Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Are you making investment decisions based on recent events? If so, you may be falling victim to recency bias.

When it comes to investing, it’s easy to get caught up in the latest news and let it influence your investment choices. However, this cognitive bias can have serious consequences for your investment performance.

Understanding recency bias is the first step to overcoming its impact on your investments. By recognizing when and how this bias affects your decision-making, you can make more informed and rational choices.

Let’s explore the psychology behind recency bias, its impact on your investments, and strategies to overcome it.

What Is Recency Bias?

Recency bias is a cognitive bias that affects our decision-making process. It is a tendency to give more importance to recent events or information when making decisions.

In other words, we tend to give more weight to the most recent information while ignoring older information.

This bias is common in the world of finance, where investors often make decisions based on the latest news or market trends.

Recency bias is a mental shortcut that our brains use to simplify complex processes. However, it can lead to irrational investment decisions.

For instance, if you hear about a company experiencing a temporary setback, you might be tempted to sell your shares, even if the long-term prospects are still solid.

Understanding recency bias is the first step to overcoming its potentially negative impact on your investments.

The Impact of Recency Bias on Investments

Recency bias can have a significant impact on your investments. It can cause you to make investment decisions based on short-term fluctuations rather than long-term trends.

This bias can lead to missed opportunities and poor investment performance.

For example, suppose you invest in a stock, mutual fund, or ETF that has been performing well for several months or years. However, the investment experiences a minor setback, and its price drops.

If you have recency bias, you may sell your shares based on this short-term setback, even though the long-term prospects are still strong. This can result in missed opportunities for future gains.

Recency bias can also lead to overreacting to news events. For example, if the stock market experiences a sudden drop due to a global event, such as a pandemic, investors may panic and sell their shares. This can cause a further drop in prices and result in significant losses.

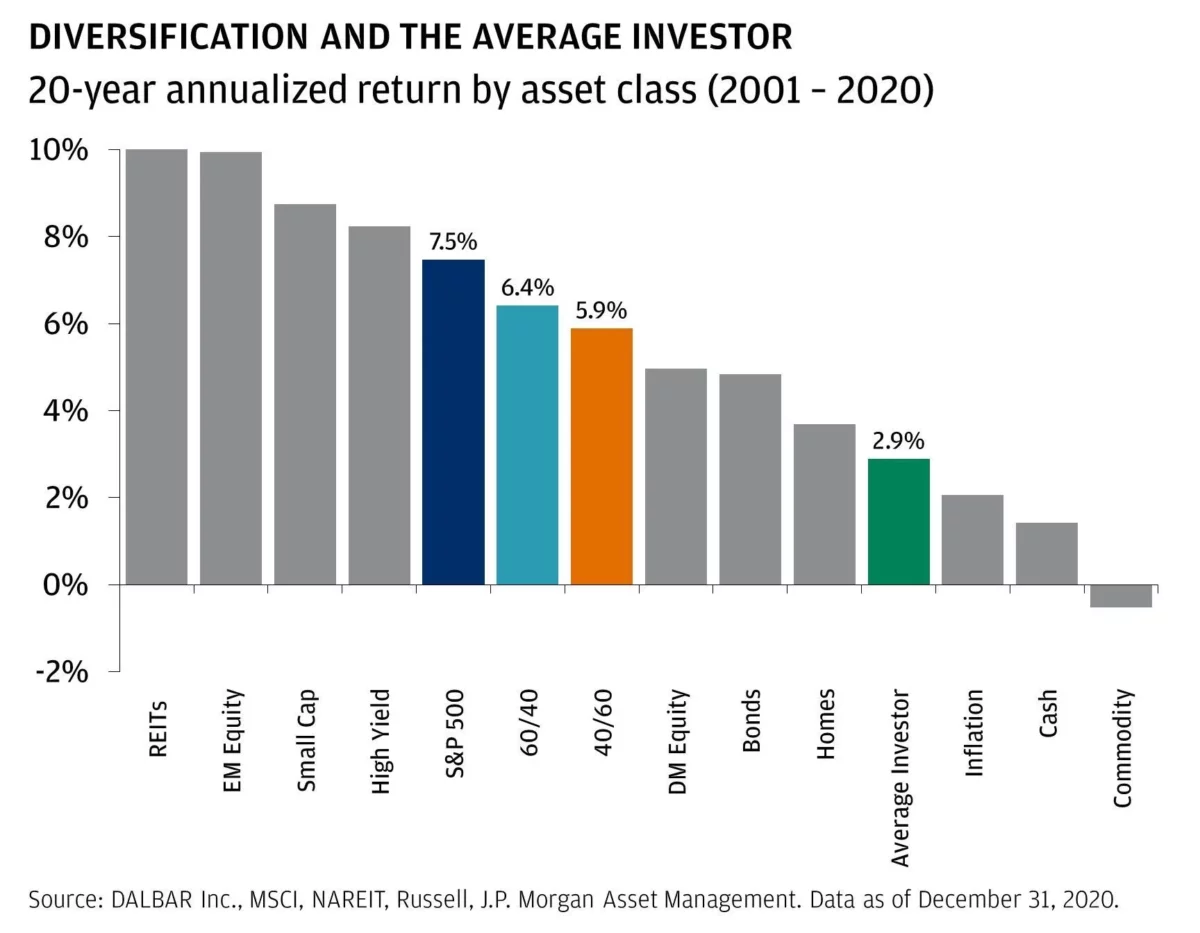

This behavior can (and often does) manifest through poor investment performance. Take this example of the clear difference between average market returns compared to average investor returns.

Recency bias plays a large part in contributing to the poor returns experienced by the average investor.

Examples of Recency Bias in Investing

Imagine that a specific sector ETF, say a technology-focused ETF, has been performing exceptionally well for the past year, significantly outperforming the broader market indices. An investor, John, reads about the high recent returns and decides to invest a large portion of his savings into this ETF, expecting that the trend will continue.

However, John’s decision is heavily influenced by recency bias. He’s focusing only on the ETF’s recent performance and ignoring several important factors, such as:

- Historical Performance: John has not considered how the ETF has performed across different market cycles. If the ETF has a history of volatile performance, the recent uptick might not be sustainable.

- Market Conditions: He hasn’t taken into account whether the recent performance is due to underlying economic conditions that may not persist in the future.

- Diversification: By investing heavily in a sector that has recently performed well, John may be inadequately diversified, increasing his risk if that sector experiences a downturn.

- Valuation: The assets within the ETF may now be overvalued due to the recent run-up, which could mean that future returns will be lower as valuations return to more sustainable levels.

- Performance Chasing: This is a common outcome of recency bias where investors chase the performance of hot funds or sectors, often leading to buying high and potentially selling low when the trend reverses.

In this example, recency bias could lead to poor investment decisions, because it causes the investor to ignore the broader, more comprehensive analysis necessary for a well-informed investment strategy.

If the technology sector were to experience a correction or downturn shortly after John’s investment, he might incur significant losses due to the lack of diversification and timing driven by recency bias.

How to Recognize and Overcome Recency Bias in Your Decision-making

Recognizing recency bias in your decision-making, especially in the context of investing, involves being aware of certain patterns of thought and behavior that may indicate you’re overvaluing recent events. Here are some strategies to identify recency bias:

- Emotional Responses to Recent Events: If you find yourself feeling particularly bullish or bearish based on the latest market moves or news, ask yourself if your emotions are influencing your decision-making process more than the data and long-term analysis.

- Short-Term Performance Focus: Pay attention if you’re overly focused on how an investment has performed in the last few weeks or months instead of looking at a multi-year or full market cycle performance.

- Trend-Chasing Behavior: Notice if you are tempted to buy into an investment (like a particular stock, sector, or asset class) simply because it has recently seen a surge in value.

- Neglecting Historical Data: Ensure you’re not disregarding long-term historical trends and data in favor of recent developments.

- Overconfidence in the Latest Information: If you find yourself putting too much stock in the latest analyst report or a piece of economic data without considering broader trends, it could be a sign of recency bias.

- Ignoring Base Rates: Base rates refer to the broader statistics or probabilities of an event happening based on a long-term dataset. If you are ignoring these in favor of recent anecdotes or outcomes, that’s a red flag.

- Forgetting about Mean Reversion: If the concept of mean reversion (the idea that returns eventually move back towards the mean or average) is absent from your thinking, you might be experiencing recency bias.

- Conversations and Discussions: Pay attention to the way you talk about investments. Are you only citing recent successes or failures when discussing your strategies?

To counteract recency bias, consider the following approaches:

- Diversification: This helps ensure that your investment decisions aren’t overly influenced by recent trends in a single sector or asset class.

- Systematic Investment Plan (SIP): Regularly investing a fixed amount can help average out the cost of investment and reduce the risk of making a poorly timed investment decision based on recent market movements.

- Review and Stick to Your Investment Policy Statement (IPS): Your IPS should outline your investment goals, strategies, and risk tolerance. Revisiting this can remind you of your long-term objectives and help keep recent events in perspective.

- Seeking Contrary Evidence: Actively look for information that contradicts your recent impressions or decisions.

- Work with a Financial Advisor: Financial advisors can provide a more objective perspective, which can help you reduce emotional interference.

Recognizing recency bias requires mindfulness and discipline. It’s about questioning the reasons behind your investment choices and ensuring they align with a well-thought-out strategy rather than the most recent headlines or market fluctuations.

Stay the Course

It’s a boring refrain: “stay the course!”

We want investing to be exciting, sexy, and entertaining. We love to glamorize investing as a game that we can win by outsmarting everyone else.

But the reality is that winning at investing comes from following a disciplined strategy and staying focused over a long period of time.

So don’t let recency bias derail your investment plan. Stay self-aware and avoid the emotional traps that can hurt your investment performance.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Michael Reynolds, CFP®, CSRIC®, AIF®, CFT-I™ | Elevation Financial

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor