Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

How Much Does Your ETF Really Cost? Let’s Discuss an Active ETF Expense Ratio vs. Index ETFs vs. Mutual Funds

One of the most important factors to consider when analyzing and comparing ETF investment options is the expenses of the fund. The ETF arena now has so many investment options, that many areas in the market have become over-represented as more and more issuers come out with very similar looking ETFs competing solely on the basis of price. Comparing costs within actively-managed ETFs is just as important as it would be for index ETFs.

The overall average ETF expense ratio for actively-managed ETFs in the US is higher than the average you would see for passive ETFs. We delve deeper into the details of what investors should look out for when analyzing expenses for actively-managed ETFs.

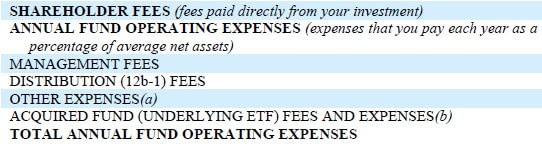

Active ETF Expense Ratio Components:

- Shareholder Fees

- Management Fees

- Distribution Fees

- Other Expenses

- Acquired Fund Fees And Expenses

- Fee Waivers

Breaking Down an Active ETF Expense Ratio

You can find a detailed break-down of the expenses for an Active ETF in its prospectus. You can most likely find the relevant disclosure on the fund’s website as well, but the most detailed version is probably in the prospectus and you can usually find this in the first few pages. Below is a snapshot of what the typical expense disclosure looks like:

1. Shareholder Fees

Most disclosures start off with something called the “Shareholder Fees”. When looking at funds in general, this component consists of a sales charge imposed on purchases that gets taken out from your initial investment and the second component is the transaction fees on purchases or redemptions. In the mutual fund world, many funds do charge a sales load anywhere from 0%-5%, but in the ETF world, such loads are nearly non-existent. The other component, transaction fees, is what you would pay your broker in trading commissions which vary from broker to broker. As such, most ETFs list “Shareholder Fees” as zero.

2. Management Fees

The biggest component of the expense structure for ETFs is usually the management fee. This is the fee that gets paid to the manager of the fund who makes the investment decisions for the fund on a day-to-day basis. This is the component that differentiates actively-managed ETF from passive ETFs because the management fee for active management, as you would expect, is higher than that for passive management.

Featured ETF Managers on Wealthtender

3. Distribution Fees

The distribution fees or the “12b-1” fees is another item that is more relevant for mutual funds than for ETFs. 12b-1 fees for mutual funds are paid by the fund out of fund assets to cover distribution expenses and sometimes shareholder service expenses. Essentially, this fee is used to compensate intermediaries for selling the fund’s shares. In fact, these fees have come under heavy debate of late as the SEC voted to scrap 12b-1 fees all together for mutual funds. Most Active ETFs, do not charge any distribution fees. If you read deep into the footnotes, you’ll see that these ETFs are actually allowed to bear a 12b-1 fee not exceeding 0.25% of the fund’s assets, but the ETFs don’t usually charge these fees. Hence, this is another line item that will list a zero expense nearly all the time.

4. Other Expenses

This line item is a catch-all for the remaining expense items that are usually too small to be listed individually. These include expenses such as the custodian fees, recordkeeping fees, unit-holder communication costs, legal and audit fees, as well as listing fees. Of course, not all of those fees may apply to all funds.

The “other expenses” vary in size from fund to fund.

5. Acquired Fund Fees And Expenses

The acquired fund fees are especially relevant for actively-managed ETFs because many Active ETFs have adopted a fund-of-funds structure. This means that they can implement their investment strategy by choosing to invest in other ETFs instead of individual securities. This also means that the fund will have to pay the expenses of the underlying ETFs. It’s important to recognize that these fees can play a relatively large role in pushing up the overall operating expenses for Active ETFs and investors should not just look at the management fee, but the total operating expenses that include the acquired fund fees.

Look Out: Fee Waivers

One especially important element to look out for in new actively-managed ETFs is fee waivers. Issuers often launch new funds with attached fee waivers that help to reduce the overall expense ratio for investors. The lower expense ratios are intended to attract investors up-front but the fee waivers usually expire around the 1 or 2-year mark, after the launch of the fund. As such, to take into account what the expenses of the actively-managed ETF might rise up to, look out for the “Gross” or “Total” operating expenses that will not include fee waiver, whereas the “Net” expenses will be the effective reduced expense ratio investors will pay within the contractually agreed period.

About the Author

Shishir Nigam, CFA, CAIA

Shishir Nigam is a self-professed investing and finance geek with various entrepreneurial interests as well. Wide-ranging investment management experience has given him the knowledge to back his words and insights. Currently, he works full-time at one of the largest commercial real estate asset managers in North America, based out of the beautiful city of Vancouver, BC.

Specialties: Portfolio Management, Fund Administration, Commercial Real Estate, Trading, Investing, Performance Reporting & Attribution, GIPS, Composite Management, Active ETFs, Writing

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor