To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Article after article on personal finance exhorts you to create a budget and a financial plan. You’re finally (reluctantly) willing to do it. But if you’re gonna do it, you really want to get it done already.

Waiting with that budget for months to track your spending doesn’t cut it. You wish somebody would tell you at least if your spending is in line with your income, without having to go through every line of every statement of every account for the past year!

Well, wish no more. Here’s a quick hack that will tell you exactly how much you spent in the last 12 months by just adding and subtracting a few numbers, and help you create a plausible budget from it.

It’s All About Flow

Money flows, like water. That’s why the term “cash flow” is so apt. If you want to have money to use, you need to put it in reservoirs (accounts), and minimize evaporation and leaks (spending). If you want to know how much evaporated or leaked out (was spent) in the past year, all you need to do is compare reservoir levels (account balances) a year apart, and account for inflows (income) and outflows (investing).

The Simple 4-Step Hack

Before we start, collect the following documents:

- Your bank and credit card statements from 13 months ago

- Your most recent bank and credit card statements

- Your paystubs from the past 12 months

- Your investment account statements from the past 12 months

You have all those in hand? Great. Here’s the simple 4-step process that side-steps having to sum up thousands and thousands of spending transactions:

- Add up the ending balances of your checking and savings accounts from your statements of 13 months ago and subtract what you owed your credit card(s) back then. In the following example, I’ve assumed a checking balance of $990, a savings balance of $740, and a credit card balance of $720, leading to a net balance 13 months ago of ,010.

- Sum up your net income numbers from the past year’s worth of pay stubs. Here I’ve assumed you’re doing this around January, and that you’re paid monthly. I’ve made up 12 months’ worth of net income numbers between $3000 and $3175, totaling $37,075. Adding to this the $1,010 from above, we reach a $38,085 total of what you would have spent if you currently have nothing in your accounts, owe nothing on your credit card(s), and didn’t set aside a single dollar to investments.

- Since whatever you sent to your investment accounts was by definition not spent, we need to sum that up and subtract it from the $38,085 total above. I’ve assumed this was a set amount of $300 each month, for a total of $3600. Subtracting that, we get a total of $34,485. This would be your total spending if you currently have nothing in your accounts and owe nothing on your credit card(s).

- Finally, every dollar that you have in your accounts now is a dollar you didn’t spend, while every dollar that’s on your credit card balance is a dollar you did spend. That’s why we now need to subtract the former and add the latter from the $34,485 total, reaching a total spending number (for this example) of $33,675.

That’s it. The end result of step 4 is how much you spent over the past year. All it took was collecting some statements, and adding and subtracting some numbers.

Note that for simplicity, I’ve assumed you have only one checking account, one savings account, one credit card, and no loans. If you have more deposit accounts, treat those like we treated the checking and savings accounts above. If you have more credit cards and/or any loans, treat them the same way we treated the single credit card above. If you have more than one job and/or business income sources, treat those income sources the same way we treated the single salary above.

From Hacked Past Spending to Estimated Budget

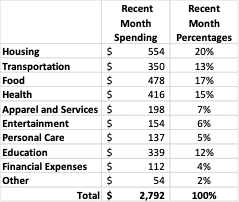

To get a sense of how that average monthly spending splits between different categories, track your spending by category for one month, and calculate the fraction spent on each category. In the following example, housing expenses are $554 for the prior month, which is 20% of the $2792 total.

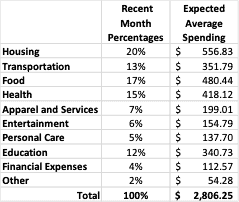

Then, apply these same percentages to your 12-month average spending. Using our above example, the average monthly spending would be $2806.25 (=$33,675/12). As shown below, if your situation hasn’t changed significantly, you can estimate that your food costs will be about 17% of your average monthly spending of $2806.25, which works out to $480.44. You can use that estimated number as your initial monthly food budget. Similarly, you can budget the other categories by applying their respective percentages to the $2806.25 average total spending.

The Bottom Line

The above is a quick and dirty hack, so the result is good enough to get you started with a plausible initial budget. However, I do recommend you start using an app like Quicken, Mint, or any of the many others out there to continuously track your income, expenses, investments, and taxes. That will allow you to tweak and correct your budget with ever more accurate numbers.

What hacks have you found that help you simplify the task of tracking expenses and making a budget?

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor