To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

I always advise consumers to start their financial advisor search with two questions:

- How does this particular financial advisor get paid?

- What type of business entity do they work for?

How financial advisors get paid influences their incentives and ultimately dictates the quality of their advice.

Because the financial advising industry is so opaque, not all advisors are forthcoming about how they are paid.

You may wish to seek out a fee only financial advisor (who does not receive commissions in any form) but mistakenly work with a fee based financial advisor (who will receive fees AND commissions).

Fee Based vs. Fee Only Financial Advisors – Which Is Right for You?

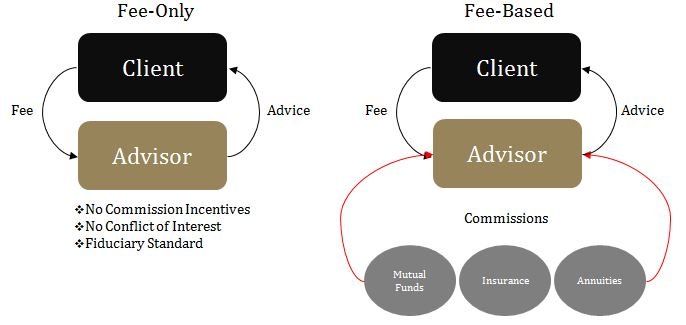

Advisors either receive commissions OR are paid by the fees their clients pay them.

The confusion arises when advisors are compensated by the fees their clients pay WHILE ALSO receiving commissions from the sale of financial products.

It’s easy to see how that mistake might be made given how similar the terminology is…

When financial advisors are paid commissions, they are not working for you, the client.

They are working for a company (brokerage, bank) that incentivizes the advisor to sell a PRODUCT.

As a consumer, you want to know if your advisor is working for YOU or working for SOMEONE ELSE when they present themselves to you.

To identify who a financial advisor is REALLY working for, I recommend focusing on these three things:

- Is the advisor a fee-only advisor or fee-based advisor?

- Do they work under a Fiduciary or Suitability standard?

- How do you identify/verify how the advisor is compensated?

What Is a Fee Only Financial Advisor and How Are They Paid?

Fee only financial advisors are only compensated by you, the client, and NEVER receive any form of commission.

How the fee only financial advisor is paid can differ by advisor – they may charge a flat fee, hourly fees, or a percentage of assets under management.

What Services Are Offered by Fee Only Financial Advisors?

Fee only advisors may also offer a range of financial planning services that include financial planning, investment management, 401k or 401a advice, ongoing financial advice, or fee for service financial advice.

What Types of Professionals May Be Considered Fee Only Financial Advisors?

Within the broader umbrella of fee only financial advisors you will also find:

- Advice only financial planners. Advice only planners do not offer investment management but may offer fee only financial advice or flat fee financial planning on a dollars per hour basis.

- Fee only financial planners. Fee only financial planners are another term for fee only financial advisors who focus on retirement planning or financial planning.

- Fee only investment manager. Also known as fee only wealth advisor, this individual will focus primarily on money management and will most likely not offer financial planning or retirement planning services.

- Advice only financial advisors. Similar to advice only financial planners, the advice only financial advisor will not directly manage investment accounts even though they may give you advice as it relates to those accounts.

The key thing to note here is that because the advisor only gets paid by YOU, they therefore work exclusively for you.

In addition, it is a violation of the fee only advisor’s fiduciary duty to hold a life insurance license or receive any trailing commissions – even from prior positions in which they may have been working as fee based financial advisers…

Because the fee only advisor does not receive commissions in any form, they will not broker life insurance or annuity transactions.

Most fee only financial advisors will refer out for financial solutions such as annuities or life insurance products.

NOTE TO READER: The fee only model is not limited to financial advisors. There are fee only financial planners as well. Fee only financial planner cost and fee only financial planner rates will in most cases be the same as those charged by fee only financial advisors. Both fee only planners and fee only advisors benefit from reducing their possible conflicts of interest by engaging in the fee only model.

What Is a Fee Based Financial Advisor and How Are They Paid?

Fee based financial advisors are compensated via a combination of the fees you (the client) pay, as well as brokerage commissions for selling financial institution products such as insurance or mutual funds.

What Services Are Offered by Fee Based Financial Advisors?

Fee based advisors may offer services like investment management, financial planning, or ongoing advice (similar to fee only advisors), but will also position and sell life insurance products, annuities, firm proprietary products, and mutual funds.

While the fee based advisor will be incentivized to position their own firms proprietary products to you the client, it is important to note that this is not a bad option in all cases.

Fee Based or Commission Based Financial Advisors

Because fee based advisors are able to broker life insurance or annuity transactions, should one of those products be an optimal planning solution for you, the fee based financial advisor can complete the transaction in house rather than referring out.

This simplifies the process and streamlines financial planning matters since one expert can handle everything in house.

The downside of fee based compensation, as you will see when we discuss suitability vs fiduciary standards, is that you – the client – may not be presented with ALL possible solutions because the fee based advisor has a vested interest in showing you only the recommendations that make them the most money…

NOTE TO READER: Just as with the fee only model, the fee based model can also apply to financial planners in addition to financial advisors. Because of this, fee based financial advisor cost will be in line with that of a fee based financial advisor. It is important to note here that because certified financial planners are held to a fiduciary standard, there is no such thing as a fee based certified financial planner.

Fiduciary vs. Suitability

What Is the Suitability Standard?

Fee based advisors are held to a “suitability” standard.

Suitability requires that investment products such as an annuity or a mutual fund sold for a commission must be suitable for the client but need not be the best possible investment product to meet the client’s needs.

As mentioned above, in many cases the fee based advisor will position their firms proprietary products as the optimal solution for your financial needs when in actuality their may be better or lower fee solutions available in the marketplace.

What Is the Fiduciary Standard?

Fee only advisors are held to a “fiduciary” standard.

The fiduciary standard requires that the advisor put their clients’ interests first and foremost.

Part of “putting clients interests first and foremost” requires eliminating bad incentives such as commissions that could sway the advisor to recommend something less than the best possible solution for the clients’ investment portfolio.

This will result in the advisor removing conflicts of interest, albeit with the tradeoff being that the advisor must refer out when situations arise that a life insurance or annuity product is indeed in your – the clients – best interest.

How to Verify an Advisor’s Compensation Structure

Most clients can spot a commission only advisor.

Your gut tells you to go with an advisor who is paid by you and not big banks or product placement firms.

But still, it’s extremely difficult to tell between fee only and fee based advisors, especially when the advisor in questions isn’t 100% transparent.

Here are three quick ways to verify how an advisor is compensated.

Check Their Form ADV

Form ADV is a compliance document hosted by state or federal regulators that lists whether the advisor is fee based or fee only, the size of the practice, what other business activities they might participate in, whether they receive other compensation, and whether any disciplinary action has been levied against the company.

Do Some Research

Most fee only advisors will be listed on fee only trade organization websites such as FeeOnlyNetwork.com, NAPFA, XYPN, or the CFP website. If you cannot find the advisor on one of those listings, it’s likely that the advisor is fee based rather than fee only.

Ask the Advisor Directly

If the advisor isn’t forthcoming or transparent, well that’s all you need to know both about their quality of character, but also about how they are most likely compensated.

In Conclusion

Fee only advisors are typically investment advisor representatives at independent smaller advisory practices.

These smaller practices are known as Registered Investment Advisors.

They will be held to a fiduciary standard, and may be Certified Financial Planners™.

Fee based advisors typically work for large banks, insurance companies, or institutional firms such as Ameriprise, JP Morgan, Morgan Stanley, or Northwestern Mutual.

The advisors will usually be titled as “Registered Representatives”.

Fee based advisors are held to a suitability standard and may have a series 6 or 7 license.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Eric Amzalag, CFP®, RICP® | Peak Financial Planning

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor