To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Depending on your income, the financial value of being an employee runs from huge at low income to “nice to have” at high income.

After working at the company for almost 2 years, the CTO pulled me aside and told me they had to let me go. They simply couldn’t find enough paying contract work for my skill set.

I wasn’t shocked – they’d let a valued colleague go a couple of months earlier; and this was in a company small enough to fit everyone, from the lowliest tech to the CEO, in a single bus.

I wasn’t angry – they’d kept me on overhead for several months, given me 3-weeks’ notice, told me I could use that (paid) time to look for my next thing, and offered to help me find that next thing.

For “corporate America,” that was more than I expected, and I appreciated it. We parted on good terms.

What Next?

Going from a great salary with a nice benefits package to being unemployed was tough.

My health insurance went from deeply discounted to a COBRA plan that cost me over $18k/year. With no income, covering that, the mortgage, the auto loan, utilities, food, etc. drained our savings fast.

I won’t kid you. It wasn’t a fun time.

I had to decide quickly – do I look for another job as an employee elsewhere, or do I hang out my own shingle and start looking for paying contract work (that my up-to-then employer couldn’t find)?

After talking it over, my wife and I figured the main reason for being an employee was job security, which recent events demonstrated was by now a myth.

My decision?

Open my own one-man company and look for paying work.

It took nearly 3 months of intensive networking to get a first nibble, another 3 months for actual work, and another month and a half for that first check to come in.

By the end of Year 1 of my new business, I’d billed over 1300 hours, with revenue 22% higher than the salary I’d lost. In the first decade, I had several amazing years, several good years, and a couple of relatively bad years, but even the worst brought more profit than my annual salary at that company.

Hey, We Want to Hire You as an Employee!

During that decade, several companies tried to entice me to shutter my business and come in as a highly compensated employee. Some salaries mentioned were high enough to make me at least consider it.

Should I or Shouldn’t I? The Relative Value of Benefits Usually Decreases as Salaries Increase

So, what does a job offer that being self-employed doesn’t?

First, there’s that “job security” I mentioned before – not convincing anymore.

Second, I don’t have to do everything by myself.

Marketing (or Business Development) takes care of finding paying work (at least when they can), Legal takes care of writing and reviewing contracts. HR takes care of payroll. Accounting takes care of paying taxes. Facilities take care of any needed physical location. Procurement takes care of needed equipment. IT takes care of fixing computer problems. Etc. Etc. Etc.

My answer to this? Keep everything as simple as possible, and contract professionals to take care of things I can’t or don’t want to learn how to do and then do (e.g., CPA, attorney, etc.).

Third, the financial value of benefits.

Let’s run through those.

Employer Portion of Payroll Taxes

If you’re self-employed, you pay self-employment taxes which cover both the employee and employer side of payroll taxes.

As of the original writing of this article in 2021, that was 12.4% of wages up to $142,800 (for 2023, that increased to $160,200) plus 2.9% of all wage income. Half of this is a deductible business expense.

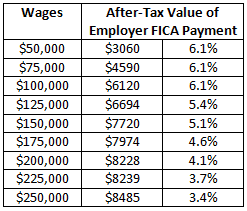

As an employee, you pay half as much, with the employer paying the other half (and getting the tax deduction for their half). Here’s what that is worth, using NerdWallet’s federal tax calculator with the following simplifying assumptions:

- Married to a homemaker, with 2 kids

- No contributions to retirement accounts

- Standard deduction

- Straight 8% assumed for state and local taxes

As you can see, the relative value of this benefit diminishes as your wages increase.

In addition, if you’re self-employed, you can set up your company as an S corp (or better yet, an LLC taxed as an S corp), and take some of your income as wages and some as profit distribution, which significantly reduces your payroll taxes.

That means having an employer pay half your payroll taxes might actually end up having a negative impact on your take-home pay.

Say your profit is $150,000 and you can defensibly take $50,000 of that as salary and $100,000 as profit distribution. Your payroll tax cost is $7650, but your taxes are about $765 lower once you deduct the employer-side payroll taxes, for a net tax impact of $6,885 (using the above assumptions).

If you’re an employee making $150,000, your half of payroll taxes is $11,029, over $4,000 higher! In the self-employed case, you’ll have payroll processing costs and need to pay an accountant to prepare your corporate tax return, which reduces your savings.

The bottom line is that if you’re making a lot and set things up correctly, becoming an employee doesn’t save you much if anything in terms of payroll taxes.

Worker’s Comp

If you’re a solo professional you don’t have to pay this, so having an employer pay it for you doesn’t save you anything (unless you suffer a work-related accident…).

Minimum Wage and Overtime Pay

If you’re a professional, these are likely irrelevant to you.

Unemployment Contributions

If you’re the sole employee of your own company, this may cost as little as $68/year during normal times. It could be higher during massive economic disruptions like the current pandemic, but even then may not be much more than $200/year.

Health Insurance (Including Dental, Vision, etc.)

This is harder to quantify, because some employers offer outstanding plans at no cost to the employee, while others offer mediocre plans with no contribution toward employee premiums.

For this run-through, let’s assume you’d pay $20,000/year for your family’s plan if you’re self-employed, and 20% of that if you’re employed, making its value $16,000.

Paid Leave

This is another one that’s not straightforward.

If you’re an employee, you don’t usually get money for this, but rather get to work fewer annual hours without a reduction in pay.

If you’re self-employed, you need to choose whether to work fewer hours or not. If you choose to work fewer hours, you may be able to offset that by charging a higher hourly rate.

For our purposes here, let’s assume this is a wash.

Disability Insurance (Short-Term and Long-Term)

Not all employers offer this, and not all self-employed individuals will qualify. Thus, it’s hard to assess the dollar value of this benefit, especially if you never suffer a disability.

Retirement Savings

Some employers match your contributions dollar-for-dollar up to some limit, say 3% (but could be more). Others match $0.50 on the dollar up to, say, 6%. Others don’t give any match.

For this calculation, let’s assume it’s dollar-for-dollar up to 6% of compensation, which makes it worth 6% of your income.

On the flip side, if you’re self-employed and make a lot of money, you can max out a solo 401(k), which you can’t do as an employee of a company that doesn’t contribute the most they’re allowed. This provides a nice tax benefit that very few employees enjoy.

Life Insurance

Some employers offer life insurance, but not all. Let’s assume the employer you’re considering contributes $1,000 toward such coverage. That’s worth 2% if you make $50,000, but only 0.4% if you make $250,000.

Other Benefits

There are many other benefits that employers can offer, and only some do. This includes, e.g., housing support, free catered meals, free laundry service, team-building via contributions toward joint after-work activities, wellness programs, paid shuttles to work, flexible spending accounts, employee assistance programs, sign-on bonuses, annual bonuses, referral bonuses, stock options, free legal consultation, free professional development, childcare benefits, student-loan payoff support, etc.

There’s no plausible way to calculate the value of such benefits for a general case, since different employers may offer none, some, or all of these, and at different levels.

For our purpose here, let’s assume an annual value of 6% of wages.

The Total Value Offered by a Job

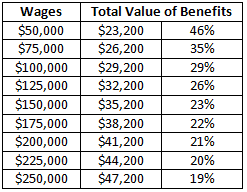

Excluding those items above that end up a wash or only have value if something unlikely happens, you end up with $17,200/year plus 12% of wages (if you contribute enough to your 401(k) to max out the assumed employer match).

As you can see, benefits are extremely valuable at the low-income end of the scale (adding nearly half of your pre-benefits compensation at $50,000), but gradually drop as your income increases.

Stated differently, if you’re self-employed and bringing in $150,000, a company would need to offer you a salary higher than $120,000 (and/or more generous benefits than we estimated here) to make it financially comparable.

If you take into account the far more generous tax benefits available to the self-employed than to employees, that number is likely closer to $130,000.

If your company’s profits are $250,000, that comparable employee wage offer would need to be at least $202,800, but likely more than $220,000.

Do the Pros Agree?

I asked a couple of financial pros how they’d respond if a client asked them whether she should accept an employment offer if she shutters her solo practice (not a buyout). Here’s what they said.

Richard Archer, CDAA, CFA, CFP, MBA, Owner and President, Archer Investment Management said, “I’ve been asked this question by two clients in the last year. The first deeply enjoyed the freedom to work wherever, whenever, and with whomever she wished. She is well-established in her career and doesn’t fear getting new clients. The amount of money and benefits would have to be well above market for her to consider returning to a corporate environment.

“The second client has tech and leadership skills that are in very high demand. The amount of equity compensation offered could be life-changing if he continues to perform at his high level. Plus, he’ll get to work on larger, better-funded projects. I could immediately tell he was excited by the big challenge he was being offered, and we immediately started talking strategy about his optimal compensation package.”

Joe Dunat, Wealth Advisor at Sturkie Wealth Management said, “With the increase in corporate layoffs, especially in mid-level manager roles, we’ve seen this question come from clients. This article illustrates a very analytical approach, but what we find is that many clients look at the situation differently. Do you miss the regular interactions and the relationships you build in one ‘building/office’ or are you comfortable with a more temporary situation? Often, being a solopreneur means shorter stints with a company and meeting new people often. It’s a terrific trade-off for someone disciplined and looking for new experiences. We also see clients who miss the birthday cake for each member of the team and a regularly scheduled holiday gathering. We find that the deciding factor on whether to go back to an employee model tends to be less analytical and more on the perceived value of a ‘safe’ workspace.”

The Bottom Line

Depending on your income, the financial value of being an employee runs from huge at low income to “nice to have” at high income. If you’re offered the same number of dollars of salary as your self-employed profits, plus benefits, it may be financially worth it. If you’re offered much less than that, it may not be.

Then, you must weigh the value of others relieving you from the need to wear all the hats working for yourself vs. the drawbacks of having a boss rather than clients. As relayed by Archer and Dunat, other non-financial aspects also come into play.

For me, even the large salaries mentioned to entice me failed to meet either test. For you, things may be different.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find an experienced financial advisor who can help you enjoy life more with less money stress. Get to know experienced financial advisors by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor who can meet with you online, or you prefer to find a nearby financial planner, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor