Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

As a man, writing on this topic is challenging because I lack first-hand experience.

However, I’ve observed the women in my life (mother, sisters, and daughters) and have helped many women clients.

In addition, I asked seven financial advisors to weigh in – all work with women clients, and five are women. Thus, I hope you find the following helpful and inspirational.

First, let me introduce the pros.

The Contributing Financial Advisors

- Myra Alport, Founder of Myra Alport Money Coach

- Michelle Francis, Financial Planner at Life Story Financial

- Danielle Miura, CFP®, founder and owner of Spark Financials

- Marianne M Nolte, CFP®, Imagine Financial Services

- Emily C. Rassam, CFP®, AIFA®, CRPS®, NSSA, Senior Planner at Archer Investment Management

- Jay W. Rishel, CFP®️, Overman Capital Management

- Philip H. Weiss, CPA, CFA, Principal at Apprise Wealth Management

The Special Money Challenges Women Face

Unless you’ve led a charmed life (or are totally oblivious), you know that women face many challenges in our society that men don’t (or do to a lesser degree). This is true in many aspects of life, not least of which is finances.

Here are women’s top 10 financial challenges.

1. Lower Labor Participation

Jay Rishel says, “According to a Bureau of Labor Statistics report, less than 58% of women participated in the labor force in 2019 vs. almost 70% of men. That means fewer women earn a salary and contribute to a retirement plan (IRA, 401k, 403b, etc.) relative to men.

“The pandemic of 2020-2022 made things worse. Many women left the workforce to be the primary caregivers of children who were unable to attend school or daycare. They still haven’t returned to the workforce in the same numbers that men have. This disruption makes the hill that much steeper for women saving for retirement.”

2. Gender Pay Gap

Even when women do work, they’re paid less than men on average, even for doing the same jobs!

According to the US Department of Labor (DOL) blog, “The data show that the majority of the gap between men’s and women’s wages cannot be explained through measurable differences between workers, such as age, education, industry, or work hours. It is highly likely that at least some of this unmeasured portion is the result of discrimination, but it is impossible to capture exactly in a statistical model…

“The jobs where women are most likely to work pay lower wages overall than jobs with a majority of men. This is especially true of jobs in care work, such as childcare workers, domestic workers, and home health aides, all of which pay below-average wages. And while it does not contribute directly to the wage gap, women-dominated jobs also are less likely to include benefits like employer-provided health insurance and retirement plans compared to occupations dominated by men.”

Some of the highest-paid jobs are in the so-called STEM fields – Science, Technology, Engineering, and Math. In our society, most girls are steered away from these fields and into more “traditionally female” fields like nursing, teaching, childcare, etc.

Rishel explains the result, “Women in full-time jobs earned 83 cents for every $1 that men earned in 2020. Add this to their lower labor participation, and it’s clear why women are behind the proverbial 8-ball when saving for retirement.”

Danielle Miura agrees, “The gender pay gap plays a large role in why women face financial challenges, such as saving for retirement and Social Security benefits.”

Marianne Nolte and Philip Weiss also note this as a serious issue facing women.

3. Career Interruptions

Miura says, “Women are more likely to be the primary caregiver for children and aging loved ones. Leaving work to care for a loved one can put a woman’s career on hold, losing benefits and possible promotions.”

Emily Rassam agrees, “A woman’s path to wealth building is usually less linear, as we’re often the ones to step back from our careers to care for children or become caregivers for our parents. As a result, we have fewer years to save. The above-mentioned wage gap means we have, on average, less salary to direct toward savings.”

Weiss also notes, “Women are more likely than men to take time off from their careers or work part-time to care for family members or raise a family.”

4. Greater Student Debt

Rassam quotes research on this, “Although women are now more educated than men, we also carry more student debt. According to an American Association of University Women study in 2019, women held 64 percent of all student debt, totaling $929 billion vs. men’s 36 percent or $531 billion debt.”

5. The “Pink Tax”

Miura notes that “Women often pay more than men for personal-care products on an everyday basis.”

This points to the so-called “Pink Tax,” which is not an actual tax – it’s the tendency by many companies to charge more for products marketed to women than for identical or nearly identical products for men. A widely quoted example is razors, where the main difference between women’s and men’s products is the color of the handle, but women’s razors cost more.

J.P. Morgan Chase quotes Jeanne Sun, General Manager of Inclusive Investing for J.P. Morgan: “By many estimates, the pink tax costs women an average of $1,300 annually. If the same amount were invested into a retirement fund each year, that would amount to about $16,000 over 10 years (assuming an annual return of 5%) and nearly $160,000 over a 40-year work life.“

6. The Money Taboo

Alpert points this out, “Women traditionally struggle to openly reveal their financial lives. Whether due to family upbringing where money was seldom discussed, a lack of financial education, or the view that talking about money is not a culturally or socially acceptable norm, women often feel embarrassed, ashamed, and judged when the subject comes up. They may not wish to face financial challenges due to highly charged emotions related to their finances and prefer the avoidance route instead.”

I can confirm that my mother, after my dad passed away, was very reluctant to discuss her finances. This even when I offered to help her manage those finances since in their 70+ years of marriage, she’d never managed their money.

She finally did agree, but was never truly comfortable with it no matter how much I explained it’s her money, and how she chooses to spend it is entirely up to her – my only concern was to make sure she could maintain her lifestyle without running out.

7. Lower Stock Market Participation

Weiss makes several related points here, “Women often delay saving for retirement, or don’t save for retirement at all because their spouse does. They often carry too much credit card debt – especially single women who have lower credit scores and higher outstanding balances. Finally, many women lack financial confidence – while studies show that women generate higher average investment returns than men, many women fail to invest. They’re less confident about their financial experiences and expertise.”

The Motley Fool notes, “Most research indicates that women have a tendency to shy away from stocks, despite the growth potential that comes with them. The average woman investor keeps 68 percent of her portfolio in cash and cash equivalents, like money market accounts, Treasury bills, and certificates of deposit, according to a 2015 BlackRock survey. By comparison, men keep 59 percent of their portfolios in cash.”

They also point out that only one woman in three feels comfortable making investment decisions vs. one in two men.

8. Longevity

All seven pros point this one out as a major issue from a financial-planning perspective.

Rassam kicks things off, “If you walk around a nursing home, you’ll notice it’s predominantly women who outlive their partners and must plan for longevity and long-term care.“

Rishel agrees, “Women live longer than men so they need more savings to get them through retirement. The National Vital Statistics Report from March 22, 2022 highlights that ‘life expectancy [difference] between the sexes was 5.1 years in 2019…’ For Non-Hispanic White females, their estimated life expectancy at birth was 81.3 years in 2019 whereas male’s was 76.3 years.”

“Women have a longer life expectancy than men. As a result, they need to save more money for retirement to last 20 to 30 years,” says Miura.

Michelle Francis also agrees and ties this to career interruptions, “Women have a longer life expectancy and are more than twice as likely to outlive men, meaning they need their money to last. And since many women exit the workforce to raise children or to care for elderly or sick family members, they’re often behind their male counterparts on the career ladder. This can lead to reduced lifetime earnings and smaller retirement savings, which compounds the problem.”

Weiss notes this is further compounded by the typical age difference between spouses, “Women live longer than men, and this effect gets magnified for most married couples as, on average, women are about two years younger than their husbands.”

My mom’s experience bears this out. Though my dad lived to age 91, my mom was three years younger so she survived him by several years. During those years, her expenses were lower, but not by anywhere near as much as the reduction in income she suffered when he passed away.

9. Lower Social Security Benefits

Another impact of a lower lifetime earning is one pointed out by Nolte, “Women often hold lower-paying jobs; therefore, they receive lower benefits in retirement. Often, if a couple has a small business, the husband takes the financial lead and is taxed on the income received. He contributes to Social Security, but the wife isn’t building a benefit for herself. As a result, women tend to have lower Social Security benefits.” Though widows can receive their late spouse’s benefit if it’s higher than theirs.

10. The “Widow Tax Trap”

Nolte points out another issue she terms The Widow Tax Trap, “Say, a husband and wife each have an employer 401(k). They‘re taxed as Married Filing Jointly, which receives the largest standard deduction. In retirement, they each begin taking Required Minimum Distributions (RMD) at the appropriate age (currently 72). Statistically, women tend to outlive their male partners. He passes away and as a widow she inherits his 401(k). Now she has to take RMDs for both her account and his, but two years after he passes away, she receives the considerably lower Single standard deduction.”

Women’s Finance-Related Advantages Over Men

With so many challenges facing them, many women might feel overwhelmed and simply hope for the best. That would be a big mistake.

Women have some distinct finance-related advantages over men and should use these to overcome the challenges.

Rassam points out two such advantages, “Thankfully, there are statistics that favor female investors. Women trade 45 percent less frequently [than men] and have an annual rate of return 1 percent higher on average (UC-Davis, Professors Brad Barber and Terrance Odean, 1990s study), and we out-save our male counterparts.”

The Motley Fool agrees, “Women’s tendency to do better than men at investing dates all the way back to the early 1990s. A study by the University of California, Berkeley, based on 35,000 brokerage accounts over a six-year period found that women generated returns that were 1% higher, on average, than men… Despite grappling with substantially lower paychecks on average, women tend to have higher savings rates than men.”

That 1-percent annual difference may not seem like much, but over a 40-year career it builds up!

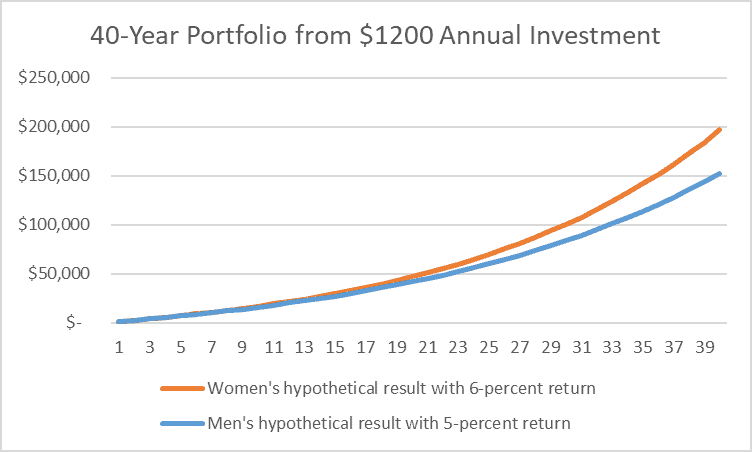

Here’s a hypothetical comparison of women’s results to men’s if both invest $1200 a year, with men’s annual return running at 5 percent, and women’s 1 percent higher.

In this scenario, the extra 1 percent annual return translates to a 29-percent larger portfolio!

The Motley Fool quotes a Vanguard study comparing women’s trading habits to men’s, “Vanguard has also found that women trade 40% less frequently than men. And that’s not just a recent trend. Between February of 1991 and January of 1997, men traded 45% more than women, according to a University of California study. All of that extra trading was said to reduce men’s net returns by 2.65% a year, as opposed to 1.72% for women.”

The Bottom Line

In our society, it’s inarguable that women face far greater financial challenges than men. The above identifies 10 such challenges.

However, women also have two important finance-related advantages over men. First, they’re more disciplined savers, putting greater emphasis on their future needs than men. Just ask Aesop’s grasshopper how important that can be.

Women are also less impulsive than men, looking at their portfolios less often, and trading far less often than men. Given how a Fidelity study once found that the best returns of all Fidelity investors were of those who forgot they had a Fidelity account, less frequent trading improves investing returns. As a result, women’s returns average about 1 percent a year higher than men’s.

In the second of this two-part article, I address women’s finance-related fears and how they can overcome those and the above challenges using their advantages.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor