Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

In a May 2024 report, the Consumer Financial Protection Bureau (CFPB) warned consumers to beware of complex costs and fees associated with Health Savings Accounts (HSAs). While good-intentioned, the CFPB risks steering consumers away from a valuable healthcare savings tool with a triple tax benefit.

Established in 2003, many financial professionals consider the Health Savings Account to be the best retirement account, even though it wasn’t supposed to be a retirement account.

The Health Savings Account (HSA) is the only account available to Americans that enjoys a triple tax benefit:

- Contributions are tax-deductible in the year you make them.

- Earnings grow untaxed.

- Distributions are tax-free if you use them to cover many health-related expenses.

The only limitation is that your health insurance must be an HSA-compliant High-Deductible Health Plan (HDHP). In addition, employers may contribute toward employees’ HSAs.

One important thing to realize is that different from a Flexible Spending Account (FSA), an HSA isn’t a use-it-or-lose-it account.

The Best Way to Use Your HSA

To make the most of your HSA, you need to do these three things:

- Contribute the maximum allowed to your HSA (in 2024, $4150 for individuals, $8300 for families, plus a $1000 catch-up extra if you’re over 55).

- Invest your HSA balance in highly rated mutual funds rather than settling for a savings account interest.

- Cover your current medical expenses without tapping your HSA so your balance grows faster.

Not everyone can afford all three, but it’s more than worth it if you can.

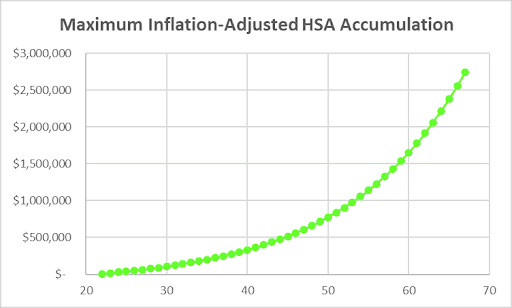

If healthcare inflation continues to be restrained, investing in stock mutual funds could return an inflation-adjusted 6-7% annually. Maxing out contributions and leaving the money in until age 67 could give you well over $2.7 million in inflation-adjusted terms by age 67 (see graph).

The above is the hypothetical maximum over 45 years, but you aren’t likely to need that much for healthcare expenses in retirement.

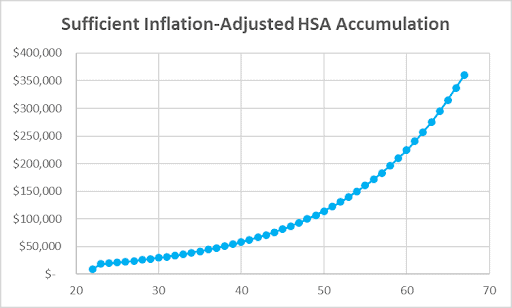

According to Fidelity, a retired couple should expect an average of $315k in health-related costs. You can accumulate more than that by maxing out just two years’ contributions at ages 22 and 23 and letting your investments coast until age 67 (next graph).

However, even if you don’t need hundreds of thousands, let alone millions, for healthcare in retirement, you can still benefit by maxing out your HSA since it can serve as a sort of ‘healthcare IRA.’

Withdrawing money from an HSA for non-health-related expenses triggers a 20% penalty, plus you’re on the hook for income taxes, just as you’d be with a traditional IRA. However, once you’re 65, the penalty goes away.

This means that your HSA lets you set aside tax-deferred contributions even if your income is above the traditional IRA income limits (Modified Adjusted Gross Income, MAGI, up to $87k for individuals and up to $240k for married filing jointly).

Even if your MAGI allows you to make tax-deferred IRA contributions, the HSA contributions let you significantly increase your tax-benefited contributions.

Note, however, that there are unique tax implications if you bequeath an HSA to anyone other than your spouse.

The CFPB Warns About HSAs

With all those advantages, one would think the HSA is a slam-dunk clear win for anyone who can use it.

However, a few days ago, the Consumer Financial Protection Bureau (CFPB) blew the whistle on the “Hidden Costs of Health Savings Accounts.”

They write, “Health savings accounts are promoted for the tax benefits that chip away at the price tag of health care… Many consumers do not realize the fees, switching costs, and low interest yields that will come with the accounts… Many providers that offer health savings accounts charge various fees, including monthly maintenance fees and paper statement fees. Expensive exit fees, like outbound transfer fees and account closure fees, can hold consumers, who may not have selected their accounts, captive to their current providers. The fees are costly and typically unavoidable… Despite the recent increase in interest rates… most providers offer consistently low interest rates. Typically, these rates are less than 1%, and, sometimes, even 0%. As a result, consumers could incur significantly more in fees than they earn in interest.”

Should You Contribute to Your Employer’s HSA Anyway?

According to the HSA Report Card, “…if you make HSA contributions directly through payroll, you likely won’t be paying FICA taxes on those contributions. However, if you choose not to use your employer’s HSA provider and make contributions outside of payroll, those contributions would be subject to FICA.”

Thus, contributing $8300 to your employer’s HSA saves you up to an extra $635 in FICA taxes – your Social Security and Medicare taxes – compared to contributing directly to a personal HSA.

What If You Don’t Like the Investment Options in Your Employer’s HSA?

If your employer’s HSA plan doesn’t offer any investment options (i.e., just an interest-bearing savings option), or if there are investment options in your HSA but you don’t like them, you can contribute to the employer’s plan and then transfer the money to your personal HSA.

This can incur a fee, typically up to $25 (no tax reporting needed).

You can also roll over the balance to your personal HSA once a year (you’d need to include Form 8889 with your tax return). This option may incur a similar fee.

If paying even a $25 transfer or rollover fee saves you $635 in payroll taxes, that’s a bargain.

Jeremy Keil, CFP, CFA, Owner, Keil Financial Partners, says, “HSAs are the #1 best account for retirement savings. They are the only account with triple tax benefits – tax-free on the way in, tax-free while in the account, and tax-free at withdrawal if used for eligible medical expenses.”

Keil continues, however, with a cautionary tale: “The CFPB is right on – most people don’t realize they can use an HSA account other than their employer’s default account, and they don’t shop around for the best rate. I just helped someone move $130k from HSA Bank where they were paid 0.50% interest to Fidelity’s HSA which pays them 5% interest. That’s almost $6,000 more interest in just the next year!”

My Solution – Using the Right Personal HSA

In my case, being self-employed, I don’t receive any employer contributions toward my HSA. That’s not a concern since employer contributions count toward the annual HSA contribution limit.

This is why I didn’t bother setting up an employer HSA plan for my one-person company. Instead, I looked for a personal HSA provider that would let me invest my HSA balance in highly rated stock mutual funds.

The provider I picked was Optum Bank (note that this isn’t an endorsement – Optum may or may not be the right provider for you).

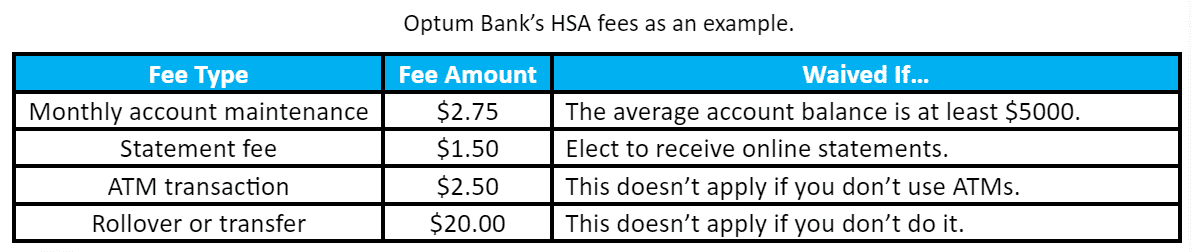

Does Optum charge fees?

Yes, but none of them applies to me because of how I use the account (see table).

Kyle Newell, Owner of Newell Wealth Management, agrees, “HSAs may have the problems stated by the CFPB – junk fees and low interest. I still suggest people evaluate them since they enjoy that triple tax advantage. Typically, I tell clients that their goal should be to save enough in the HSA where the junk fees and low interest may not apply to them.”

How about Optum’s investment options?

Out of 33 mutual fund offerings, a solid 14 win a Morningstar rating of 4 or 5 stars, along with Silver or Gold:

- Dodge & Cox Income I (DODIX) – Morningstar 5-star Gold.

- Fidelity Low-Priced Stock (FLPSX) – Morningstar 5-star Silver.

- Invesco Discovery R6 (ODIIX) – Morningstar 5-star Silver.

- PIMCO GNMA and Government Secs Instl (PDMIX) – Morningstar 4-star Gold.

- PIMCO Real Return Instl (PRRIX) – Morningstar 4-star Silver.

- Principal MidCap R-6 (PMAQX) – Morningstar 4-star Gold.

- Vanguard 500 Index Admiral (VFIAX) – Morningstar 4-star Gold.

- Vanguard Equity-Income Adm (VEIRX) – Morningstar 4-star Silver.

- Vanguard LifeStrategy Growth Inv (VASGX) – Morningstar 4-star Silver.

- Vanguard LifeStrategy Cnsrv Gr Inv (VSCGX) – Morningstar 4-star Silver.

- Vanguard Mid Cap Index Institutional (VMCIX) – Morningstar 4-star Gold.

- Vanguard Short-Term Federal Adm (VSGDX) – Morningstar 4-star Silver.

- Vanguard Small Cap Index I (VSCIX) – Morningstar 4-star Gold.

- Vanguard Wellington™ Admiral™ (VWENX) – Morningstar 5-star Gold.

My only ‘criticism’ here is that I wish I had an even higher HSA balance so I could take even more advantage of these funds, many of which have a million-dollar minimum investment outside of such a plan.

Given how I use this account, I pay no fees and don’t have to worry about portability (the ability to move the money to a different provider) because (a) since it isn’t tied to any employer, there’s no reason I can see to make such a change, and (b) even if I did want to, paying a one-time $20 fee to move a six-figure balance elsewhere is totally negligible.

Chris Mankoff, CFP, JTL Wealth Partners, shares, “I will always recommend HSAs to clients assuming they meet the requirements to fund the account. This is the second type of investment account I recommend outside of contributing to receive an employer match in a 401(k). Healthcare costs will be a large expense later in life and often happen unexpectedly, so the best way to plan or offset those costs is through a health savings account.

“The CFPB’s warning is something to pay attention to, but some of the concerns raised can be avoided by researching your options or working with a financial advisor to help select the best HSA provider. I believe that the benefits of HSAs far outweigh some of the issues highlighted by the CFPB and with due diligence can be avoided. Morningstar does a great job publishing an HSA report highlighting the different HSA providers that can be a useful reference.”

The Bottom Line

The HSA is arguably the best tax-advantaged account allowed under the US tax code.

- Contributions are tax-deductible when you make them. And if you contribute to your employer’s plan, you save up to 7.65% in payroll taxes.

- Earnings aren’t taxed.

- Withdrawals for qualified healthcare expenses are tax-free at any age, and other withdrawals can be made penalty-free once you turn 65.

This triple tax advantage is hard to beat, and even if you save far more than you’ll ever spend on healthcare, you can treat the account as another tax-deferred IRA in addition to any traditional IRA contribution you’re allowed to make, or instead, if your MAGI is too high (though taxation may be a bigger concern for non-spousal heirs of HSAs vs. IRAs).

The CFPB sounded the alarm on HSAs, citing hidden “junk” fees, restricted portability, and low-interest yields paid in HSA savings accounts.

However, it would be a big mistake to avoid contributing to an HSA if you’re eligible. If you use them as I do, none of the CFPB’s concerns will affect you, and your future self will thank you.

As Kyle Newell, Owner of Newell Wealth Management, says, “Although HSAs may have the problems the CFPB states – junk fees and low-yielding interest, I still suggest one evaluate them since they enjoy triple tax benefits. Typically, your goal should be to save enough in the HSA that the fees and low interest may not apply.”

Nathan Mueller, MBA, CFP, Founder and financial planner of BlackBird Finance, expands on this, “In my opinion, CFPB is a great advocate for the American public, and I do agree with some of the points their report makes. The struggle my clients have dealt with is low yields. Sometimes, the money needs to be used right away or may need to be used soon. This often means keeping the funds in a liquid, low-risk investment. Unfortunately, these accounts don’t always have investments that can be safe enough and offer interest similar to that of a high-yield bank account.

“I think people get fooled by thinking the brokerage CD they use in their HSA that offers protection and the same competitive interest rates as high-yield savings are the same. In reality, they often compound differently, and right now, high-yield savings accounts are doing better in that department.

“Having said all that, I’m still a big advocate of HSAs despite these drawbacks. Some HSA accounts are better than others, but the advantages of tax savings, the potential bonus of employers contributing, and the investment growth they can offer over the long term make them very valuable. The CFPB warning, to me, is just intended to raise consumer awareness.”

Have a Question to Ask a Financial Advisor?

➡️ Submit your question, and it may be answered by a financial advisor in an upcoming article or in the Expert Answers Forum on Wealthtender.

Additional Find-an-Advisor Resources:

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor