Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

In a recent article, I explored results coming out of Morningstar’s recent research into the success rate of active funds vs. passive ones (the full report is online: US Active/Passive Barometer – Midyear 2023).

The gist of the report is that in the short term (one year), active funds are more likely than not to outperform their passive counterparts.

However, in the longer term, say 10 years, only 1 in 4 actively managed funds remains open and continues to outperform that benchmark.

An intriguing finding was that, over the last 10 years, the average dollar invested in active funds outperformed the average active fund in 19 out of 20 categories. This implies that investors in active funds by and large do well in picking funds in which they invest their dollars.

How do they do this?

My Criteria When Picking Funds

As I wrote elsewhere, over the past 30 years or so, I read a great deal about fund picking and developed my own set of criteria.

In brief, I require that funds have:

- No sales load.

- A lower-than-average expense ratio.

- A lower-than-average investment turnover.

- An experienced manager or management team with a solid track record.

- Shareholder-friendly governance.

- Morningstar risk-adjusted ratings of 4 or 5 stars (bronze, silver, or gold titles are icing on the cake).

- Outperformed its benchmark index over the past 10 to 15 years (with said outperformance not the result of a single outstanding year).

What Morningstar Found in Their Data

One of the key takeaways says: “The cheapest active funds succeeded more often than the priciest ones. Over the 10 years through June 2023, nearly 31% of active funds in the cheapest quintile beat their average passive peer, compared with 19% for those in the priciest quintile.”

Using a by-eye weighting, here’s what that looks like, where the 1 through 5 at the bottom denote the five quintiles, from most expensive to least expensive in terms of fees.

This shows that if using fees as part of your fund-picking process, you’d likely increase your likelihood of outperforming passive index funds by almost 20%, from 26% to about 31%.

What Morningstar Found by Digging Deeper

Morningstar divided funds into 20 categories, which I then grouped together into 5 super-categories:

- US Large-Cap (includes 3 categories)

- US Mid/Small-Cap (6 categories)

- Foreign/World (6 categories)

- US & Global Real Estate (2 categories)

- Fixed Income (3 categories)

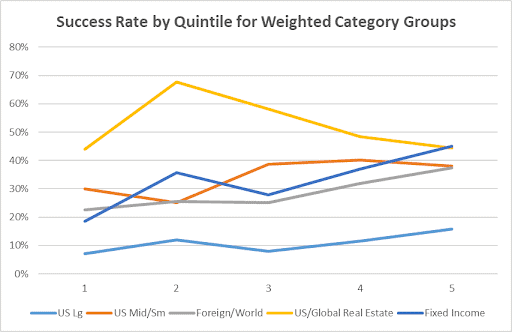

Here’s what the super-categories’ weighted success rates were like for the five quintiles.

We can see some interesting results.

- Active US large-cap funds (light blue curve) had the lowest success rates, and the cheapest quintile (right end of line) was almost twice as likely to succeed as the most expensive quintile (left end).

- Active US mid/small-cap funds (orange curve) had about triple the success rate of large-cap funds, and while there wasn’t a huge difference between the three cheaper quintiles, they had about 42% higher success rate than the two most expensive quintiles.

- Active foreign/world funds (gray curve) had similar success rates to US mid/small-cap funds, and the cheapest quintile’s success rate was 62% higher than that of the most expensive quintile.

- Active real estate funds (gold curve) were more likely than not to outperform their passive counterparts, but there isn’t a correlation between fee levels and success rates. This is likely the result of fluctuations due to the small sample size in this super-category, half the size of the next-smallest super-category (fixed income). It’s also possible that the difference in fees between quintiles in this super-category is relatively small.

- Finally, active fixed-income funds (dark blue curve) had success rates similar to those of US mid/small-cap and real estate funds, and the cheapest quintile was more than twice as likely to succeed as the most expensive quintile.

Looking at individual categories, the report shows several where the lowest-cost quintile isn’t the most successful, and in one case (Europe stocks), that honor goes to the most expensive quintile. The reason for this is likely a combination of several factors.

- Small sample size with one or several outliers (exceptionally high performers with high fees, exceptionally poor performers with low fees, or both).

- Small differences in fees between the least and most expensive quintiles.

The success rate is highest for the cheapest quintile for 8 categories, highest for the next-cheapest quintile for 6 categories, and the most expensive three quintiles split the remaining 6 categories with 2 in the middle quintile, 3 in the next-to-most-expensive quintile, and as mentioned above, 1 in the most expensive quintile.

Given the wild fluctuations between quintiles’ success rates for individual categories, I don’t think looking at those is terribly useful.

Look for yourself…

Kind of messy, right?

What the Pros Think About Fees

I asked financial advisors if they consider fees when investing clients’ money. Here’s what they said.

Michael Mezheritskiy, President of Milestone Asset Management Group says, “Fees can be a huge drag on a portfolio. We believe in using low-cost index funds. Most expensive actively managed mutual funds almost always fail to beat the index over longer time periods.”

Dana J. Menard, CFP®, RLP®, CEPA®, CDAA™, Founder and Lead Financial Planner, Twin Cities Wealth Strategies, Inc. points out, “Fees are one of my main considerations when putting together portfolios for clients, as it is one of the very few variables we can control when investing.”

Chris Magaña, Strategic Advisor & Principal, IMS Capital Management, takes a nuanced approach, “Our goal is to optimize fee structure as follows: pay as close to zero fees for market returns (beta), and be willing to pay modestly higher expenses for active management when that has a high probability of after-tax long-term outperformance.”

The Bottom Line

Even if you do nothing more than discard funds that overcharge their investors through fees in the most expensive 2 or 3 quintiles, you’d increase your chance of outperforming passive index funds over the long term (say 10 years) by 20% (from 26% to 31%).

You’d also be more likely to outperform passive funds by picking active funds in categories where the success rates are highest. These are US mid-cap growth, US small-cap growth, foreign large-cap value, diversified emerging markets, real estate (US or global), and intermediate core bonds, any of which have at least a 40% chance of success in the cheapest two quintiles.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor