Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Retirement means something different for everyone. It’s a significant transition in your life that has lots of moving pieces. The earlier you start planning, the better.

Just because you start planning for retirement doesn’t mean you can’t adjust your plans. You can even think of it as a “retirement test drive” to help identify areas that need more attention. You’ll always need to adjust, but starting with a solid roadmap (or GPS) makes things much easier.

Early Planning for a Smooth Retirement Transition

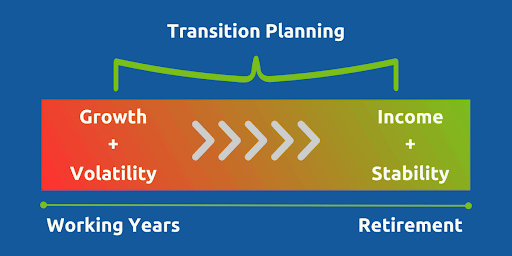

One of the best things you can do to smooth your transition is to start earlier than you think you need to. We recommend you start planning for retirement about 5 years (yes, years, not months) before you want to retire. Actually, we consider the transition into retirement as a distinctly separate phase of retirement planning – the transition phase.

Final Optimizing of Retirement Income Sources

Getting your retirement income in order may take some time to get in place. For instance, you may need to do some careful planning to maximize your last few working years. This may look like maxing out certain retirement accounts, performing backdoor Roth conversions, or shifting savings toward other expenses you’re not even thinking about yet.

By the time you reach retirement, we want you to have a clear order of operations for withdrawing funds to replace your income – also called your retirement income strategy. Also, there will be some key decisions you need to make as you terminate full-time employment.

Social Security Benefits

Developing a Social Security withdrawal strategy encompasses more than just when to draw. If you want to employ tax-saving strategies in retirement, these changes may affect your adjusted gross income (AGI). This has an impact on how much of your Social Security benefits are taxable, as well as your Medicare premiums.

We don’t want you to make a good decision for one side of your financial life to create a “pothole” in another. This is why you need to zoom out and take a bird’s eye view of the path to your dream retirement.

Maximizing Benefits of Employer-Sponsored Retirement Plans

Do you know all the ins and outs of your employee benefits? It’s never too early to start asking questions and finding recent retirees from your same company. Ask them questions like, “What do you wish you’d known before you retired?”

You may be surprised at what you’ll learn once you start asking around. As with anything, there’s probably a lot of paperwork and hurdles involved in some programs and benefits. You don’t want to wait until the last minute and miss an opportunity.

Managing Risks

The biggest concerns and risks you’ll face in retirement are the loss of income or increasing expenses. These can come in the form of sudden medical issues, inflation, premature death, or disability. These are all real threats, but there’s a lot we can do to control the financial damage caused by these risks.

Understanding Risk Tolerance and Asset Allocation

One key piece to think about is your tolerance and capacity for risk. Just like driving a car, some folks are more comfortable hitting the skinny pedal (more risk), while others like to take it a bit slower (less risk). As you exit the workforce, your ability to react to financial obstacles slowly diminishes.

You need to have a clear understanding of what your reactions will be when a down market or recession hits. You’ve got to understand these things will happen. We just don’t know when or how bad.

Managing Longevity Risk

Longevity risk is “financial planner speak” for running out of money in retirement – or simply outliving your savings. This is a significant worry for many people. However, there are many proven ways to ensure you don’t run out of money in retirement.

One of the best ways to accomplish this is to stay invested in a properly diversified portfolio and continually monitor progress. We like using a system of “guardrails” to adjust withdrawals to ensure you’ll always have enough money to live on without prematurely depleting your portfolio. We also plan in a way to account for you living a long, prosperous life.

Healthcare and Long-Term Care Costs

Speaking of long and prosperous, medical care plays a major role in your quality of life. No matter how well you take care of yourself, you can’t stop time’s toll on your body. Access to the best health care is essential to maintaining mobility to enjoy all the things you love longer.

As you near the end of your career, you’ll need to consider whether you’ll remain on your employer’s healthcare (if it’s an option), switch straight to Medicare, or if you’ll need additional coverages like Medigap or Medicare Advantage plans.

You’ll have to steer your way through what the best options are in your area, but also the financial aspects too. You need to be careful to avoid getting a visit from Aunt IRMAA (Income Related Medicare Adjustment Amounts), which can significantly increase your Medicare costs.

Proper Insurance Coverage

As you near retirement, you need to take a hard look at all your insurance coverage. This includes property and casualty insurance (home, vehicles, etc.), life insurance, disability insurance, long-term care insurance, and umbrella insurance. There are many other types of insurance, but these are the main areas we’d start with.

There are many areas where your need for insurance will decrease over time. For instance, if you know your family’s needs are covered completely through Social Security and income from your 401k, you may not need additional life insurance anymore. However, your need for things like umbrella coverage may increase in order to protect the assets you’ve accumulated to meet your needs.

Long-term care insurance is something you really need to start looking at sooner rather than later. There are a wide variety of options available with varying costs. The average stay in a long-term care facility and skilled nursing facilities is approximately 4-5 years and costs as much as $300,000 or more. This is a significant concern in retirement.

Preparing Mentally and Emotionally

The last, but probably most important, preparation we want to talk about is your mental and emotional transition into retirement. Thinking about and clarifying what you’re retiring to, not just what you’re retiring from, makes decisions so much easier. We highly suggest imagining and planning your retirement in as much detail as possible.

Shifting From a Work-centric to a Retirement-centric Identity

A huge hurdle you’ll have to overcome is your new identity as a retiree. Many of us ask strangers the question, “What do you do?” When you’re working, this can be as simple as a few words. When you’re retired, this simple yet impactful piece of your identity shifts.

As hokey or woo-woo as it sounds, you really do need to reflect and identify who you want to be post-retirement. Once again, this is easier when you start early. You can start exploring potential retirement activities now and build a community around yourself.

Staying Engaged and Maintaining a Sense of Purpose

Maybe you just want to focus on family more. Now is a great time to start doing “test runs” on family activities and traditions you want to be involved with. You may be surprised by what you’ll uncover and redirect what you want to do in retirement.

You’ve got to figure out what your “why” is going to be to get out of bed every morning. People with a strong sense of purpose and meaning in their lives are happier and live longer too. The importance of defining who you want to become in retirement can’t be overstated.

Developing Non-Financial Goals

This may sound weird coming from a financial planner, but developing non-financial goals is vital. As we just mentioned, your well-being is tied to your sense of purpose. When we’re working, it’s easy to let financial goals such as getting the next raise or saving for retirement distract us.

If you’re transitioning into retirement, now is a great time to start coming back to goals you previously set aside. Maybe you wanted to travel to all 50 states or learn to play the guitar. Get creative and let yourself dream big – then start planning how you’ll achieve those things.

More than Money

Retirement is about more than just the money. It’s about shaping your life on your terms. Planning early gives you time to fine-tune your goals and lay the groundwork for a fulfilling retirement.

Your financial, mental, and emotional well-being hinges on how well you execute your transition into retirement. Don’t just wing it or wait until the last minute. Building the road for an extraordinary journey takes time, patience, and thoughtful planning.

We hope this has given you a lot to think about. At NextGen Wealth, we specialize in helping hard-working savers, like you, master their transition into retirement. We hope the experience we’ve shared from working with hundreds of clients helps make your own transition as smooth as possible.

This article reflects the insights and opinions of its author and is not a recommendation or endorsement of their views or services.

About the Author

Clint Haynes

As a foremost Retirement Transition Specialist and the founder of NextGen Wealth, Clint Haynes is an expert in guiding couples and singles as they navigate the myriad challenges of retiring: financial, physical, mental, and emotional. Clint has been a CERTIFIED FINANCIAL PLANNER™ since 2001, loves to golf and travel, and is a total craft beer dork. He lives in Lee’s Summit, Missouri, with his incredible wife and daughter.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor