To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

October 2022

Americans Seeking Safety for Their Savings Hits 2008 Financial Crisis Levels

- US searches for “CD rates” and “best savings rate” reach highest levels since 2008 Financial Crisis.

- Analysis reveals New Jersey has the highest rate of people searching for safety and interest income.

- New York and Connecticut rank second and third, respectively.

Main Findings

Across the US, searches in October 2022 for safe places to earn income (using the terms "CD rates" and "best savings rate") reached levels not seen since the peak of the Financial Crisis in October 2008.

The study carried out by finance experts at Wealthtender examines the US overall and 50 states and the District of Columbia based on a review of online search terms frequently used by people looking for safe places to earn interest on their savings without the stress created by the stock market's daily gyrations.

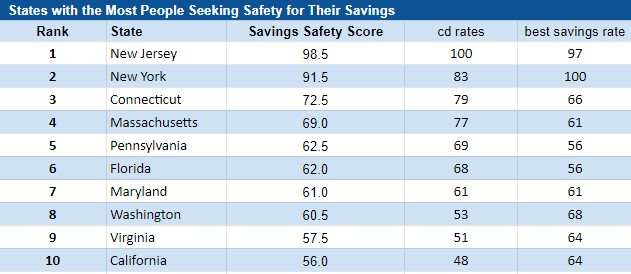

The research revealed that New Jersey ranks highest with the greatest percentage of its population looking for safe places to earn income, including Certificates of Deposit and savings accounts. With a Savings Safety Score of 98.5, New Jersey topped the list for its population, having the highest search levels for the terms "CD rates" and second-highest for "best savings rate".

New York ranked as the second-highest state looking for safe places to park their savings, with a total Savings Safety Score of 91.5. New York has the second-highest proportion of its population searching for "CD rates" and the most number of searches for the term "best savings rate", putting it second overall among states searching for safety.

Connecticut ranked as the third highest state searching for safe alternatives to stock market volatility. The state has the third-highest level of searches for the term "CD rates", in addition to being the fourth-highest state searching for "best savings rate", giving Connecticut a combined Savings Safety Score of 72.5.

Commenting on the study, Wealthtender founder and CEO Brian Thorp said, "With more economists predicting a recession in 2023 amid stock market jitters, consumers are seeking out safe places to keep their savings at levels not seen since the height of the 2008 financial crisis."

"While interest rates have risen in recent months, many consumers with a long-term investment horizon stand a better chance of outpacing inflation by dipping their toes back into the stock market at today's lower levels than locking their money up in a CD or savings account for a year or more. It's times like these when seeking professional guidance from an experienced financial advisor can truly pay dividends," Thorp continued.

This study was conducted by the team behind Wealthtender.com, a leading personal finance website helping thousands of people each month learn how they can enjoy life more with less money stress.

Methodology

To rank the states and the District of Columbia, Wealthtender considered the rate at which people conducted online searches for indicative terms used by people seeking safe places to stash their savings from January 2004 to October 2022. We then used these metrics to rank-order each state from highest to lowest, calculated upon a weighted average of search terms as follows:

- "cd rates": 50% Weight

- "best savings rate": 50% Weight

Sources: Data used to create this ranking were obtained using Google Trends for the period of January 2004 to October 2022 (as of October 12, 2022).

Note: Wealthtender has not published a ranking of the states with the least people seeking safety for their savings, as Google indicated fourteen states lacked sufficient search data for the term 'best savings rate'.

If you use these insights, please link to wealthtender.com who conducted the research. A link credit allows us to keep supplying you with future content that you may find useful.

For more information, please contact Wealthtender founder and CEO Brian Thorp at brian@wealthtender.com.

About Wealthtender

Wealthtender is dedicated to helping people find the best financial advisors and resources for their individual needs, no matter their income or stage of life.

🙋♀️ Have Questions About This Study?

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor