Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

How much you should invest in stocks in retirement depends on what you prioritize

I’ve been thinking about “retirement” for three decades.

I put the word in quotation marks because I don’t mean to ever retire in the accepted meaning of the word.

When I was 30, an Ameriprise financial planner who wanted to sign me up as a client asked me when I wanted to retire.

My reply was, “Never!”

My preferred term is becoming “work-optional.”

What It Takes to Reach Work-Optional

Whether you want to retire to travel and golfing or prefer to keep working, but only with/for people you like, on projects that light you up, and at whatever level you want, regardless of how much or little it pays, it takes money.

A lot of money.

Depending on your preferred lifestyle and where you live, “a lot” could be as little as a (few) hundred thousand dollars or multiple millions of dollars. A common rule of thumb to determine how much you will need is the so-called 4-percent rule.

It’s much easier to get to your goal if you invest your money than if you stick it in savings accounts.

What Does Retirement Success Mean

For what follows, I’ve drawn from a recent Morningstar report.

For their research, Morningstar used 1000 Monte Carlo simulations of possible sequences of returns for various asset classes, including several stock classes (e.g., US large-cap growth, US small-cap value, foreign, etc.), bond classes, and cash.

To call a strategy successful, they required that 900 of the 1000 Monte Carlo runs would maintain a positive balance after 30 years – that’s a 90-percent likelihood of not running out of money.

How Stock Allocation Affects Your Maximum Safe Initial Draw

They looked at historical data from 1927 to 1992 for five scenarios.

- 100 percent stocks

- 75 percent stocks

- 50 percent stocks

- 25 percent stocks

- No stocks

The report shows your highest safe initial draw for a 30-year retirement would have been with 75 percent invested in stocks, a 3.7 percent draw.

The worst was with zero equities, a 2.3 percent draw.

Since there were only a few dozen rolling 30-year periods in the historical data, they also looked at their 1000 simulated 30-year runs.

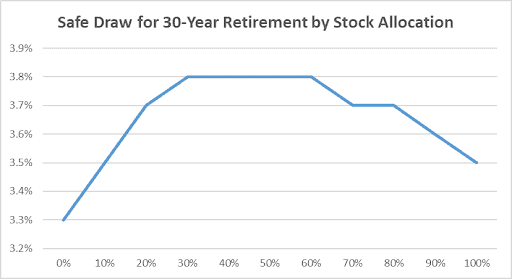

As you can see, you achieve the highest safe initial draw, of 3.8 percent, with a stock allocation between 30 and 60 percent.

But which is best? Should you go high or low?

Determining Your Best Stock Allocation

Since stocks return more but are more volatile than bonds, let alone cash, if you go to the higher end of that range – 60 percent, your median ending balance will be more than twice as high as what you’d see with a 30 percent stock allocation.

However, the spread between your balance after 30 years (for the 900 successful runs) would be greater for a 60-percent-stock portfolio than for a 30-percent-stock portfolio.

In short, if you opt for a lower stock allocation, your ending balance would be lower on average but would have a tighter spread among those 900 successful runs.

To figure out your best allocation, you need to decide if you want to swing for the figurative fences, go for (again, figurative) singles, or take the middle ground between the two.

- To have a chance at leaving a larger bequest, while risking leaving much less, push your stock allocation up to 60 percent.

- To maximize your chance of leaving a sizeable bequest, knowing it will likely be far lower than the previous option, choose a 30-percent stock allocation.

- To push your median bequest size up without risking as much as with the first option, go for the middle, perhaps q 45 percent allocation for stocks.

Asking the Pros

I asked financial advisors how they determine their clients’ asset allocations.

Douglas Greenberg, President, Pacific Northwest Advisory says, “For clients who want to leave an inheritance, our goal is to generate income without spending principal. We start with enough fixed-income assets to generate the income the client needs. The type of assets depends on the client’s willingness to accept risk, either corporate bonds or a portfolio of closed-end funds. We then invest the remainder of the client’s funds in equities.”

Michael Mezheritskiy, President of Milestone Asset Management Group has a slightly different approach. He says, “At our practice, we use a bucket strategy to determine the proper asset allocation for our clients. If they need say $50k a year from a $1 million portfolio, we place two years’ worth of expenses, $100k, in cash. Next, we put five years’ worth, $250k, in bonds and five more years’ worth in a conservative non-stock allocation. Finally, we invest the remainder in stocks. This results in 40% in stocks and 60% in bonds and cash. This approach has worked well for us.”

The Bottom Line

From Morningstar’s research results, we learn that your maximum safe initial draw is highest when you combine stocks with bonds and cash.

The highest maximum safe initial draw in their simulations came out of portfolios with 30 to 60 percent invested in stocks.

Pushing to the 60 percent end increases your median ending balance, but you have a higher chance of ending with a really low final balance.

Pushing to the 30 percent end leaves you with a lower median ending balance, but the spread between the 900 successful simulations is smaller.

Thus, you must choose the level of risk (of leaving a zero or near-zero bequest) you’re willing to accept in return for a higher likely bequest level. The higher you’re willing to fly, the greater the risk, but the farther you’ll likely reach.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor