To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Credit card debt is no joke.

First, there’s all the interest you have to pay, which drains your financial ability to buy things you need.

Second, there’s the stress and anxiety as you spiral deeper and deeper into debt.

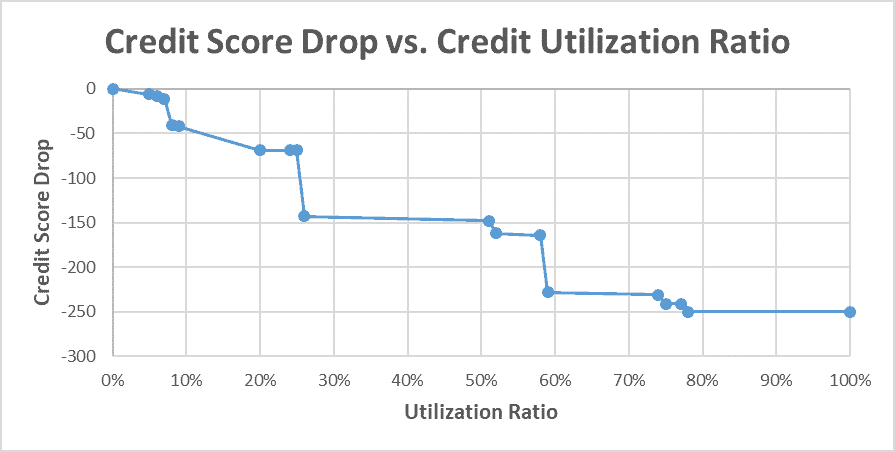

Third, as I’ve written elsewhere (see graph), your credit score can drop by 250 points just by letting your credit card debt reach 78% of your combined credit limit. This means that if you’d otherwise have an exceptional score of say 810, dropping by 250 points puts you at 560, very poor according to Experian.

The impacts of a poor credit score include higher interest on loans (if you can even get approved), your insurance premiums may increase, you may have a harder time getting approved to rent a home, etc.

How to Avoid This Problem

One of my dad’s favorite sayings was, “The wise person avoids getting into situations that only a clever person can get out of.”

Thus, the best way of avoiding spiraling credit card debt is to make sure you don’t take that first step on the slippery slope.

This is easily done by following two simple guidelines:

- Only use your credit cards to pay for things you can afford to pay in cash (true emergencies excepted, and no, getting the latest and greatest iPhone is not an emergency 😊).

- Pay your credit card balances in full each month.

In practical terms, implementing these three super-simple steps will get you there:

- Each night sum up your total credit card charges for the day and transfer that amount from your checking account to a (high-yield) savings account. This way, you won’t charge more than you have available in your accounts.

- Each time you get a credit card statement, go into your online banking app or website that night and set up payment in full from your savings account for the due date.

- Build up an emergency fund with enough money to cover your minimal expenses for 3-12 months (3 months is enough if you’re single, have a stable income, and a strong family support system; go toward the 12-month end if you have people counting on your income, if that income isn’t very stable, and if you don’t have a backup support system of people who will help you in a bind). This emergency fund will be there to back-stop you if you have a big unexpected expense and/or lose your income temporarily, so you don’t get pushed deep into credit card debt just to cover normal expenses.

The Bottom Line

Keeping out of credit card debt will protect you from many nasty impacts. The above steps are a dead-simple way to help you avoid this trap, which will then free up money that you can (and should) direct toward saving and investing to build long-term wealth.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor