To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

It’s one of the most significant financial decisions facing you as you approach retirement age.

Should you claim your Social Security retirement benefits as early as possible (at age 62), delay until your full retirement age (FRA) – 67 if you were born in 1960 or later, or delay further, potentially to age 70?

If you’ve read up on it, you’ll find many sources arguing for delaying as close as possible to age 70 if you can, as well as many arguing that there are distinct advantages to claiming early.

Which is right for you?

The following digs into this exact question and brings in guidance from four financial pros and wraps up with my own analysis and conclusion.

Who Are the Financial Pros Quoted Below?

I asked four pros for their thoughts on the topic:

- Nick Covyeau, CFP®, Owner and Financial Planner at Swell Financial

- Kevin Lao, CFP®, Founder and Director of Financial Strategies, Imagine Financial Security, LLC

- Yvonne Marsh, CFP®, CPA, Principal at Marsh Wealth Management

- Emily C. Rassam, CFP®, AIFA®, CRPS®, NSSA, Senior Planner at Archer Investment Management

First, the Facts – How Does Claiming Age Affect Your Benefits?

You can get the straight facts straight from the horse’s mouth, so to speak. According to the Social Security Administration (SSA), “In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.”

Delaying past your FRA adds 0.67% per month, or 8% per year, to your benefit relative to what it would have been at FRA.

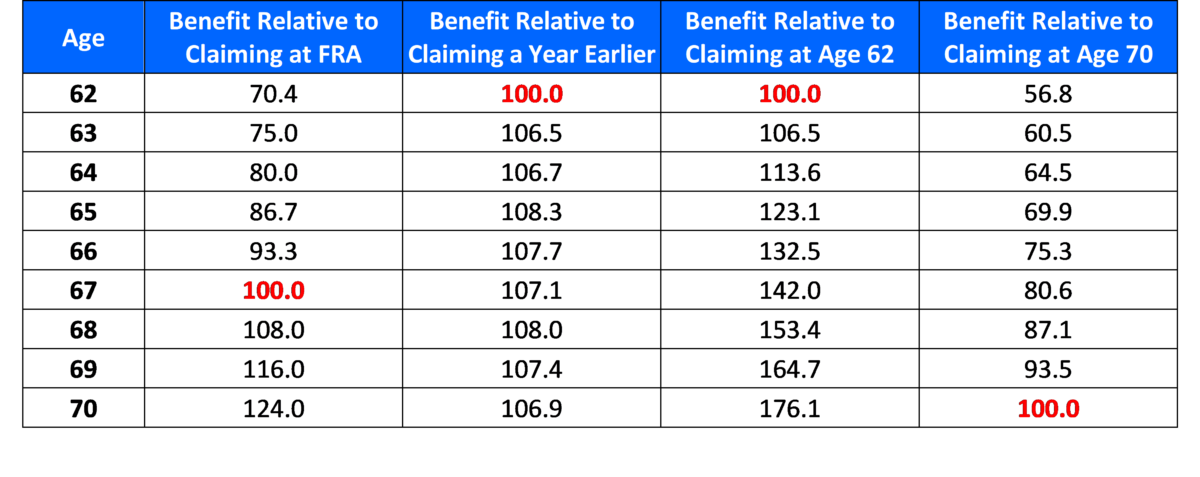

To make this easier to understand, I put it in tabular form (the red identifies the baseline for each column).

The table provides four different ways of looking at the same data. First, the benefit you get at each age relative to your benefit at your FRA (assumed here to be age 67). You can see that claiming as early as possible reduces your monthly benefit by nearly 30 percent, while delaying past age 67 adds 8 percent for each year of delay.

The next column shows you how much higher your benefit is at each age compared to claiming one year earlier, with age 62 serving as the baseline. Here you see that each year of delay gains you an additional 6.5 to 8.3 percent. Third, and related to the previous column, we see the overall percent gain in monthly benefit amount relative to the benefit at age 62.

Finally, the last column looks at how much lower your benefit is for each claiming age relative to the highest possible monthly benefit – if you delay to age 70. Here you see that the earliest claiming decreases your monthly benefit by over 43 percent.

The critical thing to understand, as we’ll see when we get to my analysis below, is that by design, your lifetime benefit, on average, will be the same no matter what age you claim your benefits. Claiming earlier reduces your monthly benefit, but you get more payments. Whereas delaying your start increases your monthly benefits, you get those for fewer months.

While this seems to make the whole discussion moot, it most decidedly does not!

It just means that your answer depends on how your personal situation compares to the average person’s. And that’s what we’ll try to suss out in the following.

What Are the Main Factors Affecting Whether You Should Delay Claiming Social Security?

There are many factors that affect your optimal strategy here. Here’s what the pros say are the most important to consider.

Nick Covyeau says, “The main factors include financial need, health, and additional sources of income.”

Kevin Lao elaborates:

- “Longevity: If you’re healthy and have longevity in your family, you might live past SSA’s life expectancy tables. Men turning 65 today are expected to live to age 83. Women turning 65 today are expected to live until about age 86. By delaying as long as possible, you’ll receive the max benefit over time. If you are NOT healthy and don’t have longevity in the family, you might consider claiming as early as possible.

- “Spouse’s longevity: If your SPOUSE has longevity and is healthy, consider delaying the larger of the two benefits. If your benefit is higher than your spouse’s, you should delay yours until 70, so your spouse can collect that higher benefit upon your death. Note that your spouse’s spousal benefits, while you’re still alive, don’t increase beyond your benefit at your FRA.

- “Impact on Rate of withdrawal on portfolio: You might consider taking SS on time to avoid draining your portfolio too quickly. If there’s a major medical expense during retirement, it’s nice to have liquidity on the balance sheet to tap into “just in case.” Social Security is not a liquid asset!”

Yvonne Marsh adds, “Life expectancy and marital status are important. I use dedicated Social Security timing software, and over the years, it consistently shows that if a person expects to live past their very early 80s, their lifetime benefit will be greater by delaying their benefit start. The longer your life expectancy, the greater the case for delaying.

“Next, your ability and desire to keep working. If you claim benefits before your FRA, you’re limited in how much earned income you can have before your benefit is reduced. In 2022, that limit is $19,560 in earned income, such as wages or independent contractor income. Your benefit is reduced by $1 for every $2 over that limit you earn, so the amount of your benefit check gets smaller in a hurry if you’re still working.

“Finally, other sources of guaranteed income. If you have other guaranteed income, such as pensions or annuities, it won’t be as critical to delay Social Security to create the biggest check possible.”

Emily Rassam rounds things out, “Online Social Security calculators only show one piece of the puzzle: total cumulative dollars received from Social Security in your lifetime. If live past age 82, online calculators will always tell you to take Social Security at age 70. However, that may not be the best answer for you, and you need to evaluate how that decision impacts your asset balances over time. If you look at the complete picture, which includes a projection of your investment portfolio balance over time, it may make more sense for you to take Social Security earlier.

“Often, if you delay until age 70, you draw down assets significantly, which can hurt your long-term asset trajectory. Like all financial decisions, a comprehensive financial plan can tell the whole story and help you make decisions with all the relevant data organized.

“It can also be emotionally difficult to start drawing down your portfolio; starting Social Security earlier can feel more like a paycheck and income.”

Do the Factors Depend on Income Level and/or Having a Spouse?

Next, I asked the pros how the above factors may be affected by your income, marital status, and especially if your spouse is significantly younger or older than you.

Lao answered, “One factor that income does impact is the so-called “tax torpedo.” Anywhere from 0 to 85 percent of your Social Security benefits will be taxable. You may be able to reduce how much of your Social Security is taxed by delaying benefits until 70, aggressively converting 401k or IRA dollars to Roth plans, and/or using IRA and 401k dollars to supplement retirement income.

“Then, at 70, you might have little to no income from other taxable investments and potentially maximize the tax efficiency of your Social Security income! This works great for married couples with less than $75k of total income or singles with less than $50k of total income.”

Covyeau says, “Learning how to align your benefits is crucial for married couples, and each situation is different. Some couples want to solely work on how to maximize their total lifetime benefit, while others want more money upfront in the early stages of retirement while they’re young and able to travel. That’s why working with your financial planner is so critical in determining what is best for YOU.”

Marsh answers, “Marital status comes into play when we look across the arc of the combined lifetimes of both spouses. At the first spouse’s passing, the surviving spouse gets to keep the greater of the two benefit checks. So, by allowing at least one of the spouse’s benefits to grow as large as possible, it provides a larger survivor’s benefit. This can be critically important for the surviving spouse at a time when the household is feeling the combined effect of less income (through the loss of the lesser Social Security check), and higher tax rates as the surviving spouse moves from Married Filing Joint brackets into Single tax brackets.

“Interestingly, if the spouses have a large age difference, the answer gets more nuanced. Let’s say a wife is 10 years younger than her husband. The odds of her being a widow for a longer time is greater since men have a shorter life expectancy, and she’s younger as well. So, it can benefit the couple to have the younger wife go ahead and start taking her benefit at age 62, knowing that when her older spouse (who hopefully maximized his benefit) passes, she’ll take over his benefit and lose her own. She needs to receive as much of her benefit as quickly as she can, knowing her benefits’ number of years is shorter than a more closely aged couple.”

What Are Some Widespread Social Security Myths?

There are some widespread myths and misunderstandings you should steer clear of.

Lao points out the biggest, “One myth is the belief that Social Security is going to be bankrupt in the next 20 years. Sometime around the year 2035, Social Security will have a shortfall, meaning current taxes will not be able to support benefits. Therefore, certain changes will need to be made before then…but Social Security will still remain the largest pension fund in the world.”

Covyeau points to a misunderstanding of benefits once your spouse passes away, “Differently than what many believe, if your spouse delayed claiming to age 70, you’re not eligible for 50 percent of his or her Social Security benefit at 70, but rather their benefit at FRA.”

Marsh says, “If you’re concerned that delaying benefits makes you lose out if you die young, understand that if you die young, it’s a moot point. But if you do live to age 95 or 100, early claiming may cripple your retirement years.”

What Are Some Tips and Resources People Can Use?

Covyeau says, “Work with a financial planner who knows the rules, can run timing scenarios and is able to look at your entire picture to develop a comprehensive strategy.”

Rassam gives two related tips, “First, don’t expect the Social Security Office to help you optimize your filing strategy. SSA employees can only tell you the rules and facts, they cannot help you strategize. Once you’ve gathered your benefit options, including any applicable spousal or survivor benefit options, visit a financial planner. A planner can help you evaluate your filing decisions in the context of your full financial plan. Second, if you do seek a planner, find one who has completed the National Social Security Advisor (NSSA) coursework or Retirement Income Certified Professional (RICP) coursework. Both take a deeper dive into the filing strategies.”

Marsh adds, “Seek a professional with access to professional-level Social Security analysis software. Optimizing benefits, especially for married couples, can literally mean a difference of tens of thousands of dollars to the household over your combined lifetimes. It’s one of the most important financial decisions you’ll ever make.”

Lao’s tip is, “If you have multiple buckets to tap in retirement, you might consider investing those buckets differently based on when you claim benefits. If you delay Social Security until 70, invest the bucket you plan to withdraw from early more conservatively. You can invest the buckets you don’t intend to tap into until later in retirement more aggressively, given your time horizons.”

Two resources he suggests using are Planning your Social Security claiming age (Consumer Financial Protection Bureau), and SocialSecurityResources (The American College).

A Couple of Often-Overlooked Factors You Must Consider

As I pointed out above, the SSA’s formula is designed to ensure that, on average, you don’t lose or gain anything by claiming early or late.

They don’t care if you, personally, make out like a bandit for decades or die before getting a red cent from the SSA, as long as the total benefits paid out to all retirees aren’t affected by timing decisions.

However, your timing decision shouldn’t be blind to important factors that can inform you. In the above, the pros pointed out many important factors, including your health, your family’s tendency to longer (or shorter) than average lifespans, marital status, and the age difference between you and your spouse.

An interesting additional factor is race. Some ethnicities tend to live longer than others. You’d probably not be surprised to learn that whites in America tend to live longer than African Americans. What may surprise you is that Hispanics tend to live several years longer than whites.

Two other factors that are often overlooked have a massive impact – education and income. The more highly educated you are, and the higher your income, the longer your life expectancy. That longer life expectancy adds weight to the benefit of delaying Social Security benefits.

Education Can Add a Decade or More to Your Life Expectancy

The NY Times reported, “In 2012, researchers found that life expectancy for white women without a high school diploma was 73.5 years compared with 83.9 years for white women with a college degree or more. For white men, it was 67.5 years for those without a diploma compared with 80.4 for those with a college degree or better.”

While it isn’t clear what portion of those 10 or 13 additional years of life expectancy (for women and men, respectively) are due to reduced mortality before retirement, it’s very likely that at least some of those extra years extend the length of retirement.

If your life expectancy in retirement increases by, say, five years, that could be five additional years to go beyond the SSA’s by-design breakeven point, so delaying your claim to age 70 makes more sense.

High Income Can Also Add a Decade or More to Your Life Expectancy

The Congressional Research Service reported in 2021, “Among men born in 1960, those in the top income quintile could expect to live 12.7 years longer at age 50 than men in the bottom income quintile. This NAS [National Academy of Sciences] study finds similar patterns for women: the life expectancy gap at age 50 between the bottom and top income quintiles of women expanded from 3.9 years for the 1930 birth cohort to 13.6 years for the 1960 birth cohort.”

The data show that life expectancy at age 50 increases not just relative to the lowest 20 percent of income but also from the middle 20 percent to the upper 40 percent.

It’s unclear to what extent this overlaps the benefit of greater education, but it pushes in the same direction – if you’re in the upper 40 percent of income, and even more so if you’re in the upper 20 percent, delaying Social Security benefits makes more sense for you.

The Bottom Line

The SSA designed its system to avoid an impact on when the overall population of retirees chooses to claim their retirement benefits. However, that doesn’t mean such timing strategies don’t make a difference in your personal case. On the contrary, making the optimal decision on when to claim Social Security retirement benefits can make a huge financial difference for you and your spouse (if any).

A final thought comes from Kelley Long, writing for the Journal of Accountancy, “Probably the most overlooked fact is that deciding to delay Social Security is not a one-time decision while claiming your benefit is (unless you want to pay back any benefits you’ve already received in order to reverse your decision). Once you’re eligible, you can claim at any time, so deciding to delay is realistically more of a semiannual decision rather than a once-in-a-lifetime opportunity.

“In fact, once you exceed your full retirement age, you can elect to receive up to six months of retroactive benefits in a lump sum. This can help alleviate one of the primary concerns that people have, which is that they might regret delaying Social Security benefits if they experience a health diagnosis or other circumstance that reveals the possibility of a shorter-than-expected lifespan or a need for a large cash infusion.”

The above points out many factors that play into your optimal strategy and can help inform your considerations when deciding on your personal course.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor