Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

As I approach my own “work optional” phase of life, I’m thinking more and more about what our retirement budget might look like.

More importantly, I’m looking at the (very large) investable net worth that would take.

And no, I’m not gonna spill the beans about our numbers here, but I will share some interesting tidbits about the wealthiest group of Americans.

The Many Levels of Wealth

The number many people concentrate on is net worth.

Stated simply, your net worth is the difference between what you own and what you owe.

The problem most Americans run into when trying to figure out if they can afford to retire is that much of their net worth is trapped in their home equity — the difference between the value of their home and what they owe on it (if they haven’t yet paid off their mortgage).

If you own a $500k home free and clear, that contributes $500k to your net worth.

It also reduces how much you need to spend each year because you don’t have to pay a monthly mortgage payment or rent.

However, you can’t (easily) use that money to pay for groceries or utilities.

That’s why I prefer to use “investable net worth” as my measure of how we’re doing in terms of approaching work-optional status.

This flavor of net worth excludes your home’s value and your mortgage balance since neither of those affects how much you can invest in income-producing assets.

When you’ve amassed at least $1M investable net worth, you’ve joined the ranks of high-net-worth (HNW) individuals.

If you’ve blown past that line and have at least $5M investable net worth, you’re considered a very-high net worth (VHNW) individual, and an ultra-high net worth (UHNW) individual if your investable net worth exceeds $30M.

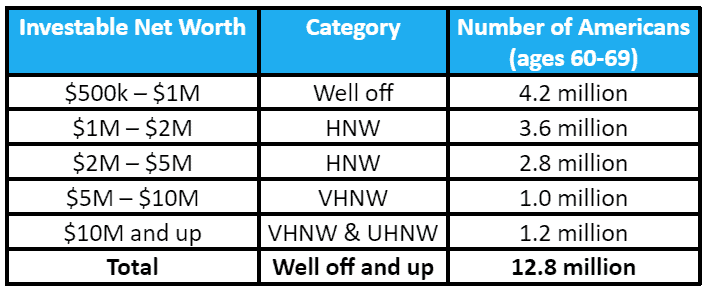

How Many Americans in Their 60s Are Wealthy?

According to Statista, there are 21 million Americans aged 60–64 and about 19 million aged 65–69.

Combining that with data from the Federal Reserve Survey of Consumer Finances, using DQYDJ’s nifty net worth by age calculator we can estimate how many Americans fall into the above net worth categories (note that you’ll need to toggle the DQYDJ tool to ignore equity in the primary home).

Here’s what these tools tell us (note that since UHNW individuals are fewer than 1 percent, the tools don’t enumerate them with any accuracy, so I don’t separate that category).

So, if we count having an investable net worth of $500k as “wealthy,” there are 12.8 million Americans ages 60–69 who fit that bill.

What Investment Returns Can You Aspire to in Retirement?

This isn’t a simple question to answer.

So much depends on how you invest your wealth.

If you’re hyper-conservative and keep everything in bonds, your long-term average, inflation-adjusted annual returns will be around 1.7 percent.

On the other hand, if you’re hyper-aggressive and invest 100 percent in equities, your long-term average annual returns will be around 7.1 percent (again, adjusted for inflation).

If you invest part of your wealth in rental properties, you’d benefit from leveraged appreciation plus rental income. This could be 25 percent or more.

If you’re wealthy and savvy enough to invest in private equity placements, you may get 30 percent or higher real returns.

For simplicity, let’s assume you allocate your wealth among these different asset classes somewhat conservatively and manage to get an inflation-adjusted annual return of 5.4 percent and that’s what you plan to live on, in addition to Social Security retirement benefits.

Regarding Social Security, the maximum monthly retirement benefit for a married couple is $9746 in 2024, which is just under $117k a year. The average is much lower, around $2700 a month or $32.4k a year.

Someone who is at least wealthy will most likely get an above-average Social Security retirement benefit. Let’s assume that’s $50k a year for our purposes here.

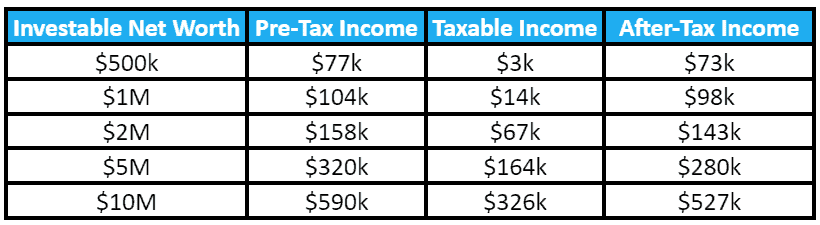

What Retirement Income Does That Buy You?

Putting it all together, let’s assume $50k from Social Security plus 5.4 percent from your portfolio.

- If your investable net worth is $500k, that gives you a retirement income of $77k.

- Invest $1M and you can live on $104k.

- With a $2M portfolio, your retirement income can be $158k.

- How about $5M? That gives you $320k to play with.

- And with $10M? Your retirement income is an amazing $590k.

Keep in mind that these numbers are all pre-tax.

If your wealth is entirely in tax-deferred accounts, your budget has to account for everything getting taxed as regular income.

If a good portion is in taxable accounts, you might be taxed using the lower long-term capital gains rates, which up to a certain taxable income is zero!

If you managed to put half in Roth accounts (IRAs or 401k plans), that portion would be tax-free.

To get a sense of how this might play out, let’s assume your portfolio is divided 40 percent in tax-deferred accounts, 20 percent in taxable accounts, 20 percent in Roth accounts, and 20 percent in rental properties where you can shield the rental income with depreciation so that’s also effectively tax-free.

We’ll also assume an 8 percent state income tax applied to the 60 percent that isn’t Roth or shielded by depreciation.

The above numbers are my back-of-the-envelope estimates, and I’m sure they aren’t accurate. But they should be good enough to get a sense of the after-tax budget you might be able to afford in retirement with these levels of wealth.

It’s important to keep in mind, however, that no level of wealth you may achieve will fully insulate you from disaster. There are a myriad of risks, many that could derail almost any retirement plan that doesn’t specifically account for them.

Omar Morillo, CFP®, Founder of Imperio Wealth Advisors says, “As an Advisor, I emphasize the crucial role of early and well-planned strategies in achieving financial comfort in retirement. It’s not just about reaching a certain wealth threshold but ensuring a sustainable and fulfilling lifestyle post-retirement. I often encourage those planning for retirement to watch out for potential landmines that can completely throw off their budget, such as the high cost of long-term care. Every retiree wants their retirement assets to last as long as needed but often fails to plan beyond the mundane and account for the unexpected.”

Anthony Ferraiolo, Partner Advisor at AdvicePeriod agrees, “Even if clients think they have enough money for retirement, we want to protect them from, e.g., multi-year long-term care events, lawsuits, or poor investment decisions, sequence-of-returns risks, greater than expected longevity, lower than expected market returns, higher than expected inflation, etc. You may have a measure of control over some of these, but others are difficult to avoid and could wipe out your funds if you didn’t plan for that possibility. The most critical part of retirement planning, in my opinion, is having the confidence and security to live a wealthy retirement, which requires insuring against such high-impact risks and planning for inevitable health issues.”

The Bottom Line

As you can see, there are vast differences between the merely well-off and those with significant wealth.

With $500k invested, you might be able to live on $73k a year. That isn’t shabby, but a “Lexus” retirement it’s not.

Even with $1M, your after-tax budget will likely be short of 6 figures.

Once you get to VHNW, your annual after-tax retirement budget will be several times higher than the median US income.

Clearly, the UHNW among us don’t have to worry about being able to afford almost anything short of mega-yachts and multiple palaces around the world.

Stephan Shipe, Owner of Scholar Financial Advising points out however, “The basic living expenses of someone with $5M vs. $15M aren’t very different. The main differences we see are travel and experiences. With $5M you could take a weeklong international trip each year, but the $15M investor can spend a month living with their family in a different country each year.”

Ultimately, however, money is just one piece of the puzzle, and once you have enough, other things should take precedence.

Ryan Goldenhar, CFA, CFP, Partner and Advisor with Wealth With Options sums it up well, “Wealth is more than simply dollars and cents, especially in retirement. Even if you’ve achieved VHNW or UHNW status, true wealth should factor in having a quality relationship with your family, spending time with friends, and being actively involved in your community, which could be volunteering and hobbies.”

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor