To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Taxes. It’s hard to think of a more reviled aspect of our government.

When I first met him, a friend was diffident responding when I asked what he does – he’s an IRS attorney… Needless to say, I don’t hold that against him. As I told him, I know taxes fund everything the government does, from highways and bridges to national defense, etc. He was visibly relieved.

However, as much as I understand and accept that taxes are necessary, that doesn’t mean I like paying more than I need to.

Should We Pay More Taxes than the Minimum Required?

Some people think that everyone (who makes more than they do) should pay as much as possible in taxes.

Everyone is eager to do away with tax breaks that don’t help them personally.

- We should abolish the mortgage interest deduction, say people who don’t have a mortgage

- We should tax investment income more than wage income rather than far less, say people whose income is mostly from work

- We should increase tax rates on high earners, say people who earn less

- We should have a special tax on the wealth of multi-millionaires and billionaires, say people who aren’t either

- We should have a flat tax, say people whose taxes would drop as a result of such a change

You get the idea, right?

However you feel about any of these points (or any number of others) about how the tax code should be changed, there’s one thing few would disagree with. Judge Learned Hand said it best 88 years ago:

“Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.” Gregory v. Helvering, 69 F.2d 809, 810 (2d Cir. 1934)

The US Tax Code Is Complicated!

The US tax code is famously long and complicated.

While in 1913 it could be printed on a single page (!), by 2005 it comprised over 2 million words, and in 2021 it spanned over 10,000 sections, according to efile.com.

The Tax Foundation estimated in 2014 that the code, along with IRS regulations and case law came to a staggering 70,000 pages! They also quoted the National Taxpayer Advocate as having stated the tax code changed on average about once a day from 2001 to 2012.

This complexity makes filing a tax return an annual ordeal for most, even for those of us who hire accountants to prepare their tax returns.

But in one aspect, this complexity can be a good thing.

If you’re creative enough, you can find wording in the tax code that lets you arrange your affairs such that your taxes are lower, to paraphrase Judge Learned Hand.

The Dreaded Required Minimum Distribution (RMD)

To encourage us to save for retirement, Congress put into the tax code many options for deferring taxes on such savings.

IRAs, SEP IRAs, SIMPLE IRAs, 401(k) plans, 403(b) plans, etc. all let you take money from your current wage income and set it aside before taxes, reducing your current tax liability. Instead, you pay taxes on withdrawals in retirement, when you actually want to use the money.

The problem Congress then faced was that the wealthy could set aside the most money, and usually don’t need to ever withdraw it. They can simply live off their taxable investment income. Then, they can leave the full, untaxed amounts in the plans to their kids who may also not need it, potentially deferring taxes for generations (at least until the SECURE act required heirs to drain inherited accounts within 10 years of the bequest).

To make sure Uncle Sam gets his bite sooner rather than later, Congress set up the so-called Required Minimum Distribution (RMD).

Whether they need the money or not, retirees are forced to take out of their retirement plans (and pay taxes on) an ever-growing portion of their balances each year, starting the year after they turn 72.

Don’t take out your full RMD, and you’re penalized a hefty 50% (!) of every dollar you failed to withdraw.

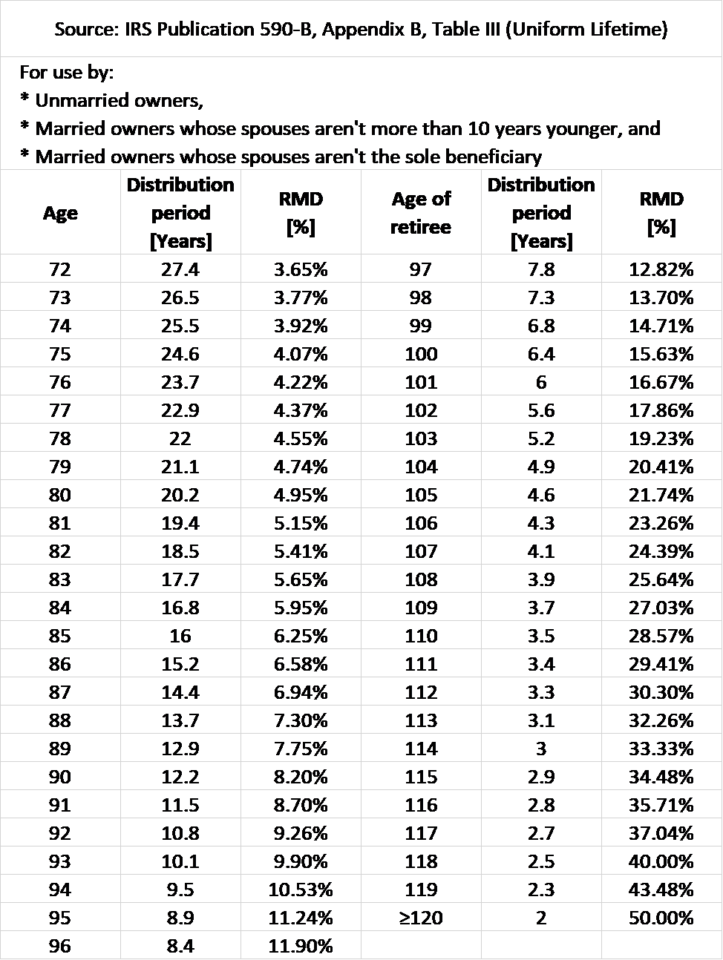

The IRS offers several tables that tell you your RMD percentage for your age. The so-called Uniform Lifetime Table (see below) applies to most taxpayers.

As you can see, when you’re 72, you have to withdraw and pay taxes on 3.65% of your retirement plan balances.

At age 75, it’s 4.07%. When you’re 80, it’s 4.95%. Turned 90? Now it’s 8.2%.

If you make it to your 100th birthday, it’s 15.63%.

Considering that good retirement planning has you withdraw no more than 4% of your portfolio to fund your retirement expenses, from age 75 and on RMDs force you to draw more than you should, so the tax man can get his cut.

Worse, on average retirees spend 1% less each year in retirement, so beyond the ever-increasing bite of the RMD, the expenses you need to fund shrink, adding insult to injury.

7 Well-Known Ways to Sidestep the RMD

There are 7 ways your financial advisor may help you sidestep or at least reduce your RMDs.

- Withdraw more earlier: If you draw down your retirement plan balances before you’re 72, your RMDs will be lower. This may make sense if, for example, it lets you delay claiming Social Security benefits, increasing your eventual benefits by up to 24%. The problem is that this “solution” reduces (not avoids) your RMD by draining your nest egg.

- Convert traditional IRAs to Roth IRAs: Since Roth IRAs are funded with after-tax dollars, they’re not subject to the RMD. However, this conversion causes you to pay taxes now. Hardly a great solution for avoiding the excess taxes forced by RMDs after you turn 72.

- Investing in Qualified Longevity Annuity Contracts (QLACs): You’re allowed to invest up to a quarter of your IRA or 401(k) in QLACs, without those annuities being subject to RMDs. However, that’s limited to $125,000, and it also reduces the money you control and can leave for your heirs.

- Invest your tax-deferred accounts in bonds and bond funds: Since income from bonds is taxed at your regular income tax rates, while returns from stocks get taxed at lower rates, holding bonds and bond funds in tax-deferred accounts and stocks and stock funds in taxable accounts reduces your taxes over the long haul. The problem is that if your retirement accounts are the bulk of your liquid wealth, you’d be sacrificing the far higher returns you’d likely have from stocks compared to bonds.

- Donate your RMD: If you want, you can donate up to $100,000 a year to charities from your retirement plans, and this satisfies the RMD without hitting you with a tax bill. The problem is that instead of losing the say $30k to taxes, you lose $100k to the donation. While charitable giving is a good cause, this isn’t a way to retain more of your wealth to leave to your kids.

- Time your first RMD earlier: Your first RMD must be taken by April 1 following the year you turn 72. After that, each RMD has to be taken by December 31 of the relevant tax year. Depending on your tax bracket situation, if you delay RMDs as long as legally allowed, you’ll take two RMDs in the tax year following the year you turn 72, which could push you into a higher bracket.

- Keep working: If you continue working past age 72, RMDs are suspended for the retirement plan where you work (you still have to take RMDs from all your other retirement plans, but not that one). Except… if you own more than 5% of your employer. If you do, this exclusion doesn’t apply to you.

Ask the Experts: Financial Advisors Share Smart RMD Strategies

For additional insights, we invited financial advisors in the Wealthtender community to offer their perspectives on required minimum distributions. Here’s what they said:

An Innovative Way to Avoid RMDs Altogether

As mentioned above, if you own 100% of your business that 7th method won’t help you.

However…

What if you’re ready to call it a career before age 72?

You find a buyer for your business and sell at least 95% of it.

Now that you no longer own more than 5%, your 401(k) balance at what used to be your business isn’t subject to RMDs, as long as you stay on the payroll. You could even make retaining you as an employee a requirement of the sales contract.

There are a few hoops to jump through…

- Complete the sale of at least 95% of your business before the calendar year in which you turn 72.

- Sell to someone who isn’t your direct relative (spouse, child, parent, etc.)

- Remain on the company payroll for as long as you want to defer your RMD

Interestingly, my accountant says there’s no requirement on how many hours you work, your hourly pay, or what work you do. It could be 10 hours a month at minimum wage for reviewing documents. You just need to remain on the payroll and continue to participate in the 401(k).

Even more interesting, before you sell your business, you can make sure your 401(k) allows you to roll over other tax-deferred retirement plans into it. Then, roll all your traditional IRAs into the RMD-proofed 401(k).

Voila! No more RMDs!

Now, your withdrawals are dictated solely by your spending needs, dramatically reducing your tax bills late in life.

If you don’t own >5% of your employer (and especially if you own none of it), and they don’t have a set retirement age, being friendly with the owner offers benefits beyond being treated well at work.

Ask her to keep you on the payroll at minimal hours and minimum wage, so you can delay your RMDs. Here too, you may be able to roll over your IRAs into the company’s 401(k). The obvious limitation is that at some point your contribution to the company will stop being worth even this minimal cost, and they’ll let you go.

But if you still own, say, 1% of the company, they may overlook your decline…

The Bottom Line

RMDs may force you to deplete your tax-advantaged retirement plans faster than you need or want.

There are at least 7 ways to reduce or delay your RMDs, but most throw out the baby with the bathwater.

The above shows an innovative approach to the one RMD exception that’s actually helpful, that lets owners of small businesses legally sidestep RMDs for as long as they want if they’re planning to sell their business anyway.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor