Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

I started from a negative net worth and got to the other end of the wealth distribution. Many of my friends are now also well off.

Here’s what I learned.

There are Three Simple Factors that Determine How Wealthy You Become

- Money

- Risk

- Time

Simple, right? Just three words sum up the whole deal. But maybe we should use a few more words to clarify…

- Money: How much do you set aside monthly for your future self’s sake?

- Risk: How do you invest the money you set aside?

- Time: How long are you willing to set aside money and leave it invested?

So simple, but boy are there a lot of details that go into each of those factors!

Let’s dip our toes a little further into the water…

Factor 1: Money Set Aside

This factor is captured in your so-called “savings rate,” which is the difference between what you make and what you spend (or better, spend the difference between what you make and what you invest, a.k.a. pay yourself first).

This isn’t rocket science or an amazing new discovery, it’s as simple as can be. Here’s how some people you may have heard of put it:

- “A budget is telling your money where to go, instead of wondering where it went.” – John C. Maxwell

- “Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

- “By definition, saving – for anything – requires us to not get things now so that we can get bigger ones later.” – Jean Chatzky

As is often the case, simple does not mean easy.

Our societal setup isn’t designed to make everyone wealthy. It’s designed to maximize the flow of money, and unsurprisingly, that flow ends up enriching further the already wealthy. That may not be fair, but it falls under the category of, “Give me the serenity to accept that which I cannot change.”

Does this mean you just have to accept whatever happens to you financially?

Not at all.

Here are some things you can do, and that I highly recommend you consider doing, broken down into the two parts of the money equation: how much you make, and how much you spend.

How Much You Make

Your income isn’t something handed down from on high, that you can’t change. You absolutely can affect it. You can cause it to drop by, e.g., quitting without knowing where your next dollar will come from. However, you can also increase it, e.g.:

- Work longer hours for someone else: (take on more shifts or a second job): This trades more of your time (read, life) for proportionally more money, but makes life harder and is ultimately limited.

- Take on more responsibility: This may well increase your stress level, but will likely increase your income far more than working longer hours.

- Get more advanced training and/or education: This adds to your skill set and marketability, letting you score a better-paying job. Doing this takes more effort and time in the short term, but ultimately increases your reward far more than proportionally to the time you invest.

- Start your own business: The low-risk, slower path is to start a side hustle while continuing to work at your current job. The higher-risk, faster path is to start a business and go all-in.

- Get your money to work for you: This is the truest path to passive income and financial independence. It usually takes a long time unless you take on high levels of risk. If you do take high risk, you have some chance of getting there faster, and more chance of never making it. The fact that this will likely take a long time doesn’t imply you should delay it – to the contrary, it means you should start it as soon as possible.

As to starting your own business, Alexander Lewis recently published an article on the type of business most likely to lead to top-1-percent income – professional services. That matches my experience, as a solo consultant.

How Much You Spend

If your income is very low, there’s only so much you can do about cutting your spending.

If you’re already living on a friend’s couch, subsisting on supermarket ramen noodles, using public transportation, and only spending what you have to, go back to the previous part, because this one is already tapped out.

If your income isn’t quite that low, go through the following exercise:

- Track your spending for 2-3 months.

- Take each purchase and classify it as (a) “I wish I hadn’t wasted money on that because it didn’t make me any happier” or “Wasted”; (b) “I don’t regret spending that money, but I could have found a cheaper alternative,” or “Overpaid”; or (c) “I spent the right amount on that,” or “Keep.”

- Build a budget around all the “Keeps,” plus say 10 percent less on the “Overpaid” than you paid, plus say 50 percent less than you spent on the “Wasted,” but targeted at things you value more.

- Rinse and repeat until the “Wasted” category is a small enough (for you) portion of your spending, and the “Overpaid” category is mostly empty.

As your income grows, allocate at most half (better, 1/3) of every new dollar of income to elevating your standard of living. That’s enough to enjoy a better life, but over time increases your savings rate painlessly.

Factor 2: Appropriate Investment Risk

There are two ways to end up poor, even if you set aside money – they are taking too little or too much risk. Here are some inspirational quotes on the importance of taking on some risk:

- “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” – Robert G. Allen

- “Fortune sides with him who dares.” – Virgil

And here’s the other side of the coin:

- “The individual investor should act consistently as an investor and not as a speculator.” – Ben Graham

- “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

The takeaway here is that if you take on too little risk, it’s next to impossible to build wealth, but that taking on too much risk, a.k.a. gambling, will turn out badly in nearly all cases.

Remember that every time you buy or sell, there’s someone selling or buying, respectively, on the other side of the transaction. You’re betting that you’re making the smarter deal. If you’re gambling, odds are you’re the one making the sucker bet far more often than not.

As an investment advisor once told me, it almost doesn’t matter what your investment plan is, as long as it’s plausible and consistent. If you keep chasing the hottest thing, you won’t be consistent, and you’ll likely keep buying high and selling low.

Factor 3: Sufficient Time Pursuing Your Strategy

The longer you pursue your strategy, the better, for two reasons.

- Each investment purchase has longer to compound its returns

- Overall, you’re putting more money to work for you

Albert Einstein (most likely erroneously) is said to have called compound interest the greatest force in the universe or something to that effect. Despite the fact that it’s doubtful he ever said anything of the sort, letting investment have plenty of time to compound is extremely powerful.

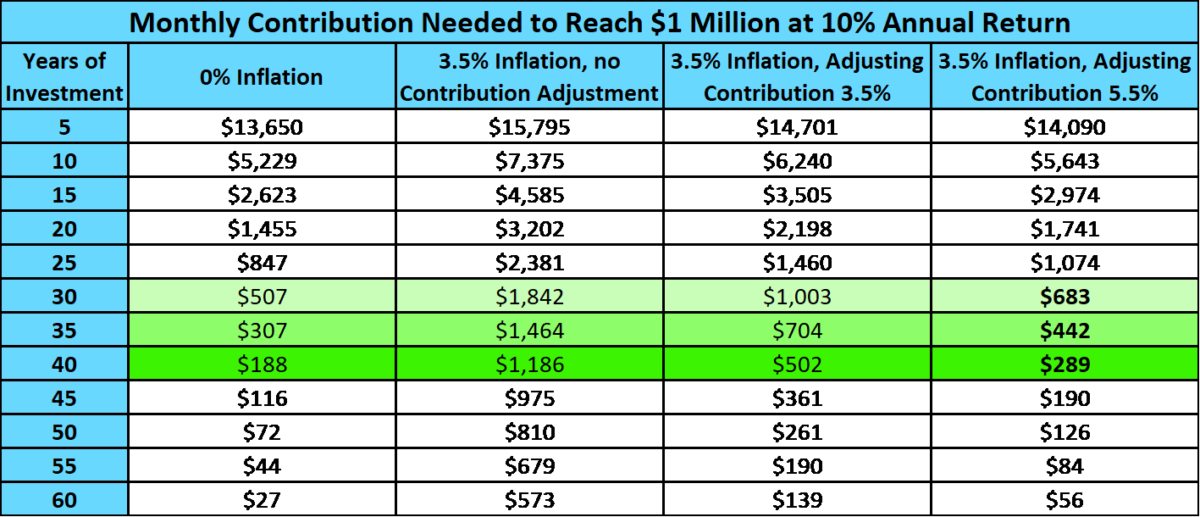

As the table below shows, waiting a decade to start investing double or triple the amount you need to invest monthly to achieve the same portfolio size at the same retirement age.

Conversely, starting a decade earlier likely cuts your required monthly investment in half or two-thirds!

How the Three Factors Interact

According to CNBC, about 8 percent of Americans are millionaires.

Obviously, that means about 92 percent are not, which agrees with the general consensus that reaching your first million dollars is hard.

The upshot of that is that you shouldn’t expect to find any legitimate, low-risk, quick way to riches. You can pick any one or two of the above factors and dial it to the extreme you like, at the cost of pushing the remaining factor(s) to the other extreme.

If you want a way to get rich quickly that doesn’t require starting out with a large fortune, you need to take extreme risk. Unfortunately, that means that for every one person who does this successfully, a large number who’ll try the same will fail miserably.

Alternatively, if you want something that’s low risk and takes little time to reach $1 million, you need to start with a large fraction of that $1 million, which is, as we discussed above, not easy.

The way to reach $1 million if you’re starting from (near) zero, without taking extreme risk, is to invest over a long time. As Ben Le Fort wrote, the boring way to become a millionaire is to invest in the whole stock market (through low-cost index funds) for a long time.

The Fly in the Ointment

Unfortunately, wealth isn’t a static target.

Getting to $1 million used to be considered having “made it.” According to Forbes, Americans now believe it takes $2.2 million to be wealthy.

This is because (a) there are constantly new things we want to have to feel wealthy, and (b) the cost of everything goes up, a.k.a. inflation. Inflation ran 8.6 percent year-over-year as of the end of May 2022. If it does the same over the next 12 months, in 2023 that $2.2 million will likely be $2.4 million, if not more.

That’s why, when you look at how much you need to invest each month, it’s best to consider inflation-adjusted returns and, as important, increase the amount you invest upward to at least keep us with inflation.

Most online calculators fail to account at least for the latter (though they may seem to account for it, play around with the inflation level input and you’ll see the results don’t change).

Here’s how the required monthly investment changes based on some assumptions.

If you assume the ~10-percent long-term return of stocks, investing $307 per month from age 22 to age 57 (35 years) will get you to $1 million.

However, that $1 million will be worth significantly less by then. If we assume the long-term average of 3.5 percent annual inflation, over 35 years, the purchasing power of that million will be cut by 70 percent!

If you want to overcome that, but make no adjustment in your monthly investment contribution, the required investment jumps from $307 to $1464!

Adjust your monthly investment amounts to keep up with inflation, and you can get by with “just” $704 per month.

However, since even that’s pretty hard, especially when you’re just starting out and have a lower salary, you can instead adjust each year by inflation plus 2 percent. Do that, and an initial investment of $442 per month should get you there.

If you want to invest less, you need to extend your timeline. Keep going another five years, and you can reduce your monthly contribution from that $442 to a far more plausible $289! If you want to retire five years earlier, however, your starting monthly investment would increase to $683.

Finally, keep in mind that all the above assumes ~6.5 percent inflation-adjusted annual return, which may be achievable with a 100-percent allocation to stocks. If that’s too much risk for your peace of mind, you’ll need to increase your monthly contribution to account for the lower return that comes along with the lower risk.

The Bottom Line

There are three simple factors that determine whether or not you can reach whatever level of wealth you desire. How much money you can invest, how much risk you’re willing to take, and how long you’re willing to continue investing.

Assuming you don’t take crazy-high risk (lottery anyone?) and aren’t starting anywhere near your wealth goal, you’ll need to trade between how long you’re willing to work on building that wealth vs. how much you’re willing and able to invest each month.

The above provides some guidance on typical numbers assuming stock-level returns. If you want to reach $2.2 million rather than $1 million, you’ll need to multiply all the numbers in the table by 2.2.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor