and non-clients) may be interested in writing a review for you, but they prefer to remain anonymous (publicly) when their review is published. Fortunately, the SEC understands this and permits you to promote anonymous testimonials and endorsements when accompanied by proper disclosures. However, not all online review platforms allow reviewers to remain anonymous, and if the identification of the reviewer is unknown to you, you cannot promote the review as a testimonial or endorsement since you’ll be unable to add the required disclosures.

When evaluating online review platforms, take into consideration their policies and your knowledge of sensitive clients:

Anonymous Review Policies of Online Review Platforms

| 🔴 | Not allowed | |

| Yelp | 🟡 | Possible, if user sets up an anonymous Yelp account |

| Wealthtender | 🟢 | Yes, with accompanying disclosures 1 |

| Your Website | 🟢 | Yes, with accompanying disclosures |

1 Wealthtender requires all reviewers to provide a valid email address. This information is only shared with their financial advisor to ensure the ability to add proper disclosures. Reviewers may choose to publicly display their full name, abbreviated name, or simply ‘anonymous’.

Reviews from Non-Clients (Endorsements)

Beyond reviews from your current clients (testimonials), the SEC also permits you to collect and promote reviews written by your past clients and non-clients (endorsements) when accompanied by proper disclosures clearly indicating the reviewer is not a client. While client reviews often help prospects better understand the client experience, reviews from others who know you well may help prospects learn more about your areas of expertise and character.

For example, consider the potential impact of reviews written by experts and professionals in your niche who can attest to your specialist knowledge; Or reviews written by leaders of non-profit organizations where you volunteer praising your dedication to the community.

Reviews from non-clients may be especially valuable among financial advisors who recently transitioned from another industry, younger advisors with few clients, but lots of credible references, and even newer investment adviser representatives who recently departed a broker-dealer and whose former clients were unable to transition due to a non-solicitation clause.

Monitoring for New Reviews

While there are countless general online review platforms making it nearly impossible to know if you receive a review on an obscure website, it’s likely your reviews will be posted to well-known online review sites like Google, Yelp, and industry-specific platforms like Wealthtender. Each of these platforms allows you to be notified when you receive a new review.

Monitoring for new reviews on these platforms should be fairly straightforward. Regardless, you’ll want to consider which online review sites you will proactively monitor and the email address you will associate with your accounts on these platforms. Do you want review notifications sent to your primary work email address? Or do you have a shared email account regularly checked by your staff that may be preferred to streamline oversight and recordkeeping?

Monitoring for Bad Actors

While unlikely to be a significant concern for most advisors, the SEC requires that your policies and procedures address how you will monitor for bad actors. (Note: Since the SEC is only concerned with paid testimonials or endorsements from individuals deemed bad actors, you can mitigate compliance concerns if you prohibit any form of cash or non-cash compensation for reviews.)

A bad actor is defined by the SEC as an ineligible person (or certain associated persons) who is subject either to a disqualifying Commission action or to any disqualifying event. The former includes any Commission opinion or order barring, suspending, or prohibiting a person from acting in any capacity under the Federal securities laws. The latter encompasses events in any of five categories, including court convictions and cease and desist orders that occurred within ten years prior to the person disseminating an endorsement or testimonial.

The SEC indicates, in addition to confirming a compensated reviewer is not a bad actor at the time their review is published, you should conduct an (at least) annual review to determine whether each compensated review is written by an individual meeting the bad actor definition. In such a case, the SEC requires that the review is updated to include clear and prominent disclosure indicating the reviewer is subject to a Commission order or disciplinary action, along with a link to the order on the Commission’s website.

Online Review Platforms: Ability to Comply with SEC Bad Actor Requirements

| 🔴 | Not possible 1 | |

| Yelp | 🔴 | Not possible 1 |

| Wealthtender | 🟢 | Yes, disclosures can be updated as required |

| Your Website | 🟢 | Yes, disclosures can be updated as required |

1 These platforms are not compatible with SEC disclosure expectations, but you can follow their procedures and attempt to request a review to be removed by filing a legal violation form.

Reviewing the Content of Testimonials and Endorsements

When you receive a new review, the policies and procedures you establish today can serve as a useful framework to satisfy your compliance obligations consistently and in a timely manner.

In this section, we cover three areas of utmost importance to ensure your compliance with SEC requirements.

1. Identifying and Addressing Prohibited Content

Upon receiving a new review, it’s important to review its content through a regulatory lens to determine if it includes prohibited content. Specifically, the SEC prohibits you from promoting reviews that (verbatim from the rule):

- Include any untrue statement of a material fact, or omit to state a material fact necessary in order to make the statement made, in the light of the circumstances under which it was made, not misleading.

- Include a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the Commission.

- Include information that would reasonably be likely to cause an untrue or misleading implication or inference to be drawn concerning a material fact relating to the investment adviser.

- Discuss any potential benefits to clients or investors connected with or resulting from the investment adviser’s services or methods of operation without providing fair and balanced treatment of any material risks or material limitations associated with the potential benefits.

- Include a reference to specific investment advice provided by the investment adviser where such investment advice is not presented in a manner that is fair and balanced.

- Include or exclude performance results, or present performance time periods, in a manner that is not fair and balanced.

- Otherwise be materially misleading.

While this list of prohibitions may feel intimidating, you’re likely to find most reviews reflect a client’s perception of your character, qualities, personality, and experience working with you, which should be straightforward to address in accompanying disclosures as unique to the reviewer and not representative of a typical client.

In situations where a prohibition is triggered, you should discuss your options with your compliance team, which may include:

- Redacting or removing the prohibited language and publishing the review with accompanying disclosure to explain the redaction or revisions

- Not publishing the review on your website, or if on Wealthtender, requesting the review not be published due to an SEC prohibition

🚦 Keep in mind any reviews you receive on sites like Google and Yelp, whether or not they include prohibited content, cannot be promoted as a testimonial or endorsement due to their inability to comply with SEC disclosure requirements. Also, if you link to your Google or Yelp reviews from your website and any review includes prohibited content, the SEC could view this as fraudulent or deceptive.

2. Documenting Unsubstantiated Material Statements of Fact

While many reviews you receive will entirely reflect the opinions of reviewers, others may include a statement the reviewer believes to be fact. The SEC wants to ensure these claims can be substantiated by you upon demand if they are material.

In certain circumstances, you may want to include a statement of substantiation within the review’s accompanying disclosures for quick recollection of the circumstances if asked by the SEC at a future date. Such a statement also helps demonstrate to the SEC that you had a reasonable belief the statement was factual at the time it was written.

Consider two examples:

- A reviewer writes that you hold the Certified Financial Planner designation. Because this is an easily verifiable fact, no further action is necessary.

- A reviewer writes that you exclusively invest their portfolio in Vanguard funds. This statement may be factual at the time of writing but is subject to change. While this fact should be easy to verify in a future SEC exam, you’ll rest easier by confirming only Vanguard funds are in their portfolio at the time of writing and documenting your confirmation in the accompanying disclosure and/or your files.

Handling Spam and Inappropriate Content

The SEC supports the limited editing or removal of reviews which are spam, profane, defamatory, offensive, threatening, unlawful, or to correct a factual error, as long as the edits are not designed to favor or disfavor the advisor. Your policies and procedures should document how you will handle reviews of this nature in an objective manner.

🚦 Note: Reviews published on Google are scanned by their algorithms which occasionally mistake legitimate reviews for spam and remove them from the platform. When this occurs, and you inquire with Google about the removal, you’re likely to receive this message: “Sometimes our algorithms report and remove legitimate reviews. After a review is removed, we can’t reinstate it. These removal measures help make sure that reviews on Google properties are relevant, helpful, and trustworthy.”

Responding to Online Reviews

Although the SEC doesn’t explicitly provide guidance on whether or not you can reply to an online review, you should consider establishing your policy on this topic upfront.

A general rule of thumb and consensus opinion among securities attorneys familiar with the SEC Marketing rule is you should never reply to reviews on platforms like Google and Yelp. Doing so substantially heightens your risk of entanglement and adoption as defined by the SEC, subjecting you to the rule’s general prohibitions and disclosure requirements which are incompatible with these platforms. Accordingly, you risk violating the SEC rule with no ability to regain compliance.

Whether you plan to thank reviewers who write favorable reviews or would like to respond to a neutral or negative review, consider establishing your policy to handle these communications individually with reviewers by email or phone.

And remember, it’s ok to have some neutral or negative reviews. In fact, studies conducted among other trust-based professions like doctors and lawyers show consumers tend to be skeptical of professionals without negative reviews.

What to Do About Negative Reviews

Let’s face it. One of the biggest fears of getting started with online reviews is waking up to find a new 1-star review with your name on it. Realistically, it’s much more likely your existing clients will write favorable reviews (or, at worst, neutral) and extremely unlikely a non-client you ask to write a review will be motivated to write anything negative.

So what’s the best way to overcome a negative review? First, take a deep breath. Next, take another. Seriously. (And if your first 3-star or lower review is received on your Wealthtender profile page, email yourfriends@wealthtender.com and we’ll send you a gift certificate for a 1-year premium subscription to the Calm meditation app. Also seriously. We’ll get through this together.)

Once your emotions subside, you’ll be better prepared to determine an appropriate and rational course of action.

Consider these suggestions if you receive a negative review:

- Put yourself in the shoes of the reviewer; Try to understand their motivation and what they might be feeling; You may come up with additional ideas to address their concerns.

- Is there a practical remedy to the reviewer’s concerns you can offer? If so, try reaching them by phone to humanize the discussion and see if you can reach a positive outcome.

- Whether or not you’re successful in resolving the concerns raised in a negative review, you can use the additional disclosures field accompanying the review to offer your own perspective on the matter. Take the high ground and avoid an emotional response.

- The best way to overcome a negative review is to earn lots of positive reviews!

A quick note: No matter the online review platform, consumers own the content they write, which means they are free to delete or edit reviews they have written or write a new review. We’re sharing this insight for educational purposes only and suspect the SEC could frown upon advisors encouraging a reviewer to revisit an existing review, so be sure to ask your compliance team for guidance if this is a path you’re considering. Also, even if a reviewer deletes a review, you should be prepared to discuss the circumstances with the SEC upon request.

While the circumstances of each review will differ, consider noting in your policies and procedures how you generally plan to handle negative reviews (e.g. responding offline by phone or email, etc.).

Review Aggregation

You are not permitted by the SEC to directly promote or refer prospects to your reviews on platforms like Google and Yelp, which don’t support required advertising disclosures.

Fortunately, with a reviewer’s permission, you can republish their review on SEC-compliant platforms like Wealthtender and your own website by adding appropriate disclosures. This is known as review aggregation.

By aggregating your reviews on platforms compatible with the SEC rule, you can turn reviews otherwise off-limits into powerful testimonials to proactively attract new clients.

In your online review policies and procedures, consider including a brief discussion of your approach to review aggregation. If you do choose to aggregate reviews from a platform like Google, your policy should be to aggregate every review from the platform where permission is received to mitigate SEC cherry-picking concerns.

SEC Marketing Rule and Compliance with the Advisers Act

Your policies and procedures for testimonials and endorsements should be incorporated into your existing Advisers Act policies and procedures. It’s important to review these combined policies and procedures in totality to ensure your handling of online reviews aligns with your procedures for advertisements.

For example, while the Marketing rule does not explicitly require review and pre-approval of your online reviews, the SEC believes your existing obligations under the Advisers Act compliance rule for advertisements should: a) prevent violations from occurring, b) ensure your ability to detect violations that have occurred, and c) correct promptly any violations that have occurred.

If your existing policies and procedures already include pre-review and approval of advertisements, reviewing samples of advertisements, periodic reviews, and/or spot-checking, incorporating your online reviews into your current workflows should satisfy SEC expectations.

Because online reviews for financial advisors are new, the SEC also expects your Advisers Act policies and procedures to include training on the Marketing rule, including its prohibitions and disclosure requirements.

SEC Marketing Rule Form ADV Update

A new section of Form ADV (subsection L under Item 5) has been added to describe your use of testimonials and/or endorsements, including online reviews (and other disclosures beyond the scope of this playbook). You’ll also need to disclose if you pay cash or non-cash compensation to reviewers. These questions are simply ‘yes’ or ‘no’.

Note: You are not required to update your Form ADV Item 5 until your next annual update.

Recordkeeping Requirements for the SEC Marketing Rule

The SEC expects you to maintain records of your advertisements, including online reviews and their accompanying disclosures, in an easily accessible place for five years (which can include cloud storage and email archives). If you already have an archiving solution, simply add any online review platforms to be archived as well.

Additionally, the SEC has updated the books and records rule to require that you make and keep any documentation that shows you have a reasonable basis to believe your online reviews are compliant with the Marketing rule. By following a checklist for each incoming review and documenting your process, you’ll be prepared for a future SEC sweep or examination.

Getting Started with Testimonials and Endorsements

We hope you found this article helpful, and we encourage you to read each of the articles in our SEC Marketing Rule Education Series for more ideas to compliantly attract new clients and grow your business with testimonials and endorsements.

Financial advisors embracing online reviews will lead the industry in attracting new clients throughout the historic transfer of wealth from Baby Boomers to Millennials over the next decade.

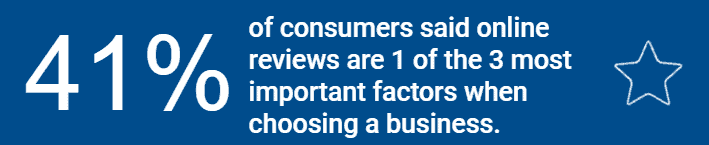

Online reviews establish a human connection with prospects, demonstrating your trustworthiness and increasing their confidence in contacting and hiring you. But online reviews are just one important part of an effective marketing plan to strengthen your online reputation and attract new clients in today’s world.

At Wealthtender, we’re dedicated to helping you grow your business with our Modern Advisor Marketing™ platform that provides the knowledge and reassurance your future clients are looking for online to hire you with confidence and conviction.

Beyond our industry-first Certified Advisor Reviews™ designed for compliance with the SEC Marketing rule, financial advisors and wealth management firms that join Wealthtender gain recognition for their areas of specialization and SEO benefits to rank higher in Google search results.

Whether you choose to join our growing community of financial advisors and advisory firms on Wealthtender or prefer to grow on your own, we hope these articles help you achieve exceptional results with your online reviews for years to come.

If you have questions, feedback, or would like to discuss the SEC Marketing rule with us, please email yourfriends@wealthtender.com or call Wealthtender Founder and CEO Brian Thorp directly at (512) 856-5406.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Request Your Free Personalized Digital Marketing Report from Wealthtender

For personalized insights with tips to help you get more clients online, request your free digital marketing report from Wealthtender. Simply fill out this brief form, and we’ll email your personalized report to you within one business day.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor