Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Finding a home to buy that you can afford without starving, wearing rags, and/or going without health insurance is nearly impossible for tens of millions of American households. In the current market, even renting isn’t easy.

It’s one of the fiercest-fought arguments in personal finance.

Is it better to rent or buy your home?

Here’s why I suspect we’ll never have a final, universally true answer:

- Housing costs vary from one year to the next (or even from one quarter to the next)

- Housing costs vary from market to market (or even neighborhood to neighborhood).

- What’s true for me may be completely wrong for you. Worse yet, what’s true for you now may be wrong for you next year (or even next month).

There’s not much any of us can do to address the last of these issues.

Addressing the second, location-based variations, is somewhat doable but, ideally, you want information specific to the county, town, or even neighborhood you’re considering.

That’s something best done with an experienced realtor.

This leaves us with timeliness, which is why, each year, the Joint Center for Housing Studies of Harvard University publishes an annual report titled, “The State of the Nation’s Housing.”

Here’s some of what this year’s report says…

Housing Remains Unaffordable for Millions

TLDR – “Housing markets continue to cool even as homeowners and renters face higher costs. On the for-sale side, home sales and construction levels are declining, as is the pace of home price appreciation, while rental markets are experiencing sharply reduced rent growth and rising vacancy rates. Nevertheless, home prices and rents remain elevated from pre-pandemic levels. Millions of households are now priced out of homeownership, grappling with housing cost burdens, or lacking shelter altogether, including a disproportionate share of people of color…”

Purchase and Rent Prices Are Taking a Breather After Soaring for Several Years

From early 2020 to early 2023, asking rents for professionally managed apartments soared nearly 24%, while home prices shot up an astounding 37.5%. Even after adjusting for 16% inflation, that’s a real increase of 6.5% for rent and over 18% for purchase.

However, most of those increases were from 2020 to 2022.

From Feb 2022 to Feb 2023, home prices dropped 3% in nominal dollars, dropping by 8.5%, adjusting for inflation.

As for rent, increases peaked at 15.3% year-over-year in early 2022, dropping to just 4.5% in early 2023 in nominal dollars, a 1.5% real drop. Some markets even showed a nominal drop – e.g., Phoenix and Tampa.

The Outlook Is Mostly Grim

The sudden increase in mortgage rates (recently 8.0%), following so quickly after sub-3% rates just a year earlier, is locking current homeowners, throttling the supply of existing homes for sale.

These same high rates, coupled with high prices, made housing unaffordable for millions, leading homebuilders to scale back on new single-family home construction (about 876k starts in 2022 vs. 2021’s 1.14 million).

Multi-family unit construction is still breaking records, but mostly targeting the higher-cost market segment.

This means renters with high income may well see moderating asking rents, but lower-income renters will continue to feel the pain of unaffordably high rent.

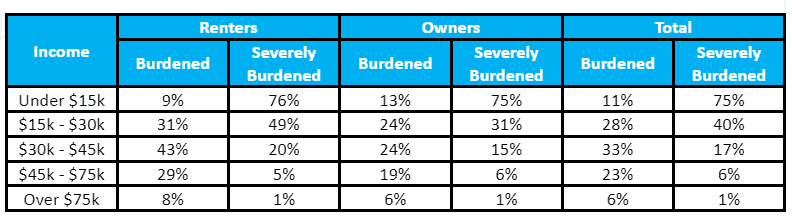

According to the Harvard report, the fraction of burdened households is worse for renters than owners, but both are troubling for those earning under $45k, where more than 2 in 3 households are burdened (spending more than 30% of gross income on housing) or severely burdened (spending over half their gross income on housing)!

For those earning a full-time income at the federal minimum wage (about $15k), 1 in 9 are burdened, and 3 in 4 are severely burdened, leaving just 1 in 7 unburdened!

How Much Do You Need to Make?

For renters, housing costs are dominated by rent, and the recent median rent across the country stood at $2,011.

To be considered “unburdened” (i.e., spending under 30% of gross income on housing) at that rent level, you’d need to make $80,440.

For buying, we’ll need to make some assumptions.

- Price: $431k, the median sale price of homes sold in the US in the third quarter of 2023

- Interest: 7.79%, the weekly average interest rate for 30-year-fixed loans

- Down payment: 20%

- Property taxes: 1.11%

- Homeowner insurance: $150/month

All told, your monthly payment, including principal, interest, taxes, and insurance (PITI), would be $3079. To avoid being burdened, you’d need to make over $123k.

And if we include maintenance costs (see below), this climbs to $137.5k.

Is Renting Cheaper than Buying?

Clearly, a $3079 monthly payment is more than $2011 rent.

However, we may not be comparing apples to apples. According to RentCafe, the average apartment size for new rentals in 2022 was 887 square feet.

The Motley Fool reports that the median size of homes in the US is 2014 square feet.

Beyond the fact that we’d be ignoring the size difference (and in housing size matters), mortgage interest is tax deductible while rent isn’t.

Also, rent tends to increase with real estate prices (the long-term average is a 5.24% annual increase for home prices), while a fixed-rate mortgage stays fixed.

If we look, say, five years after getting into a home, annual mortgage interest would be $26.4k, which (assuming a 30% total marginal tax rate) could translate into a $660 monthly cost reduction for buying (this would be $687 in the first year and gradually decline to zero over 30 years).

Thus, five years in, the after-tax cost of buying would be $2419. Adding 1% maintenance cost (the accepted average, though my 23-year experience is 0.5%), that climbs to $2778.

With a 5.24% average annual increase for rent, the $2011 current rent would be $2596 in five years, still cheaper than buying, right?

Not so fast!

Don’t forget the equity the homebuyer builds.

Assuming the same 5.24% price appreciation and the small portion of each payment that reduces the balance owed, after five years the buyer may have $142.4k in new equity (above the initial 20% down payment).

On a monthly basis, that works out to a $2,373 equity increase (of which $2090 is due to appreciation).

Subtracting that from our $2,778 monthly cost for the homeowner, we’re left with a mere $405 net monthly impact on the buyer’s net worth, far less than the estimated average $2,304 rent over the same five years.

Thus, if you:

- Can find a home to buy that you like,

- Can come up with a 20% down payment,

- Can qualify for a mortgage at the average interest rate,

- Can afford the monthly payments,

- Don’t need to move for 5+ years,

Then buying is likely still the better option, even ignoring the size difference.

Dawn Mabery Chestnut, CFP®, MSPFP, MPAS™, CFEI, Mabery Consulting, LLC says, “Thinking long term, once the mortgage is paid off, you have a home for the rest of your life rent- and mortgage-free. Then, you can tap your equity via a home equity line of credit, a new mortgage, or even a reverse mortgage, if needed for high pre-retirement expenses and/or long-term retirement income. Finally, some find the peace of mind in having housing stability of homeownership priceless.”

Ellen Masters, Financial Advisor, Masters Financial, LLC agrees, “In the long term, owning a home is cheaper than renting. However, buying when you don’t expect to stay in place for 5+ years can be more expensive than renting. Thus, if you’re going through a life transition (e.g., divorce), renting gives you freedom and flexibility. If you’re looking to settle down, buying is likely the better choice. An interesting way to think of this is like renting vs. buying a car. You don’t buy a car for a short visit someplace. Similarly, you wouldn’t normally rent for years (though some people prefer leasing a car despite it being more expensive than buying).”

Who Can Afford Housing?

To avoid being burdened, the median rent requires the above-mentioned $80,440 income, which puts you in the 74th percentile of income.

To buy a median-priced home, you’d need the above-mentioned $137.5k income or 90th percentile.

Is it any wonder that nearly 41 million US households are housing burdened (or severely so)?

And the impact?

As the Harvard report states: “With such high housing costs, many households with lower incomes may struggle to pay for other necessities like food, clothes, and healthcare, which have become more expensive as inflation has risen. In 2021, the median renter and homeowner households with incomes under $30,000 had just $380 and $680 per month, respectively, after paying for housing to cover other necessities—the lowest residual incomes in two decades.”

The Bottom Line

The “American Dream” was supposed to be owning your home and expecting your kids to be better off than you.

That dream has gradually become a nightmare as more and more households struggle to pay for necessities, given the huge chunk of each paycheck that goes to keeping a roof over their heads.

Renting isn’t, financially speaking, the better solution for most.

However, finding a home to buy that you can afford without starving, wearing rags, and/or going without health insurance is nearly impossible for tens of millions of American households. In the current market, even renting isn’t easy.

Something’s gotta give, and at this point, it’s not clear what that something will be.

We can just hope that it isn’t catastrophic for our society.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor