Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

One of my favorite quotes ascribed to Albert Einstein, “Every problem should be simplified as far as possible, but no further.” The 50/30/20 rule fails this admonition. Badly.

Budgeting. It’s probably right up there in your list of favorite things to do (sarcasm alert!), along with visiting your dentist.

Unfortunately, like visiting your dentist, it’s important that you do it.

The consequences of not doing a decent job of it is likely responsible, at least in part, for the dismal retirement outlook for so many of us.

Elizabeth Warren’s Proposed “50/30/20 Rule” for Simple Budgeting

According to Investopedia, “Senator Elizabeth Warren popularized the so-called ‘50/30/20 budget rule’ (sometimes labeled ‘50-30-20’) in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.”

This is certainly an extremely simple budgeting method.

Allocate 50% of your after-tax income to your needs. These are the things you’d have a really hard time doing without or where the consequences of doing without could be severe:

- Rent or mortgage payments

- Utilities (includes high-speed broadband connection only if it’s crucial to your livelihood)

- Transportation (a car if needed, or public transport if that offers a plausible alternative)

- Health care (insurance premiums, copays, co-insurance, and deductibles)

- Insurance (renters or homeowners, and auto if you drive)

- Minimum debt payments

Next, allocate 30% to wants. This includes everything that’s not in the “needs” category above, and that doesn’t increase your net worth (what you own minus what you owe). Some examples include:

- Eating out and entertainment (movies, shows, etc.)

- Consumer items (another pair of shoes, replacing a 2-year-old phone that still works fine, etc.)

- High-speed broadband connection (except when it’s crucial to your livelihood)

- A car (assuming public transport offers an acceptable, albeit less convenient solution)

- Cable TV and streaming services

- Gym membership

- Amazon Prime membership

- Upgrading from what you already use to higher-cost alternatives (e.g., buying a new luxury vehicle rather than keeping a car that reliably gets you from point A to point B, buying a filet mignon to cook at home instead of a chicken breast, etc.)

Finally, the last 20% goes to savings, which includes:

- Building up an emergency fund of at least 3 months’ needs, and preferably more

- Paying down high-interest debt as fast as possible

- Contributing to an employer’s retirement plan enough to capture any employer match

- Contributing to an IRA, HSA, and/or other tax-advantaged plans

- Investing in a taxable account for goals closer than retirement

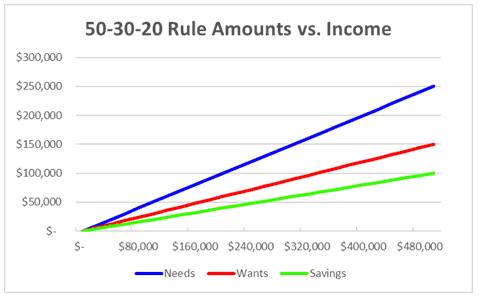

Here’s how it looks, in terms of dollars for each category vs. your income.

How the 50/30/20 Rule Fails Einstein’s Admonition

One of my favorite quotes ascribed to Albert Einstein, “Every problem should be simplified as far as possible, but no further.”

The 50/30/20 rule fails this admonition.

Badly.

Let’s count the ways it fails.

- It’s hard to differentiate between many needs and wants: Sure. Buying an expensive framed print to decorate your home’s walls is pretty clearly a want, not a need. However, is your rent truly a need at its current level? If you’re living in a fancy penthouse in mid-town NYC, I suspect you could reduce your costs by a large factor if you had to by downgrading to a lower floor, possibly moving to a different borough, or in an extreme case, possibly taking in a renter (or sublessee, if you have your landlord’s permission).

- If your after-tax income is $20,000 or even $40,000 for a family of 4, and you’re living in the US (especially in a high-cost area), it’s very doubtful you have any money left over for wants or savings once you pay for your irreducible needs.

- If your income is multi-6-figures, you’d be very unwise to spend 80% of it on needs and wants and save only 20%.

In short, it’s another example of something that tries to be one-size-fits-all but ends up being one-size-fits-few-well-most-poorly-and-some-not-at-all.

How the 50/30/20 Rule Can Hurt Your Finances

When Your Income Is Low

If your income is low relative to the cost of living in your area, I can tell from personal experience (when I first arrived in the US, had a negative net worth, and was earning only $31,000 to take care of a family of 4) that you’ve likely become expert in ferreting out those expenses that you can do without and cutting them back mercilessly.

You’d hardly let 30% of your limited resources be wasted on wants when you don’t have enough for all your needs!

Similarly, telling you to save 20% runs the risk of making you feel like a failure, possibly leading you to simply give up.

In this situation, following the red and green lines down to the 0/0 point at the bottom left of the graph above doesn’t make sense.

When Your Income Is High

The needs vs. wants differentiation is much less important once you make enough money.

If you have a multi-6-figure income, you should be setting aside and investing as much as possible of that, preferably over 50%.

If you set aside just 20% in this situation, you’re needlessly taking on the risk that if your income suddenly drop, you’ll have an insufficient safety net.

You could lose your home.

Your retirement plan could be devastated.

On the other hand, if you do set aside 50% or more, does it really matter how much of the other 50% that you spend is needs vs. wants?

The Bottom Line – Do This Instead

When Your Income Is Low

If you earn less than a middle-class income, asking you to save 20% is a big ask.

Not necessarily impossible, but you have to be uber-frugal to accomplish it. In this situation, I’d suggest allowing yourself to reduce that savings rate to perhaps 10%, but then doing whatever you can to increase your income and allocating half of any increase to bulk up your savings (even above 20%).

David Berns, Financial Planner, Truadvice Wealth Management agrees, “Elizabeth Warren’s ‘50/30/20 Rule’ is outdated for today’s worker bee here in the US. With the cost of goods and services continuing to rise, Americans are struggling to keep the lights on, let alone setting aside 20% in savings. People are taking money out of their retirement accounts to get by, hurting themselves in the long run. It seems this ‘advice’ comes from people in the top 1% who seemingly yell from the mountaintops that this works for everyone. Times have changed. We’re three years out of a global pandemic and still feel the effects.”

When Your Income Is High

If your income is high, think about the level of risk you’re willing to accept vs. the freedom you’d feel by building up a large enough portfolio that you wouldn’t need to work anymore.

Then, set aside and invest as much as you can, certainly more than 20% (if possible, more than 50%). Alternatively, consider using a chunk of that extra cash to rapidly pay off your mortgage (at least if you can do that within a few years while keeping at least a year’s worth of expenses in an emergency fund).

When Your Income Is in the Middle

If you have a middle-class income, the 50/30/20 rule may fit you about as well as it fits anyone.

In this situation, ask yourself if you prefer its simplicity to the possibility of better results coming out of a more nuanced approach.

If you’re unlikely to follow through with anything more nuanced, feel free to simplify using Warren’s suggestion.

Otherwise, I recommend becoming much more intimately aware of your budget and the different ways you could adapt it to changing life circumstances.

For example, paying the full cost of college attendance for your kids would fall into the wants category, but it may make sense to spend that extra money even if it temporarily increases your wants allocation beyond 30%.

Christine Luken, Financial Dignity® Coach, Founder of 7 Pillars LLC, wraps things up, quipping, “Cookie cutters belong in the kitchen, not in your personal finances. Each of us has a unique family and financial situation. Trying to stuff yourself into someone else’s cookie-cutter budget probably won’t work for the long term. Get the advice of a financial coach or advisor who can create a custom plan to achieve YOUR money goals.”

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor who can meet with you online, or you prefer to find a nearby financial planner, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

–

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor