Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

I still remember the huge uproar when the Affordable Care Act (ACA), also known as “Obamacare,” was first debated in Congress.

President Obama famously promised, “If you like your existing health insurance, you can keep it.”

Yeah… not so much. It wasn’t a couple of years before we couldn’t keep the plan we had before, despite liking it.

Over the following years, our health insurance premiums went up by leaps and bounds.

However, despite what some politicians on one side of the aisle keep saying, the ACA seems to be here to stay.

And to be fair, the ACA did bring affordable health coverage to millions of previously uninsured Americans and did away with some of health insurers’ favorite ways of declining to pay when we needed them - limits on lifetime benefits and pre-existing conditions.

The problem is that the “affordable” part doesn’t really mean insurance is all that affordable. It’s just that the government uses the tax system to hand out subsidies to those who can’t afford the not-so-affordable health insurance.

Jing Zheng, founder of Neat Financial Planning, says about maximizing subsidies, “For individuals and families purchasing health insurance through the Health Insurance Marketplace, strategic income planning is a key tool to maximize the Premium Tax Credit, lowering overall health insurance costs. Eligibility applies to those with household incomes ranging from 100 to 400 percent of the Federal Poverty Line (FPL). This strategy can be particularly effective for those experiencing income reduction, career gaps, or early retirement.

“A case in point is when I advised a single mother in her early 50s with three children. Post-divorce, she was earning a modest income but had some assets from her divorce settlement. To maintain her eligibility for the premium tax credit, we tailored her portfolio allocation and withdrawal strategy to minimize capital gains and interest income. This minimized her modified adjusted gross income (MAGI), maximizing her premium tax credit. In 2024, for a family of four with a MAGI at 250 percent of the FPL, the premium tax credit could cover nearly 84 percent of Silver-tier premiums.”

But what if you can’t qualify for the subsidies?

All is not lost. Here are 2 creative ways to cut your health insurance premiums by a lot.

The First Way – If You’re Generally Healthy

In the following, I’ll use our premiums, as a middle-aged couple in Maryland with no kids at home, to estimate the savings you can expect.

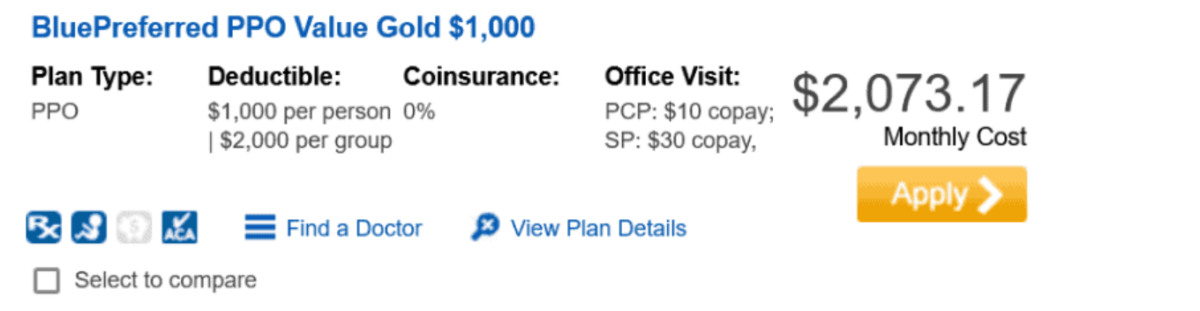

Here’s a quote from BlueCross BlueShield for the highest-tier plan available in Maryland, BluePreferred PPO Value Gold $1,000.

As you can see, the deductible is a mere $1,000 per person or $2,000 for a couple. The annual out-of-pocket maximum is $6,750 per person or $13,500 for a couple. There is a separate, lower deductible of $150 for prescriptions, and most coverages don’t apply the deductible (some noted exceptions – ER visits and hospitalization).

What’s not to like?

Ummm, the premiums! The annual cost of premiums is just shy of $27k!

And even if you’re generally healthy, you’ll still have to pay those insane premiums.

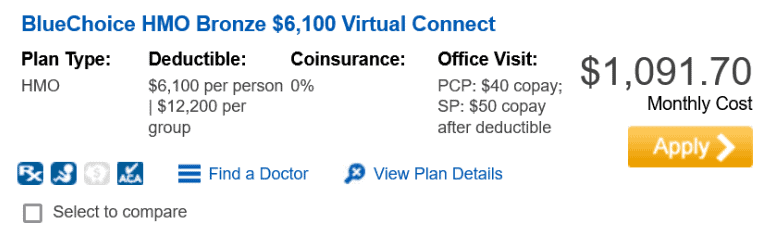

Instead, consider going with the least expensive Bronze plan, specifically the BlueChoice HMO Bronze $6,100 Virtual Connect.

Here, the deductible is $6,100 per person or $12,200 for a couple. The annual out-of-pocket maximum is $9,400 per person or $18,800 for a couple. Prescriptions have the same deductible as health services, so you’ll have to pay out of pocket for many non-preventative prescriptions. Visiting your primary care physician won’t apply the deductible, but specialists do.

In short, this isn’t the right plan for you if your health is deteriorating and you expect to see many doctors and be in and out of clinics, hospitals, urgent care facilities, imaging centers, etc.

However, if you’re generally healthy, paying $13.1k in premiums starts you off with an annual savings of nearly $12k relative to the Gold-tier plan.

That’s a savings of more than 47%!

This approach to cutting health insurance premiums:

- Guarantees your premiums will be vastly lower.

- Guarantees you won’t have to pay catastrophic sums (the annual out-of-pocket maximum for one person is $9,400 which is a small fraction of what your costs could be with a major health issue without insurance)

- Gives you the advantage of lower-cost rates that the insurance carrier negotiated with providers by having millions of insured people.

C Garrett Moore at Moore Financial Management, suggests another option, “Health sharing programs, such as Christian Healthcare Ministries, are another option. While not true insurance and not without shortcomings, they can be a great option to substantially decrease costs while still having protection, especially if you’re relatively healthy.”

The Second Way – If Your Health Requires the Highest Possible Level of Coverage

This one is truly creative and tricky.

Even if you’re middle-aged, you could become a part-time student!

Most universities require their full-time students to buy the student health plan. Part-time students taking at least 6 credits per semester can opt-in too.

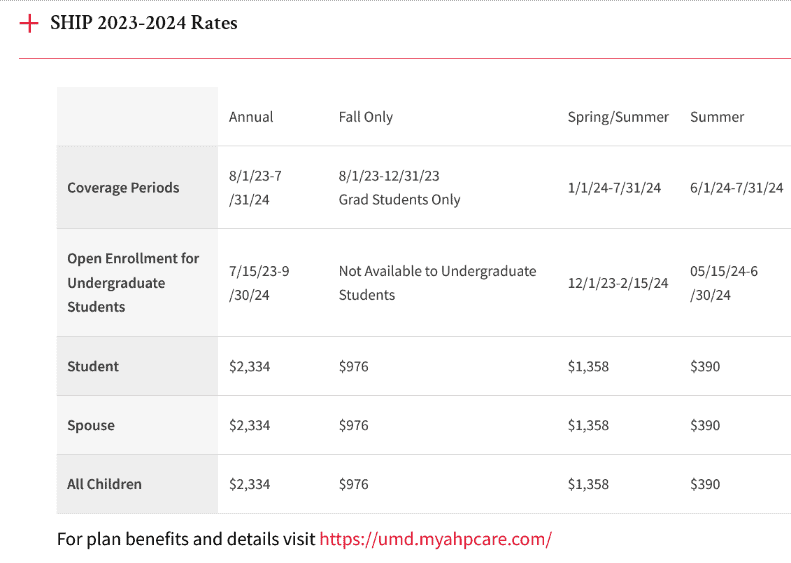

In the following, I’ll use the University of Maryland as an example.

The in-state cost of taking 6 credits per semester is 6 × $412 plus $371 mandatory fees, or $2,843 per semester. Double that and you have an annual cost of $5,686 in tuition and fees.

Add $4,668 in health insurance premiums for a couple for the year, and you have an annual cost of $10,354 for an ACA Platinum-level health plan!

That’s over 58% off relative to the Gold-tier plan (there’s no Platinum BCBS plan available to the general public in Maryland).

The reason you can get such an amazing deal is that university plans don’t share the same risk pool as general public plans.

Instead of having to cover everyone, no matter how old or sick, university plans are overwhelmingly sold to healthy people from ages 18 to 26. This allows the insurer to charge much less for premiums because they expect to pay out much less in benefits.

And as a bonus, you get to expand your horizons by taking a couple of university courses per semester!

The Bottom Line

Health insurance in the US is expensive.

Really expensive.

Most larger employers offer employment-based plans where the employer covers 80-100% of the cost of coverage. If your employer offers one of these, that can be a great deal.

However, if you have to buy your own plan, the above are two creative ways to dramatically lower your costs.

Have a Question to Ask a Financial Advisor?

➡️ Submit your question, and it may be answered by a financial advisor in an upcoming article or in the Expert Answers Forum on Wealthtender.

Additional Find-an-Advisor Resources:

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor